Activity trends of children's recreation camps

Information agency Credinform has prepared a review of trends of the largest children’s recreation camps.

The largest camps (TOP-100) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2013-2018). The analysis was based on the data of the Information and Analytical system Globas.

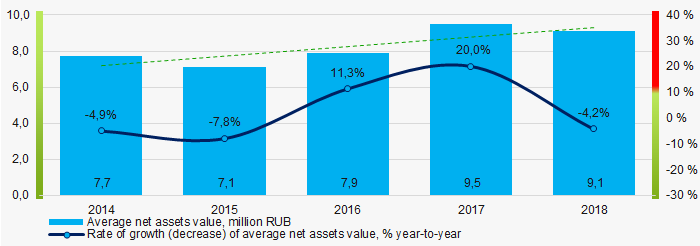

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest camp in term of net assets is LLC Children's recreation camp named after A.V. Kazakevich, INN 9104000322, the Republic of Crimea. In 2018, net assets value of the company exceeded 106 million RUB.

The lowest net assets volume among TOP-100 belonged to LLC Children's recreation camp ORLYENOK-YUG, INN 9101006904, the Republic of Crimea. In 2018, insufficiency of property of the company was indicated in negative value of -38 million RUB.

Covering the five-year period, the average net assets values have a trend to increase (Picture 1).

Picture 1. Change in average net assets value in 2014 – 2018

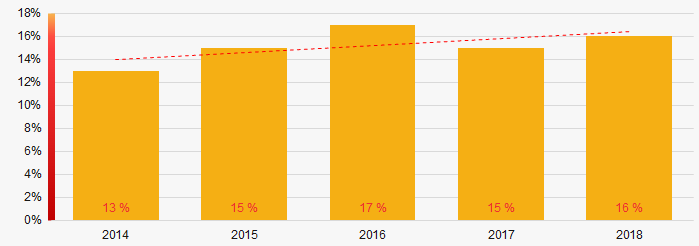

Picture 1. Change in average net assets value in 2014 – 2018The shares of TOP-100 companies with insufficient property have trend to increase over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-100

Picture 2. Shares of companies with negative net assets value in TOP-100Sales revenue

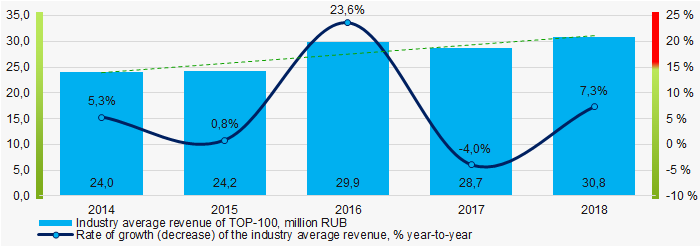

LLC Children's recreation camp Morskaya volna, INN 2365013436, Krasnodar territory, is at the head of TOP-100 by revenue, which was amounted to 304 million RUB in 2018.

In general, there is a trend to increase in revenue (Picture 3).

Picture 3. Change in industry average net profit in 2014-2018

Picture 3. Change in industry average net profit in 2014-2018Profit and loss

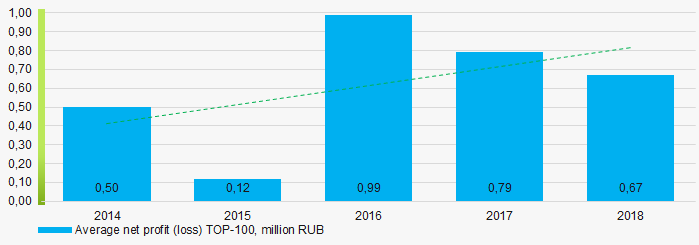

КThe largest company in term of net profit is LLC Sports and recreation camp Detskiy gorodok Salyut, INN 5075029454, Moscow region. The company’s profit for 2018 amounted to 41 million RUB.

Over the five-year period, there is a trend to increase in average net profit (Picture 4).

Picture 4. Change in industry average net profit (loss ) values in 2014-2018

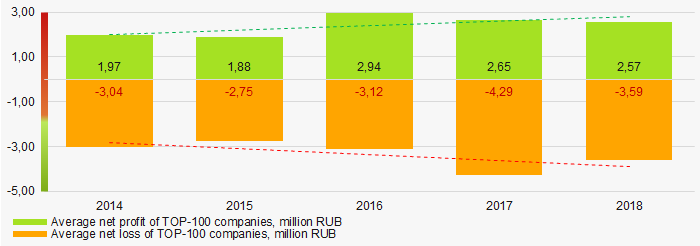

Picture 4. Change in industry average net profit (loss ) values in 2014-2018For the five-year period, the average net profit values of TOP-100 companies increase with the average net loss value also having the increasing trend (Picture 5).

