Return on sales of Russian meat processing companies

Information agency Credinform prepared a ranking of the largest meat processing enterprises of Russia.

The companies with the highest volume of revenue were selected for the ranking (according to the data from the Statistical Register for the latest available period - for the year 2013), which specialize in processing of meat and poultry, in release of ready-made products (sausages, semi-finished products, meat stuffing etc.). For each company it was calculated the return on sales and given the solvency index Globas-i® of IA Credinform.

Return on sales (%) shows the share of operating income in sales volume of a company. In other words, the return on sales is the ratio, which illustrates what share of profit contains in each ruble earned.

The ratio characterizes the efficiency of use by a company of its resources, the efficiency of company’s financial management.

The values of return on sales are specific to each organization, what can be explained by the difference of competitive strategies of companies and their assortment.

Companies should be assessed relying on the industry-average indicator.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Revenues, in mln RUB, for 2013 | Return on sales, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | Invest Alyans LLC INN 5074028377 |

Kaluga region | 8 039,0 | 20,5 | 193 the highest |

| 2 | Starodvorskie kolbasy CJSC INN 3328426780 |

Vladimir region | 8 634,1 | 15,5 | 229 high |

| 3 | Cherkizovsky myasopererabatyvayushchy zavod OJSC INN 7718013714 |

Moscow | 18 396,9 | 8,8 | 190 the highest |

| 4 | Myasokombinat Dubki LLC INN 6432013128 |

Saratov region | 8 662,9 | 7,3 | 216 high |

| 5 | Mikoyanovsky myasokombinat CJSC INN 7722169626 |

Moscow | 10 437,1 | 6,1 | 204 high |

| 6 | Ostankinsky myasopererabatyvayushchy kombinat OJSC INN 7715034360 |

Moscow | 27 240,2 | 3,1 | 202 high |

| 7 | Ptitsekombinat LLC INN 2631029799 |

Stavropol territory | 8 083,2 | 2,7 | 251 high |

| 8 | Velikoluksky myasokombinat OJSC INN 6025009824 |

Pskovregion | 11 187,7 | 1,9 | 280 high |

| 9 | MPZ Agro-Belogore LLC INN 3123183960 |

Belgorodregion | 10 907,0 | 1,6 | 270 high |

| 10 | Khalyal ASH LLC INN 5050046264 |

Moscow region | 23 342,2 | 0,1 | 297 high |

The revenues of the leading meat processing compnaies of Russia (TOP-10), according to the latest published annual financial statement (for the year 2013) made 134,9 bln RUB, that is by 13,4% lower as in the previous period (118,4 bln RUB).

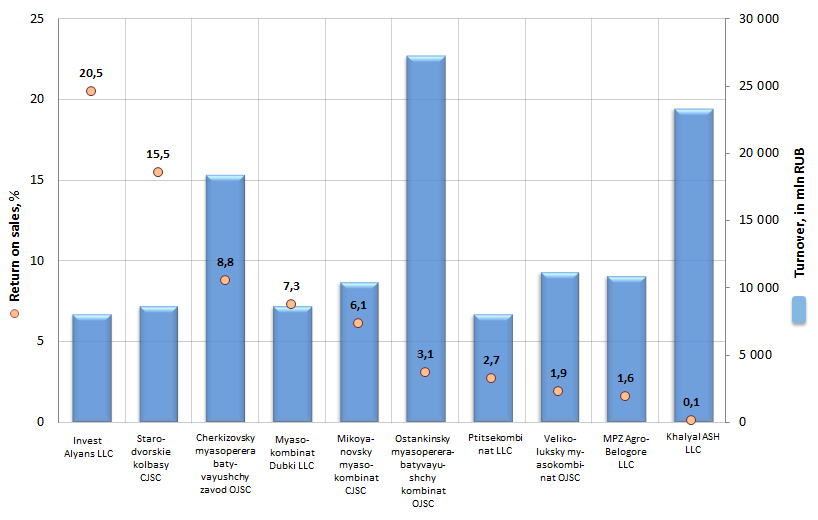

Picture. Return on sales and revenues of the leading meat processing companies of the RF (TOP-10)

The return on sales of all organizations of the TOP-10 list is in the positive zone, in other words, the leaders of the meat market have a portfolio of positive financial result behind them.

