The GLOBAS-i® system continues to increase the amount of current financial statements.

The GLOBAS-i® system continues to increase the amount of current financial statements. At the moment 2013 financial statements are under processing and will be available in the nearest future.

As of today the Information system GLOBAS-i® contains more than 23 000 new balance sheets. Information about 8,8 mln.

Russian companies with financial history for the last 20 years, as well as information about 7 mln. individual entrepreneurs are available in the System.

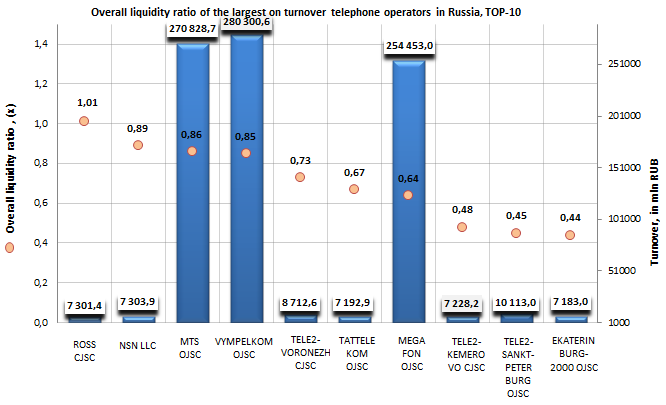

Overall liquidity of telephone operators in Russia

Information agency Credinform offers to get acquainted with the ranking of Russian telephone operators. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in overall liquidity ratio.

Overall liquidity ratio (in foreign sources often is named as current liquidity ratio) shows company’s ability to repay current (short-term) liabilities using only working assets. This indicator is calculated as the relation of current assets to current liabilities, i.e. to short-term liabilities. According to accepted standards, a norm for this ratio is the range between 1,0 and 2,0. Lower limit arises from that it should be at least enough working assets for full satisfaction of short-term liabilities, otherwise a company will be at risk of bankruptcy. However, the reverse situation with a significant excess of short-term assets over liabilities (three-four times as much or more) is considered also to be undesired, because it can testify to the failure of capital structure, as well as to irrational or ineffective investment of funds.

| № | Name INN | Region | Turnover for 2012, in mln RUB | Overall liquidity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | ROSTOVSKAYA SOTOVAYA SVYAZ CJSC INN 6163025500 |

Rostov region | 7301 | 1,01 | 198 (the highest) |

| 2 | NOKIA SOLYUSHNZ END NETVORKS LLC INN 7725593720 |

Moscow | 7304 | 0,89 | 276 (high) |

| 3 | MOBILNYE TELESISTEMY OJSC INN 7740000076 |

Moscow | 270829 | 0,86 | 218 (high) |

| 4 | VYMPEL-KOMMUNIKATSII OJSC INN 7713076301 |

Moscow | 280301 | 0,85 | 238 (high) |

| 5 | TELE2-VORONEZH CJSC INN 3666036485 |

Voronezh region | 8713 | 0,73 | 252 (high) |

| 6 | TATTELEKOM OJSC INN 1681000024 |

Republic of Tatarstan | 7193 | 0,67 | 192 (the highest) |

| 7 | MEGAFON OJSC INN 7812014560 |

Moscow | 254453 | 0,64 | 216 (high) |

| 8 | TELE2-KEMEROVO CJSC INN 4207041667 |

Kemerovo region | 7228 | 0,48 | 209 (high) |

| 9 | TELE2-SANKT-PETERBURG OJSC INN 7815020097 |

Saint-Petersburg | 10113 | 0,45 | 247 (high) |

| 10 | EKATERINBURG-2000 LLC INN 6661079603 |

Sverdlovsk region | 7183 | 0,44 | 234 (high) |

The leader of the ranking, ROSTOVSKAYA SOTOVAYA SVYAZ CJSC, turned out to be the only one enterprise, which showed the overall liquidity ratio in compliance with the recommended values. Moreover, the company got the highest solvency index GLOBAS-i®, that testifies to its stable financial standing.

At the same time the companies NOKIA SOLYUSHNZ END NETVORKS LLC (0,89), MOBILNYE TELESISTEMY OJSC (0,86) and VYMPEL-KOMMUNIKATSII OJSC (0,85) have the values of the overall liquidity ratio, which deviate a little from recommended values, that is why it is not worth to speak of high credit risks for these enterprises. Besides, considering the combination of both financial and non-financial indicators, all three companies got a high solvency index GLOBAS-i®.

Unfortunately, the rest enterprises of the ranking showed the values of the overall liquidity ratio being essentially below the recommended lower limit, what testifies to that they have not enough working assets for full satisfaction of short-term liabilities. However, all enterprises got a high and the highest solvency index GLOBAS-i®, what points to their ability to pay off loan liabilities in time and fully.

For the growth of the overall liquidity ratio and maintenance of its minimum required value some rules must be known and observed. So, for stably high (within the normative range) overall liquidity ratio it is important the profitable operation of an enterprise, including also its growth, and financing of investment program (investments into noncurrent assets) should be accounted for long-term and not for short-term credits. Also it is necessary to aim at reasonable minimization of inventory and WIP, i.e. at decrease in the least liquid current assets.