New inspection rules are introduced for the monitoring authorities

As of November 15, 2014 the Federal Law № 307-FZ came into force. According to the law, the regulatory regime made by the monitoring authorities was changed.

The business community has been complaining for a long time about the immense amount of inspections on the part of monitoring authorities, damping the economic development of the country. Recently, the state authorities carry out an immense amount of extraordinary inspections apart from the scheduled ones. At the same time, it is impossible to learn about the data on the control activity preliminary. The adopted law doesn’t contain the information on the reduction of the number of extraordinary inspections, however the reason for visiting should be clearly defined and the company should be preliminary informed.

During the annual state-of-the nation address the President told about the necessity to free the business from the obsessive inspection and control. The Head of the state offered to make the business inspections public and what is also important to introduce “monitoring holidays” for the term of three years for the small businesses with a good standing. Putin also noted that in the next year the special register is going to be brought into operation. It will contain the data about the particular authority and particular purpose of initiating the inspection, and what results were obtained.

The adopted law imposes ban on the demanding of the documents being irrelevant to the inspection subject. However, the list of questions relevant to the inspection subject is not specified in the law. By all means, the connection between the cause for inspection and the list of the demanded documents should be visible. However, the law doesn’t specify how to distinguish what is relevant to the inspection subject and what the taxation authorities are not entitled to demand for.

One more statutory provision says that if the expiration of instruction to eliminate company’s violations is the reason of carrying out of the extraordinary inspection, the subject of such inspection may be only the execution of this instruction. In other words, the inspectors should only monitor the fact that the violation is corrected without having delving the company’s activity. However, as a matter of practice this provision will scarcely save the company from the excessive attention of the inspectors, as there are no limitations concerning the fact that extraordinary inspections can be carried out only for this reason. It means that the inspectors may monitor the activity of the company to the extent they consider necessary.

In addition, the President stated his willingness to build trust partnership relations between business community and the state, and mentioned that the accusatory tendency in the work of the monitoring authorities should be broken.

In the Globas-i® system there is an opportunity to observe inspections of the company which were planned by the monitoring authorities and the month they are to be carried out. According to the business entity inspection master plan of the Office of the Procurator General of the RF, the system was filled with the inspections plans of the Federal Tax Service, the State Labor Inspectorate, the Federal Service of State Registration, the Land Register and Mapping, the Federal Service for Ecological, Technological and Atomic Supervision, the Ministry of Emergency Situations of Russia, Russian Federal Consumer Rights Protection and Human Health Control Service, regional administration, housing inspectorates and other monitoring authorities.

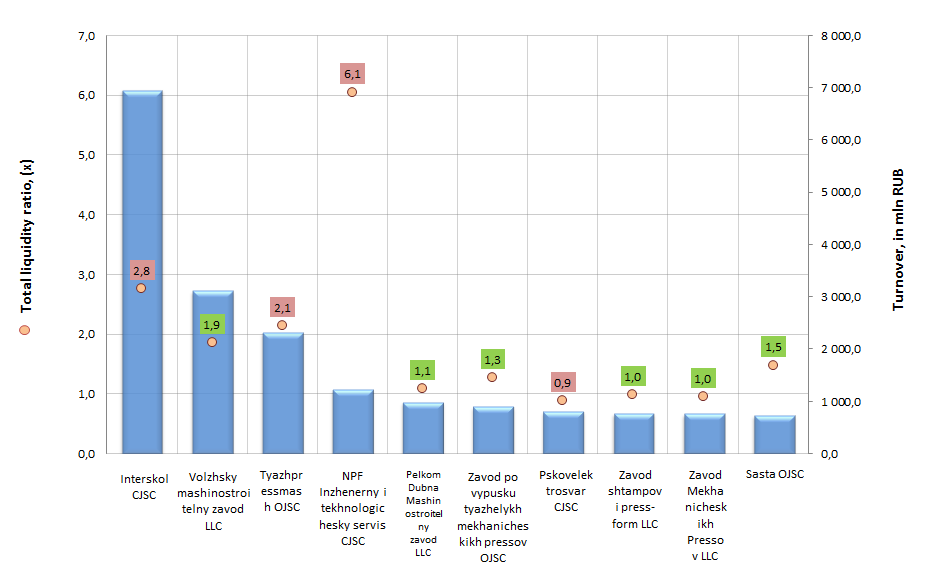

Total liquidity of enterprises of machine-tool industry

Information agency Credinform prepared a ranking of companies of machine-tool industry. The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in consolidated revenues per annum.

