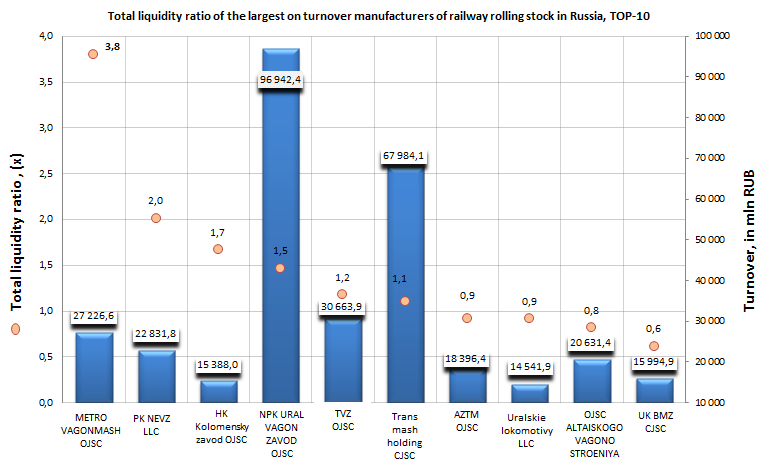

Total liquidity ratio of manufacturers of railway rolling stock

Information agency Credinform prepared a ranking of manufacturers of railway rolling stock on total liquidity ratio. The companies with the highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in total liquidity ratio.

Total liquidity ratio (х) is calculated as the relation of the sum of company’s current assets to short-term liabilities and shows the sufficiency of its funds for repayment of short-terms liabilities. The higher is the indicator value, the better is the solvency of an organization, however, the ratio value higher than 2 can testify to an irrational capital structure, what can be connected with a slowdown in the turnover of funds, invested into inventory, or unreasonable growth of accounts receivable. Recommended values of the indicator: from 1 to 2.

It should be reminded that current assets include following indicators: inventory, value added tax on acquired assets, accounts receivable, financial investments (except monetary equivalents), cash and cash equivalents and other current assets.

Under short-term liabilities are considered: borrowers' liabilities, accounts payable, deferred income, estimated liabilities and other short-term liabilities.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Total liquidity ratio, (х) | Solvency indexGLOBAS-i® |

|---|---|---|---|---|---|

| 1 | METROVAGONMASH OJSC INN 5029006702 |

Moscow region | 27 227 | 3,8 | 140 (the highest) |

| 2 | PROIZVODSTVENNAYAKOMPANIYANOVOCHERKASSKYELEKTROVOZOSTROITELNYZAVODLLC INN 6150040250 |

Rostov region | 22 832 | 2,01 | 222 (high) |

| 3 | Holdingovaya kompaniya Kolomensky zavod OJSC INN 5022013517 |

Moscow region | 15 388 | 1,67 | 172 (the highest) |

| 4 | OJSC NAUCHNO-PROIZVODSTVENNAYAKORPORATSIYAURALVAGONZAVODIMENIF.E. DZERZHINSKOGO INN 6623029538 |

Sverdlovsk region | 96 942 | 1,47 | 169 (the highest) |

| 5 | TVERSKOI VAGONOSTROITELNY ZAVOD OJSC INN 6902008908 |

Tver region | 30 664 | 1,18 | 239 (high) |

| 6 | TransmashholdingCJSC INN 7723199790 |

Moscow | 67 984 | 1,11 | 173 (the highest) |

| 7 | ARMAVIRSKY ZAVOD TYAZHOLOGO MASHINOSTROENIYA OJSC INN 2302044590 |

Krasnodar territory | 18 396 | 0,92 | 244 (high) |

| 8 | UralskielokomotivyLLC INN 6606033929 |

Sverdlovsk region | 14 542 | 0,92 | 251 (high) |

| 9 | OJSC ALTAISKOGOVAGONOSTROENIYA INN 2208000010 |

Altaiterritory | 20 631 | 0,82 | 249 (high) |

| 10 | UPRAVLYAYUSHCHAYAKOMPANIYABRYANSKYMASHINOSTROITELNYZAVODCJSC INN 3232035432 |

Bryansk region | 15 995 | 0,61 | 247 (high) |

The first place of the ranking list belongs to METROVAGONMASH OJSC with the value of the total liquidity ratio 3,8, that is higher, than recommended values, and can testify to an irrational capital structure. However, the company got the highest solvency index GLOBAS-i®, that characterizes it as financially stable.

