Five myths about the Russian economy

Stereotypes about the Russian economy spread by some media and analysts in our country and abroad make us hostage of the strong myths. The number of especially rooted of them do not allow to objectively assess the situation in the domestic economy, and lead to biased interpretation of ongoing processes and erroneous conclusions.

Let’s examine five major opinions using objective data. Myth or reality?

Myth Number 1. Russia has undeveloped raw material mono-economy based on the sale of oil and gas

According to the data of the Ministry of Finance of Russia for the 1st half of 2019, the share of oil and gas revenues in the consolidated budget reached 4,1 trillion RUB or slightly over 22%. Incomes not related to the production and sale of oil and gas for the same period amounted to 14,5 trillion RUB, that is almost 3,5 times more.

Information is confirmed by the Federal State Statistics Service (hereinafter “Rosstat”) data. In the 1st half of 2019, the mining industry accumulated only 13,5% of the GDP produced, wholesale and retail trade - 14,3%, manufacturing – 13,5%, real estate business – 9,7% (see Picture 1).

Picture 1. Russia's GDP produced for the 1st half of 2019 at the industry level, % of total monetary value

Picture 1. Russia's GDP produced for the 1st half of 2019 at the industry level, % of total monetary valueSource: Rosstat

Myth Number 2. Russia produces practically nothing and is critically dependent on imports

Among G20 members, Russia's imports in relation to its nominal GDP do not exceed 14%. The higher the share, the more the country depends on the supply of goods and services from abroad. The relatively low level of imports may mean that the state produces a significant part of what it consumes and invests. For comparison, the share of imports in Germany's GDP reaches 34%, which is almost 2,5 times more than in Russia (see Picture 2).

Our country has leading technologies and competencies in nuclear energy, space, icebreaker building, and high-tech weaponry. The lag in production of consumer goods largely determines the reason for the appearance of such a myth.

G20 is a union of countries representing about 90% of global GDP, 80% of global trade and two-thirds of the world population.

Picture 2. Imports of G20 members to the GDP for 2018, %

Picture 2. Imports of G20 members to the GDP for 2018, %Source: International Monetary Fund, IMF

Myth Number 3. It is impossible to develop small business in Russia, small companies are closing

The myth that small business in Russia is about to disappear as a subject of economic relations has been circulating since the beginning of market transformations. Leaving the Federal Tax Service combating shell companies aside, the increase in the number of liquidated enterprises in 2018-2019 is explained by the unsatisfactory economic situation in the country. Objective reasons were thoroughly examined in the Credinform Newsletter for August 2018; the publication is available on the website.

The verity is different: over the past 5 years turnover of small companies, including microenterprises, has increased 2,1 times: from 24,8 trillion RUB in 2013 to 53,3 trillion RUB in 2018. Investment in fixed assets increased 1,8 times: to 1,1 trillion RUB. (see Picture 3).

During the quinquennium, the growth of costs for the production and sale of products increased 1,5 times in the economy in general - these are material costs, labor costs, insurance contributions to the Federal Compulsory Medical Insurance Fund, Pension Fund, Social Insurance Fund, depreciation and other expenses. Thus, the real increase in the turnover of small businesses over 5 years amounted to 60%, which is averagely about 12% per year.

Picture 3. Turnover and capital investment of small enterprises, including microenterprises

Picture 3. Turnover and capital investment of small enterprises, including microenterprisesSource: Rosstat

Myth Number 4. Due to the poor socio-economic situation in the country, millions of Russians leave for the West, and the problem is worsening every year

Migration flows are also a fertile ground for myth-making: difficult living conditions, inability to realize oneself and open a business lead to ever-increasing migration from the country. At the same time, it is failed to mention that Russia is among Top-5 countries with a positive migration rate: the number of arrivals exceeds the number of those who left the country. Moreover, 90% leaved for the CIS.

Migration to the West is low. According to the US Department of Homeland Security, the number of migrants from Russia over the past few years has remained at approximately the same level - about 9 thousand people a year and tends to decrease (see Picture 4).

