Class action lawsuits in arbitration proceedings

A new chapter 22.2 «Investigation of cases on Protection of Rights and Legal Interests of group of people», was entered to the Civil Procedural Code of the RF by the Federal Law as of 18.07.2019 №191-FL. That makes it possible for individuals and companies to apply to the court for protection of rights and legal interests of group of persons. This application should be complied by set of conditions:

- common defendant for every member of a group;

- the same rights and legal interests should be judicial matter for members of a group;

- rights of members of the group and obligations of a defendant are determined by identical factual situation;

- all members of the group apply united method of the rights protection;

- joining the application of more than 20 persons on the beginning of court hearing.

Besides, amendments were made to the Arbitration Procedural Code of the RF. In particular, to the article 225.10, that regulates class action lawsuits in arbitration proceedings.

It is provided by the amendments, that joining class action lawsuit can be arranged by written application to corresponding party or application to the court, if integration is carried out after start of proceeding on class action lawsuit. It is possible to access to group action lawsuit before the beginning of court hearing. It can be done via completion of the corresponding form on the web site of arbitration court or with the use of service «My arbitrator».

Person performing interests of the group and joined to the claim on protection of group interests, has right to sign notarized agreement, defining rules of incurring legal expenses. It concerns both civil and arbitration proceedings. Matter of change or termination of such group agreements is regarded only through court proceedings at the place of class action lawsuit proceeding.

Amendments will come into force since October 1.

Trends in the work of Chechen companies

Information agency Credinform represents an overview of activity trends of the largest companies of the real sector of the economy in the Chechen Republic.

The republican companies with the largest volume of annual revenue (TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of the property of an enterprise, is calculated annually as the difference between assets on the balance sheet of the enterprise and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company of the Chechen Republic in terms of net assets is SITI-STROI LLC . Its net assets amounted to more than 7,2 billion rubles in 2017.

The smallest size of net assets in TOP-500 enterprises was owned by GAZPROM MEZHREGIONGAZ GROZNY LLC. Insufficiency of assets of this company was expressed by a negative value -74,4 billion rubles.

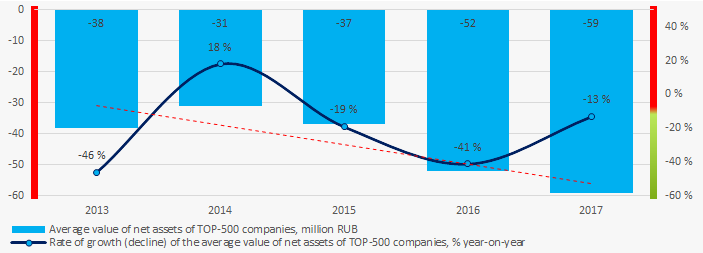

Over a five-year period, the indicators of the average size of net assets of TOP-500 companies were expressed by negative values with a downtrend (Picture 1).

Picture 1. Change in the average indicators of the net assets value of TOP-500 enterprises in 2013 – 2017

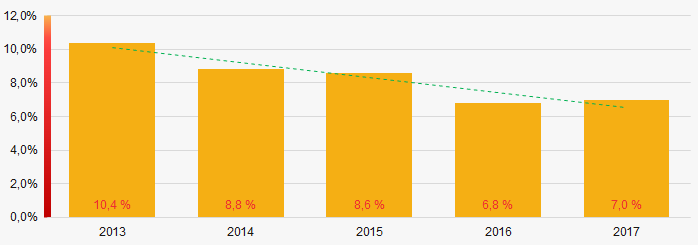

Picture 1. Change in the average indicators of the net assets value of TOP-500 enterprises in 2013 – 2017The shares of TOP-500 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-500

Picture 2. Shares of enterprises with negative values of net assets in TOP-500Sales revenue

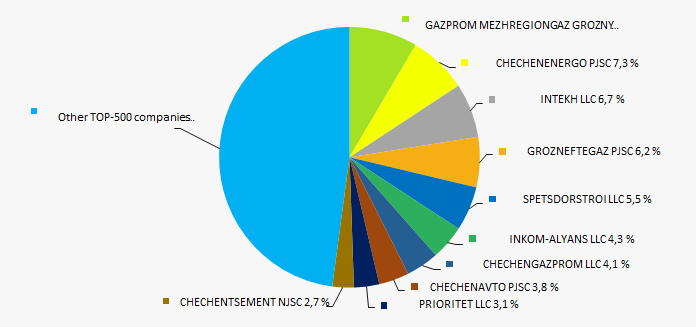

The revenue volume of 10 leading regional companies made 52% of the total revenue of TOP-500 in 2017 (Picture 3). It points to a high level of industrial concentration in the Chechen Republic.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2017

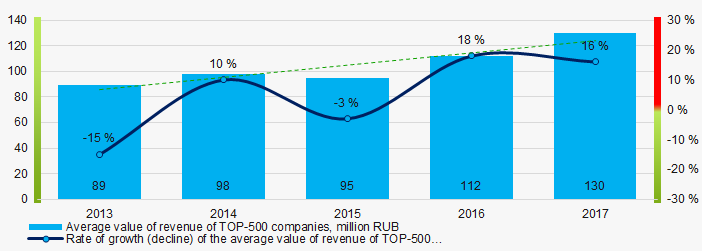

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2017In general, there is a trend towards an increase in revenue volume (Picture 4).