Picture 5. Change in average net profit and net loss of ТОP-100 in 2014 – 2018

Picture 5. Change in average net profit and net loss of ТОP-100 in 2014 – 2018Key financial ratios

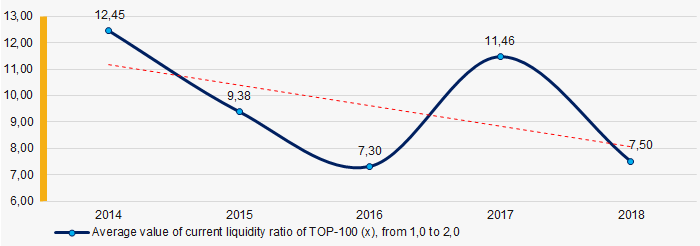

For the five-year period, the average values of the current liquidity ratio were significantly above the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 6).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 6. Change in industry average values of current liquidity ratio in 2014 – 2018

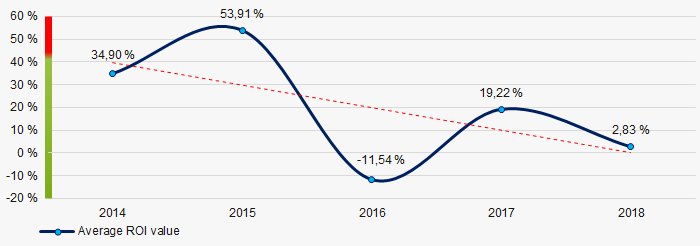

Picture 6. Change in industry average values of current liquidity ratio in 2014 – 2018For the five-year period, the average values of ROI ratio have a trend to decrease (Picture 7).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 7. Change in average values of ROI ratio in 2014 – 2018

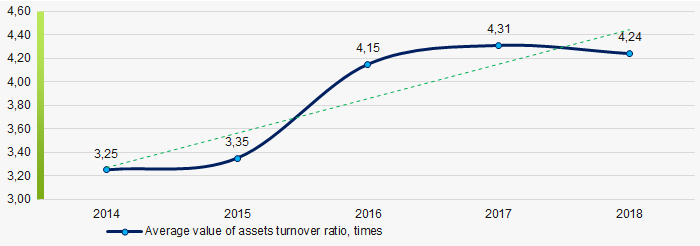

Picture 7. Change in average values of ROI ratio in 2014 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the five-year period, business activity ratio demonstrated the increasing trend (Picture 8).

Picture 8. Change in average values of assets turnover ratio in 2014 – 2018

Picture 8. Change in average values of assets turnover ratio in 2014 – 2018Small business

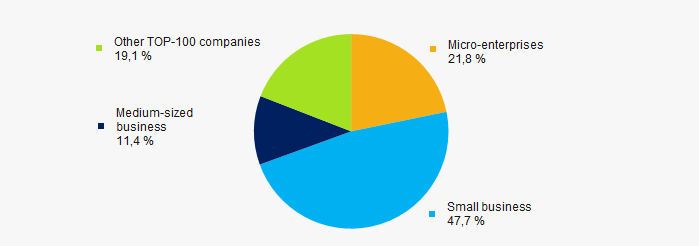

67% companies of TOP-100 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-100 companies amounted to 81% that is significantly higher than the national average figure (Picture 9).

Picture 9. Shares of small and medium-sized enterprises in TOP-100

Picture 9. Shares of small and medium-sized enterprises in TOP-100Main regions of activity

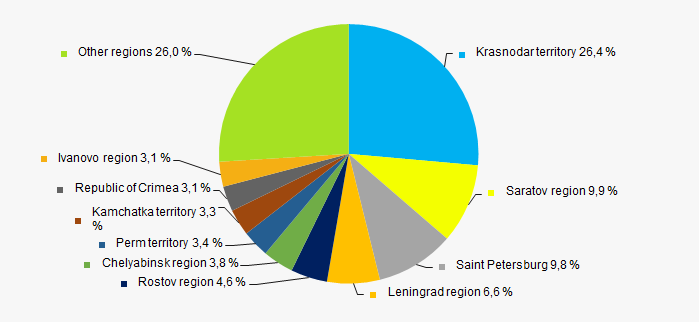

Companies of TOP-100 are registered in 36 regions of Russia, and unequally located across the country. taking into account the specifics of activity Over 26% of companies largest by revenue are located in Krasnodar territory (Picture 10).

Picture 10. Distribution of TOP-100 revenue by regions of Russia

Picture 10. Distribution of TOP-100 revenue by regions of RussiaFinancial position score

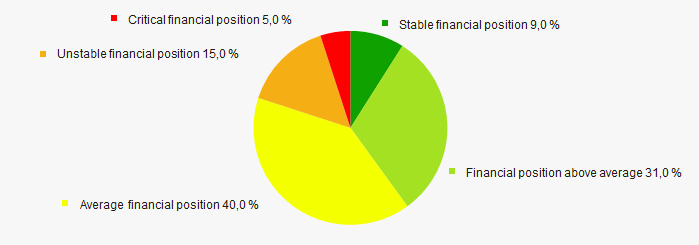

Assessment of the financial position of TOP-100 companies shows that the majority of them have average financial position (Picture 11).

