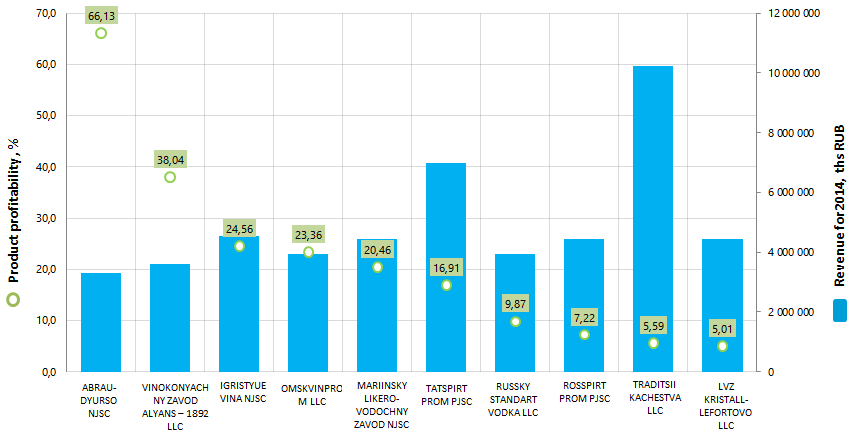

Product profitability of the largest Russian enterprises – manufacturers of alcoholic beverages and ethyl alcohol

Information agency Credinform offers the ranking of Russian enterprises – manufacturers of alcoholic beverages and ethyl alcohol. The companies with the highest volume of revenue were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by decrease in product profitability ratio (Table 1).

Product profitability is calculated as the relation of sales profit to expenses from ordinary activities. Totally the profitability reflects the economic efficiency of production, and product profitability ratio allows us to make a conclusion to understand whether output of one or another product is reasonable. There are no specified values prescribed for indicators of this group, because they vary strongly depending on the industry.

| Name, INN, region | Net profit 2014, ths RUB | Revenue of 2014, ths RUB | Revenue of 2014, to 2013, %% | Product profitability, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| ABRAU-DYURSO NJSC INN 2315092440 Krasnodar territory |

15 026 | 3 301 993 | 115 | 66,13 | 238 high |

| VINOKONYACHNY ZAVOD ALYANS – 1892 LLC INN 3914010751 Kaliningrad region |

472 723 | 3 612 778 | 95 | 38,04 | 188 the highest |

| IGRISTYUE VINA NJSC INN 7830001010 Saint-Petersburg |

467 445 | 4 538 263 | 117 | 24,56 | 235 high |

| OMSKVINPROM LLC INN 5506006782 Omsk region |

547 962 | 3 941 737 | 78 | 23,36 | 241 high |

| MARIINSKY LIKERO-VODOCHNY ZAVOD NJSC INN 4213003050 Kemerovo region |

177 077 | 4 433 126 | 79 | 20,46 | 250 high |

| TATSPIRTPROM PJSC INN 1681000049 Republic of Tatarstan |

1 153 257 | 6 996 663 | 95 | 16,91 | 191 the highest |

| RUSSKY STANDART VODKA LLC INN 7703286148 Saint-Petersburg |

382 147 | 3 930 241 | 115 | 9,87 | 223 high |

| ROSSPIRTPROMPJSC INN 7730605160 Moscow |

101 259 | 4 427 908 | 197 | 7,22 | 251 high |

| TRADITSII KACHESTVA LLC INN 5006008213 Moscow region |

229 445 | 10 220 701 | 92 | 5,59 | 220 high |

| LVZ KRISTALL-LEFORTOVO LLC INN 1328005717 Republic of Mordovia |

109 793 | 4 438 155 | 235 | 5,01 | 272 high |

ABRAU-DYURSO NJSC takes the first place of the ranking with the value of production profitability 66,13%. High result, at times exceeding the industry average indicator of 8,21%, testifies to the lowest production costs in the industry. However, in comparison with its competitors, this enterprise shows relatively modest results in terms of net profit.

The leader of the industry on the volume of revenue for 2014 - TRADITSII KACHESTVA - is on the next-to-last place of the TOP-10 with the indicator value 5,59%, that is below the average industry level. At the same time, the enterprise reduced the volume of revenue by 8% compared to the previous period.

All TOP-10 companies got the highest and high solvency index Globas-i®, that points to their ability to pay off their debts in time and fully.

Picture 1. Revenue and product profitability of enterprises – manufacturers of alcoholic beverages and ethyl alcohol (TOP-10)

Totally the companies of the industry operate profitably, but demonstrate a decrease in the industry average indicator of product profitability from 16,91% in 2009 up to 8,21% in 2014. Five companies from the TOP-10 showed a decrease in sales result in 2014, and the revenue of the largest 100 companies of the industry in total has decreased by 3% in 2014 compared to the previous period and amounted to 117,5 bln RUB.

