Trends in publishing activities

Information Agency Credinform presents a review of trends in publishing activities.

The publishing houses with the highest volume of annual revenue (TOP-10 and TOP-1000) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2016). The analysis was based on the data from the Information and Analytical system Globas.

Net assets

It is an indicator of fair value of corporate assets that is calculated annually as assets on balance less company’s liabilities. Net assets value is negative (insufficiency of property) if liabilities are larger than the property value.

| No. in TOP-1000 | Name, INN, region | Net assets value, million RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | Prosveshcheniye Publishers NJSC INN 7715995942 Moscow |

4 388,3 | 9 020,7 | 1 133,2 | 249 Strong |

| 2. | AST Publishing House LLC INN 7710899593 Moscow The company is a defendant in arbitration proceedings and has unsatisfied writs of execution. |

416,4 | 746,0 | 4 952,6 | 550 Insufficient |

| 3. | Publishing House E LLC INN 7708188426 Moscow |

3 172,0 | 3 889,3 | 4 225,0 | 161 Superior |

| 4. | ARGUMENTY I FACTY NJSC INN 7701103751 Moscow |

1 864,0 | 2 080,1 | 2 419,4 | 182 Strong |

| 5. | YAUZA Publishing House LLC INN 7707195170 Moscow |

482,9 | 870,8 | 2 027,8 | 166 Superior |

| 996. | Publishing House Interview LLC INN 7702753946 Moscow |

-336,5 | -512,9 | -515,9 | 372 Adequate |

| 997. | Editorial Office of the Kultura Newspaper PJSC INN 7707146913 Moscow |

-164,0 | -386,1 | -519,8 | 301 Adequate |

| 998. | Business News Media NJSC INN 7712108141 Moscow |

-349,6 | -639,0 | -581,0 | 271 Medium |

| 999. | INEWS LLC INN 7743814193 Moscow |

-425,8 | -529,6 | -790,7 | 330 Adequate |

| 1000. | Company Afisha LLC INN 7710861670 Moscow |

-212,1 | -425,6 | -797,6 | 304 Adequate |

*) — growth or decline values compared to prior period are highlighted green and red respectively in columns 4 and 5.

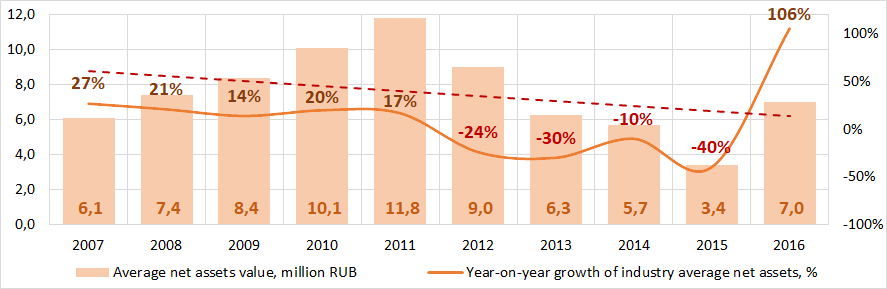

Picture 1. Change in average net asset value of the largest publishing houses in 2007 — 2016

Picture 1. Change in average net asset value of the largest publishing houses in 2007 — 2016Sales revenue

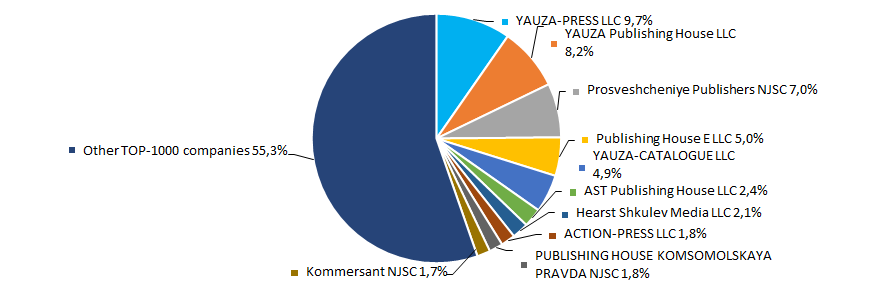

In 2016 sales revenue of 10 industry leaders amounted to 45% of total revenue of TOP-1000 companies. This is an indicator of a relatively high level of monopolization within the sector (Picture 2).