Picture 11. Distribution of TOP-100 companies by financial position score

Picture 11. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

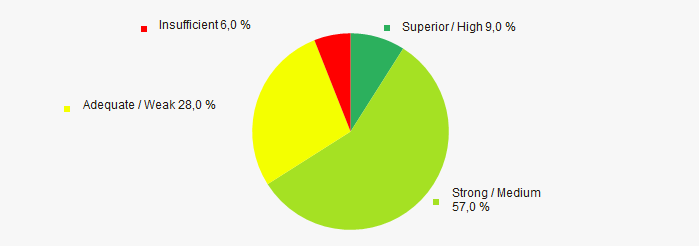

Most of TOP-100 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 12).

Picture 12. Distribution of TOP-100 companies by solvency index Globas

Picture 12. Distribution of TOP-100 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest children’s recreation camps, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  2,7 2,7 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Top 10 banks in terms of loans

Because of low consumer`s demand and slowdown of inflation to projected values, the Bank of Russia moved to easing of monetary policy. The main tool of the regulator is the key rate: currently it amounts to 6,5%. On the next meeting of the Board of directors of the Bank of Russia, that will be held on December 13th, a decision, possibly, will be taken for further lowering of the key rate. Taken measures should encourage bank lending, and, consequently, revival of demand.

The key rate is the main tool to implement monetary policy. The Central Bank of the Russian Federation sets the key rate in order to influence the level of loan rates in the country's economy. In fact, the key rate is the interest rate at which the Bank of Russia lends money to commercial banks.

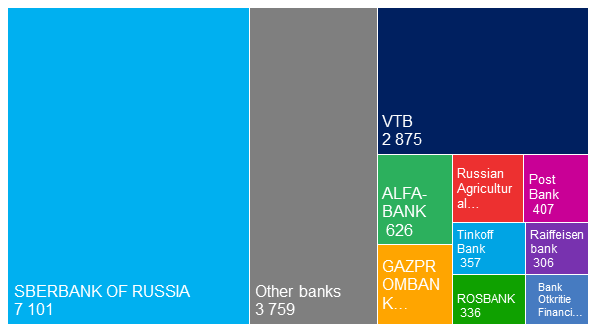

Sberbank of Russia is the leading bank in terms of the volume of loans granted to natural persons: on November of 2019, loan portfolio achieved 7 101 billion RUB, that amounts to 41,6% of the total volume of provided loans (s. Picture 1).

Picture 1. Volume of loans granted to natural persons on November of 2019, billion RUB.

Picture 1. Volume of loans granted to natural persons on November of 2019, billion RUB.Among Top 10 banks Rosbank shows the largest growth rate of loans for a year: +134% compared to November of 2018 (s. Table 1).

| № | Name of commercial bank | Total volume of loans granted on November of 2019, billion RUB | Growth rate of loans compared to November of 2018 % | Share at lending market, % |

| 1 | Sberbank of Russia | 7 101 | 18 | 41,6 |

| 2 | VTB | 2 875 | 17 | 16,8 |

| 3 | Alfa-Bank | 626 | 47 | 3,7 |

| 4 | Gazprombank | 560 | 20 | 3,3 |

| 5 | Russian Agricultural Bank | 451 | 8 | 2,6 |

| 6 | Post Bank | 407 | 42 | 2,4 |

| 7 | Tinkoff Bank | 357 | 77 | 2,1 |

| 8 | Rosbank | 336 | 134 | 2,0 |

| 9 | Raiffeisenbank | 306 | 15 | 1,8 |

| 10 | Bank Otkritie Financial Corporation | 296 | 127 | 1,7 |

| Other banks | 3 759 | 15 | 22,0 | |

Table 2 contains current minimum interest rates on basic credit products in Top 10 Russian banks in terms of loans granted to natural persons. Green value demonstrates the most profitable offer.

| № | Name of commercial bank | Mortgage loan | Credit | Credit card |

| 1 | Sberbank of Russia | from 5,0% | from 11,9% | from 21,9% |

| 2 | VTB | from 8,4% | from 10,9% | from 16,0% |

| 3 | Alfa-Bank | from 8,09% | from 8,8% | from 11,99% |

| 4 | Gazprombank | from 4,5% | from 9,5% | from 25,9% |

| 5 | Russian Agricultural Bank | from 3,75% | from 7,5% | from 22,9% |

| 6 | Post Bank | Not granted | from 9,9% | from 17,9% |

| 7 | Tinkoff Bank | Not granted | from 9,0% | from 12,0% |

| 8 | Rosbank | from 6,99% | from 10,99% | from 23,9% |

| 9 | Raiffeisenbank | from 4,99% | from 8,99% | from 19,0% |

| 10 | Bank Otkritie Financial Corporation | from 7,95% | from 8,5% | from 13,9% |

The banking system of Russia, despite all the difficulties of it`s establishment, plays the key role in the development of the economy of Russia. Credit interest rates, including mortgage loans, set in the majority of banks, just several years ago seemed unattainable, and now they become real.