Picture 4. Change in the average revenue of TOP-500 enterprises in 2013 – 2017

Picture 4. Change in the average revenue of TOP-500 enterprises in 2013 – 2017Profit and losses

The largest company of the Chechen Republic in terms of net profit is GAZPROM GAZORASPREDELENIE GROZNY NJSC. Company's profit amounted to 584 million rubles in 2017.

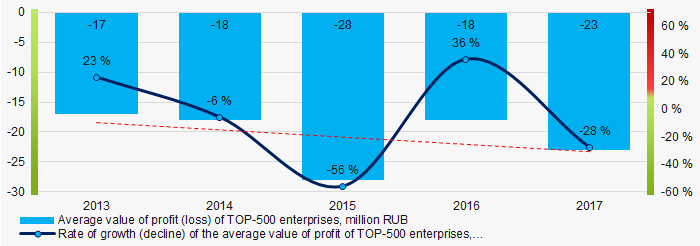

n general, there is a tendency to increase the average size of loss in TOP-500 over the five-year period (Picture 5).

Picture 5. Change in the average values of profit (loss) of TOP-500 enterprises in 2013 – 2017

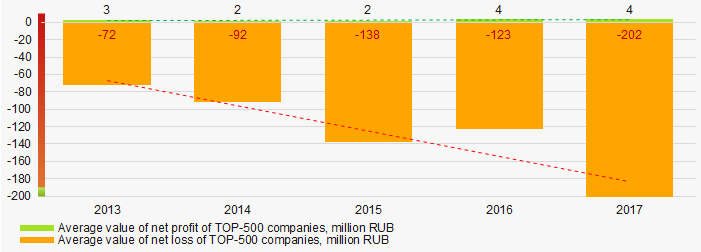

Picture 5. Change in the average values of profit (loss) of TOP-500 enterprises in 2013 – 2017Over a five-year period, the average values of net profit’s indicators of TOP-500 companies tend to increase insignificantly, while the value of net loss also increases. (Picture 6).

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2013 – 2017

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2013 – 2017 Key financial ratios

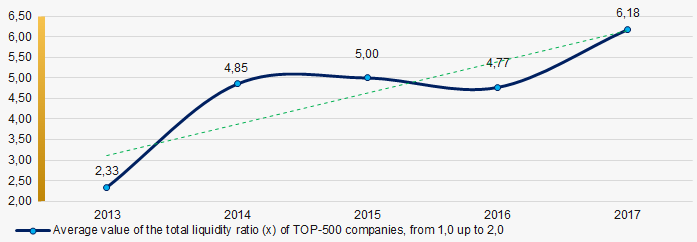

Over the five-year period the average indicators of the total liquidity ratio of TOP-500 enterprises were above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 enterprises in 2013 –

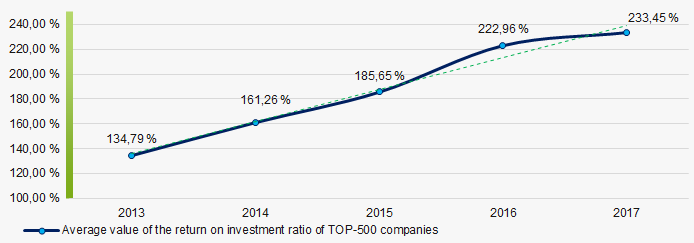

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 enterprises in 2013 – There has been a very high level of average values of the return on investment ratio for five years, with a tendency to increase. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-500 enterprises in 2013 – 2017

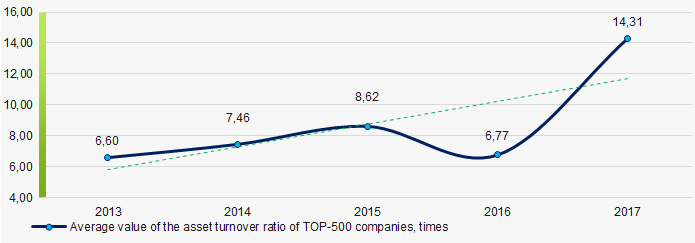

Picture 8. Change in the average values of the return on investment ratio of TOP-500 enterprises in 2013 – 2017 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to increase over the five-year period (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 enterprises in 2013 – 2017

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 enterprises in 2013 – 2017Small business

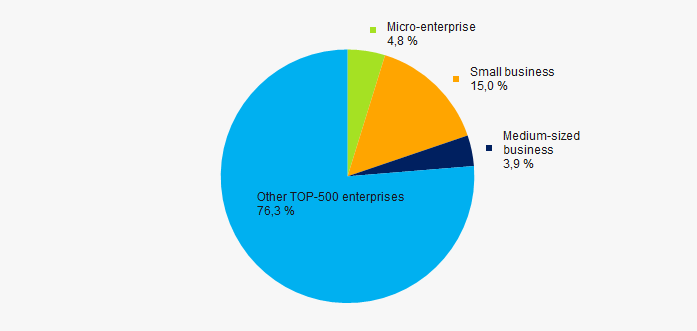

47% of TOP-500 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-500 companies amounts to 23,7%, that is higher than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companiesMain regions of activity

