The Trans-Pacific Partnership: with whom and why?

In the early October 2015, 12 countries of the Trans-Pacific region reached the Trans-Pacific partnership agreement. Initiative of the partnership creation belongs to Brunei, New Zealand, Singapore and Chile. Under the TPP* frameworks the USA, Australia, Canada, Japan, Malaysia, Mexico, Chile, Peru and Vietnam formed the economic union. The TPP is expected to operate after each of 12 countries will ratify the agreement, i.e. in or after 2016.

The TTP countries formed a kind of free trade zone in the South-Pacific. According to the agreements reached, the general policy for the intellectual property rights protection should be implemented, as well as the general policy for government procurements, export control, competitive policy and probably there will be agreement for currency issues.

There should be no customs fees between the partner countries. Also it is necessary to unify sanitary and phytosanitary measures and labor markets. Moreover, the agreement provides for settlement in environmental impact, internet trading and services trading. According to the analysts, several countries are easier to come to terms with each other, than to agree for reduction of trade barriers under the WTO*.

The experts considers the TTP as an alternative to ASEAN* and APEC* in the South-Pacific, because they are not aimed at promoting the America’s attention to Asia. The TPP formation could also be a barrier for the China policy in this region. The USA President explicitly stated about it in his speech for the Congress in April 2015. The USA also considers this partnership as a tool for strengthening their allies in the South-East at the confrontations with China.

Today China actively partakes in APEC format, SCO*, promotes the Silk Road project, RCEP*, supporting in implementation of economic interests. Despite some countries directly cooperate with China, there are difficulties with entering its domestic market and not every South-East country agrees with this state of affairs. That is why the question of China’s participation in the TPP is not arisen yet. On the other hand, the USA suggests equal in the TPP. However, Russia and China can be the members only with the approval of the United States because of their dominant position.

Today Russia’s leadership approaches the project in the context of assessment, because the partnership does not affect interests of the country in the trade on the South-East market. In its turn, Russia develops the EEU* project and has already stated the idea of connecting this project with the Chinese “Silk road economic belt” linked with the RCEP. By the Russian government, the TPP appearance is considered as backstage project and an intention of some countries to solve problems out of WTO, because negotiations on the partnership creation are conducted in secret from own nationals, business community, public and even other countries.

The decision concerning the TPP is considered by the foreign affairs experts as a first step to split of the region into economic blocs. That is why the position of negotiators relating to the TPP is a matter of concern, connected with the risk of world trade segmentation after the partnership creation. However, it does not prevent Russia to directly cooperate with Vietnam, New Zealand and other countries.

*

TPP – Trans-Pacific Partnership

WTO – World Trade Organization

ASEAN - Association of Southeast Asian Nations

APEC - Asia-Pacific Economic Cooperation

SCO - Shanghai Cooperation Organisation

RCEP - Regional Comprehensive Economic Partnership

EEU - Eurasian Economic Union.

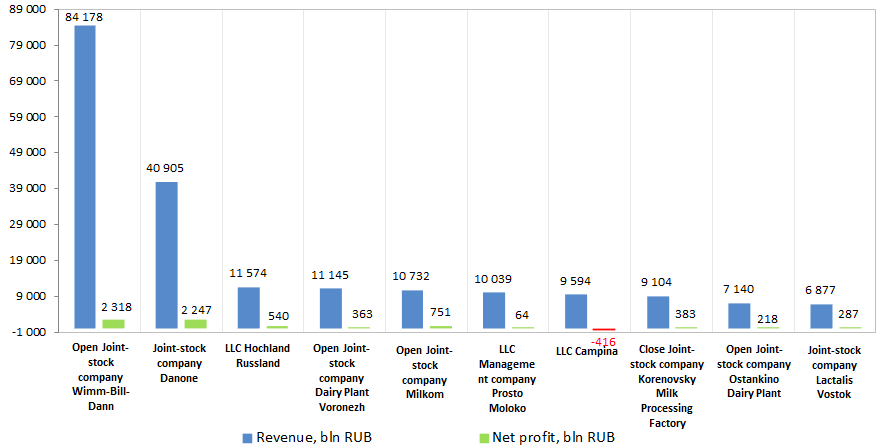

Net profit of the largest manufacturers of dairy products in Russia

Information agency Credinform prepared the ranking of the largest manufacturers of milk, cheese and other dairy products in Russia.

The TOP-10 companies with the highest volume of revenue were selected for the ranking (according to the data from the Statistical Register for the latest available period - for the year 2014); dynamic of the profit related to the previous period, the value of net profit were rated (look at the table 1).

Net profit is undistributed profit (uncovered loss) of the reported period, remained after paying the profit tax and other obligatory payments to the budgets of all levels. Index may be considered as total financial result of enterprise activity.

Net profit may be used for investments into production process, organizing capital reserves, growth of working capital.

Assuming that main aim of the enterprise activity is profit-making, presence of net loss is the evidence of wrong financial strategy, errors of management, changes in external environment.