Picture 2. TOP-10 companies by their share in 2016 total revenue of TOP-1000 companies

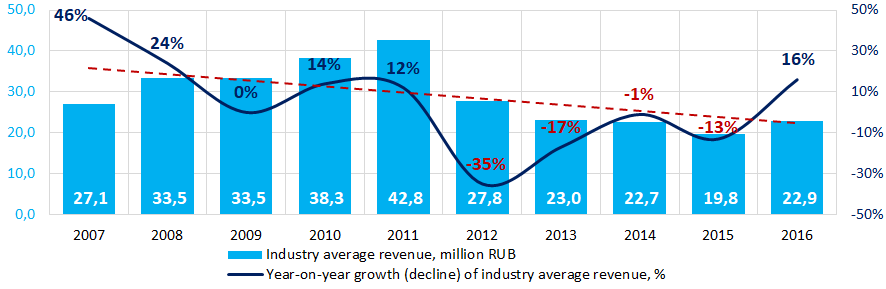

Picture 2. TOP-10 companies by their share in 2016 total revenue of TOP-1000 companiesIn general, revenue tends to decline (Picture 3).

Picture 3. Change in average revenue of publishing houses in 2007— 2016

Picture 3. Change in average revenue of publishing houses in 2007— 2016Profit and loss

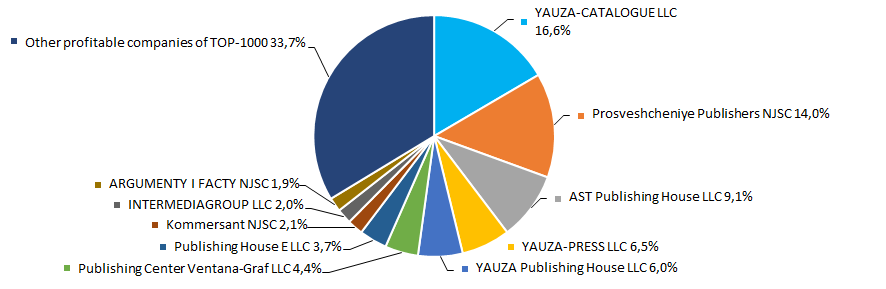

In 2016 profit of 10 industry leaders amounted to 66% of total profit of TOP-1000 companies (Picture 4).

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companies

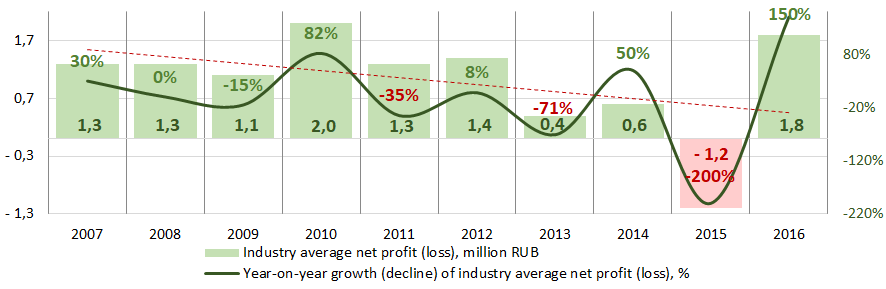

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companiesAverage profit values of companies of the sector within a decade tend to decline (Picture 5).