Two companies showed the return on sales being above 10%: Invest Alyans LLC (20,5%) – involved in the release of semi-finished meat - and Starodvorskie kolbasy CJSC (15,5%).

The largest enterprise of the branch – Ostankinsky myasopererabatyvayushchy kombinat OJSC - shows the average value of the return on sales (3,1%), that is an acceptable result, taking into account the size of revenues, complexity of production chain and logistics network of the company (increases the production costs).

According to the independent estimation of IA Credinform, all participants of the TOP-10 list got high and the highest solvency index. This fact points to that the market players can pay off their debts in time and fully, while risk of default is minimal or low.

A new development in the bankruptcy law

Beginning from January 29th, 2015 a Federal law №482-FZ regulating amendments to the Federal bankruptcy law came into force. The new developments will significantly influence on prosecution practice of insolvency cases. In particular the amendments will refer to rules of bringing the petition in bankruptcy before the court, rules of provisional liquidator appointment at the debtor’s bankruptcy, as well as the list of pledge lender’s rights.

One of the main changes is granting of the right for banks to apply a claim to arbitration court on declaration of the debtor’s bankruptcy without preliminary reference to the court and acceptance of legally effective court decision. Thus the law sets a privileged position for creditors – credit organizations.

According to the new rules, a credit organization may bring the petition in debtor’s bankruptcy before the court in case of his/ her breach of financial liabilities within 3 months upon condition of preliminary notification of the debtor and all the creditors known to the claimer of intention to file such kind of claim.

From January 29th till July 1st, 2015 it will be appropriate to make a written notice no less than 30 days before applying to arbitration court. Beginning from July 1st, 2015 the bank is obliged to publish the notice of intention to bring the petition in debtor’s bankruptcy before the arbitration court in the Unified State Register of Information Сoncerning Activity of Legal Entities no less than 15 calendar days before applying to court.

Thus firstly, the banks were entitled the right to initiate the bankruptcy proceedings without additional legal proceedings; secondly, now they are able to commence the insolvency proceedings ahead of other creditors obtaining access to the documents and debtor’s property in the course of the monitoring procedure.

Moreover, according to the new norms, the debtor can’t initiate the bankruptcy proceedings with the guaranteed appointment of candidate for provisional liquidator loyal to him/her. Now the provisional liquidator will be appointed from the list of members of self-regulated organization being chosen by random selection. The method of choosing of the self-regulated organization will be set by the Ministry of Economic Development of the Russian Federation. Up to that moment the self-regulated organization will be chosen by the court at the applying of the claim by the debtor.

At the same time the debtor is obliged to notify all the claimers known to him of the intention to bring the petition in bankruptcy. The notification is provided in the same manner and within the same terms as the notification of the credit organization of the intention to bring the debtor’s petition in bankruptcy.

Thus the adopted amendment significantly mitigates the risks of abuse on the part of the debtor, but it doesn’t remove it completely. The possibility of abuse lies in the potential agreement between the debtor and the management of randomly chosen self-regulated organization of court-appointed liquidator on appointment of the loyal liquidator. Thus the risk of management of the monitoring procedure by the debtor is reduced, but not eliminated completely.

The adopted amendments are also relevant to the amount of claims that allows initiating the bankruptcy procedure. Thus the amount of claims for starting of the legal entities bankruptcy procedure was increased from 100 to 300 thousand RUR. At the same time, the threshold for agricultural companies is left untouched at the level of 500 thousand RUR. Concerning strategic enterprises and natural monopolies the amount of claims is increased from 500 thousand RUR to 1 million RUR. In addition, in future in order to avoid expensive bankruptcy proceedings due to small debts there may be increase of this threshold for the legal entities in case of serious fluctuation in exchange-value of ruble.

It is the smallest part of the introduced amendments concerning the bankruptcy proceedings. However it’s getting clear that many terms are aimed at the protection of creditors, primarily - credit organizations. According to experts, it is related to the fact that in the current economic situation resulting from the high level of the general debt load, the banks turned out to be in the risk group. At the same time, due to the high professional level and interest in the efficient solution of the conflicts, they are assigned the leading role in the procedure of control of debtors during performance of necessary proceedings.