Picture 4. Emigration from Russia to the USA, thousand people

Picture 4. Emigration from Russia to the USA, thousand peopleSource: Department of Homeland Security

Myth Number 5. Russia is not attractive for foreign investment; the capital is flowing out

Do foreign investors keep away from Russia? Not at all. According to the UN Conference on Trade and Development, Russia is ranked 9th in terms of total accumulated foreign direct investment from 2000 to 2018 among G20 members, being ahead of France, India, Italy, Japan, etc. Total investment accumulated over 18 years amounted to 512 billion dollars (see Picture 5).

UN Conference on Trade and Development (UNCTAD) is an intergovernmental body established in 1964; it is responsible for dealing with development issues, particularly international t rade, finance and technologies.

Picture 5. Accumulated foreign direct investment of G20 for 2000-2018, billion US dollars

Picture 5. Accumulated foreign direct investment of G20 for 2000-2018, billion US dollarsSource: United Nations Conference on Trade and Development, UNCTAD

Conclusion

The Russian economy does have difficulties. There is an artificial restriction for the domestic business to foreign markets, including capital markets, in the form of more protective than political ongoing sanctions policy, as well as in the introduction of customs barriers and direct legislative prohibitions. Another problem is low consumer demand due to the stagnation of cash incomes of the population. High taxes hinder business development. The impressive budgetary funds allocated for National projects are inefficiently used. There is a natural population decline and a reduction in professional personnel.

In addition to difficulties, the following strong myths hinder from changing the situation in the economy: the country's unattractiveness for foreign investment, inability to conduct small business, and large-scale emigration. Spread of misconceptions makes the overcoming of challenges in the economy much more difficult.

For how long shell companies have left?

The Federal Tax Service undertakes serious measures against shell companies since 2016, striking them off the Unified State Register of Legal Entities. The number of active legal entities in Russia reduced by 11% for two years.

There was a record reduction in a number of companies established for illegal actions – tax evasion, money laundering, cashing-out and withdrawing the funds abroad. According to the Federal Tax Service (hereinafter “the FTS”), the number of shell companies reduced to 309,5 th, that is 7,3% of total number of companies on July 2018.

At the beginning of 2016, there were significantly such kind of companies: 35,5% or 1,6 mln; and in 2011 about 40% of companies in Russia could be classified as shell companies.

As of July 1, 2018 totally 4,2 mln legal entities were registered in the Unified State Register of Legal Entities (hereinafter “EGRUL”). In the year-earlier period this figure exceeded 4,5 mln.

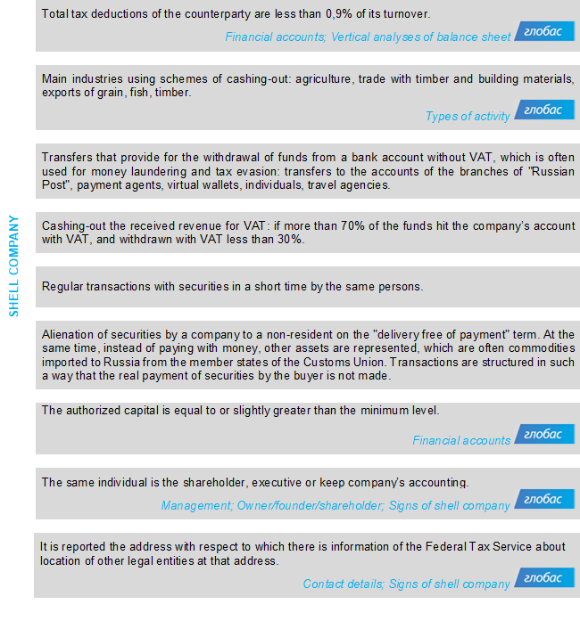

Not the FTS alone detects attributes of shell companies. The Bank of Russia also plays an important role in struggle against shell companies. Since 2015, the regulator publishes guidance notes demonstrating main doubtful business transactions and signs requiring additional analyses (see Picture 1).

Picture 1. Signs of a shell company according to the instruction of the Central Bank

Picture 1. Signs of a shell company according to the instruction of the Central BankThe majority of active Russian companies are located in Moscow – 885 th or 21% of total number of companies. 324 th and 222 th are accounted for Saint-Petersburg and Moscow region respectively. These subjects also leads by the number of dissolved companies: for the first half-year of 2018, 118 th companies were dissolved in Moscow, 33 th – in Saint-Petersburg, and 15 th – in Moscow region.

