Russia becomes a safe haven for capital

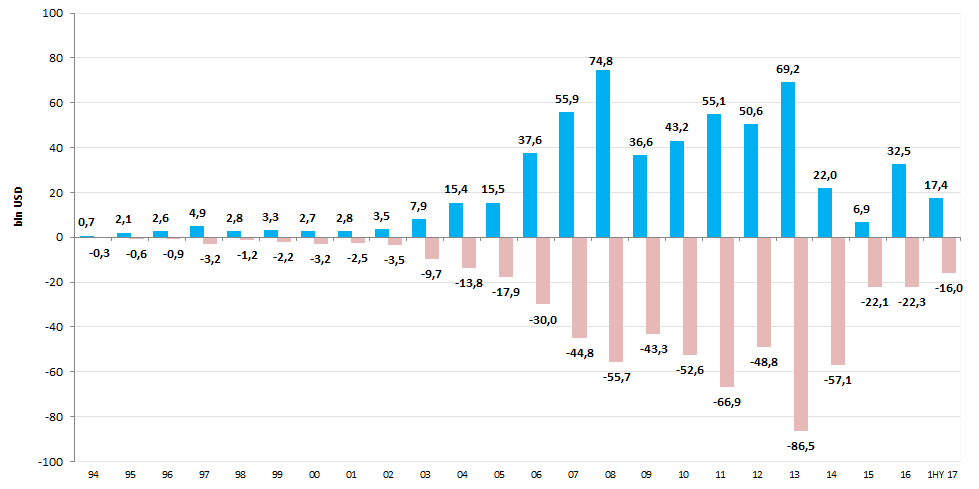

For the whole period of data collection by the Central bank (from 1994 to the 1st half of 2017), total volume of foreign direct investment (FDI) in Russia amounted to 565,8 bln USD. Peak volume of investment to the domestic economy was observed during the period of 2006-2013 under favorable global conditions in commodity markets. Then the decline in investment activity took place and FDI inflow reduced to the minimal level since 2002. In 2016 the situation began to change and FDI volume amounted to 32,5 bln USD. In the 1st half of 2017 Russia has attracted 17,4 bln USD (see picture 2). This figure has increased in 2,3 times compared to the 1st half of 2016 with 7,5 bln USD.

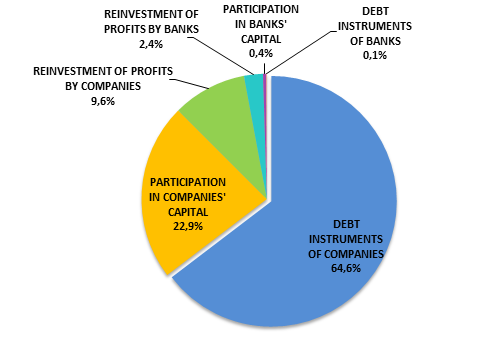

FDI are investment of residents in the capital of a foreign company, attraction of debt instruments abroad (crediting), as well as reinvestment - capital investment in business objects on the territory of the RF at the expense of revenues, profits of a foreign investor or commercial organization. The structure of cumulative FDI for the period of 2010 – 1st half of 2017 is presented on the picture 1. Debt instruments of the company are the most commonly used mechanism for attracting investments (64,6% of total volume of cumulative FDI).

Picture 1. Structure of cumulative FDI in Russia for the period of 2010 – 1st half of 2017, % of total volume

Picture 1. Structure of cumulative FDI in Russia for the period of 2010 – 1st half of 2017, % of total volumeTo see the scale of investment in the RF, it is necessary to compare its volume with other countries. According to the World Bank, the USA with 479,4 bln USD of investment attracted in 2017 is an undisputable leader. France closes Top-10 and is inferior to the USA in 11 times – 42,3 bln USD; Russia – almost in 15 times.

| Rank | Country | FDI volume in 2016, bln USD |

| 1 | The USA | 479,4 |

| 2 | Great Britain | 299,7 |

| 3 | PRC | 170,6 |

| 4 | The Netherlands | 80,8 |

| 5 | Ireland | 79,2 |

| 6 | Brazil | 78,9 |

| 7 | Singapore | 61,6 |

| 8 | Germany | 52,5 |

| 9 | India | 44,4 |

| 10 | France | 42,3 |

ИInvestment is a double-edged sword: along with inflow, the outflow of capital takes place. From 1994 to the 1st half of 2017 605,1 bln USD were moved away. However capital outflow during the period in question was quite low – 39,3 bln USD. All time high withdrawal of 86,5 bln USD was recorded in 2013 and coincident with the beginning of a trend to reduce oil prices.

