Control and supervision reform: what entrepreneurs should expect?

The way the «Public Government» seeks to relieve the administrative pressure on business, keeping safety in mind.

The necessity of reform on control and supervisory activity was for the first time emphasized as early as in 2009. Why hasn’t it been finished yet? What will the state and business community receive from its implementation?

«Stop nightmarize the business». The question concerning the necessity of control and supervisory activity (CSA) reforming arose in 2009. The famous aphorism concerning redundant number of inspections, by which the authorities «nightmarize» the entrepreneurs appeared during that particular period. However the business community scrutiny, department disputes and some other reasons caused the postponing of problem solution in terms of legislation. Two years ago when the discussion was reestablished the President Vladimir Putin ordered the Government of Dmitry Medvedev to develop the «road map», which offers a possibility to overcome disagreements of different departments, taking part in the reform, to accommodate the interests of business to the full and to prepare a state control bill. The Government affirmed the «road map» on improvement of CSA in Russia as a part of executing of the President’s instruction as of April 1st, 2016. It became the first integrated document which systematized the most important directions of the reform. The main burden during the creation of the new legislative initiatives was laid on the «Public Government» headed by Mikhail Abyzov. He holds as well the position of the head of the government subcommission for improvement of control (supervisory) and permitting functions. The Ministry of Economic Development of the Russian Federation prepares the framework law «On the basics of the state and municipal control (supervision) in the Russian Federation», being the fundamental of control and supervisory reform.

Priority project. The recent up to date results of «Public Government» work concerning CSA reforming were represented within the Sochi International Investment Forum 2016 on September 30th. The project being developed under the leadership of Mikhail Abyzov was included by Vladimir Putin and Dmitry Medvedev to the list of priority ones. Its implementation is divided into three steps up to 2024. 3 main goals of the reform are defined in the project:

- ensuring safety of human life and health by reducing deaths, as well as diseases, poisonings, victims and injured by 10% in 2018, by 30% in 2021 and by 50% in 2024;

- reducing the level of threats and material damage by 10% in 2018 г., by 20% in 2021 and by 30% in 2024;

- increasing the level of maturity and efficiency of CSA by 10% in 2018, by 30% in 2021 and by 50% in 2024.

The reduction of the administrative pressure on business by 20% in 2018, by 30% in 2021 and by 50% in 2024 is designated separately.

It is planned to achieve the defined goals by implementing 8 projects, among the main of them are: change to risk-oriented approach in control and supervision, introduction of the new assessment system of control authorities’ work, preventing of violations in enterprises, reducing the level of corruption and improvement of control and supervisory authorities personnel. Within implementation of the stated projects it is planned to eliminate out-of-date, redundant, controversial and duplicate requirements under carrying out inspections, which relate to 90% of ineffective business expenses from execution of the state requirements.

Risk-oriented approach. Special attention is paid to the implementation of the risk-oriented approach, providing dependence of inspection frequency on the potential risks degree (for example, damage to life and health of citizens, environment, property and safety) on the object. According to this model, the continuous inspections will take place only on the objects of heightened danger. Objects constituting no potential essential threat can be released from them. According to the worldwide experience, using of this approach significantly decreases the total number of inspections. The «Public Government» plans that by 2018 the risk-oriented approach is to be implemented by 90%.

Between business freedom and citizens’ well-being. Annually 44 departments in Russia carry out 130 kinds of the state control; as a result there are more than 2 million inspections. According to Mikhail Abyzov, the expenses from redundant control and supervisory activities amount to from 1,5% to 7,5% of GDP. At the same time during inspections only 60% of real violations are revealed. One of the strategic goals of CSA reform is an annual reduction of inspections by 15%, which will give a possibility to reduce the business expenses by half by 2024 under their carrying out. Except for the quantity parameters, much stress is placed on quality improvement of the system under reform. Significant efforts are directed to increase the inspection efficiency and its results together with the simultaneous reduction of administrative pressure on business. It is important to build a new system which on the one hand could be economically less burdensome for entrepreneurs, and on the other – provide real protection for life and health of citizens, as well as the safety of state.

