Where is it more popular to take credits?

According to research of the National Bureau of Credit Histories (NBCH), the majority of credit borrowers live in Republic of Buryatia, Republic of Khakassia and Amur region.

It’s interesting that according to Rosstat, average salary in these regions is far from being the lowest countrywide and varies from RUR 24,2 to 17,8 th. At the same time, the minimum of the average salary is registered in Kalmykiya and amounts to RUR 11,3 th.

According to NBCH, the average Russian borrower spends almost 26% of his/her income on promissory notes service every month. However, lately more and more borrowers spend almost 60% of their salary monthly on loan servicing. In the Republic of Buryatia there are 18,92 % of such borrowers, in Khakassia - 17,88%, in Amur region - 17,74%.

| № | Region | Share of borrowers with debt burden over 60% |

|---|---|---|

| 1 | Republic of Buryatia | 18,92% |

| 2 | Republic of Khakassia | 17,88% |

| 3 | Amur region | 17,74% |

| 4 | Altai Territory | 13,50% |

| 5 | Arkhangelsk region | 13,30% |

| 6 | Sakhalin region | 13,17% |

| 7 | Zabaykalsky Krai | 13,05% |

| 8 | Novgorod region | 12,95% |

| 9 | Tyumen region | 12,34% |

| 10 | Kamchatka Krai | 12,14% |

Experts link the growth in number of borrowers with their wrong world view, perceiving credits as additional source of revenue. Thus, the availability of loans together with irrational treatment lead to situation when families, having taken a lot of credits, borrow more and more money in order to pay off the previous debts.

In addition to that, the borrower’s TOP-10 includes the regions where the regional average salary exceeds the average salary countrywide. For instance, in the Sakhalin region this indicator amounts to RUR 39,9 th., in Tyumen region – RUR 36,3 th., in Kamchatka Krai – RUR 34,5 th. However, in this case it’s worth paying attention to the price level in these regions. Thus, according to Dmitry Medvedev, the food and housing prices in Sakhalin region and Kamchatka Krai are significantly higher than average salary countrywide, therefore the cost of one ruble is lower there. Experts note the wealth divide in the Tyumen region.

At that the representatives of the banking sector state that recently the rate of borrowers with low incomes has significantly grown. They are almost hooked on the credits. However, the experts can’t find the reasons why in some regions credits are paid off better, than in others. Thus, the economic situation, earnings stability of the citizens, operational effectiveness of the local collection agencies (the agencies that specialize in past-due debt and bad debts collection) exert influence on the regional credit rate. Moreover, cultural characteristics and habits of the citizens shouldn’t be left unmentioned. For example, if the borrower sees that his/her neighbor doesn’t have trouble with no paying off his/her debt, his/her desire to pay disappears.

It bears reminding that, previously the Bank of Russia proposed to impose restrictions by the debt to income ratio (DTI). There were two options. The first option was to impose restrictions for banks on granting of credits to clients, if the borrower’s DTI reaches the threshold values. More merciful option intended to grant credits to borrowers with excessive DTI, laying tougher requirements for the credit. However, Vasiliy Pozdyshev, director of bank regulation department of the Central Bank of Russia, stated last autumn that the ratio wouldn’t be imposed.

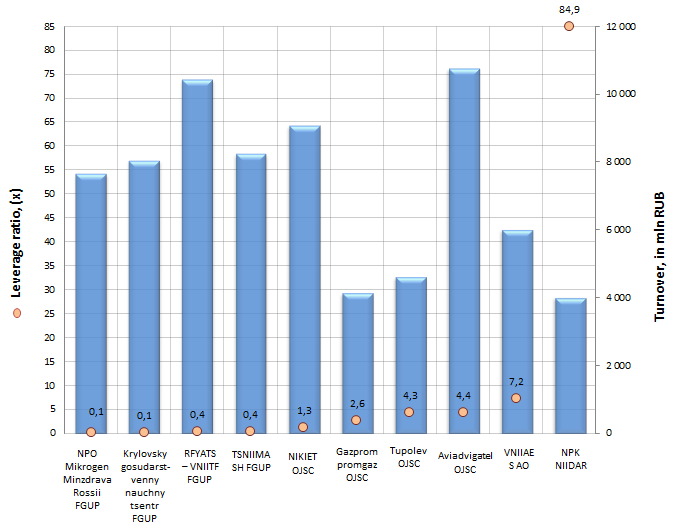

Financial leverage of companies, involved in developments in the field of natural and engineering sciences

Information agency Credinform prepared a ranking of Russian companies, involved in developments in the field of natural and engineering sciences.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by increase in leverage ratio.

