Ranking the largest timber sawing and planing industry companies of St. Petersburg and the Leningrad region

Credinform Information Agency has come with the ranking release of timber sawing and planing industry companies of St. Petersburg and the Leningrad region. Ten companies with the largest sales revenues (as stated Statistics Register 2011) were selected and then ranked upon their accounts payable turnover.

The accounts payable turnover (days) is a relation of the average payables, taken for a certain time period, to the cost of goods sold. It shows the period (number of days) in which company discharges its liabilities.

| № | Company | Region | Turnover in 2011, mln. RUB | The accounts payable turnover(days) | Globas-i® solvency index |

|---|---|---|---|---|---|

| 1 | OOO "ECOTECH" Company Limited INN – Tax number: 4711005451 | The Leningrad Region | 83,4 | 426,1 | 292(high) |

| 2 | ZAO JV "KARET" INN – Tax number: 7817005947 |

St. Petersburg | 106,5 | 310,15 | 279(high) |

| 3 | OOO Ltd Volosovsky TPINN – Tax number: 4717009237 | The Leningrad Region | 142,3 | 164,67 | 285(high) |

| 4 | OAO Priozerskii Derevoobrabatyvayushchii zavod INN – Tax number: 4712000329 | The Leningrad Region | 349,8 | 113,17 | 315(sufficient) |

| 5 | OOO First Woodsteeping Works Ltd.INN – Tax number: 4708013050 | The Leningrad Region | 91,7 | 107,23 | 306(sufficient) |

| 6 | OOO OKC-5 Ltd.INN – Tax number: 7804408402 | St. Petersburg | 183,8 | 93,64 | 226(high) |

| 7 | ZAO Joint Stock Company Tichvinski kompleksni lesproINN – Tax number: 4715001850 | The Leningrad Region | 213,2 | 66,74 | 253(high) |

| 8 | ZAO DELOINN – Tax number: 4712013511 | The Leningrad Region | 134,1 | 65,25 | 235(high) |

| 9 | OOO Soyuz VINN – Tax number: 4704079332 | The Leningrad Region | 91,7 | 62,95 | 320(sufficient) |

| 10 | OOO Limited Liability Company Metsa Svir INN – Tax number: 4711005733 | The Leningrad Region | 1 635,6 | 12,08 | 244(high) |

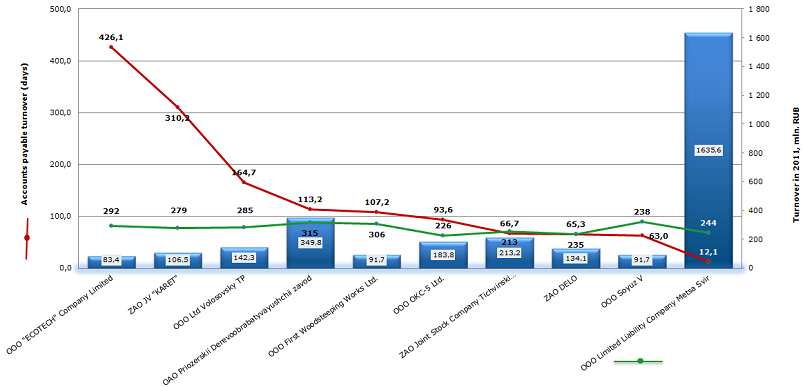

Diagram. The accounts payable turnover of Top-10 timber sawing and planing industry companies of St. Petersburg and the Leningrad region

In the table, you find industry biggest companies of St. Petersburg and the Leningrad region. Following 2011 results, top-10 total turnover reached 3 032,1 mln. RUB. The average value of payable turnover ratio is 142 days.

You can see from the table that no company, except for OOO "ECOTECH" Company Limited, has exceeded 350 mln. RUB. of its turnover.

Following 2011 results, three companies on Top-10 list – OOO "ECOTECH" Company Limited, ZAO JV "KARET", and OOO Ltd Volosovsky TP – have the longest period of the accounts payable turnover, 426, 310 and 165 days respectively. The slow-paced turnover here is most probably reasoned by industry’s features like dependency on timber delivery, high prices monopoly tariffs etc.; besides, the sales revenues of these companies are relatively small – the so called ‘scale effect’ is less important here compared to the large companies. However, all these firms got the highest score in Credinform independent Globas-i® solvency ranking; this means they are able to discharge their liabilities duly and in time, and risk of becoming a default is rather minor.