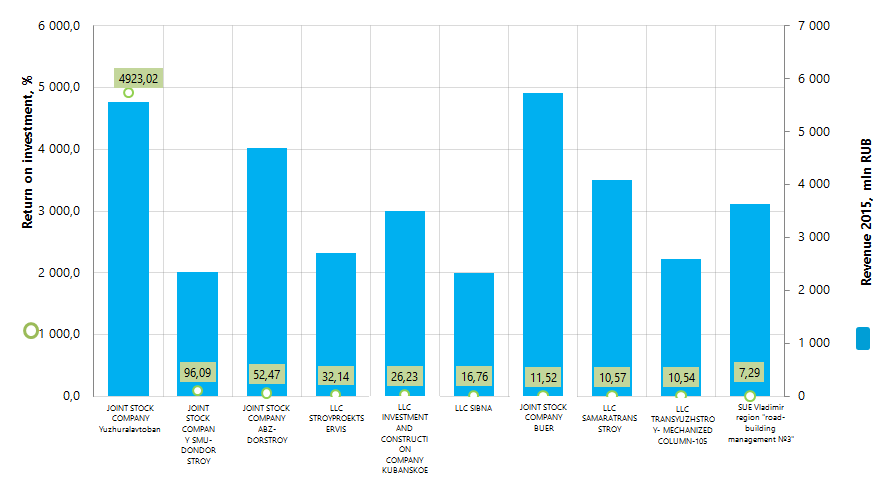

Return on investment of the largest Russian companies engaged in highway construction

Information agency Credinform prepared a ranking of the largest Russian companies engaged in highway construction.

Companies with the highest volume of revenue (Top-10), engaged in construction of roads and highways, were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2015). The enterprises were ranked by reduction of return on investment (Table 1).

Return on investment (%) is net profit to the sum of equity capital and long-term liabilities. This indicator shows the benefit from equity capital and funds attracted on a long-term basis. It also allows to assess a reasonability of attracting borrowings at a certain interest.

There is no standard value for profitability indicators, because they change in accordance with the industry the company operates in. The indicators of each particular company are reasonable to be examined in comparison with the industry indicators.

| Name, INN, region | Net profit 2015, mln RUB | Revenue, 2015, mln RUB | Revenue in 2015 to 2014, % | Return on investment, 2015, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| JOINT STOCK COMPANY Yuzhuralavtoban INN 7445011899 Chelyabinsk region |

1 349,3 | 5 565,3 | 142 | 4 923,02 | 223 High |

| JOINT STOCK COMPANY SMU-DONDORSTROY INN 6164248080 Rostov region |

71,6 | 2 350,3 | 257 | 96,09 | 225 High |

| JOINT STOCK COMPANY ABZ-DORSTROY INN 7811099353 Saint-Petersburg |

68,6 | 4 702,3 | 145 | 52,47 | 231 High |

| LLC STROYPROEKTSERVIS INN 3812100526 Irkutsk region |

86,8 | 2 707,7 | 114 | 32,14 | 237 High |

| LLC INVESTMENT AND CONSTRUCTION COMPANY KUBANSKOE INN 0901050864 Karachayevo-Cherkessian Republic |

73,5 | 3 511,6 | 112 | 26,23 | 218 High |

| LLC SIBNA INN 3808047372 Irkutsk region |

77,6 | 2 330,8 | 146 | 16,76 | 247 High |

| JOINT STOCK COMPANY BUER INN 7816124109 Saint-Petersburg |

4,6 | 5 728,1 | 147 | 11,52 | 195 The highest |

| LLC SAMARATRANSSTROY INN 6376021161 Samara region |

27,6 | 4 097,2 | 127 | 10,57 | 299 High |

| LLC TRANSYUZHSTROY- MECHANIZED COLUMN-105 INN 7708811915 Belgorod region |

0,5 | 2 603,3 | 505 | 10,54 | 307 Satisfactory |

| SUE Vladimir region "road-building management №3" INN 3329000602 Vladimir region |

78,8 | 3 633,4 | 90 | 7,29 | 212 High |

The average value of return on investment for the highway construction companies of TOP-10 in 2015 amounted to 32,04. The same indicator of TOP-100 companies for the same period was 47,39 at the average, while the industry average indicator is 6,76.

The highest return on investment in 2015 was demonstrated by JOINT STOCK COMPANY Yuzhuralavtoban, leading in the sector by net profit and revenue. In 2015 the enterprise provided services by state and municipal contracts at the amount exceeding 2 bln RUB, and revenue was 5 565,3 mln RUB.

All companies of the ranking have positive return on investment values, that can indicates positive benefit from total volume of investment.

SUE Vladimir region "road-building management №3" with reduced net profit in 2015 is the last in the ranking. Moreover, the enterprise also decreased revenue by 10%.

Per totality of financial and non-financial indicators, nine companies have got the highest or high solvency index Globas-i, indicating their ability to timely and fully fulfill the liabilities.

