Return on sales in fish trade

Information agency Credinform represents the ranking of the largest Russian wholesalers of fish and seafood. The trading companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by return on sales ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on sales (%) is calculated as the share of operating profit in the total sales of a company. The ratio reflects the efficiency of industrial and commercial activity of an enterprise and shows the share of company’s funds obtained as a result of sale of products, after covering its cost price, paying taxes and interest payments on loans.

The spread in values of the return of sales in companies of the same industry is determined by differences in competitive strategies and product lines.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of fish and seafood the practical value of the return on sales ratio made 2,74% in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, million rubles | Net profit (loss), million rubles | Return on sales, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| ISLAND CO LTD INN 7819025427 Saint-Petersburg |

6840 6840 |

6458 6458 |

271 271 |

242 242 |

6,33 6,33 |

5,63 5,63 |

208 Strong |

| RUSSIAN FISH COMPANY NJSC INN 7701174512 Moscow |

17592 17592 |

21426 21426 |

641 641 |

688 688 |

6,07 6,07 |

5,36 5,36 |

175 High |

| SK RITEIL NJSC INN 7743703239 Moscow In process of reorganization in the form of acquisition of other legal entities, 25.05.2016. |

7869 7869 |

8701 8701 |

20 20 |

15 15 |

3,38 3,38 |

3,37 3,37 |

240 Strong |

| SK RYBA LLC INN 7743632267 Moscow |

4254 4254 |

4250 4250 |

7 7 |

83 83 |

0,72 0,72 |

3,10 3,10 |

212 Strong |

| ISOLA LLC INN 7811445525 Saint-Petersburg |

6098 6098 |

6148 6148 |

168 168 |

153 153 |

2,57 2,57 |

2,73 2,73 |

233 Strong |

| LA MAREE LLC INN 7705360936 Moscow |

9881 9881 |

4417 4417 |

60 60 |

21 21 |

-1,15 -1,15 |

1,46 1,46 |

233 Strong |

| BLOK DMITRIYA DONSKOGO LLC INN 3905036023 Kaliningrad region |

8058 8058 |

7072 7072 |

87 87 |

43 43 |

1,43 1,43 |

1,30 1,30 |

216 Strong |

| MAGUROS LLC INN 7736544838 Moscow |

3874 3874 |

4363 4363 |

41 41 |

9 9 |

1,56 1,56 |

1,24 1,24 |

197 High |

| NOREBO RU NJSC INN 5190908693 Murmansk region |

5526 5526 |

6829 6829 |

27 27 |

-22 -22 |

0,81 0,81 |

-0,04 -0,04 |

283 Medium |

| BREMOR LLC INN 7722206719 Moscow region |

4714 4714 |

4757 4757 |

140 140 |

-250 -250 |

3,78 3,78 |

-2,55 -2,55 |

296 Medium |

| Total by TOP-10 companies |  74706 74706 |

74420 74420 |

1425 1425 |

982 982 |

|||

| Average value by TOP-10 companies |  7471 7471 |

7442 7442 |

143 143 |

98 98 |

2,55 2,55 |

2,16 2,16 |

|

| Industry average value |  121 121 |

110 110 |

2 2 |

2 2 |

2,50 2,50 |

2,74 2,74 |

|

— improvement of the indicator to the previous period,

— improvement of the indicator to the previous period,  — decline in the indicator to the previous period.

— decline in the indicator to the previous period.

The average value of the return on sales ratio of TOP-10 companies is below the industry average one and practical value. Three companies improved the result in 2017.

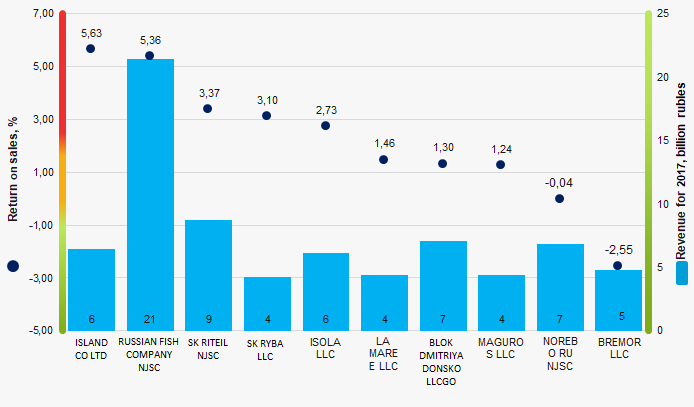

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of fish and seafood (TOP-10)

