Product costs of manufacturers of concrete

Information agency Credinform prepared a ranking of Russian enterprises - manufacturers of concrete.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in cumulative annual turnover.

Product costs (in RUB) are expenses of an enterprise for manufacture and realization of products, represented in monetary form.

Product costs belong to the most important qualitative indicators, which collectively show all sides of company’s business activity. The level of product costs is connected with volume and quality of production, use of labor time, raw and other materials, equipment, expenditure of payroll budget etc. Product costs, on their turn, are the basis of determination of prices for production. The lower are product costs, the higher is profit and level of profitability. To reduce product costs, it needs to know their composition, structure and factors of their dynamics.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to product costs, but also to all available combination of review data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Product costs, in mln RUB, for 2013 | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | PKF Stroibeton LLC INN 5018059580 |

Moscow region | 9 823 | 8 689 | 223 (high) |

| 2 | Kombinat Mosinzhbeton OJSC INN7724208292 |

Moscow | 4 376 | 3 811 | 275 (high) |

| 3 | Beaton CJSC INN 7825367884 |

Saint-Petersburg | 3 467 | 3 464 | 197 (the highest) |

| 4 | Evrobeton CJSC INN 7734536888 |

Moscow | 2 271 | 1 918 | 285 (high) |

| 5 | StroiBetonMonolit LLC INN 5047050341 |

Moscow region | 1 955 | 1 923 | 172 (the highest) |

| 6 | Metrobeton CJSC INN 7803033447 |

Saint-Petersburg | 1 727 | 1 132 | 257 (high) |

| 7 | SF SMU-152 TRANSINZHSTROYA CJSC INN 7701145790 |

Moscow | 1 579 | 1 547 | 237 (high) |

| 8 | TSK-Beton LLC INN 7811470024 |

Saint-Petersburg | 1 509 | 1 424 | 364 (satisfactory) |

| 9 | ABZ Leninsky LLC INN 7727785467 |

Moscow | 1 450 | 1 396 | 253 (high) |

| 10 | Beton-Ekspress CJSC INN 6673143733 |

Sverdlovsk region | 1 427 | 1 161 | 262 (high) |

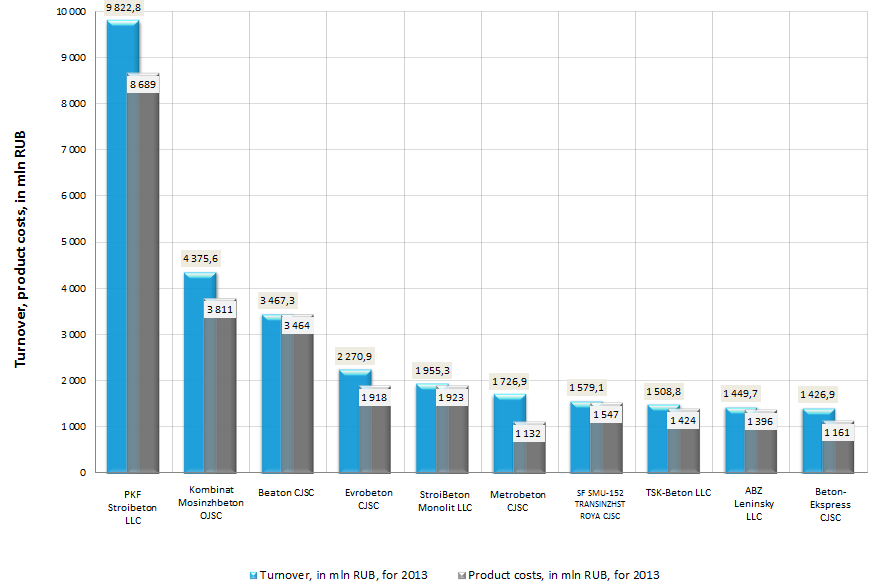

Picture. Turnover and product costs of the largest manufacturers of concrete (TOP-10)

The turnover of the largest companies – manufacturers of concrete in the RF (TOP-10) made 29 583 bln RUB, according to the latest published annual financial statement (for the year 2013), and cumulative product costs – 26 464 bln RUB. Now therefore, total expenses of enterprises of this branch are high enough, it is necessary to cut costs, otherwise the probability to get a negative result of net profit increases.

Among industry leaders the main manufacturers of concrete are concentrated in Moscow agglomeration and Saint-Petersburg, what is explained by large volume of construction and new housing supply in these regions.

PKF Stroibeton LLC (Moscow region) is the firm engaged in the manufacture of ready-mixed concrete, mortar, curb stone, asphalt concrete, as well as dry building mixes and concrete products.