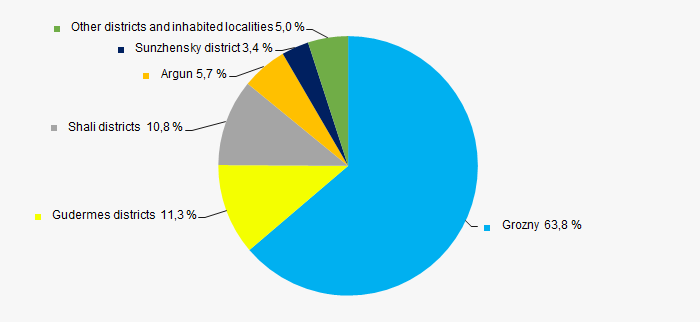

The TOP-500 enterprises are registered in 18 districts and inhabited localities of the Republic and are distributed unequal across the territory. Almost 86% of the revenue volume of TOP-500 companies are concentrated in the republican center – Grozny, Gudermes and Shali districts (Picture 11).

Picture 11. Distribution of the revenue of TOP-500 companies by regions of the Chechen Republic

Picture 11. Distribution of the revenue of TOP-500 companies by regions of the Chechen RepublicFinancial position score

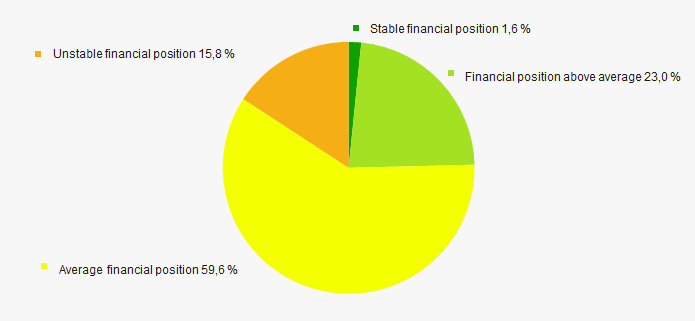

An assessment of the financial position of TOP-500 companies shows that more than half of them are in average financial position. (Picture 12).

Picture 12. Distribution of TOP-500 companies by financial position score

Picture 12. Distribution of TOP-500 companies by financial position scoreSolvency index Globas

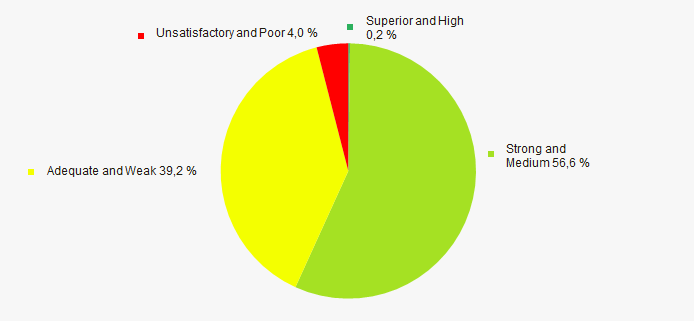

The largest part of TOP-1000 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-500 companies by solvency index Globas

Picture 13. Distribution of TOP-500 companies by solvency index GlobasIndustrial production index

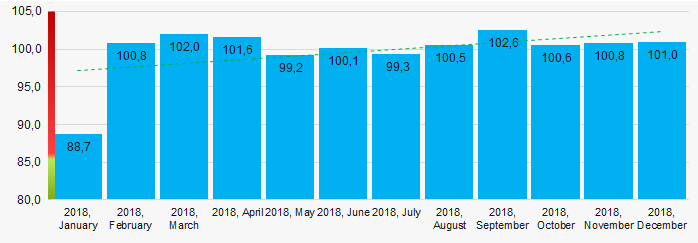

According to the Federal Service of State Statistics, there is a tendency towards an increase in indicators of the industrial production index in the Chechen Republic during 12 months of 2018 (Picture 14). At the same time, the average index indicator from month to month amounted to 99,8.

Picture 14. Industrial production index in the Chechen Republic in 2018, production index in the Republic of Crimea and Sevastopol in 2018, month to month (%)

Picture 14. Industrial production index in the Chechen Republic in 2018, production index in the Republic of Crimea and Sevastopol in 2018, month to month (%)According to the same information, the share of enterprises of the Chechen Republic in the total amount of revenue from the sale of goods, works, services made 0,041% countrywide for 2018, and for the 1st quarter of 2019 – 0,037%, that is lower than the indicator for the 1st quarter of 2018, which amounted to 0,039%.

Conclusion

A comprehensive assessment of activity of the largest companies in the real sector of the economy of the Chechen Republic, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors of TOP-500 enterprise | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Concentration level of capital |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  5 5 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Dynamics of the share of enterprises of the Republic in the total amount of revenue from the sale of goods, works, services countrywide |  -10 -10 |

| Average value of the specific share of factors |  1,3 1,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).