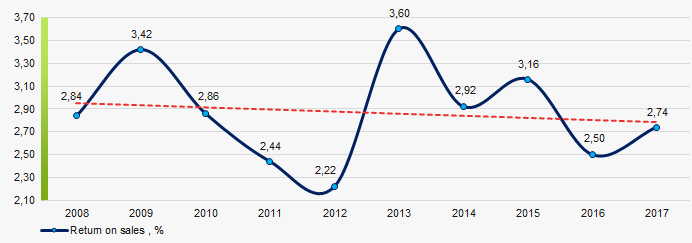

Picture 1. Return on sales ratio and revenue of the largest Russian wholesalers of fish and seafood (TOP-10)The industry average indicators of the return on sales ratio have a downward trend over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of fish and seafood in 2008 – 2017

Picture 2. Change in the industry average values of the return on sales ratio of Russian wholesalers of fish and seafood in 2008 – 2017The largest global IT companies

Today the IT market is rapidly changing; the leading positions are traditionally occupied by the American, Japanese and South Korean companies. China has joined the fray over leadership in one of the most high-tech spheres of human activity. The examples are such companies as Huawei or Alibaba (see table 1).

The paradox of the current moment is that non-market methods are used by the states with market-based economy to deter competitors – express prohibition of cooperation between multinational companies.

Thus, the U.S. Department of Commerce announced that Huawei Technologies and its 70 branches are included in Entity List on May 15, 2019. As a result, Huawei will not be able to buy spare parts and components from American manufacturers without approval of the US government.

Then Google stated that it would no longer supply the Android operating system to Huawei smartphones. The sold smartphones will remain without updates, including the trending Honor. Qualcomm (American manufacturer of chips) and ARM (British manufacturer of processors) are also informed about termination of cooperation with Huawei. Huawei will be able to overcome the negative consequences thanks to its own operating system and chips, the development of which is being successfully carried out.

Huawei produces every fifth smartphone in the world; it is already ahead of Apple and became the second manufacturer after Samsung. Seven years ago, the Chinese company occupied only three percent of the market. The growth of Huawei is a prime example of the Chinese national policy of technological superiority supported by the state.

The company has not only become a successful player in the consumer electronics market, but also become the largest manufacturer of telecommunications equipment. Huawei is aimed to be the flagman company in launching of 5G networks. The main competitors - Nokia and Ericsson are already seriously behind both in terms of equipment cost and market shares in most countries.

Great expectations are placed on 5G due to high speed and energy efficiency. This will allow to create the machine-to-machine communication systems: without 5G networks it is impossible to conduct a mass launch of self-driving vehicles, build smart cities and track a huge amount of data in real-time mode on industrial plants as well as in megalopolises. The 5G network will give the opportunities to manage the virtual objects simultaneously with other people.

The imposed USA restrictions will negatively influence on American IT corporations. The EU countries do not refuse to cooperate with Chinese partners. The market participants are thinking about reducing their dependence on American suppliers. New mobile operating systems and other computer architectures will be developed. In future, the US monopoly in IT industry will decline.

| Position | Company | 2018 revenue, billion USD | Headquarters | |

| 1 |  |

Apple Inc. | $265,6 | Cupertino, US |

| 2 |  |

Samsung Electronics | $221,6 | Suwon, South Korea |

| 3 |  |

Amazon | $232,9 | Seattle, US |

| 4 |  |

Hon Hai Precision/Foxconn | $150,3 | New Taipei City, Taiwan |

| 5 |  |

Alphabet Inc. (owner of Google) | $136,8 | Mountain View, US |

| 6 |  |

Microsoft | $110,4 | Redmond, US |

| 7 |  |

Nippon Telegraph and Telephone (NTT) | $109,3 | Tokyo, Japan |

| 8 |  |

Huawei | $105,2 | Shenzhen, China |

| 9 |  |

Dell Technologies | $90,6 | Round Rock, TX, US |

| 10 |  |

Hitachi | $87,8 | Tokyo, Japan |

| 11 |  |

Sony | $80,2 | Tokyo, Japan |

| 12 |  |

IBM | $79,6 | Armonk, NY, US |

| 13 |  |

Panasonic | $74,1 | Osaka, Japan |

| 14 |  |

Intel | $70,8 | Santa Clara, CA, US |

| 15 |  |

JD.com | $67,2 | Beijing, China |

| 16 |  |

HP Inc. | $58,5 | Palo Alto, CA, US |

| 17 |  |

Alibaba | $56,2 | Hangzhou, China |

| 18 |  |

$55,8 | Menlo Park, U.S. | |

| 19 |  |

LG Electronics | $51,8 | Seoul, South Korea |