Picture 2. Dynamics of foreign direct investment in the RF and capital outflow, bln USD for the period of 1994 – 1st half of 2017

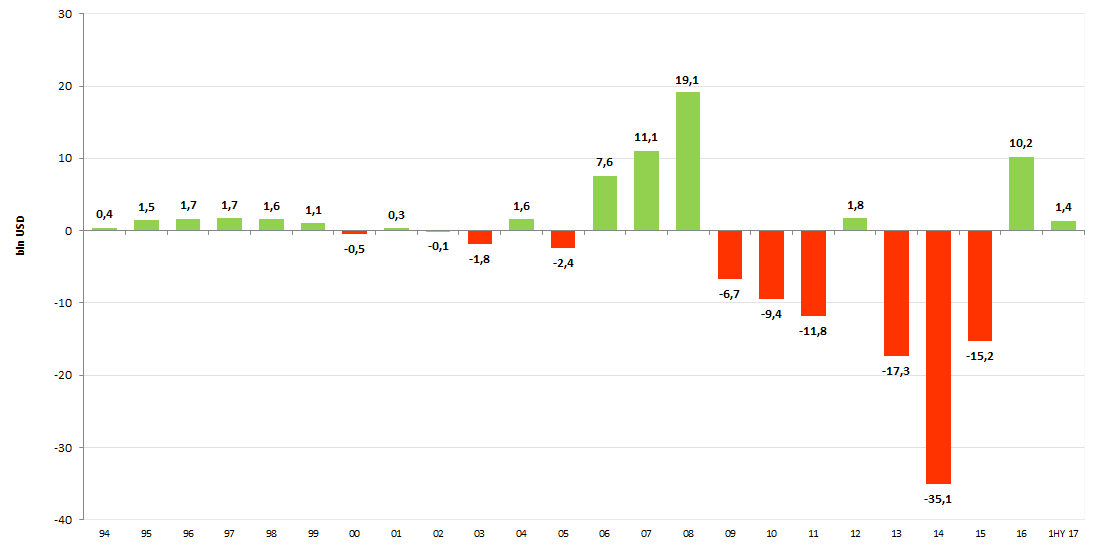

Picture 2. Dynamics of foreign direct investment in the RF and capital outflow, bln USD for the period of 1994 – 1st half of 2017 Equally demonstrative is the picture 3 showing dynamics of balance of received and withdrawn investment. The most unfavorable situation was recorded in 2014 when aggravation of the geopolitical situation around Russia, being unprecedented in post-Soviet history, took place along with high volatility on commodity and exchange markets. It’s a fact that capital likes calm, and it rapidly moves to more stable and predictable jurisdictions at the time of turbulence.

For the first time in 8 years, in 2016 the positive balance of investments exceeded 10 bln USD. Such a good result was achieved only in 2007-2008. Hopefully, the balance will also be in the positive zone and the outflow of capital will not exceed investment in the Russian Federation by the end of 2017: if in the 1st half of 2016 the balance was negative -7,5 bln USD, then in the 1st half of 2017 it exceeded 1,4 bln USD.

Picture 3. Dynamics of balance received to the RF and withdrawn investment, bln USD for the period of 1994 – 1st half of 2017

Picture 3. Dynamics of balance received to the RF and withdrawn investment, bln USD for the period of 1994 – 1st half of 2017 Just FDI are of priority importance for the recipient country in general and for Russia in particular because of the following possibilities:

- Allow covering the shortage of cash resources of domestic companies for quick and large-scale re-equipment of the production base. All other types of foreign investment are mostly speculative and therefore short-term money, not allowing to implement such a task.

- Provide for borrowing of qualified management, since along with financial resources, the experience of a foreign investor in managing the activity of an investment object is received.

- Accelerate the process of inclusion of regional and sectoral economy in the world economy, development of effective integration processes.