Picture 5. Change in average profit of the largest publishing houses in 2007 — 2016

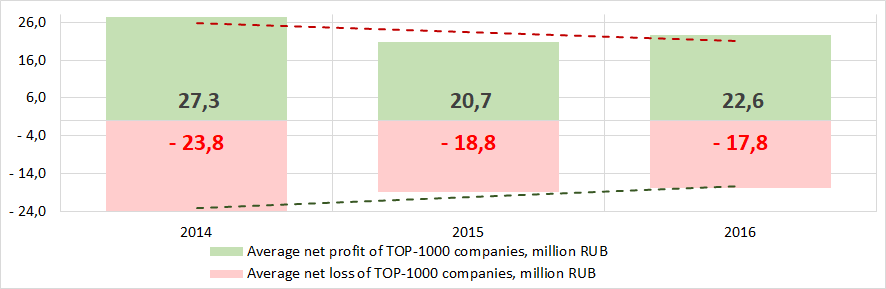

Picture 5. Change in average profit of the largest publishing houses in 2007 — 2016Average profit values of TOP-1000 companies for three years tend to decline, as well as average loss value (Picture 6).

Picture 6. Change in average profit and loss of the largest publishing houses in 2014 — 2016

Picture 6. Change in average profit and loss of the largest publishing houses in 2014 — 2016Key financial ratios

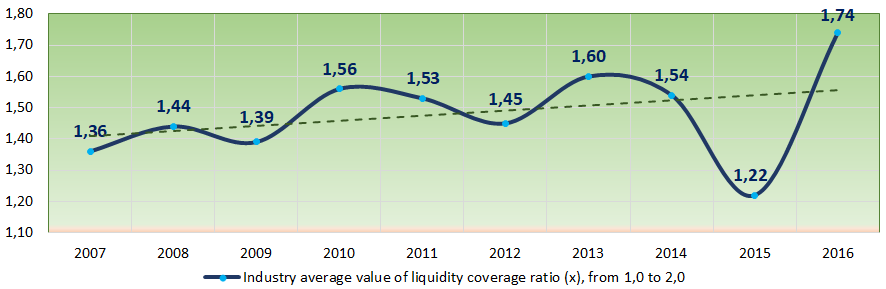

During the last decade industry average values of liquidity coverage ratio were within the recommended value — from 1,0 to 2,0 (Picture 7). In general, the ratio value tends to increase.

Liquidity coverage ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of liquidity coverage ratio of publishing houses amounted from 0,75 to 3,33 in 2016.

Picture 7. Change in average values of liquidity coverage ratio of publishing houses in 2007 — 2016

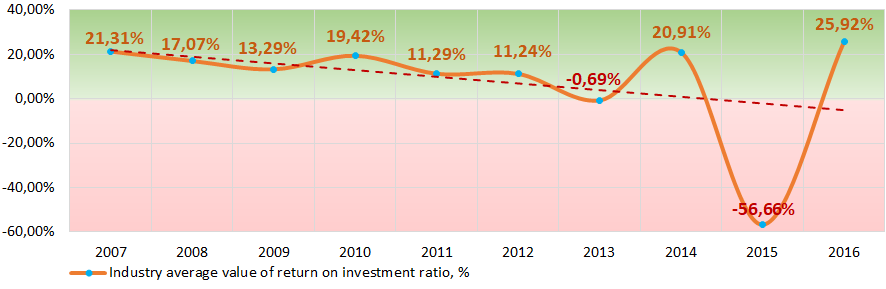

Picture 7. Change in average values of liquidity coverage ratio of publishing houses in 2007 — 2016The return on investment ratio (Picture 8) was not stable during the decade, tending to decrease. It is a ratio of net profit to shareholders’ equity and noncurrent liabilities, and it demonstrates benefit from shareholders’ equity engaged in business activity and long-term raised funds of the company.