Five companies from TOP-10 Russian manufacturers of railway rolling stock have the values of total liquidity ratio, which correspond to recommended values: PROIZVODSTVENNAYA KOMPANIYA NOVOCHERKASSKY ELEKTROVOZOSTROITELNY ZAVOD LLC (2,01), Holdingovaya kompaniya Kolomensky zavod OJSC (1,67), OJSC NAUCHNO-PROIZVODSTVENNAYA KORPORATSIYA URALVAGONZAVOD IMENY F.E. DZERZHINSKOGO (1,47), TVERSKOI VAGONOSTROITELNY ZAVOD OJSC (1,18) and Transmashholding CJSC (1,11). Similar results testify to optimal capital structure and companies’ ability to repay short-terms liabilities asap. In support of good results the companies got the highest and a high solvency index GLOBAS -i®.

The indicator values of companies ARMAVIRSKY ZAVOD TYAZHOLOGO MASHINOSTROENIYA OJSC (0,92), Uralskie lokomotivy LLC (0,92) and OJSC ALTAISKOGO VAGONOSTROENIYA (0,82) deviate a little from recommended values, all three enterprises got a high solvency index GLOBAS-i®.

The last enterprise in the ranking list is UPRAVLYAYUSHCHAYA KOMPANIYA BRYANSKY MASHINOSTROITELNY ZAVOD CJSC with the value of the total liquidity ratio 0,61, what is lower, than recommended values, and can testify that there are insufficient current assets for repayment of short-terms liabilities. However, for the objective assessment of financial stability of a company it is necessary to consider the combination of financial and non-financial indicators, that’s why this company also got a high solvency index GLOBAS-i®.

For the growth of the total liquidity ratio and maintenance of its minimum required value some rules must be known and observed. For stably high (within the normative range) total liquidity ratio it is important the profitable operation of an enterprise, including its growth. The financing of investment program (investments into noncurrent assets) should be accounted for long-term and not for short-term credits. Also it is necessary to aim at reasonable minimization of inventory and WIP, i.e. at decrease of the least liquid current assets.

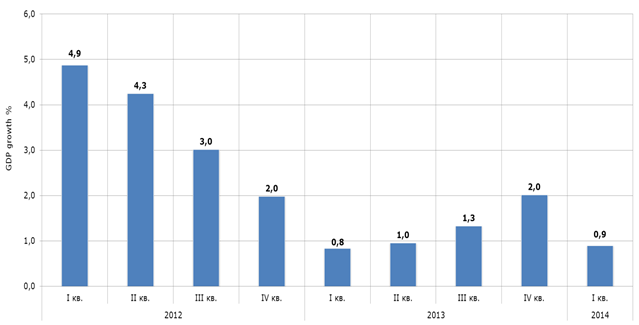

Is it worth expecting for the economic recession?

The escalated geopolitical environment in the events surrounding Ukraine provided a large dose of pessimism to many experts in making an assessment of the national economic growth prospects. The Occident’s sanctions have had an impact on worsening of the not very good investment climate as it was. The capital outflow has increased and according to the Ministry of Finance of the Russian Federation it will be 100 bln dollars in the current year. The devaluation of the ruble at the beginning of the year against the Central Bank’s dollar-euro basket broke up the inflationary developments. The raising of the key discount rate up to 7.5% by the Central Bank has dampened the market for a little bit, but now this solution is the drag for a new impulse to development. What is worth expecting for against the background of these events in the current year?

“The Ministry of Finance of the Russian Federation admits the technical recession in the 2nd and 3rd quarters of the 2014”, says Maxim Oreshkin, the director of division of the long-term strategic planning of The Ministry of Finance.

However, not everything is so decisive. On May 15 the Russian Federal State Statistics Service estimated the GDP growth dynamics in the 1st quarter of 2014 at 0.9% that turned out to be 0.1% more than The Ministry of Economic Development and Trade expected in their previous calculation. According to Andrey Klepach, the deputy economics minister, there was not and will be no recession in the economy. There will be lower point in the 1st quarter and taking into account the gradual settlement of a dispute in Ukraine and the sanctions war damping we should expect for its growth acceleration.

Russian GDP growth by quarter, %

There are a number of other facts for the easing of this situation: as on May 20, the Russian stock market has almost won back lost positions in February and April of the current year, caused by the investors panic because of the actions of Russia in Crimea.

Moreover, according to the last estimating of the Russian Federal State Statistics Service in January and April the run-up of the manufacturing output set up 1.4% to January and April in 2013, compared with the same period in the last year there was the industrial recession to -0.6%.

It is gratifying to emphasize that in the considered time-horizon of the current year the manufacturing increased to 2.8%, last year there was the recession to -0.9%.

To sum up, according to our provisional estimate the economy growth at year-end may be 0.6% more than The Ministry of Finance of the Russian Federation considered earlier.