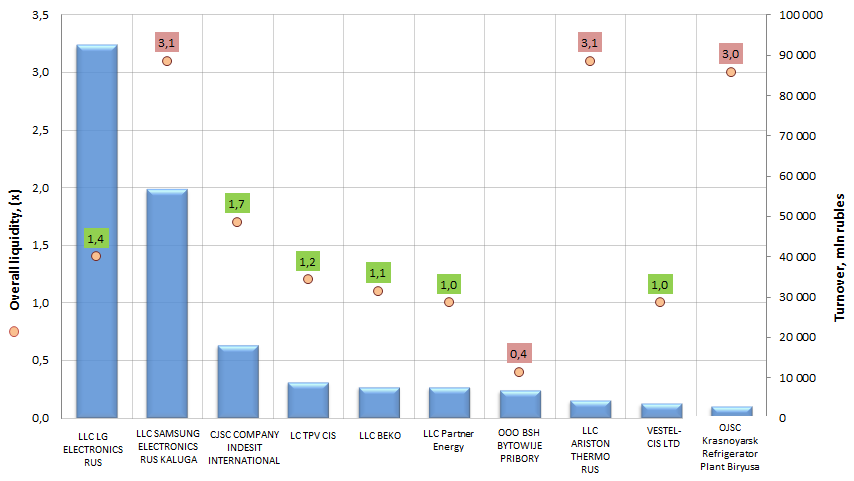

Overall liquidity ratio of the companies engaged in production of household appliances

Information Agency Credinform has prepared the ranking of the companies engaged in production of household appliances.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the companies were ranged by decrease in annual revenue.

Overall liquidity ratio (х) - is a ratio of total working capital to short-term liabilities. The ratio shows the sufficiency of the most easily marketable assets - working capital for repayment of debts, maturity date of which is less than two months. The recommended value is from 1,0 to 2,0.

Ratio value equal 1 assumes equality of the current assets and liabilities. However if to take into account the fact that the degree of liquidity of various current assets is significantly different, it is possible to allow that not all assets will be immediately released or released by full cost; as a result, threat of deterioration in the financial condition of the company is possible. Moreover the company must have a certain amount of inventory in order to continue its production and business activities after fulfillment of all current liabilities.

For the most full and fair opinion about the company’s financial condition, not only the average revenue values should be taken into account, but also the whole set of financial data.

| № | Name | Region | Revenue, mln. rubles, 2013 | Overall liquidity ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | LLC LG ELECTRONICS RUS INN 5075018950 |

Moscow region | 92 573,5 | 1,4 | 192 The highest |

| 2 | LLC SAMSUNG ELECTRONICS RUS KALUGA INN 4025413896 |

Kaluga region | 56 757,2 | 3,1 | 221 high |

| 3 | CJSC COMPANY INDESIT INTERNATIONAL ИНН 4823005682 |

Lipetsk region | 18 080,6 | 1,7 | 196 The highest |

| 4 | LLC TPV CIS INN 4703119938 |

Saint-Petersburg | 8 893,2 | 1,2 | 261 high |

| 5 | LLC BEKO INN 7804157910 |

Vladimir region | 7 818,8 | 1,1 | 240 high |

| 6 | LLC Partner Energy INN 7723642517 |

Moscow region | 7 655,9 | 1,0 | 241 high |

| 7 | OOO BSH BYTOWIJE PRIBORY INN 7819301797 |

Saint-Petersburg | 6 932,2 | 0,4 | 326 satisfactory |

| 8 | LLC ARISTON THERMO RUS INN 4703066115 |

Leningrad region | 4 402,0 | 3,1 | 172 The highest |

| 9 | VESTEL-CIS LTD INN 3301015292 |

Vladimir region | 3 664,7 | 1,0 | 318 satisfactory |

| 10 | OJSC Krasnoyarsk Refrigerator Plant Biryusa INN 2451000695 |

Krasnoyarsk Territory | 2 905,4 | 3,0 | 264 high |

Picture 1. Revenue, overall liquidity ratio of the companies engaged in production of household appliances

According to the latest financial statements, the revenue of the largest household appliances manufacturers (Top-10) amounted to 209,7 bln. RUB. In 2013 the total revenue of Top-10 enterprises increased by 3,9% from the level of 2012.

Today the world's leading brands of home appliances, which are in the Top-list, have localized production in Russia. This is such companies as: Samsung, LG, Indesit, Ariston.

LG ELECTRONICS RUS is the leader of Russian market by total revenue. Its plant in Moscow region carries out assembly and provision of retailers with wide variety of household appliances under brand LG (TVs, refrigerators, etc.). The overall liquidity ratio (1,4) says that the company strikes the balance between working capital and short-term liabilities and is ready to pay off with the contractors, without harming of financial condition.

The second place by total revenue takes SAMSUNG ELECTRONICS RUS KALUGA (Samsung brand). The company’s financial policy is rather discreet, while total short-term liabilities are much less than current working capital. Such fact speaks about low debt load of the company and the existence of considerable amount of free resources, which were formed by own sources. From the position of creditors, such way of working capital formation is the most appropriate option. From the position of manager, the significant stock accumulation and diversion of funds to accounts receivable may be connected with inefficient assets management. At the same time, the enterprise perhaps may not fully use the abilities for obtaining the loans.

Other leaders of the market (except OOO BSH BYTOWIJE PRIBORY), have shown acceptable overall liquidity ratio (the ratio value is equal 1 or above)

OOO BSH BYTOWIJE PRIBORY (the manufacturer of refrigerators and washing machines under the Bosch and Siemens brands) shows the excess of current liabilities over current assets. There is a risk that the company won’t be able to pay off with the creditors, using their most liquid assets.

According to an independent assessment of the Information Agency Credinform, eight out of ten participants from the Top-10 list received the highest and high solvency index. Such fact speaks about ability of the largest market participants to meet its obligations on time and fully, the risk of unfulfillment is low.

VESTEL-CIS LTD (brand VESTEL) and OOO BSH BYTOWIJE PRIBORY have satisfactory solvency index. It should be taken into account the possibility of financial difficulties in the nearest 12 months.

Net inflow into funds, which invest in Russian stocks, amounted to 32,7 mln dollars

It is observed the capital inflow on the Russian stock market after 10 weeks of negative dynamics. Total net cash inflow into funds, investing in Russian stocks, made about 3,3 mln dollars for the period from the 29th of January till the 4th of February of the current year. As a reminder, a week earlier this indicator had amounted to 32,7 mln dollars.

According to Emerging Portfolio Fund Research (EPFR – the company is engaged in the analysis of financial flows for financial institutions worldwide), the inflow into equity funds focused exclusively on Russia made 31,2 mln dollars within a week, decreased by 30%.

Along with that, the analysts note that the influx on the Russian stock market takes place against the background of general outflow of capital from emerging markets. This tendency can be explained by the fact that investors began increasingly to pay attention to the cheapness of the Russian stock market in regard to other emerging markets. Due to the depreciation of the ruble the Russian stocks look even more attractive in dollar terms.

The growth of the Russian stock market was also positively influenced by the increase in oil prices, fueled by news about reduction of investments in oil development, as well as by the strike of American refineries. The English-Dutch group Royal Dutch Shell had announced the decommissioning of oil field Brent in the North Sea, being one of the largest in the UK and which had given the name to the crude oil benchmark, that led to the price increase for black gold.

The experts also note that the current inflow on the Russian stock market can be regarded as a kind of compensation after the negative dynamics of previous months and warn against hasty conclusions.