Leverage ratio shows the relation of borrowed and own financing sources of an enterprise.

Recommended value: <1. If the indicator is above 1, it testifies to excess of the volume of borrowed funds over own resources of company, and the it is higher, the higher is the risk of the occurrence of liquidity crisis and financial inability of a firm.

However, it’s to be understood that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all presented combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Leverage ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | NPO Mikrogen Minzdrava Rossii FGUP INN: 7722292838 |

Moscow | 7 655 | 0,1 | 242 high |

| 2 | Krylovsky gosudarstvenny nauchny tsentr FGUP INN: 7810213747 |

Saint-Petersburg | 8 052 | 0,1 | 183 the highest |

| 3 | RFYATS– VNIITF FGUP INN: 7423000572 |

Chelyabinsk region | 10 448 | 0,4 | 223 high |

| 4 | TSNIIMASH FGUP INN: 5018034218 |

Moscow region | 8 248 | 0,4 | 203 high |

| 5 | NIKIET OJSC INN: 7708698473 |

Moscow | 9 089 | 1,3 | 161 the highest |

| 6 | Gazprom promgaz OJSC INN: 7734034550 |

Moscow | 4 141 | 2,6 | 195 the highest |

| 7 | Tupolev OJSC INN: 7705313252 |

Moscow | 4 611 | 4,3 | 312 satisfactory |

| 8 | AviadvigatelOJSC INN: 5904000620 |

Perm territory | 10 771 | 4,4 | 220 high |

| 9 | VNIIAES AO INN: 7721247141 |

Moscow | 6 023 | 7,2 | 228 high |

| 10 | NPK NIIDAR INN: 7718016698 |

Moscow | 4 020 | 84,9 | 158 the highest |

Рисунок 1. Turnover and leverage ratio of companies involved in developments in the field of natural and engineering sciences (TOP-10)

The turnover of the largest companies involved in developments in the field of natural and engineering sciences (TOP-10) made 73 057 bln RUB, according to the latest published financial statement (for the year 2013).

Only 4 participants of TOP-10 showed the leverage ratio being within recommended values: NPO Mikrogen FGUP НПО (0,1), Krylovsky gosudarstvenny nauchny tsentr FGUP (0,1), RFYATS – VNIITF FGUP (0,4), TSNIIMASH FGUP (0,4).

In other words, borrowed funds of enterprises do not exceed own assets, and if we assume that investors will call in their investments, the mentioned companies will repay its debt with no special troubles.

- «NPO Mikrogen» is one of three leaders of Russian pharmaceutical companies and is the largest national manufacturer of immunobiological preparations: vaccines, sera, specific immunoglobulins, growth mediums, allergens, probiotics. The unique area of research and production activity of NPO Mikrogen is manufacture of bacteriophages - safety antimicrobials, a viable alternative for antibiotics.

- «Krylovsky gosudarstvenny nauchny tsentr FGUP» conducts fundamental research in the field of marine and river equipment; develops programs of ship and vessel building and appraisals of projects of marine and river ships, vessels and facilities.

- «Rossijsky Federalny Yaderny Tsentr – Vserossijsky nauchno-issledovatelsky institut tekhnicheskoy fiziki imeni akademika E.I. Zababakhina» is one of two located in Russia active nuclear arms centres of world-class. At the present time RFYATS – VNIITF is the largest scientific organization both on production of nuclear weapons and on fundamental and applied researching.

- «Federalnoe gosudarstvennoe unitarnoe predpriyatie Tsentralny nauchno-issledovatelsky institut mashinostroeniya» is the lead institute of the Federal space agency. «TSNIImash» is one of the first enterprises of rocket-and-space branch of the country. From the date of its foundation, it takes part in solution of paramount tasks of domestic rocket and space industry.

Other industry leaders of TOP-10 have borrowed funds exceeding own funds, what is explained to a large extent by their commercial structure.

According to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 (except Tupolev OJSC) got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully in the moment of their incurrence.