Picture 8. Change in industry average values of return on investment ratio of publishing houses in 2007 — 2016

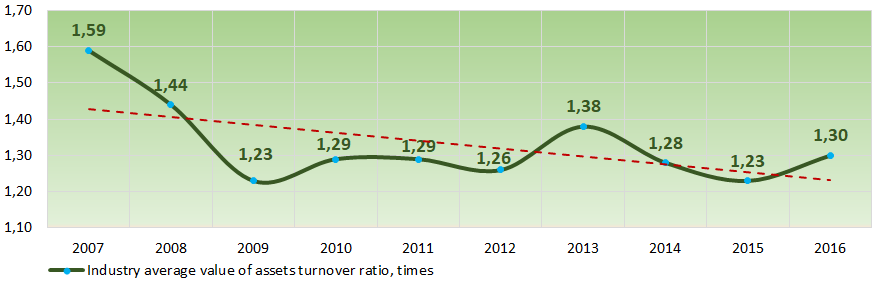

Picture 8. Change in industry average values of return on investment ratio of publishing houses in 2007 — 2016Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the decade, this activity ratio tended to decrease in general (Picture 9).

Picture 9. Change in industry average values of assets turnover ratio of publishing houses in 2007 — 2016

Picture 9. Change in industry average values of assets turnover ratio of publishing houses in 2007 — 2016Activities structure

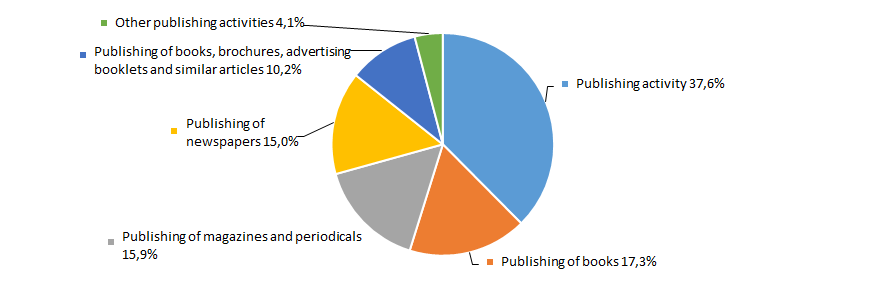

Companies that specialize in wide-profile publishing activities have the largest share in total revenue of TOP-1000 companies (Picture 10).

Picture 10. Types of activity by their share in total revenue of TOP-1000 companies, %

Picture 10. Types of activity by their share in total revenue of TOP-1000 companies, %77% companies of TOP-1000 are included in the register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation, among them 35% are micro enterprises, 40% are small businesses, and 2% are considered medium-sized businesses.

Key regions of activity

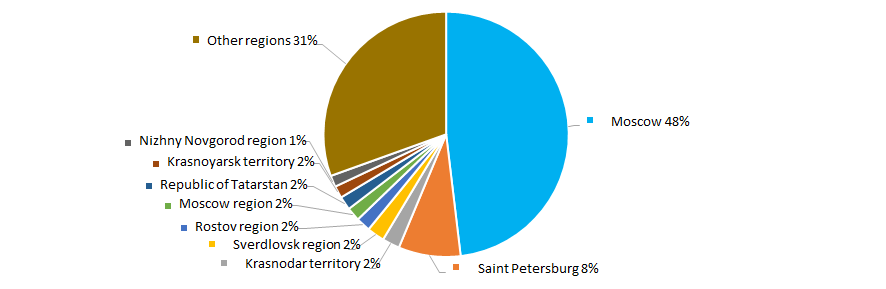

TOP-1000 companies are unevenly located throughout Russian territory, and are registered in 71 region (Picture 11).

Picture 11. TOP-1000 companies by Russian regions

Picture 11. TOP-1000 companies by Russian regionsFinancial position score

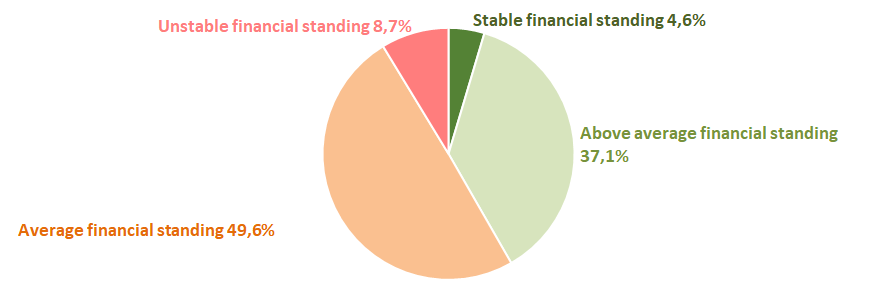

Assessment of financial state of TOP-1000 companies indicates that most of the companies have an average financial standing (Picture 12).