LLC TRANSYUZHSTROY- MECHANIZED COLUMN-105 got satisfactory index due to the information about being a defendant in arbitration cases on collecting the debt and unclosed writs of execution.

Total revenue of TOP-10 companies in 2015 amounted to 37,2 bln RUB, that is by 79% higher than in 2014. In comparison with 2014, total net profit in 2015 was more than double increased.

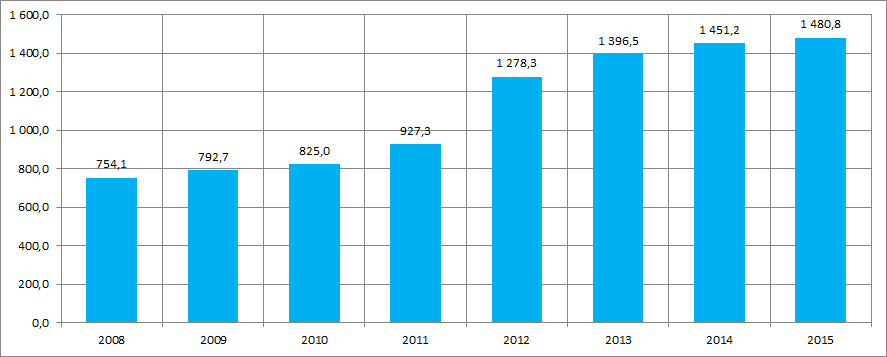

The industry in general shows positive dynamics. According to the Federal state statistics service (Rosstat), the length of general-purpose highways in 2015 was 1480,8 th km, exceeding the data of 2008 more than twice (Picture 2).

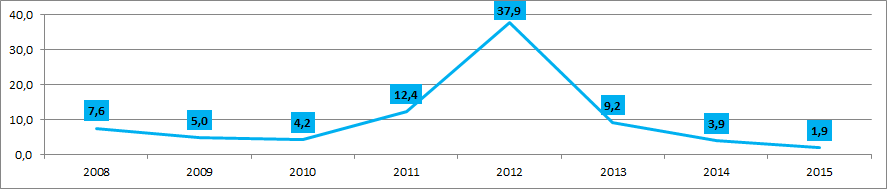

However, being at the maximum level in 2012, the growth rates begin to fall.

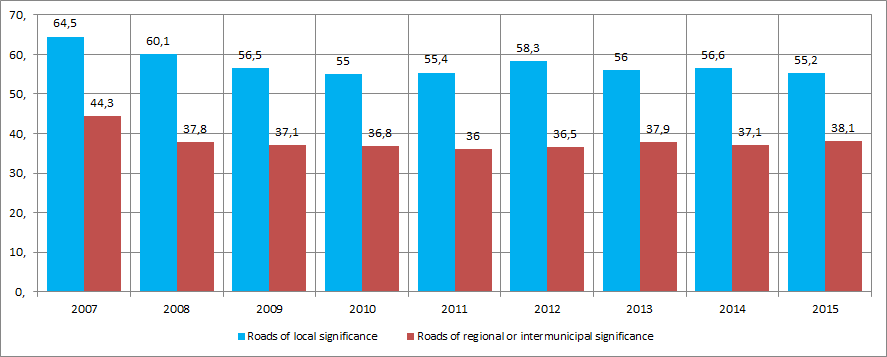

In recent years Rosstat records some growth in the share of general-purpose highways of regional significance, conforming the standards, and decrease in share of roads of local significance (Picture 4).

*) – Standards to the roads condition are specified by GOST P 50597-93 “Highways and streets. Requirements to the operational state, admissible under the terms of traffic safety” with ODN 218.0.006-2002 “Rules for diagnosis and assessment of state of the roads” approved by the order of the Ministry of Transport of the Russian Federation № IS-840-r.

Enterprises engaged in highway construction are distributed by regions quite equally. According to the Information and analytical system Globas-i, 100 companies largest in term of revenue for 2015 are registered in 43 regions. The majority of them are registered in the following regions (TOP-11 of regions):

| Region | Number of companies |

|---|---|

| Moscow | 12 |

| Saint-Petersburg | 10 |

| Rostov region | 6 |

| Samara region | 6 |

| Belgorod region | 5 |

| Altai territory | 4 |

| Republic of Tatarstan | 4 |

| Khabarovsk territory | 4 |

| Irkutsk region | 3 |

| Republic of Bashkortostan | 3 |

| Khanty-Mansi autonomous district - Yugra | 3 |

60% of companies largest in this industry are concentrated in 11 regions of the country.