Three companies – OAO Priozerskii Derevoobrabatyvayushchii zavod, with the accounts payable turnover 113 days, OOO First Woodsteeping Works Ltd., 107 days and OOO Soyuz V, 63 days – got Globas-i® sufficient ranking, which means there is no guarantee they will pay their liabilities out, duly and in time – besides, they are not strong enough to adapt to changing economic situation. Although the accounts payable turnover of these companies is lower than that of the Top-10 Big Three, there is a clear need for companies’ management to re-think their financial strategy – credit line drawdown terms, product markets, logistics policy, and marketing programmes.

The rest of the companies on Top-10 list got high solvency ranking – noteworthy, the accounts payable turnover of OOO "ECOTECH" Company Limited, 12 days, is much lower than that of the largest manufacturers. There is no big surprise here, however, - company’s revenues include ‘scale effect’ which makes it possible for it to discharge its current liabilities, duly and in time.

Russia's foreign debt continues to increase

Russia's foreign debt for the first half of 2013 amounted to USD 49 568.1 million, according to Statistics Registry. That is 19% higher than in H1 2012. According to the data of the Central Bank of the Russian Federation, the amount of foreign debt to April 1, 2013 compared to the same period in 2012 increased by 23.04% to a record USD 691 billion, USD 206 billion of which fall to share of commercial banks’ debts and USD 408 billion – to the share of other businesses and organizations. The size of the foreign debt per capita is 162 thousand rubles.

The amount of foreign debt has become come up rapidly since 2005, constantly increasing the rate. With the beginning of the crisis in 2008, the growth has hesitated in the banking sector firstly. Reduction was observed in the crisis year of 2009. But already in 2010 the growth of foreign debt was found to be and it amounted to USD 467 billion for January 1, 2010. For 2011-2012 it increased by 11.5%.

The bulk of foreign debt is accounted for by the private sector. But principal borrowers could be named l the private sector by a long stretch of the imagination, because the major debtors are the largest state-owned companies and banks. Despite the fact that formally the state is not liable for the debts of the enterprises and organizations, the experience of the 2008 crisis showed that in a critical situation the state prevented the bankruptcy of many companies from the contingency fund. In many ways this was the reason that the Russian anti-crisis program was one of the most expensive in the world in terms of GDP and was variously estimated RUB 10 trillion or 25% of GDP in 2008.

That is why the foreign debts of public enterprises are called "quasi-public" and part of the risk in the payment of the debts is covered by the state.

Who are the main debtors? In 2011, the total debt of "Rosneft" amounted to USD 23.4 billion. Due to the need to obtain a large loan by company in 2012 (according to estimates range from USD 35 to 38 billion) for the purchase of "TNK-BP" it increased substantially. The total debt "Gazprom" has also significantly increased because of construction of "South Stream", the largest pipeline system in Europe. The cost of the project is currently estimated at USD 23 billion. "Russian Railways", "Russian Aluminum", "Lukoil", "Severstal", "RusHydro", as well as banks VTB and Sberbank are also among the leaders of foreign debts.

Due to the situation, the question “why do domestic large companies apply for loans to foreign investors?” arises. Firstly, the Russian banks do not have sufficient funds to meet the investment demand from large enterprises. Secondly, financial market segments, giving the "long" money, such as pension and insurance funds unfortunately are not sufficiently developed in the country. Thirdly, borrowing abroad, especially in the long term, is just more profitable, because of the high rate of inflation and high interest rates refinancing by the Central Bank.

Is the size of the foreign debt of critical? The size of the foreign debt is currently 28% of GDP, which is not a critical figure. But analyzing the ratio of debt to the part of GDP, accounting for non-budget enterprises and organization (about 60% of GDP), the resulting figure is about to 50%.

Excluding small and medium-sized businesses that do not take foreign loans, the ratio of debt will come to 70%, which certainly can be considered critical.