Picture 12.TOP-1000 companies by their financial position score

Picture 12.TOP-1000 companies by their financial position scoreSolvency index Globas

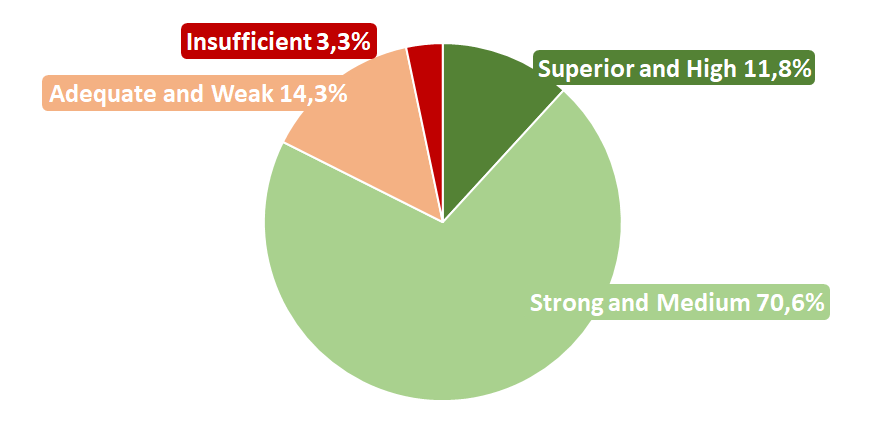

Most of TOP-1000 companies have got a superior, high, strong and medium Solvency index Globas,that indicates their capability to meet liabilities timely and in full (Picture 13).

Picture 13. TOP-1000 companies by Solvency index Globas

Picture 13. TOP-1000 companies by Solvency index GlobasTherefore, a comprehensive assessment of the largest publishing houses, that considers key indexes, financial figures and ratios, is indicative of negative trends in the sector.

Net profit ratio of the largest Russian publishing houses

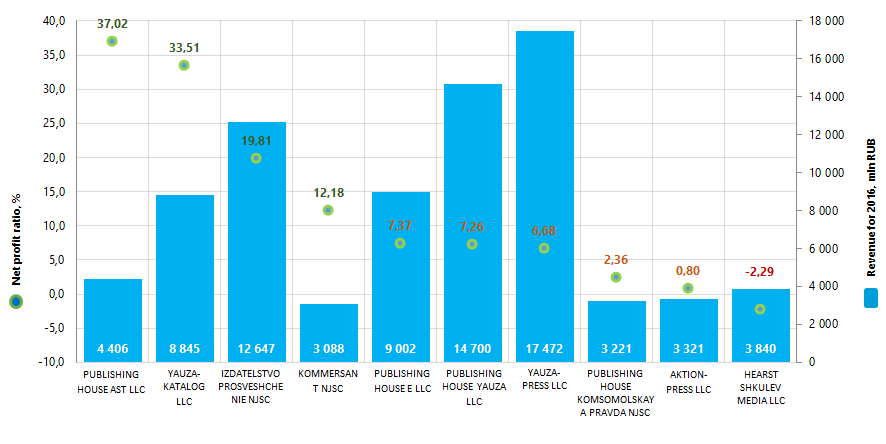

Information agency Credinform represents the ranking of the largest Russian publishing houses. Enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). Then they were ranked by net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and characterizes the level of sales profit. There is no normative value for the indicator. It is recommended to compare enterprises of one industry, or change of the ratio in the course of time of a certain company. A negative value of the ratio indicates a net loss. A high value shows an efficient operation of an enterprise.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For publishing houses the practical value of net profit made from 7,78% in 2016.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Net profit ratio, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| IZDATELSTVO AST LLC INN 7710899593 Moscow Participates as a defendant in arbitration proceedings, there are unclosed writs of execution. |

