Updated forecast of the main macroeconomic indicators in Russia for 2015-2016

Predictive component is always used in the basis of State budget. Thus, The Ministry of economic development offers two forecast scenarios of Russia’s economic development: basic and optimistic. Besides, under the circumstances the Ministry prepared the updated forecast of Russia's social and economic development, it also includes the conservative scenario. As it is the most likely, let’s consider this version. The Ministry of economic development on the base of market expectations regarding energy market offers 2015 annual average oil price at the level of 50 USD per barrel, 2016 price is 40 USD per barrel (table 1).

When the average oil price is lower than 50 USD per barrel, the ruble rate is within the limits of 65-70 rubles per USD. According to early estimates of the Ministry of economic development, with the growth in annual average oil price, the strengthening of ruble to 53 RUB per USD is possible, but only by 2018. However currently, the dollar value, suggested by the Ministry in the conservative scenario, is above 75 rubles. Although in 2016 the exchange rate will slightly strengthen and be lower than 61 RUB per USD.

In 2015 inflation rate within the basic scenario of economic development will amount to 11,4%, within the conservative scenario to 11,7%. In 2016 inflation situation should improve, nevertheless within the basic scenario will amount to 6,7%, within the conservative scenario to 8,8%.

By the end of 2015 under the influence of negative trends the decline in GDP or, under some improvements, a small increase will continue. According to the updated forecast within the conservative scenario the Ministry defines the decline in 2015 GDP to 3.7%. However in 2016 the Ministry expects the growth to 1% -2%, within conservative scenario there has to be a decrease by 0.9%.

| 2015 | 2016 | |||||

|---|---|---|---|---|---|---|

| The Ministry of economic development (basic version / conservative scenario) | Central Bank of the Russian Federation (the worst version (IIIb) / stress scenario) | The Ministry of Finance (assessment) | The Ministry of economic development (basic version / conservative / conservative scenario) | Central Bank of the Russian Federation (the worst version (IIIb) / stress scenario) | The Ministry of Finance (assessment) | |

| Annual average Urals oil price (global), USD/barrel | 52 / 50 | 84 / 60 | 50 | 55 / 40 | 70 / 60 | 60 |

| GDP, the rate of growth (decrease) % | (-3,3) / (-3,7) | (-0,7) / (-3,2) | (-2,8) | 1,8 / (-0,9) | 0,7 /(-1,2) | 2,3 |

| Inflation | 11,4 / 11,7 | 6,7-6,9 / 10,8 | 11,9 | 6,7% / 8,8 | 5,1-5,5 / 7,0 | 7,0 |

The Central Bank of the Russian Federation is still more optimistic in its forecasts even within the stress scenario of Russia’s economic development. The 2015 annual average oil price is expected to be at the level of 60 USD per barrel; in 2016 it should be restored to 80. By 2015 results, the GDP will decrease by 3,2%, in 2016 the growth will be 0,7% with 70 USD per barrel rate; with the rate at the level of 60 USD per barrel the decrease by 1,2% is expected. Perhaps, inflation in 2015 will amount to 10,8%, in 2016 it should stay at the level of 7%.

As the Ministry of economic development is conservative in its forecasts, it always makes the assessment and income planning within the most severe development conditions. The forecast analysis of the Ministry was used in the recently represented to Russian government draft called «Draft of Main Directions of the budget policy and innovations in budget legislation for 2016-2018».

According to the Ministry, by 2015 results the annual average oil price should be 50 USD per barrel, in 2016 it should increase to 60. In 2015 the GDP will decrease by 2,8%, in 2016 there will be the growth by 2,3%. In 2015 inflation rate will amount to 11,9%, in 2016 it should not exceed 7,0%.

The analysis of the Russian economists’ assessments shows, that the annual average oil price will be within the limits of 45-65 USD/barrel. Under such oil prices the ruble rate will vary within 75 – 55 RUB per USD. With the existing low oil price parities we should expect the spike in inflation to 12%, with higher price the reduction to 6% is possible. By 2015 results, with low oil price there will be a fall in GDP to 4%. Nevertheless, it is expected, that under the circumstances the economic development will stabilize and, perhaps, by the end of 2016, a little growth will be marked.

- industry: in 2015 in comparison with previous year the decrease by 3,1% is expected and by 0,4% in 2016;

- investment in fixed assets: in 2015 it will decrease by 11,3% and by 6,3% in 2016;

- turnover of retail trade: in 2015 it will decrease by 8,2% and by 2,1% in 2016;

- capital outflow: in 2015 it will amount to 93 bln. USD and to 75 bln. USD in 2016;

- actual wage: in 2015 it will decrease by 8% and by 2,2% in 2016;

- unemployment: in 2015 it will be at the level of 5,8%; in 2016 at the level of 6,3%;

Factors, which directly or indirectly will influence on decrease of annual average oil price, budget revenues, and, accordingly, economic development of Russia:

- the slowdown in global economic growth;

- the slowdown in China’s economic growth;

- within existing USA and EU sanctions, the limiting access of Russian companies to global capital market;

- increase of oil production against the reduction of its consumption and access of new players, such as Iran, to the global oil market;

- long-term trend of low oil price;

- cost reduction on shale oil production;

- the strengthening of USD against other world currencies;

- Russian export growth against the significant decrease of import volume;

- sharp decrease in investment, absence of growth sources, outflow of net capital from private sector;

- reduction of income and expenditure of the households;

- sales resistance in the terms of reduction of income.