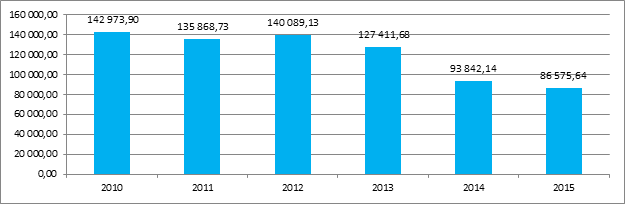

A decrease in physical volumes of production of alcoholic drinks and alcoholic beverages, except for spirit manufacture, is testified also by the data of Rosstat for 2010 - 2015 years. (Picture 2 and Table 2).

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2015 to 2010, +/- % | |

|---|---|---|---|---|---|---|---|

| Table wines | 43 933,65 | 42 126,52 | 37 577,99 | 33 587,90 | 32 497,46 | 39 270,13 | -11 |

| Vodka | 92 565,87 | 86 308,38 | 97 640,37 | 84 587,58 | 63 537,87 | 62 816,46 | -32 |

| Cognac | 8 859,08 | 8 206,67 | 10 273,41 | 7 400,70 | 6 625,62 | 7 242,82 | -18 |

| Alcoholic beverages with an alcohol content of up to 25 % inclusive of the volume of the finished product | 3 391,34 | 3 155,86 | 3 687,68 | 3 393,99 | 2 849,62 | 2 729,75 | -20 |

| Alcoholic beverages with an alcohol content of more than 25 % of the volume of the finished product | 6 926,99 | 4 763,85 | 5 277,60 | 5 144,12 | 3 743,88 | 3 846,02 | -44 |

| Alcohol products | 220 451,01 | 208 910,27 | 206 099,73 | 194 149,22 | 165 100,34 | 168 622,86 | -24 |

| Denatured ethyl alcohol | 4 183,40 | 2 691,58 | 2 707,84 | 13 243,41 | 11 673,01 | 11 350,63 | 171 |

| Ethyl alcohol rectified from food raw material | 30 975,40 | 31 963,15 | 42 165,63 | 40 207,61 | 34 315,68 | 37 102,82 | 20 |

The industry of production of alcoholic beverages is characterized by a high concentration of wine producers in the southern regions of Russia, i.e. closer to sources of raw materials. This is evidenced by the statistics of the Information and analytical system Globas-i® about the number of companies of the industry registered in regions, having financial statements for 2014 in the statistical register (TOP-10 regions):

| 1. | Krasnodar territory | 22 |

| 2. | Moscowregion | 7 |

| 3. | Moscow | 6 |

| 4. | Stavropol territory | 6 |

| 5. | Saint-Petersburg | 4 |

| 6. | Leningrad region | 4 |

| 7. | Republic of Dagestan | 4 |

| 8. | Kaliningrad region | 3 |

| 9. | Republic of Mordovia | 3 |

| 10. | Tver region | 3 |

Moreover, it should be noted that the main enterprises for the production of strong alcoholic beverages are concentrated in large industrial centers of the country.

Procurements will support the economy

In spite of crisis developments in the economy, the number of procurements of state-owned companies and budget organizations in Russia carried out within the Federal Laws 223-FZ and 44-FZ is on the increase. The main difference between the two Federal Laws, governing the contract system, is the source of financing. Thus, in procurements by 223-FZ a customer pays (carries out) the supply of a good (work, service) from own funds, including via grants, funds obtained by the implementation of income-generating activities, and by 44-FZ - at the expense of federal and local budgets.

In total as of year-end 2015 3,0 mln notices on procurements were published by 44-FZ, that is by 10,4% more than the level of 2014, and nearly 1,3 mln notices on procurements by 223- FZ, increase for the year - by 18,4% (s. picture 1).

Picture 1. Change of the number of notices of procurements by 223-FZ and 44 (94-FZ)

Picture 1. Change of the number of notices of procurements by 223-FZ and 44 (94-FZ)The increase in the absolute number of procurements is accompanied by a significant increase in the total value of all procurement procedures, the money for the implementation of which (in case of the conclusion of agreements, contracts) will be directed to suppliers that will monetary support the business under the existing difficulties of credit attracting and private investments (s. Picture 2). The total volume of notices on published procurements in 2015 is estimated at 29,5 trillion RUB, that is 36,5% of Russia's GDP (80,8 trillion RUB).

In relative terms, the cost of procurements by 223-FZ grew by 29,9% for the year (up to 23,1 trillion RUB), by 44-FZ - by 7,2% (up to 6,5 trillion RUB).

Picture 2. Change of the total value of procurements on the posted notices, bln RUB

Picture 2. Change of the total value of procurements on the posted notices, bln RUBAccording to the Picture 3, the average cost of one procurement carried out by 223-FZ increased by 9,7% in 2015 (up to 18,2 mln RUB), and the average value of a procurement by 44-FZ decreased slightly - by 3,0% (up to 2,1 mln RUB).

