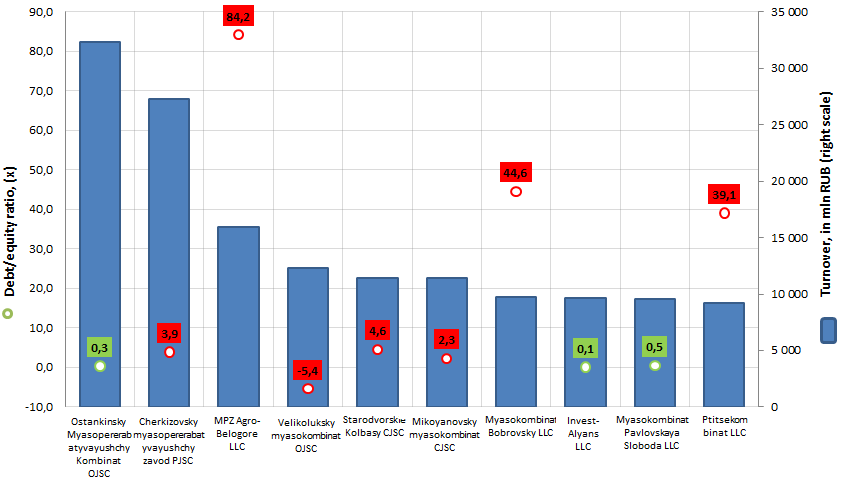

Debt/equity ratio of the largest meat manufacturers of Russia

Information agency Credinform prepared a ranking of the largest Russian meat-processing enterprises.

The TOP-10 list of enterprises was drawn up for the ranking on the volume of revenue, according to the data from the Statistical Register for the latest available accounting period (for the year 2014). Moreover following data were calculated: the dynamics of revenue related to the previous year, debt/equity ratio, solvency index GLOBAS-i® (s. Table 1).

Debt/equity ratio (х) is a relative value of the ratio of borrowed and own sources of company financing. It shows the degree of financial dependence of an organization. Recommended value is: 0≤(x)<1. If the indicator is negative, this fact testifies that an enterprise has losses. If the indicator exceeds the upper limit (1), it means that company’s financial standing is critical - borrowed funds exceed own capital.

For getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average indicator values in industry, but also to all presented combination of financial indicators and ratios of a company.

| № | Name | Region | Revenue, in mln RUB, for 2014 | Increaseofrevenueby 2013, % | Debt/equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Ostankinsky Myasopererabatyvayushchy Kombinat OJSC INN 7715034360 |

Moscow | 32 314 | 18,6 | 0,3 | 231 high |

| 2 | Cherkizovsky myasopererabatyvayushchy zavod PJSC INN 7718013714 |

Moscow | 27 233 | 48,0 | 3,9 | 243 high |

| 3 | MPZ Agro-Belogore LLC INN 3123183960 |

Belgorod region | 15 977 | 46,5 | 84,2 | 242 high |

| 4 | Velikoluksky myasokombinat OJSC INN 6025009824 |

Pskov region | 12 293 | 9,9 | -5,4 | 314 satisfactory |

| 5 | Starodvorskie Kolbasy CJSC INN 3328426780 |

Vladimir region | 11 462 | 32,8 | 4,6 | 225 high |

| 6 | Mikoyanovsky myasokombinat CJSC INN 7722169626 |

Moscow | 11 382 | 9,0 | 2,3 | 203 high |

| 7 | Myasokombinat Bobrovsky LLC INN 3602007714 |

Voronezh region | 9 722 | 82,3 | 44,6 | 204 high |

| 8 | Invest-Alyans LLC INN 5074028377 |

Kaluga region | 9 669 | 20,3 | 0,1 | 193 the highest |

| 9 | Myasokombinat Pavlovskaya Sloboda LLC INN 5017041244 |

Moscow region | 9 568 | 31,5 | 0,5 | 191 the highest |

| 10 | Ptitsekombinat LLC INN 2631029799 |

Stavropol territory | 9 181 | 13,6 | 39,1 | 229 high |

Industry leader – Ostankinsky Myasopererabatyvayushchy Kombinat OJSC - demonstrates an acceptable debt/equity ratio: 0,3. In other words, the level of company’s can be covered by means of own funds. Invest-Alyans LLC and Myasokombinat Pavlovskaya Sloboda LLC also comply with the recommended ratу: 0,1 and 0,5, respectively. The borrowings by the rest of producers exceed owner’s equity, the enterprises "live on credit," that is fraught with the loss of financial independence.

The negative ratio (-5,4) by Velikoluksky myasokombinat OJSC indicates a high debt load the company to its current or potential counterparties, whose owner’s equity does not cover debts (in the case of simultaneous calling on the part of borrowers).

The annual revenue of companies from the TOP-10 list amounted to 148,8 bln RUB at the end of 2014 and increased by 28,8% for the period, that is a good result, taking into account the general state of the Russian economy.

Counter-sanctions entered by Russia on the western meat products, gave a domestic producer a great chance to raise the output of meat and meat products, to increase its presence on the market.

At the end of 2015 the production of meat of slaughter animals increased by 13% (2,2 mln tones); poultry – by 9,6% (4,3 mln tones); semi-finished meat – by 4,4% (1,8 mln tones).

Monitoring of small and medium-size enterprises support

Society interest to development of small enterprise in Russia, expressed in mentioning in the mass media, can be described as wave-like line of heavy growth from 1998 to 2002, significant decrease from 2003 to 2006, new increase in 2007 – 2008, fluent decrease from 2009 to 2011 and constant increase from 2012 up to the moment.

Contribution made by small enterprises to the whole GDP in Russia, according to experts, was 12% in 2004, 17% - in 2008 and in 2015 – about 20%. In countries of the European Union, USA, China this index at average exceeds 50%. Official employment in small and medium enterprise (SME) is more than 17 mln people or about 20% of employable population in Russia.

Analysis of positive experience of developed countries and realizing the fact small enterprises can become one of the main drivers of Russian economy development stimulate the Government to pay attention to this problem. So, if in 2005 funds devoted from the federal budget for the Government support of SME were 1,5 bln RUB, in 2015 volume of subsidies was 16,9 bln RUB.

Latest initiative of the Ministry of economic development is devoted to the problems of effectiveness and productivity of support of small and medium enterprises. In fulfillment of the Federal Law from June 29,2015 №156-FZ «On the Amendments to Individual Legislative Acts of the Russian Federation on the issues of development of small and medium-size businesses in the Russian Federation» December 23, 2015 the Government Regulation № 1410 «On procedure of monitoring by Joint-stock company «Federal Corporation for the Development of Small and Medium Enterprises» of support by the federal bodies of executive power, authorities of subjects of the RF, self-governing authorities to small and medium-size businesses and SME infrastructure forming companies» was enacted.

By this regulation rules for conducting by the Federal Corporation on development of small and medium-size enterprises monitoring on authorities support of small and medium-size enterprises were confirmed. Report form for monitoring results was also approved.

Among aims of monitoring were defined quality of support, effectiveness and productivity in support use. It lets summarize, systemize and analyze the information about support measures results and prepare improvement proposals.

Monitoring results will be included in the annual report of the Corporation addressed to the President of the RF, to the State Duma, the Council of the Federation and to the Government.

Subscribing for the Information and Analytical system Globas-i®, you can get the List of small and medium-size enterprises and social-oriented non-commercial organizations – recipients of subsidies in Russia. Currently in section Lists we recommend posted on the Globas-i® there are more than 64 000 organizations.