- Promote employment growth and increase of social and economic stability of the country (region). Create stationary jobs, which is not the case for other types of foreign investment.

- Unlike loans and credits, FDI is not burdensome on external debt and even contribute to obtaining funds for its repayment.

- Stimulate the development of production of import-substituting and export products with a high share of added value. Only direct foreign investment implements the task of structural reorganization of the recipient country's economy, consisting in transition from raw materials industries to processing and from simple products to complex ones.

Trends in the field of hydropower industry

Information Agency Credinform has prepared the review of trends in the field of hydropower industry.

The largest enterprises (TOP-5 and TOP-25) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical system Globas.

Legal forms

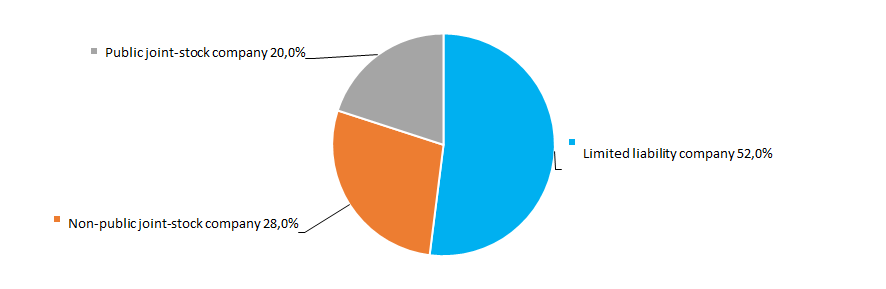

The most popular legal form among companies in the field of hydropower industry is Limited Liability Company. A significant place also take public and non-public joint stock companies (Picture 1).

Picture 1. Distribution of TOP-25 companies by legal forms

Picture 1. Distribution of TOP-25 companies by legal formsSales revenue

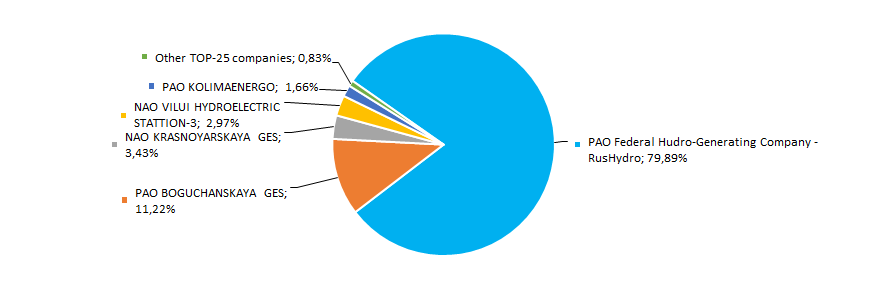

In 2016 total revenue of 5 largest companies amounted to 99,2% from TOP-25 total revenue. This fact testifies high level of monopolization within the industry. In 2016, the largest company by total revenue is PAO Federal Hydro-Generating Company – RusHydro (Picture 2).

Picture 2. The shares of TOP-5 companies in TOP-25 total revenue for 2016, %

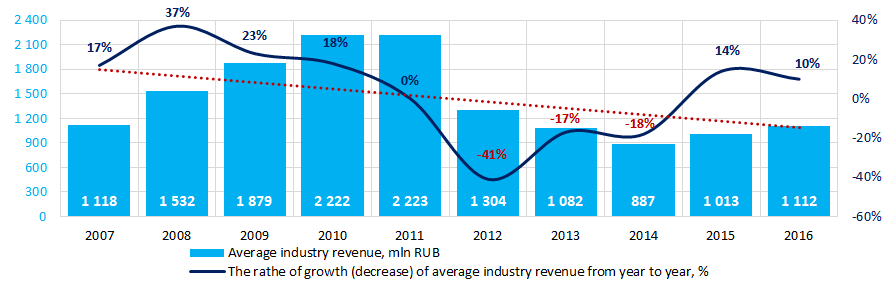

Picture 2. The shares of TOP-5 companies in TOP-25 total revenue for 2016, %The best results by revenue among the industry for the ten-year period were achieved in 2011. In general, the decrease in average industry indicators was observed within this period (Picture 3).