4 615,6 | 4 405,7 | 330,0 | 1 630,9 | 7,15 | 37,02 | 550 Insufficient |

| YAUZA-KATALOG LLC INN 7721629285 Moscow |

3 698,8 | 8 844,5 | 400,4 | 2 964,2 | 10,82 | 33,51 | 205 Strong |

| IZDATELSTVO PROSVESHCHENIE NJSC INN 7715995942 Moscow |

11 107,9 | 12 646,6 | 5 680,5 | 2 505,0 | 51,14 | 19,81 | 249 Strong |

| KOMMERSANT NJSC INN 7707120552 Moscow |

2 515,1 | 3 087,6 | 30,3 | 376,0 | 1,20 | 12,18 | 185 High |

| IZDATELSTVO E LLC INN 7708188426 Moscow |

7 231,4 | 9 001,8 | 717,3 | 663,3 | 9,92 | 7,37 | 161 Superior |

| IZDATELSTVO YAUZA LLC INN 7707195170 Moscow |

12 622,0 | 14 700,3 | 860,8 | 1 067,5 | 6,82 | 7,26 | 166 Superior |

| YAUZA-PRESS LLC INN 7721562746 Moscow |

13 469,1 | 17 472,5 | 815,2 | 1 167,6 | 6,05 | 6,68 | 169 Superior |

| PUBLISHING HOUSE KOMSOMOLSKAYA PRAVDA NJSC INN 7714037217 Moscow |

3 656,4 | 3 221,3 | 25,5 | 75,9 | 0,70 | 2,36 | 216 Strong |

| AKTION-PRESS LLC INN 7702272022 Moscow |

2 856,0 | 3 320,7 | 0,4 | 26,7 | 0,01 | 0,80 | 254 Medium |

| HEARST SHKULEV MEDIA LLC INN 7708183322 Moscow |

3 598,3 | 3 839,9 | -10,8 | -87,8 | -0,30 | -2,29 | 258 Medium |

| Total by TOP-10 companies | 65 370,6 | 80 540,8 | 8 849,5 | 10 389,4 | |||

| Average value by TOP-10 companies | 6 537,1 | 8 054,1 | 885,0 | 1 038,9 | 9,35 | 12,47 | |

| Industry average value | 19,8 | 22,5 | -1,2 | 1,8 | -6,11 | 7,78 | |

The average value of the net profit ratio of TOP-10 enterprises is much higher than the industry average. One company from the TOP-10 list increased revenue and net profit indicators in 2015 — 2016 compared to previous periods (marked with green filling in columns 2 — 5 of Table 1). Other companies decreased revenue or profit indicators or have a loss (marked with red filling in columns 2 — 5 of Table 1).

Picture 1. Net profit ratio and revenue of the largest Russian publishing houses (TOP-10)

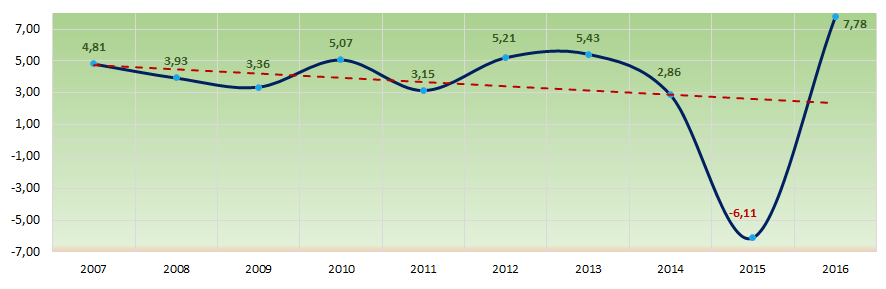

Picture 1. Net profit ratio and revenue of the largest Russian publishing houses (TOP-10)The industry average indicators of the net profit ratio were below the practical value of 2016 over the past 10 years, with a downward trend (Picture 2).

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian publishers in 2007 — 2016

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian publishers in 2007 — 2016