Newly established companies do not compensate the number of liquidated ones. For example, in Moscow the total number of business subjects decreased by 56 th for the first half-year of 2018 (see Table 1).

| № | Region | Legal entities, total for 01.07.2018 | Share of total number of legal entities, % | Legal entities established for the first half-year of 2018 | Legal entities dissolved for the first half-year of 2018 | Difference between the number of established and dissolved legal entities |

| The Russian Federation | 4 243 566 | 100 | 197 082 | 329 540 | -132 458 | |

| 1 | Moscow | 884 969 | 21 | 62 143 | 117 916 | -55 773 |

| 2 | Saint-Petersburg | 324 202 | 8 | 19 053 | 33 479 | -14 426 |

| 3 | Moscow region | 222 188 | 5 | 7 664 | 14 827 | -7 163 |

| 4 | Sverdlovsk region | 145 226 | 3 | 4 967 | 8 989 | -4 022 |

| 5 | Krasnodar territory | 135 736 | 3 | 5 553 | 9 563 | -4 010 |

| 6 | Novosibirsk region | 117 931 | 3 | 5 516 | 6 654 | -1 138 |

| 7 | The Republic of Tatarstan | 113 050 | 3 | 5 437 | 5 600 | -163 |

| 8 | Samara region | 103 472 | 2 | 5 869 | 7 397 | -1 528 |

| 9 | Chelyabinsk region | 93 484 | 2 | 2 843 | 5 024 | -2 181 |

| 10 | Nizhniy Novgorod region | 89 433 | 2 | 3 658 | 6 305 | -2 647 |

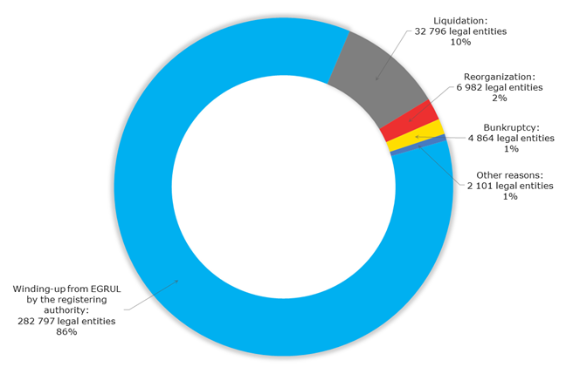

Totally 330 th companies were liquidated for the first half-year of 2018. Compulsory winding-up by the registering authority was the reason of termination of 283 th or 86% of companies (see Picture 2).

Almost 45 th or 13% of legal entities were dissolved due to economic reasons, including: liquidation – 33 th, reorganization – 7 th, bankruptcy – about 5 th.

Picture 2. Reasons of termination of legal entities

Picture 2. Reasons of termination of legal entitiesOn the background of obvious success in struggle against shell companies, there are cases when nonconformity to strictly specified formal criteria led to problems for genuinely operating companies.

All addresses with over ten companies registered at were automatically included in the FTS list of suspects. However, the compilers of lists of mass registration addresses did not take into account a number of large buildings and business centers with premises rented by hundreds of companies. According to Globas on July 2018, there is a record on unreliability of legal address for 612 th companies or over 14% of total number of active legal entities.

The list of directors / shareholders of multiple entities includes famous business people and public persons at the top of well-known brands, such as: Leonid Fridlyand, co-owner of the jewelry boutiques chain "Mercury". Georgy Boos, the former governor of Kaliningrad region, was also unlucky - according to the FTS, he is a shareholder of multiple entities, including LLC Likhoslavl Lighting Equipment Plant. Moreover, executives, in the name of who regional representative offices and branches were opened, appeared to be in "risk zone".

The FTS will obviously need to strike a balance between the formal struggle with shell companies and the interests of an honest entrepreneur. Tightening formal criteria will not stop unreliable counterparties, as getting around the rules is the goal of their existence, and it becomes more difficult for conscientious enterprises to fulfill ever-increasing requirements.