On difficulties of decision-making in economic policy

At the end of the first quarter of 2016 the decline of the Russian economy slowed down. This tendency has been observed since mid-2015 and, as seen, remained in the first quarter of 2016. This fact allowed the head of the Ministry of Economic Development and Trade to state that Russia's economy was out of recession as early as in the 3rd quarter of 2015. According to estimates of the establishment, the GDP fell by only 0.2% in the first quarter of 2016, excluding seasonal factor, compared to the fourth quarter of 2015 and it is better than believed.

It is expected that industrial production will show a positive result at the end of the current year. Among branches the following are banked on: the food industry, oil and gas chemistry, production of mineral fertilizers, certain types of equipment. Despite positive expectations, not all is so clearly: it would seem, an increase in balanced profit of companies by 53% in 2015 was to be the impact for economic growth, but at the same time investment has fallen and continues to fall.

It is believed that the success can be obtained when specific final goals are singled and reached, such as: to achieve the inflation of 4%, to keep the budget deficit at 3% of GDP, to distribute funds to cash-strapped parties through emission. However, as practice shows, nether the tightening of monetary policy (tight control of costs and revenues of the budget) nor an infusion of emission funds will not stimulate the growth of the Russian economy.

According to specialists, we need «a complex and intelligent economic policy» and the Ministry of Economic Development and Trade sees its implementation through a solution of the following large-scale problems:

1. Creation of an investment resource.

It is meant not so much the conditions for investment, as the formation of environment for cost-saving by companies, and as the result their income will increase. The first steps should be limitation of monopolies’ tariffs and reduction of administrative costs of the business.

2. Direct funds of the resources to real investment.

In solving this problem the use of provisioned resources for other purposes causes a serious concern, for example, their withdrawal abroad that falls under the concept of «capital outflow» or «warehousing» on own accounts, which will lead to an increase in short-term assets. Such a situation can be avoided by a high level of trust between the business and government agencies, as well as improving of the business climate in general.

3. Use of special instruments of support.

Under these instruments are considered: project financing, public-private partnership. By project financing is meant a target credit for the realization of an investment project, by this the return of provisioned funds occurs from money income received in the course of its development. Public-private partnership - on the one hand, is a form of interaction between government and business, on the other hand, joint investment on mutually advantageous terms for solution of important tasks.

4. Demand creation for the production of Russian companies.

Domestic demand for domestic products is proposed to form at the expense of support for import substitution projects, external - by supporting of non-resource export.

Adopting a responsible macroeconomic policy, the implementation of internal structural changes, reducing barriers to business, the predictability of the fiscal burden, capital market development, the protection of property rights, non-raising of taxes, retrenchment, restraint in the rise in tariffs - all of this, as expected, should stimulate the growth of the economy.

Accounts payable turnover of the largest Russian travel companies

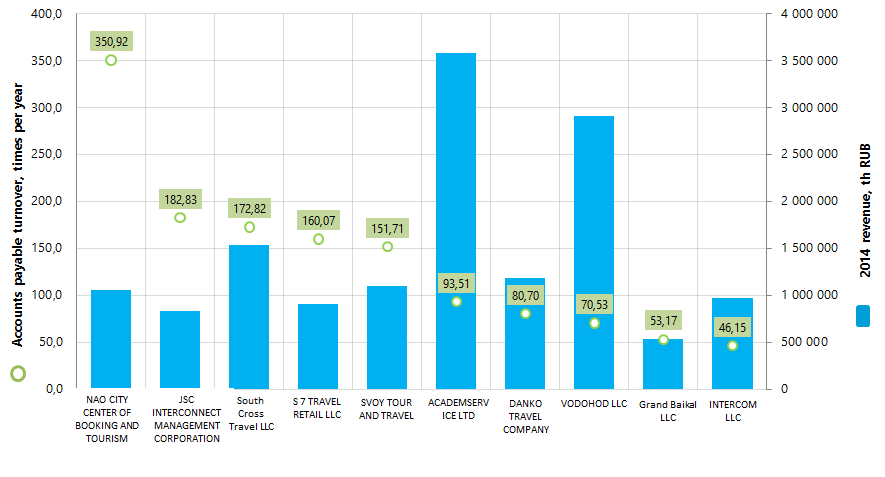

Information Agency Credinform has prepared the ranking of the largest Russian travel companies by accounts payable turnover.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). Then, the companies were ranged by decrease in accounts payable turnover ratio (TOP-10).

Accounts payable turnover (times per year) – is a ratio of average accounts payable for a period to sales revenue. The ratio shows how many times within a year the enterprise paid its average accounts payable.

The ratio reflects the repayment process of the debt to contractors (partners, suppliers, agents etc.). It identifies the number of debt repayments and is calculated for cash flows assessment. The ratio helps to make a conclusion about the efficiency of company’s activity and its strategic financial management.