Total liquidity ratio (х) is the relation of the sum of company’s current assets to short-term liabilities. It shows the sufficiency of its funds for repayment of short-terms liabilities.

Recommended value is from 1,0 to 2,0.

The ratio value, being equal to 1, assumes the equality of current assets and liabilities. However, considering that the degree of liquidity of different elements of current assets differs essentially, it is conceivable, that not all assets will be realized immediately or realized on full value, and as the result – the possibility of potential threat of improvement of financial standing of an enterprise. Moreover, the organization should have some volume of production supplies for continuing of production and economic activities after discharge of all current liabilities.

But if the ratio value essentially exceeds 1, then it can be drawn the conclusion that an enterprise has considerable volume of free resources, which were formed through owned sources. This alternative of working capital formation is the most appropriate from the opinion of company’s creditors. In the meantime, from manager’s perspective, sizable stocking at a company, diversion of funds to accounts receivable can be connected with inefficient assets management. At the same time it is possible that the firm uses its opportunities on obtaining of credits not in full.

However, it’s to be understood that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average indicators of profit, but also to all presented combination of financial data.

| № | Name | Region | Turnover in mln RUB, for 2013 | Total liquidity ratio (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Interskol CJSC INN 5047073660 |

Moscow region | 6 954,6 | 2,8 | 233 (high) |

| 2 | Volzhsky mashinostroitelny zavod LLC INN 6321276844 |

Samara region | 3 113,0 | 1,9 | 332 (satisfactory) |

| 3 | Tyazhpressmash OJSC INN 6229009163 |

Ryazan region | 2 327,0 | 2,1 | 198 (the highest) |

| 4 | NPF Inzhenerny i tekhnologichesky servis CJSC INN 7806013625 |

Saint-Petersburg | 1 228,8 | 6,1 | 245 (high) |

| 5 | Pelkom Dubna Mashinostroitelny zavod LLC INN 5010025437 |

Moscow region | 987,4 | 1,1 | 270 (high) |

| 6 | Zavod po vypusku tyazhelykh mekhanicheskikh pressov OJSC INN 3662118923 |

Voronezh region | 898,4 | 1,3 | 277 (high) |

| 7 | Pskovelektrosvar CJSC INN 6027076488 |

Pskov region | 806,6 | 0,9 | 321 (satisfactory) |

| 8 | Zavod shtampov i press-form LLC INN 5258040053 |

Nizhny Novgorod region | 774,3 | 1,0 | 261 (high) |

| 9 | Zavod Mekhanicheskikh Pressov LLC INN 2221202506 |

Altai territory | 762,1 | 1,0 | 292 (high) |

| 10 | Sasta OJSC INN 6232000019 |

Ryazan region | 735,3 | 1,5 | 248 (high) |

Рicture 1. Total liquidity ratio and turnover of the largest enterprises of machine-tool industry (TOP-10)

The turnover of the largest enterprises of machine-tool industry amounted to 18,6 bln RUB, following the results of the latest published annual financial statement, what gives about 45% of the revenue of all enterprises of the market.

Only 6 participants of TOP-10 uphold the standard value of total liquidity ratio: Volzhsky mashinostroitelny zavod LLC (1,9), Sasta OJSC (1,5), Zavod po vypusku tyazhelykh mekhanicheskikh pressov OJSC (1,3), Pelkom Dubna Mashinostroitelny zavod LLC (1,1), Zavod shtampov i press-form LLC (1,0), Zavod Mekhanicheskikh Pressov LLC (1,0).

These organizations uphold rationally the balance between assets and liabilities. Probability of liquidity crisis by such ratio of the analyzed indicator is below average.

The liabilities of Pskovelektrosvar CJSC exceed the assets, consequently, company’s liquidity comes down and in case of force-majeure circumstances it will be difficult for the enterprise to raise spare cash.

The rest companies conduct a moderate policy of financial management by way of their accumulation, or irrationally use available highly liquid assets in development, what not always pays by highly competitive conditions and inflation.

According to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 list got a high and the highest solvency index (except Volzhsky mashinostroitelny zavod LLC and Pskovelektrosvar CJSC), what can signal to potential investors, that the largest market players can pay off their debts in time and fully, while risk of default is minimal or low.