Fixing of net profit during some years can make future existence of the firm questionable, leading to its bankruptcy.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit in the industry, but also to all available combination of financial data.

| № | Brand/name | Region | Revenue, mlnRUB, 2014 | Revenue increase, % | Net profit, mln RUB, 2014 | GLOBAS-i® index of insolvency |

|---|---|---|---|---|---|---|

| 1 | Open Joint-stock company Wimm-Bill-Dann INN 7713085659 |

Moscow | 84 178,4 | 13,1 | 2318,0 | 230 high |

| 2 | Joint-stock company Danone Russia INN 7714626332 |

Moscow | 40 905,0 | 1,9 | 2247,0 | 266 high |

| 3 | LLCHochland Russland INN 5040048921 |

Moscow region | 11 574,1 | 33,8 | 539,6 | 170 The highest |

| 4 | Open Joint-stock company Dairy Plant Voronezh INN 3662009586 |

Voronezh region | 11 145,2 | 26,0 | 363,2 | 196 The highest |

| 5 | Open Joint-stock company Milkom INN 1834100340 |

The Udmurt Republic | 10 732,1 | 111,6 | 750,7 | 178 The highest |

| 6 | LLC Management Company Prosto Moloko INN 1660183627 |

The Republic of Tatarstan | 10 038,5 | 97,7 | 63,6 | 268 high |

| 7 | LLC Campina INN 5045021970 |

Moscow region | 9594,0 | 1,4 | -416,3 | 264 high |

| 8 | Close Joint-stock company Korenovsky Milk Processing company INN 2335013799 |

Krasnodar territory | 9103,6 | 32,4 | 382,7 | 194 The highest |

| 9 | Open Joint-stock company Ostankino Dairy Plant INN 7715087436 |

Moscow | 7139,8 | 12,0 | 218,2 | 199 The highest |

| 10 | Joint-stock company Lactalis Vostok INN 7716128854 |

Moscow region | 6877,2 | -16,8 | 286,6 | 213 high |

Net profit (loss) of the largest manufacturers of dairy products (Top-10) varies from

-416,3 mln RUB (LLC Campina) to 2318 mln RUB (Open joint-stock company Wimm-Bill-Dann).

Picture 1. Revenue and net profit of the largest manufacturers of milk products (Top-10)

Annual revenue of top-10 companies list according to the last annual financial report (2014) was 201,3 bln RUB, that is 16,2% higher than total index of the same manufacturers of the previous period.

The largest turnover increase (111,6%) shows manufacturer from the Udmurt Republic - Open Joint-stock company Milkom. The company was based on the subholding «Milk processing» and performs wholesale and direct sales of own products throughout Russia. «Milkom» company realizes products of the four largest milk processing companies of the Udmurt Republic: «Izhmoloko», «Sarapul-moloko», «Glazov-moloko», «Kezsky cheese factory». The company is also a distributor of LLC «Savushkin product», LLC «Yastro». Today the industry suplies market with more than 170 000 tons of dairy products per year. Today the range of products counts more than 500 brands that are produced under several registered trademarks.

It worth mentioning the long-standing leaders of the industry: Open joint-stock company Wimm-Bill-Dann and Joint-stock company Danone Russia – the largest companies, according both to the annual turnover and net profit on the dairy products market.

- Business history of «Wimm-Bill-Dann» starts in 1992. In 1993 «Wimm-Bill-Dann» began jogurts producing. That time this kind of dairy products was not well known and just began gaining popularity among the consumers. In 2002 «Wimm-Bill-Dann» is the first Russian food company, placed shares at New York Stock Exchange (NYSE). First placement of shares brought 200 bln USD to the company. On February 2011 the company, the largest manufacturer of juices and dairy products in Russia, joints the PepsiCo family. After buyng «Wimm-Bill-Dann» PepsiCo became the largest enterprise on food and drinks in Russia. Brends of output products became well known: «Agusha», «Domik v Derevne», «Chudo», «Veseliy Molochnik», «J7», «Mazhitel», «Immunel», «Lamber», « Essentuki », «BIO MAX» and others.

- In 1992 Danone is one of the first western companies appearing at the Russian market. In 1995 the first Danone plant began working. At the end of 2010 Danone jointed its dairy products business to the Unimilk company. Unimilk has its history since 2002. For several years of existence the company united about 30 milk processing plants of childhood nutrition. Investments volume of Danone since the moment of the beginning of activity in Russia reached 2 bln USD. There are 18 plants of the group, that products are manufactured under such brends as Danone, «Activia», Actimel, «Rastishka», «Danissimo», «Prostokvashino», «Bio Balance», «Actual», «Smeshariki», «Tyoma» and others.

All participants of the Top-10 largest manufacturers of dairy products ranking have got the highest and high solvency index. This obstacle shows ability of the companies to pay debt obligations in time and in full extent to debt creditors, risk of non-perfomance is minimal.