Picture 3. The change of average industry revenue of the companies in the field of hydropower industry in 2007-2016

Picture 3. The change of average industry revenue of the companies in the field of hydropower industry in 2007-2016Profit and loss

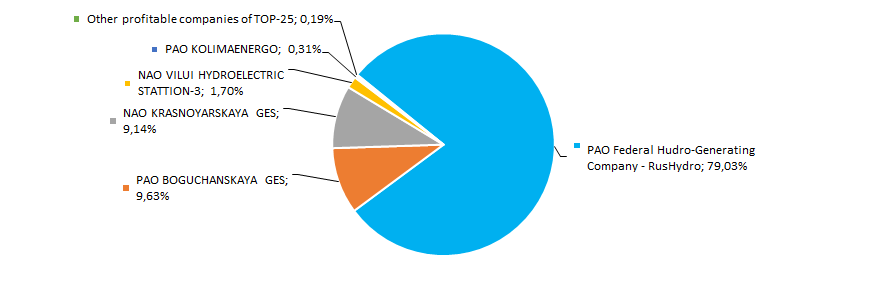

In 2016 profit of 5 largest companies amounted to 99,8% from TOP- 25 total profit. In 2016, the leading position by amount of profit takes PAO Federal Hydro-Generating Company – RusHydro (Picture 4).

Picture 4. The shares of TOP-5 companies in TOP-25 total profit for 2016, %

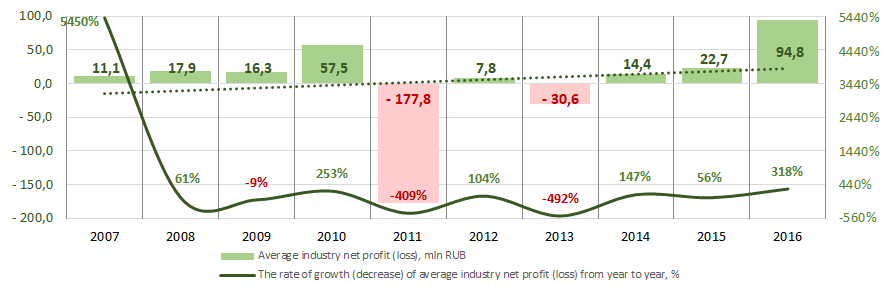

Picture 4. The shares of TOP-5 companies in TOP-25 total profit for 2016, %For the ten-year period, the average industry revenue values of companies in the field of hydropower industry are not stable and in general demonstrates increasing tendency. The negative values were observed in 2011 and 2013 against the background of crisis phenomena in the economy. In recent years the significant growth of indicators is observed. The best results of the industry were in 2016 (Picture 5).

Picture 5. The change of average industry profit of the companies in the field of hydropower industry in 2007-2016

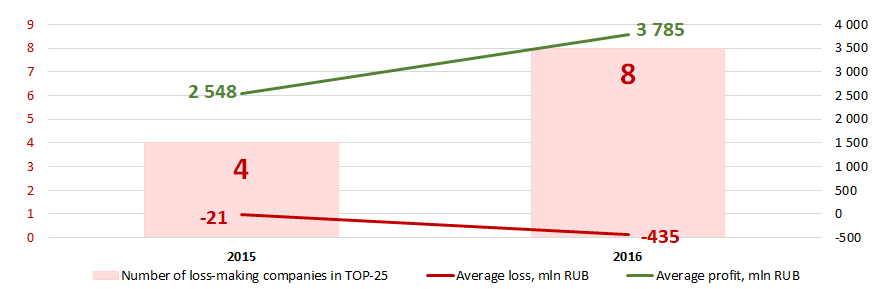

Picture 5. The change of average industry profit of the companies in the field of hydropower industry in 2007-2016In 2015, the TOP-25 list included 4 loss-making companies. In 2016 the number of loss-making companies doubled increased up to 8. Meanwhile, their average loss increased by 20 times. The average profit of other companies from TOP-25 list increased by 49% for the same period (Picture 6).

