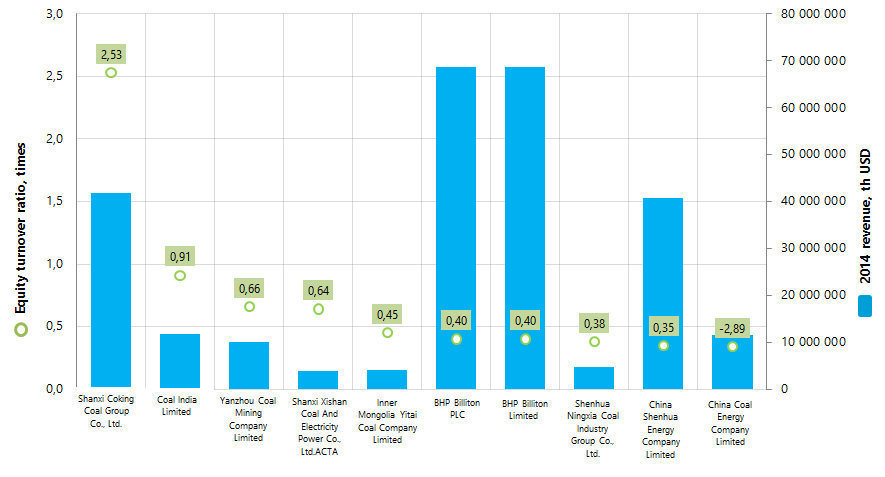

Equity turnover ratio of the world's largest coal mining companies

Information Agency Credinform has prepared the ranking of the largest global coal mining companies by equity turnover ratio. The world's largest enterprises in terms of 2014 revenue were selected within the industry. Then, the companies were ranked by equity turnover ratio (Top-10).

Equity turnover ratio (times) is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

Equity turnover ratio reflects the turnover rate of own capital. The higher is the ratio value, the better the enterprise uses its own funds. Low ratio value indicates about inaction of the part of own funds.

| № | Name | Country | 2014 revenue, th USD | Equity turnover ratio, times |

|---|---|---|---|---|

| 1 | Shanxi Coking Coal Group Co., Ltd. | China | 41 820 287 | 2,53 |

| 2 | Coal India Limited | India | 11 838 160 | 0,91 |

| 3 | Yanzhou Coal Mining Company Limited | China | 9 971 937 | 0,66 |

| 4 | Shanxi Xishan Coal And Electricity Power Co., Ltd. | China | 3 934 521 | 0,64 |

| 5 | Inner Mongolia Yitai Coal Company Limited | China | 4 084 748 | 0,45 |

| 6 | BHP Billiton PLC | Great Britain | 68 765 000 | 0,40 |

| 7 | BHP Billiton Limited | Australia | 68 724 000 | 0,40 |

| 8 | Shenhua Ningxia Coal Industry Group Co., Ltd. | China | 4 746 725 | 0,38 |

| 9 | China Shenhua Energy Company Limited | China | 40 689 820 | 0,35 |

| 10 | China Coal Energy Company Limited | China | 11 581 654 | 0,34 |

Equity turnover ratio of the world's coal mining leaders varies from 2,53 times (Shanxi Coking Coal Group Co., Ltd.), to 0,34 times (China Coal Energy Company Limited). Equity turnover ratio of the largest enterprise by annual revenue BHP Billiton PLC is 0,4 times per period.

Picture 1. Equity turnover ratio and revenue of the world's largest coal mining companies (TOP -10)

JOINT STOCK COMPANY SUEK-KUZBASS (INN 4212024138) is the largest Russian coal mining company, which is not included in the TOP-10 and takes the 29th place of the world's rating by 2014 annual revenue (1 224 208 th USD); the company’s equity turnover ratio is 29,9 times per period. At the same time, the ratio of the ranking’s leader Shanxi Coking Coal Group Co., Ltd. is 2,53 times.

Coal is still one of the most important sources of thermal power and valuable raw material for chemical industry. The share of coal and oil shale in total volume of world's fossil fuel reserves is about 90%, peat - 5%, oil and natural gases - 5%.

