Import substitution will be in Russia

At the country level questions of import substitution in Russia are raised for a long time. However, sanctions imposed against Russia by western countries gave an impulse for its realization. By import substitution is meant replacement on the Russian market of foreign made goods by national ones. According to experts, in several industries import makes considerable proportion, for example, in the machine-tool industry dependence of import deliveries is 90%, in radio electronics – 85%, in the civil aircraft industry more than 80% components are imported. The situation in other industries is presented in table 1.

| № | Name of industry | Share of imported production, % |

|---|---|---|

| 1 | Machine-tool industry | 90 |

| 2 | Radio electronics | 85 |

| 3 | Civil aircraft industry | 80 |

| 4 | Consumer goods industry | 80 |

| 5 | Pharmaceutical and medical industry | 75 |

| 6 | Heavy engineering industry | 70 |

| 7 | Oil-gas equipment industry | 60 |

| 8 | Electric-power industry | 50 |

| 9 | Agricultural machinery industry | 50-90 (in dependence of the kind of production) |

At the beginning of 2014 measures on the import substitution were reflected in the approved new edition of the Government program of the RF «Development of manufacturing industry and improvement of its competitiveness» (decision from April 15, 2014 №328). Later President of the RF signed the list of instructions of additional measures on economic growth stimulation, and on the import substitution in manufacturing industry and agriculture. In this case the Government prepared the Assistance Plan of import substitution in industry, and in the end of 2014 approved the program of the import substitution in agriculture.

Moreover, in autumn of 2014 the Government approved the investors support program, according to that financing for the import substitution support is made by means of subsidies and co-financing of researches. It involves manufacturing industry, chemical industry, machine-tool industry, housing construction, transport, communications and data telecommunications, electric power and agriculture industry.

In April of 2015 for the benefit of January crisis bailout plan realization the involved governmental agencies developed 19 industrial import substitution programs for the next few years. According to the programs, import substitution measures will be taken in pharmaceutical industry, heavy engineering industry, aircraft, ship construction industry and software industry. It is believed that to the year 2020 realization of the above mentioned programs will shorten dependence on imports, e.g., in machine-tool industry from the current 90% to 40%.

The results of practical work are shown by opening of the Import substitution and localization center in Saint-Petersburg. This center is considered by specialists as place for promotion of the Russian companies`production. Among other tasks: exhibitions, arising of demand and offer for national products, relevant marketing services, implementation of new collaboration forms, for example, cluster agreement.

It is believed that today national manufacturer has a possibility to use the obstacle that Russian regions and states of the former Soviet Union can share of import substitution experience, demonstrate potential, place queries for the interested equipment. The Centre plans development of information system that will include data of the deliveries that the enterprises want to replace with national equivalents.

Credit security of the largest Russian car manufacturers

Information agency Credinform has prepared the ranking of the largest Russian car manufacturers.

In order to prepare the ranking, the list of Top-10 enterprises by the annual revenue volume in the last available in the Statistical register financial period (2014) was created; besides, the revenue dynamic relating to the previous period and interest coverage ratio were calculated (see Table 1).

Interest coverage ratio(x) is a ratio of the profit before taxes and credit interests to total interest payable. It characterizes the creditors’ security rate from non-payment of interests for the provided credit and shows how many times within the accounting period the company earned the assets for payment of interest charges. Recommended value is: >1.

Thus if the ratio is lower than 1, it demonstrates company’s inability to meet all the loan liabilities immediately. This may in its turn lead to business financial imbalance in the present complicated macroeconomic environment, especially in the period of significant (to 40%) car sales decrease on the Russian market.

If the value of the indicator under consideration is not available, there won’t be borrowed assets in company’s accounts and therefore interest payable to creditors. It can be in itself considered from the positive point of view. However for the successful business operations, market holding, implementation of innovations, there is a necessity for access to the capital market. Due to this the aim of the financial management involves reasonable balancing between development and its financial well-being.