Picture 6. The number of loss-making companies, average loss and profit within TOP-25 companies in 2015 – 2016

Picture 6. The number of loss-making companies, average loss and profit within TOP-25 companies in 2015 – 2016Main financial indicators

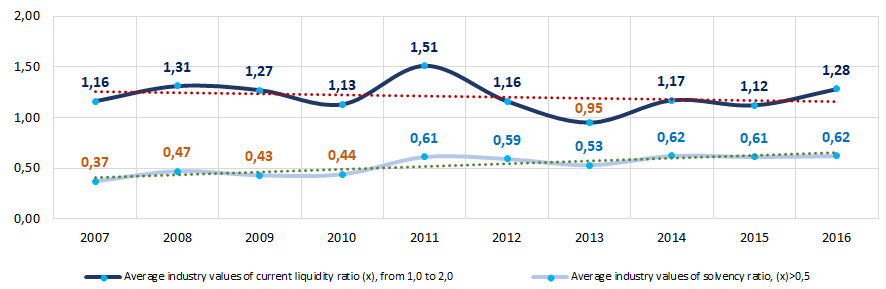

For the ten-year period, only in 2013 the average industry values of current liquidity ratio were lower than recommended values - from 1,0 to 2,0. (yellow color on Picture 7). In general, the downtrend of indicators is observed. Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Solvency ratio (ratio of equity capital to total balance) shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5. The ratio value less than minimum limit signifies about strong dependence from external sources of funds. The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2016 the practical value of solvency ratio for electrical power generation, distribution and transmission companies is from 0,02 to 0,84.

For the ten-year period, the average industry values of the ratio were lower than recommended values from 2007 to 2010 and within practical values (Picture 7).

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of hydropower industry in 2007 – 2016

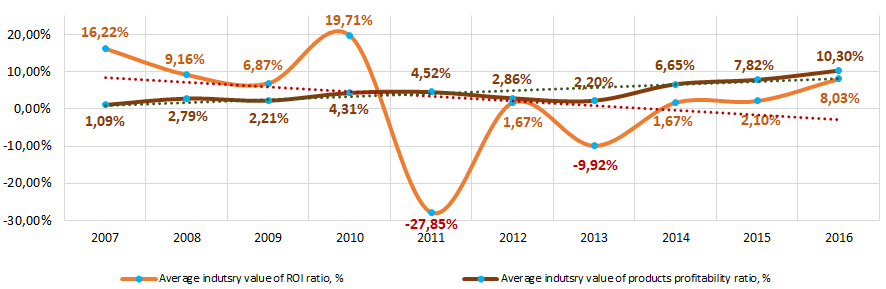

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of hydropower industry in 2007 – 2016For the last ten years, the instability of ROI ratio with downtrend was observed. In the periods of crisis phenomena in the economy (2011 and 2013) the ratios decreased to negative values (Picture 8). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Within the same period, the products profitability ratio demonstrated the increasing tendency (Picture 8). The greatest growth of indicators was observed after 2014. Product profitability ratio is a ratio of sales profit to general expenses. In general, the profitability characterizes the production efficiency.

Picture 8. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of hydropower industry in 2007 – 2016

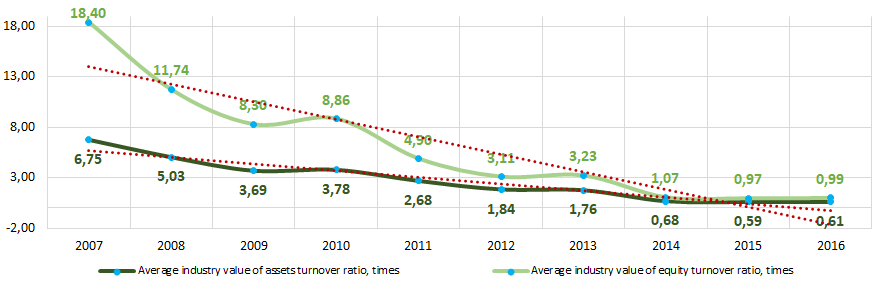

Picture 8. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of hydropower industry in 2007 – 2016For the ten-year period, the values of activity ratios demonstrate downtrend (Picture 9).

Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

Picture 9. Changes of average industry values of activity ratios of companies in the field of hydropower industry in 2007 – 2016

Picture 9. Changes of average industry values of activity ratios of companies in the field of hydropower industry in 2007 – 2016Main regions of activity

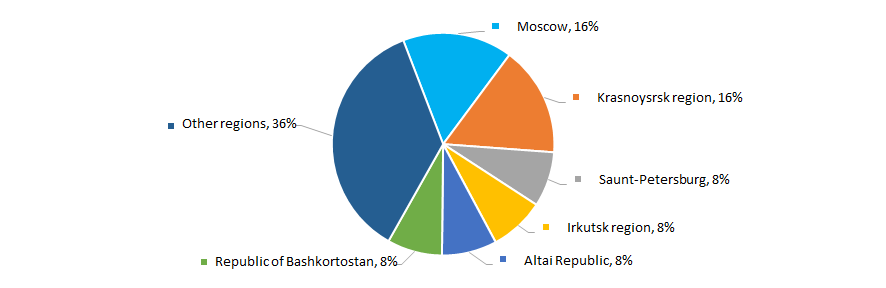

Companies in the field of hydropower industry are unequally distributed across the country. Most of them are registered in Moscow and Krasnoyarsk region (Picture 10). On the one hand, this could be related to the registration of head offices in the largest financial center. On the other hand, Krasnoyarsk region is the region with the maximum potential of renewable resources for electricity generation.

TOP-25 companies are registered only in 15 regions of the Russian Federation.

Picture 10. Distribution of TOP-25 companies by Russian regions

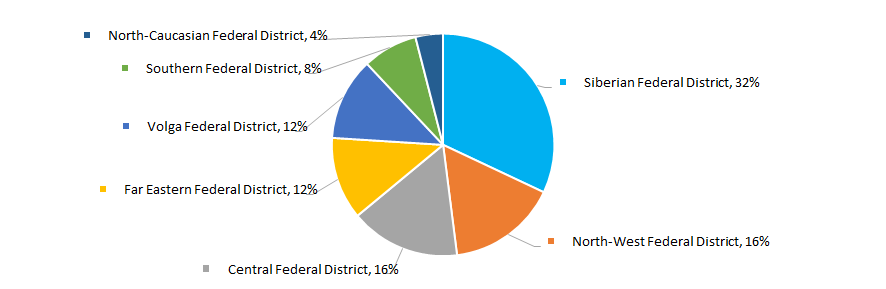

Picture 10. Distribution of TOP-25 companies by Russian regionsMost of the companies of the industry are concentrated in the Central Federal District (Picture 11).

Picture 11. Distribution of TOP-25 companies by federal districts of Russia

Picture 11. Distribution of TOP-25 companies by federal districts of RussiaThe share of companies from TOP-25 list with branches or representative offices amounted to 20%.

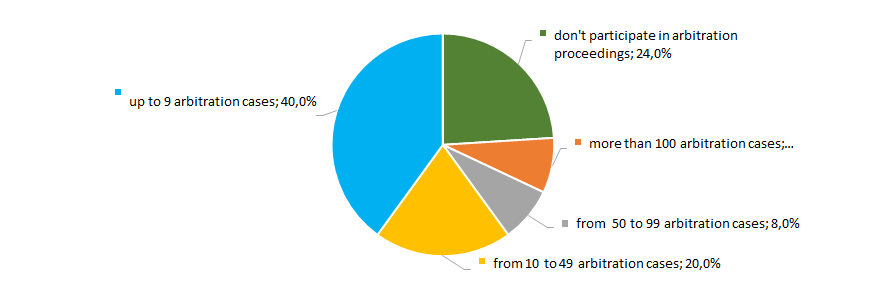

Participation in arbitration proceedings

The better half of industry companies don’t participate in arbitration proceedings or participate inactively (Picture 12).

Picture 12. Distribution of TOP-25 companies by participation in arbitration proceedings

Picture 12. Distribution of TOP-25 companies by participation in arbitration proceedingsReliability index

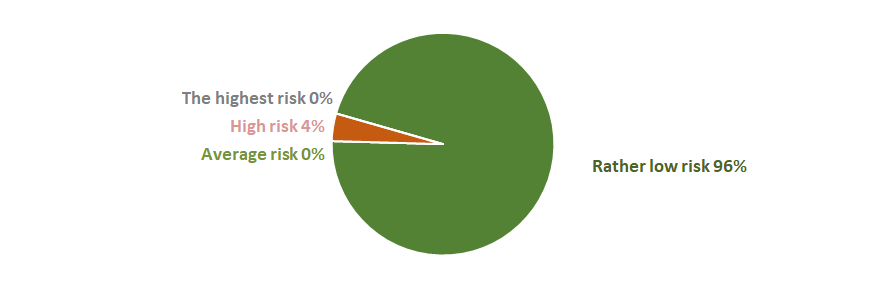

From the point of flight-by-night features or unreliable companies, the vast majority of industry companies show rather low level of cooperation (Picture 13).

