The Ministry of Finance counted the potential budget deficit in the current year

The Ministry of Finance leaves open the possibility of emergence of the risks of federal budget implementation in the current year with the deficit just over 3% GDP. This was pronounced by Anton Siluanov, the Minister of Finance, to the journalists at the end of 2014.

Having said that Mr. Siluanov stated that such a pessimistic forecast is realistic providing that the current dynamic of oil prices and economic growth rates remain the same.

The head of the ministry expressed an opinion that even if the limits for the next year are reduced by 10 %, it won’t be enough to balance the budget. At the same time, he stated that the Ministry has several ideas on further measures necessary for optimizing of the budget. In this issue two ways of development are suggested: either gradual consolidation or optimization of budget in accordance with the current state of business, or use of the Reserve Fund in grater volumes.

Furthermore Mr. Siluanov stated that in 2015 the Ministry is off to come to decisions on budget and finances, orienting on the current situation. At the same time by 2017 the Ministry of Finance sets for itself a goal of the balanced budget at the oil price USD 70 p/b.

The head of the Ministry stated that concerning additional capitalization of banks the budget deficit in the current year will amount to 0,7% GDP. Earlier the Audit Chamber mentioned the figure 0,8-1% GDP.

It bears reminding that as of December 19, 2014 the State Duma passed the law on allocation of RUR 1 trillion as an asset contribution to the Deposit Insurance Agency for additional capitalization of banks through federal loan bond mechanism.

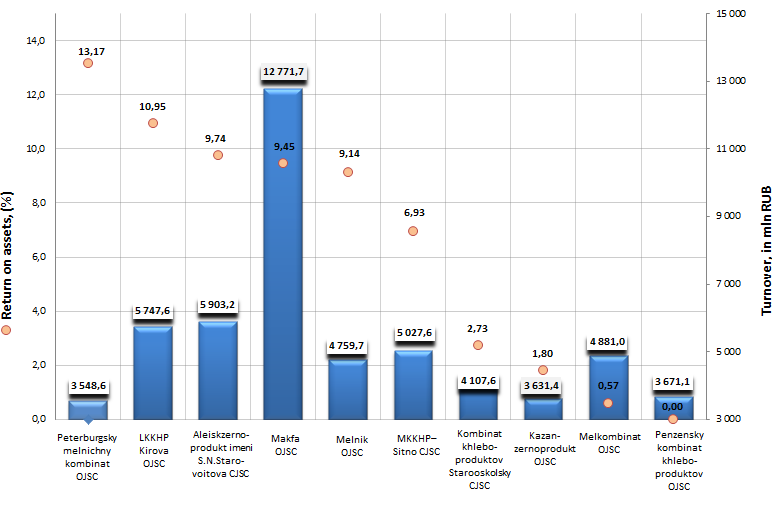

Return on assets of manufacturers of flour milling products

Information agency Credinform offers to get acquainted with the ranking of Russian manufacturers of flour milling products. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on assets.

Return on assets is a financial indicator, which characterizes benefit from the use of all assets of an organization. This ratio is calculated as the relation of net profit and interests payable to company’s total assets value and shows, how many monetary units of net profit were earned by each unit of total assets.

There are no specified or recommended values prescribed for profitability ratios, because their values vary strongly depending on the branch.

| № | Name, INN | Region | Turnover for 2013, in mln RUB | Return on assets, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Peterburgsky melnichny kombinat OJSC INN 7810229592 |

Saint-Petersburg | 3549 | 13,17 | 197 (the highest) |

| 2 | Leningradsky kombinat khleboproduktov im. S.M. Kirova OJSC INN 7830002303 |

Saint-Petersburg | 5748 | 10,95 | 209 (high) |

| 3 | Aleisk zernoprodukt imeni S.N.Starovoitova CJSC INN 2201000766 |

Altai territory | 5903 | 9,74 | 186 (the highest) |

| 4 | Makfa OJSC INN 7438015885 |

Chelyabinsk region | 12 772 | 9,45 | 207 (high) |

| 5 | Melnik OJSC INN 2209006093 |

Altai territory | 4760 | 9,14 | 203 (high) |

| 6 | Magnitogorsky kombinat khleboproduktov – Sitno CJSC INN 7414001724 |

Chelyabinsk region | 5028 | 6,93 | 224 (high) |

| 7 | Starooskolsky kombinat khleboproduktov CJSC INN 3128033189 |

Belgorod region | 4108 | 2,73 | 235 (high) |

| 8 | Kazanzernoprodukt OJSC INN 1658001372 |

Republic of Tatarstan | 3631 | 1,80 | 239 (high) |

| 9 | Melkombinat OJSC INN 6903001493 |

Tver region | 4881 | 0,57 | 250 (high) |

| 10 | Penzensky kombinat khleboproduktov OJSC INN 5834002580 |

Penza region | 3671 | 0,00 | 250 (high) |

At year-end 2013 the largest ten domestic manufacturers of flour milling products succeeded in increasing of cumulative turnover by 22% in comparison with the year 2012, what is surely a good result. The experts explain such impressive indicators by low prices for wheat and rye – basic raw material of flour milling industry. Along with that the export of flour in 2013 remained at lower level, because in spite of reduction the prices for Russian flour remained still high enough for majority external markets.

The first five companies showed the return on assets value being above 9%, what is a good result. Now therefore, from each ruble invested in assets the enterprises generate more than 9 kopecks of net profit.

The company Peterburgsky melnichny kombinat OJSC took the lead in this ranking with return on assets ratio 13,17%. The enterprise got the highest solvency index GLOBAS-i®, what characterizes it as financially stable.

Return on assets of manufacturers of flour milling products, TOP-10

The leader of Russian flour milling market, the company Makfa OJSC, takes the 4th place of the ranking with the return on assets value 9,45%. The enterprise closed the year 2013 with revenues equal to 12 772 mln RUB, what is by 20% more than in 2012. The company got a high solvency index GLOBAS-i®, what testifies to that it can pay off its debts in time and fully.

Penzensky kombinat khleboproduktov OJSC rounds out the represented ranking with the return on assets value 0%, what testifies to an irrational use of company’s assets. However, considering the combination of both financial and non-financial factors, the enterprise got a high solvency index GLOBAS-i®.