In order to get the fullest and fairest view of the company’s financial situation, it is necessary to pay attention not only to the average indicator values in the industry, but also to all the submitted financial indicators and ratios of the company.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth, % | Interest coverage ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | ООО Volkswagen Group Rus INN 5042059767 |

Kaluga region | 230 582,6 | -4,4 | 0,4 | 284 high |

| 2 | ОАО AvtoVAZ INN 6320002223 |

Samara region | 189 370,0 | 8,1 | -7,3 | 297 high |

| 3 | ООО Nissan Manufacturing Rus INN 7842337791 |

Saint-Petersburg | 152 032,9 | 21,8 | - | 269 high |

| 4 | ZAO Renault Rossiya INN 7709259743 |

Moscow | 110 591,8 | 4,4 | 21,2 | 230 high |

| 5 | PAO KamAZ INN 1650032058 |

Republic of Tatarstan | 104 388,6 | -2,6 | 0,4 | 255 high |

| 6 | ООО Ellada Intertreid INN 3906072056 |

Kaliningrad region | 91 640,0 | 15,8 | -18,6 | 218 high |

| 7 | ООО Hyundai Motor Manufacturing Rus INN 7801463902 |

Saint-Petersburg | 85 392,3 | 7,1 | 7,8 | 219 high |

| 8 | ООО Avtomobilny zavod GAZ INN 5250018433 |

Nizhny Novgorod region | 59 277,7 | -13,9 | 0,6 | 302 satisfactory |

| 9 | ООО Ford Sollers Holding INN 1646021952 |

Republic of Tatarstan | 54 887,7 | -34,7 | -2,1 | 327 satisfactory |

| 10 | ZAO Avtotor INN 3905011678 |

Kaliningrad region | 40 967,4 | -4,4 | - | 272 high |

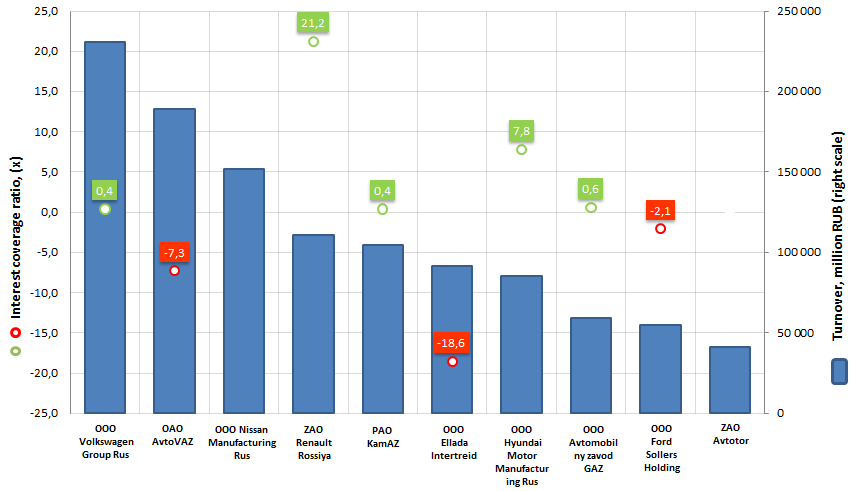

Interest coverage ratio value of the largest car manufacturers (Top-10) varies from -18,6 (OOO Ellada Intertreid) to 21,2 (ZAO Renault Rossiya). The negative indicator shows that there is a net profit before taxes (the company may get the net profit due to changes of deferred tax assets).

Figure 1. Revenue and interest coverage ratio of the Russian largest car manufacturers (Top-10)

Following the results of 2014, the annual revenue of the Top-10 companies amounted to 1119,1 bln RUB. It is higher than the total indicators of the same car manufacturers in the previous period by 0,9%. Taking into consideration the inflation, the financial result of the industry’s giants seems to be modest.

The range of companies have decreased the revenue: OOO Ford Sollers Holing (-34,4%); OOO Avtomobilny zavod GAZ (-13,9%); OOO Volkswagen Group Rus (-4,4%); ZAO Avtotor (-4,4%); PAO KamAZ (-2,6%).

The situation in the automobile industry is complicated; the consumer resistance broke down the sales practically of all companies. Only those companies are going to stay alive, which managed to locate the manufacture within the country, to establish cooperation with Russian suppliers thereby protecting themselves from exchange rate fluctuations.

Nevertheless, the losses took place: the largest brands General Motors – Chevrolet and Opel declared their exit from market.

According to the Association of the European Business (AEB), 129,9 thousands of new cars were sold in October 2015 in Russia. It is by 38,5% lower than in October 2014 and by 7,7% lower comparing with the previous month.

The Top-3 leaders by concerns (alliances) are the following ones: Avtovaz-Renault-Nissan, Hyundai-KIA Group, VW Group.

In the whole, 1,32 million of cars were sold within 10 months, that is by 33,6% lower than in the same period of 2014.

224,0 thousand cars were sold under Lada brand. It is followed by KIA - 134,1 thousand cars (-13%), Hyundai 133,5 thousand (-10%), and Renault - 98,1 thousand (-37%).

The leading models are: Lada Granta – 99 653 cars (-22,7%), Hyundai Solaris – 95 047 (0,0%), and KIA Rio – 80 667 (+9,7%).