The higher is the ratio, the faster the enterprise pays to the suppliers. Low ratio value may testify about problems with bill payment as well as more effective relationship with suppliers, provides more favorable deferred payment schedule and uses accounts payable as a source of cheap financial resources.

For the most full and fair opinion about the company’s position, the whole set of financial and non-financial indicators and ratios should be taken into account.

| N | Name, INN, region | 2014 net profit, th RUB | 2014 revenue, th RUB | 2014/2013 revenue, % | 2014/2013 short-term and long-term liabilities, % | Accounts payable turnover, times per year | Solvency index Globas-i® |

|---|---|---|---|---|---|---|---|

| 1 | NAO CITY CENTER OF BOOKING AND TOURISM INN 7707113869 Moscow region |

9 335 | 1 061 228 | 85 | 77 | 350,92 | 258 High |

| 2 | JOINT STOCK COMPANY INTERCONNECT MANAGEMENT CORPORATION INN 7728580286 Moscow |

298 154 | 831 455 | 21 | 105 | 182,83 | 212 High |

| 3 | South Cross Travel LLC INN 7707650655 Moscow |

1 753 | 1 530 916 | 81 | 286 | 172,82 | 550 Unsatisfactory |

| 4 | S 7 TRAVEL RETAIL LLC INN 7701607660 Moscow |

69 269 | 907 537 | 129 | 96 | 160,07 | 236 High |

| 5 | SVOY TOUR AND TRAVEL INN 7730633954 Moscow |

-22 289 | 1 098 191 | 111 | 60 | 151,71 | 337 Satisfactory |

| 6 | ACADEMSERVICE LTD INN 5024053441 Moscow region |

2 662 | 3 580 755 | 102 | 104 | 93,51 | 189 The highest |

| 7 | DANKO TRAVEL COMPANY INN 7704524814 Moscow |

38 451 | 1 188 419 | 96 | 96 | 80,70 | 266 High |

| 8 | LIMITED LIABILITY COMPANY VODOHOD INN 7707511820 Moscow |

-64 702 | 2 907 212 | 96 | 115 | 70,53 | 218 High |

| 9 | Grand Baikal LLC INN 3808079832 Irkutsk region |

50 906 | 534 871 | 103 | 146 | 53,17 | 191 The highest |

| 10 | INTERCOM LLC INN 7708676102 Moscow |

179 869 | 970 449 | 89 | 131 | 46,15 | 265 High |

Accounts payable turnover of the largest travel companies (TOP-10) varies from 350,92 times per year (NAO CITY CENTER OF BOOKING AND TOURISM) to 46,15 times (INTERCOM LLC). In 2014 the average ratio among travel industry amounted to 152,28 times. 4 leading companies from the Top-10 list have indicators higher than this value.

8 out of 10 participants have high and the highest solvency index Globas-i. This fact shows the ability of the companies to meet their obligations in time and fully; the risk of unfulfillment is low.

SVOY TOUR AND TRAVEL LLC has the satisfactory solvency index Globas-i in connection with its participation as a defendant in debt collection arbitration proceedings. The solvency level doesn’t guarantee the repayment of debts in time and fully.

South Cross Travel LLC has unsatisfactory solvency index Globas-i due to the submitted bankruptcy notice. Besides, in comparison with 2013, the company demonstrates the significant growth of debt obligations in 2014 among TOP-10 participants.

The companies from the TOP-10 list as well as enterprises within industry as a whole have high accounts payable turnover. Thus, in 2014 with the average value of the indicator for travel industry 152,28 times, the indicator of electric grid companies amounted to only 28,16 times, perfumes manufacturers 59,92 times.

According to 2014 results, the annual revenue of TOP-10 industry leaders amounted to 14,6 bln RUB, that is 19% lower than total revenue in 2013. At the same time, only 4 companies from the TOP-10 list improved the revenue indicators in comparison with the previous year.

However, the data from the Statistical Register for 2014-2015 (Table 2) demonstrates the growing revenue of travel companies in 2015 and simultaneous growth of debts to suppliers and contractors.

| Russian Federation, Tourism | 2014 | 2015 | 2015/2014, % |

|---|---|---|---|

| Net sales proceeds of goods, products, works and services (less the value added tax, excises and other similar compulsory payments) (th RUB) | 1 411 635 887 | 1 719 242 724 | 122 |

| Payable to suppliers and contractors for goods, works and services (th RUB) | 189 908 171 | 233 983 756 | 123 |

Analysis of the distribution across the country of 50 largest travel companies in terms of 2014 revenue indicates about high concentration of business in Moscow – the largest financial center of the country and the city with the most credit worthy population (Table 3).

| Region | The number of registered companies from TOP-50 largest enterprises in terms of 2014 revenue |

|---|---|

| Moscow | 32 |

| Saint-Petersburg | 5 |

| Moscow region | 3 |

| Sverdlovsk region | 3 |

| Irkutsk region | 2 |

| Khabarovsk region | 2 |