Kombinat Mosinzhbeton OJSC (Moscow) is one of the largest Moscow enterprises on manufacture of concrete, concrete products and asphalt concrete. The assortment of goods manufactured by the plant includes more than 70 types of high-quality concrete mixes (from road to extra-strong and hydrotechnical) and 120 types of concrete products.

Beaton CJSC (Saint-Petersburg) has gathered experience in manufacture of road concrete mixes and concretes of different marks and classes: for road construction, for housing and industrial construction, for building and construction of bridge and tunnel structures, as well as concretes for works with built-in-place piles.

According to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 (except TSK-Beton LLC) got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully in the moment of their incurrence.

The standing of the branch will be determined to a large extent by speed of housing construction: for 9 months of 2014 the volume of new housing supply countrywide has increased by 24,6% to the relevant period of 2013 – up to 48,2 mln sq. m.

However, the increased value of credit and mortgage programs, as well as unstable macroeconomic situation, could have a negative impact on the dynamics of building sector next year.

The Central Bank of Russia and the Ministry of Economic Development are working on the "shock" script of economic development

In the end of September 2014 the Ministry of Economic Development of RF published the stressful script of economic development for 2015. According to the script in 2015 economy awaits the decline on 0.6%, followed by an increase in prices on 7,6%. The ministry assumes that such script could be real if the oil price will set on a mark at 91 dollars per barrel. It is to be recalled that, in May version of stressful script the GDP growth on 0,6% was predicted following the 2015 results.

Stressful script became the last version of forecast of Russian economy development from the Ministry of Economic Development. In the document it is called «A script» and it tests the national economy for deterioration of the external economic situation, leading to a stronger reduction of oil prices.

According to the presented script, the average annual oil price of Urals brand in 2015 will decrease to 91 dollars per barrel. During the next 2 years its stabilization at the level of 90 dollars per barrel is predicted. It is supposed that the prices will reduce on the other raw markets too, which will lead to a reduction of the export income in 2015–2017 on 36–45 bln. dollars a year in comparison with basic forecast, on the basis of which the budget is make up.

The reduction of exporters profit and the rise in price of the imported goods could lead to reduction of investments on 3,5% in 2015. The depreciation of the ruble will influence on consumer prices, the inflation will grow to 7,6% in 2015. The decrease of consumer confidence, in turn, will reduce the retail sales volume on 2,3%. Thus in such a contingency the GDP will decrease on 0,6% in 2015, but won't grow by 1,2% as it is supposed in the basic forecast. However the growth restoration at the level of 1,7–2,8% GDP is expected in 2016–2017.

It should be noted that stressful script is supposed the weakening of national currency rate to 40 rubles per dollar in 2015. However in the current year ruble beats all possible anti-records. Thus since October 29, 2014 the dollar rate is set at the level of 42,39 rubles per dollar by the Central Bank of Russia. Herewith the official rate of dollar has crossed the mark of 41 rubles for the first time on October 17, 2014.

The Central Bank of Russia is preparing its own stressful script. Its details haven’t announced yet, but at a government meeting the chairman of The Central Bank Elvira Nabiullina gave special attention to a negative script of the development. It assumes the reduction of oil prices to 87 dollars per barrel in 2017. According to the script, the economy will grow not higher than 0,5% within three years (2015-2017).

However the basic version of monetary policy of The Central Bank of Russia is close to the basic script of the Ministry of Economic Development by key points. The basic version of monetary policy of The Central Bank suggests the oil price at the level of 104,8 dollars per barrel and the following points: gradual recovery of the world economy, moderate downward trend of oil prices, decrease of geopolitical risks and gradual cancellation of sanctions and foreign trade restrictions. The Central Bank of Russia isn't going to change the target indicators on inflation. However it assumes the increase of prices growth in 2014 on 7,5% and higher, though the target indicator is 5%.

The regulator doesn’t deny the idea of completing the transition to the mode of inflation targeting. According to Elvira Nabiullina, targeting is extremely timely in the current situation, as it creates the conditions for long-term interest rates and predictable financial conditions.

It is to be recalled that earlier The World Bank lowered the basic forecast of the Russian economy growth in 2014 to a level of stagnation: from projected earlier 1.1 to 0.5%. Herewith the basic script takes into account the influence of the following factors: preservation of the international tension due to Ukrainian crisis, sanctions, lack of structural reforms and at the same time preservation of rather high stability level of Russian economy. Thus according to forecast of The World Bank, growth rates of the economy in 2015 will decrease to 0,3%, and in 2016 will amount to 0,4%.