Picture 13. Distribution of TOP-25 companies by reliability index

Picture 13. Distribution of TOP-25 companies by reliability indexFinancial position score

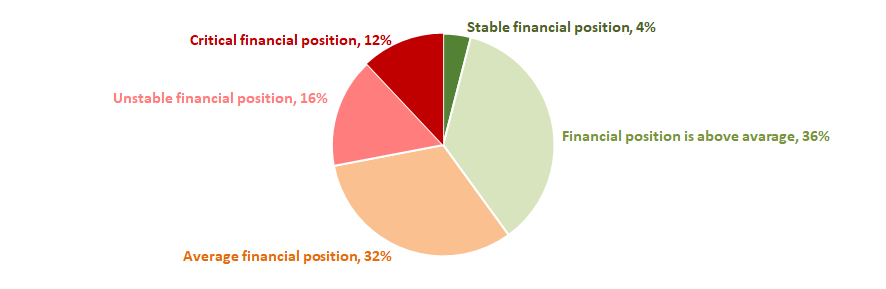

The assessment of company’s financial position shows that more than a quarter of companies are in unstable and critical financial position and more than a third of companies have average financial position (Picture 14).

Picture 14. Distribution of TOP-25 companies by financial position score

Picture 14. Distribution of TOP-25 companies by financial position scoreLiquidity index

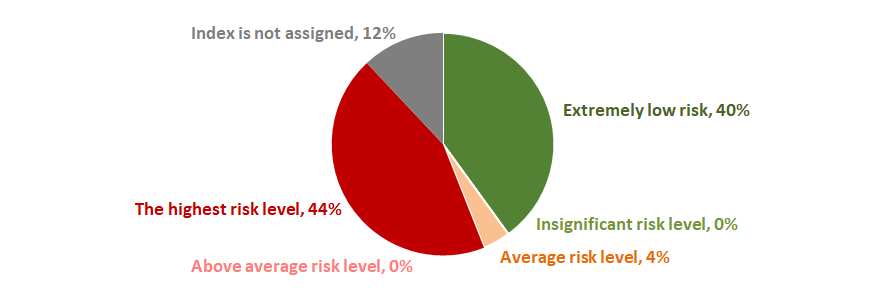

Almost more than a half of industry companies have the highest or average level of bankruptcy risk in the short-term period (Picture 15).

Picture 15. Distribution of TOP-25 companies by liquidity index

Picture 15. Distribution of TOP-25 companies by liquidity indexSolvency index Globas

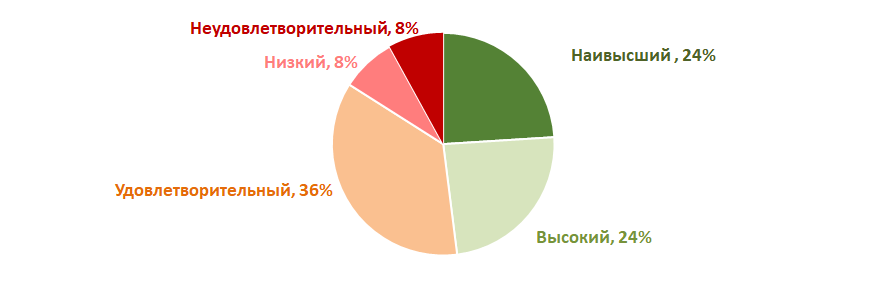

More than a third of TOP-25 companies have adequate and weak solvency index Globas. Thus, almost more than a half of companies have superior, high or strong, medium solvency index Globas (Picture 16).

Picture 16. Distribution of TOP-500 companies by solvency index Globas

Picture 16. Distribution of TOP-500 companies by solvency index GlobasHereby, the complex assessment of hydropower industry companies, taking into account main indexes, financial ratios and indicators, shows negative trends in this field of activity from 2009 to 2014. However, in recent years, the situation changed for the better.