According to Statistical review of the world’s energy made by BP company in 2013: 7 896,4 mln tons of coal were produced in the world. The distribution of coal mining countries is reflected in Table 2.

| Country | 2013 coal mining, mln tons | The share in world production, % |

|---|---|---|

| People's Republic Of China | 3 680,0 | 46,60 |

| USA | 892,6 | 11,30 |

| India | 605,1 | 7,66 |

| Australia | 478,0 | 6,05 |

| Indonesia | 421,0 | 5,33 |

| Russia | 347,1 | 4,40 |

| South Africa | 256,7 | 3,25 |

| Germany | 190,3 | 2,41 |

| Poland | 142,9 | 1,81 |

| Kazakhstan | 114,7 | 1,45 |

The world's leader in coal mining is China, that is reflected in the current ranking: 7 out of 10 participants from the Top-10 list are Chinese companies.

For reference

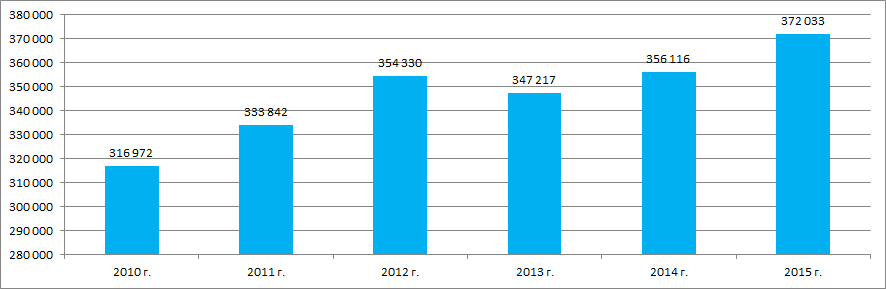

Picture 2. Coal mining in Russia in 2010 – 2015 (according to the Federal State Statistics Service), th tons

Bank of Russia will continue the moderately tight monetary policy

One of the forms of state regulation of the economy is the monetary policy. The Central Bank of Russia (the CB of the RF, Mega-regulator) implements it through activities that affect the change of the money supply (monetary policy) and regulate the volume of loans, level of interest rates and other indicators (credit policy).

In monetary policy the Mega-regulator uses basic instruments and methods that are defined by the federal law №86-FZ "On the Central Bank of the Russian Federation (Bank of Russia)» dated 10.0.2002 in Art. 35:

- interest rates on operations of the Bank of Russia;

- mandatory reserve requirements;

- open-market transactions;

- refinancing of credit institutions;

- exchange rate interventions;

- setting of monetary targets;

- direct quantitative restrictions;

- bond issue on behalf of itself;

- other instruments defined by the Bank of Russia.

As of the end of March 2016 there were a number of changes taken place in the system of instruments of the monetary policy of the Bank of Russia. Thus, the value of the refinance rate has been equated to the value of the key rate of the CB of the RF, at present it is 11%.

By commitments of credit institutions in foreign currency, with the exception of obligations to individuals, the legal reserve requirements has been increased by 1 percentage point since April 1, 2016 and now they reach 5,25%.

All shares of legal entities - residents of the Russian Federation and Russian depositary receipts for shares of legal entities - non-residents of the Russian Federation are excluded from the Lombard List of the Bank of Russia after February 1, 2016 included in it on the date of adoption of this decision.

Since January 19, 2016 the instrument of refinancing of credit institutions has been created, that allows to secure the right of claim on loans granted to leasing companies within the provisions defined by the Fund for the Development of Industry.

The Bank of Russia hasn’t been carrying out foreign exchange interventions (purchase / sale) in the domestic currency market since July 29, 2015. At the same time the Federal Treasury hasn’t been making the purchase / sale of foreign currency since February 3, 2015.

The lending of the CB of the RF on ongoing transactions aimed at ruble liquidity provision has been increased since March 1, 2016, for example, on «overnight» credits - up to 0,4 bln RUB per day, collateral loans – up to 10,7 bln RUB, transactions «currency swap» - up to 37,0 bln RUB, repo transactions - up to 299,7 bln RUB. At the same time on open-market transactions it is noted a decrease on the provision of liquidity volumes, for example, for repo auctions - almost three times.

The analysis of the situation in the Russian economy has shown that, for example, to reduce the inflation in the economy up to 4% in 2017 the Mega-regulator will carry out the moderately tight monetary policy. However, according to the Central Bank, it will take a more prolonged period, than had been expected earlier, because inflation risks remain high due to the unpredictable oil market environment, persistent inflation expectations, uncertainty of separate parameters of the budget. In support of its intentions the CB of the RF has kept the key rate intact, which it has set as early as in August 3, 2015.