Thus, according to Information Agency Credinform experts, at this stage as a whole, the certain models of Russia’s economic development appear. If the annual average oil price is close to 60 USD per barrel, we should expect the zero growth of the Russian economy. This situation is called stagnation. Decrease in oil price to 30 USD per barrel will lead to decline in production, revenues and economic recession as a whole. Thus it should be expected, that the GDP will fall by 4-5%.

The Russian industry touched the bottom

Following the decline in economic activity and deterioration of macroeconomic conditions (ruble devaluation, bad situation on the commodity markets, high inflation expectations and borrowing rate, sanctions), the significant drop in output is recorded.

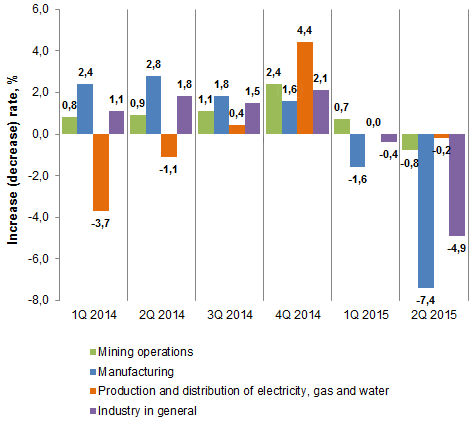

The negative dynamics in January-July 2015 compared with January-July 2014 amounted to -3.0%, while the negative developments in the II quarter have intensified: the industry in general fell by 4.9% and manufacturing by 7, 4% over the same period in 2014.

Active consumer demand, which was observed at the end of 2014 (against the national currency upswing), has run low and cannot be the growth driver. On the contrary, today the Russians’ expenses developed, at best, into delayed demand, and in fact are falling following the accrued wages depreciation.

Dynamics of industrial output to the corresponding period of last year, %

Looking at the industry sectors, a positive thing is observed: there are segments that show good growth rates. These include leather production (the growth for the 1st year half was 36%), steel-making equipment (35.7%), canned vegetables (27.6%), cheese (25.7%) etc. (See Table 1).

| № | Commodity group | January-July 2015 in % to January-July 2014 |

|---|---|---|

| 1 | Patent leather and patent laminated leather | 36,0 |

| 2 | Steel-making equipment, casting machines | 35,7 |

| 3 | Counters of production and consumption of the liquid | 31,6 |

| 4 | Canned vegetables and mushrooms | 27,6 |

| 5 | Plastic materials for floor, wall and ceiling covering | 26,1 |

| 6 | Cheese and cheese products | 25,7 |

| 7 | Sheet cast, rolled, drawn and blown glass | 19,7 |

| 8 | Jams, jellies, compotes, fruit and berry puree | 17,7 |

| 9 | Synthetic rubber | 17,5 |

| 10 | Electric motors, DC generators | 17,3 |

On the other hand, there are sectors where the situation is critical (see Table 2): the production of passenger cars decreased by 65.7%; internal combustion engines by 37.3%. That indicates the crisis in the automotive retail sector.

| № | Commodity group | January-July 2015 in % to January-July 2014 |

|---|---|---|

| 1 | Cardboard boxes (transport container) | -65,7 |

| 2 | Mainline passenger cars | -64,7 |

| 3 | Sliced veneer | -60,3 |

| 4 | Men’s trousers | -56,9 |

| 5 | Warm jackets | -55,6 |

| 6 | Mainline freight cars | -54,0 |

| 7 | TV receiving equipment | -40,3 |

| 8 | Golden and silver chains | -40,0 |

| 9 | Copper bars and sections | -39,4 |

| 10 | Internal combustion engines | -37,3 |

Since the inertia is usual for the economic processes, the impact of negative business conditions and fall of consumer demand will be particularly noticeable in the second half of the year. Yet there is no reason to expect the industrial growth recovery. And the events of the second half of August (problems in the Chinese economy, triggering a collapse in international markets) points out a possible sprouting of economic crisis on the top countries of the world.

It is noteworthy that the policy of import substitution initiated by the government, as well as sanctions restrictions on a number of goods from the EU and the United States brought the results: for example, the production of cheese in the 1st year half increased by 25.7%, which will have a positive impact on our food security. With reasonable approach, devaluation of the ruble can be used as an impetus for the industry to domestic counterparts (the development of new industries), and export-oriented companies to sweep new markets.