Picture 3. Change in the average value of one procurement on the published notices, mln RUB

Picture 3. Change in the average value of one procurement on the published notices, mln RUBAs of the 2nd of May 2016, 80,6 thousands registered customers carry out the procurements by 223-FZ, that is almost two times higher than their number at the end of 2013. About 260 thousands customers are currently involved in procurements by 44-FZ (94-FZ), and their amount is slightly higher than the data of the end of 2013 (s. Picture 4), because the number of budget organizations in Russia has no tendency to a significant increase.

Picture 4. Change of the number of registered customers

Picture 4. Change of the number of registered customersThe maximum total value of contracts as a result of procurements by 44-FZ at year-end 2015 belongs to the Federal state-owned institution «Upravlenie federalnykh avtomobilnykh dorog «Taman» Federalnogo dorozhnogo agentstva» (The Department of federal automobile roads «Taman» of the Federal Road Agency). The Department has concluded contracts for a total sum of 228,3 bln RUB. The company carries out the design and construction of a bridge across the Kerch Strait. Next in the ranking of the largest customers are: Construction department of Moscow – 133,6 bln RUB, and the Ministry of Defense of the RF - 114 bln RUB. (s. Table 1).

Regarding the institutions, which most often carry out procurements by 44-FZ, here you can see a somewhat different picture: the Department of Health of Moscow takes the first place, which published 3504 procurement notices in the preceding year, it is followed by the State public institution «Upravlenie materialno-tekhnicheskogo obespecheniya Ministerstvo zdravookhraneniya Respubliki Bashkortostan» – 3179 procurements.

Table 1. Major customers on the amount of the completed contracts and the number of procurements in 2015 under the Federal Law 44-FZ

| № | Name of the customer | Amount of the completed contracts, mln RUB |

|---|---|---|

| 1 | Federal state-owned institution «Upravlenie federalnykh avtomobilnykh dorog «Taman» Federalnogo dorozhnogo agentstva» | 228 344 |

| 2 | Construction department of Moscow | 133 582 |

| 3 | Ministry of Defense of the RF | 114 030 |

| 4 | Federal Space Agency («Roskosmos») | 104 850 |

| 5 | Committee for St. Petersburg Transport Infrastructure Development | 94 713 |

| № | Name of the customer | Number of procurements |

| 1 | Department of Health of Moscow | 3 504 |

| 2 | State public institution «Upravlenie materialno-tekhnicheskogo obespecheniya Ministerstvo zdravookhraneniya Respubliki Bashkortostan» | 3 179 |

| 3 | Ministry of Defense of the RF | 2 257 |

| 4 | Department of Health and Social Protection of the population of Belgorod region | 2 132 |

| 5 | State public institution of Novosibirsk region «Novosiboblfarm» | 1 966 |

On the total value of procurements made within the Federal Law 223-FZ Rosneft Oil Company JSC is the undisputed leader. The total cost of lots of this customers is 5,6 trillion RUB or more than 24% of the sum of all procurements on this Federal Law (s. Table 2).

And a major Russian carrier – RZHD JSC (Russian Railways) - is involved in procurements as a customer the most frequently: in 2015 the company held 18 182 procurement procedures.

Table 2. Major customers on the total price of lots and the number of procurements in 2015 under the Federal Law 223-FZ

| № | Name of the customer | Total price of lots, mln RUB |

|---|---|---|

| 1 | Rosneft Oil Company JSC | 5 609 444 |

| 2 | Gazprom pererabotka Blagoveshchensk LLC | 801 560 |

| 3 | Uralsevergaz - nezavisimaya gazovaya kompaniya JSC | 630 939 |

| 4 | Kuzbasskaya energosetevaya kompaniya LLC | 629 619 |

| 5 | Gazprom neftekhim Salavat JSC | 603 003 |

| № | Name of the customer | Number of procurements |

| 1 | Russian Railways JSC | 18 182 |

| 2 | Rostelecom PJSC | 7 746 |

| 3 | Sberbank of Russia PJSC | 5 565 |

| 4 | T Plus PJSC | 5 451 |

| 5 | Rosneft Oil Company JSC | 3 569 |

Thus, the contract system intended to implement procurement activities of state budget legal entities on a competitive basis, reduce corruption component and increase their transparency, turned on top of that into a huge system of redistribution of financial flows to the real economy, the size of which is comparable with the quarterly GDP of Russia, in particular GDP of the RF in the IV quarter of 2015 amounted to 22,0 trillion RUB. This fact can be considered as a boon for the business environment, in conditions of tough monetary policy of the Central Bank and the inability to obtain credits in Western banks due to the imposed sanctions. Not only large suppliers can connect to this source of «long» money, but also small business, individual entrepreneurs and even natural persons, offering an unique product to the market. According to the Federal Law* not less than 15% of the total annual volume of procurements must be purchased from small businesses.

* According to Part. 1, Article 30 of the Federal Law № 44-FZ "About contract system in the procurements of goods, works and services for state and municipal needs" from 05/04/2013, customers are obliged to make purchases from small businesses, socially oriented non-profit organizations in the volume of not less than fifteen percent of the total annual volume of procurements.