Taxes: being optimized or charged

Amendments in legislation stimulates the search for new ways of checking counterparties.

Counterparties check is now not the only ground for obtaining tax benefit. How to carry out due diligence if the law prescribes cases when a company can receive a tax refund?

Referring to the Ruling No. 53 of the Plenum of the Supreme Arbitration Court of the Russian Federation of 12 October 2006 “Concerning the Evaluation by Arbitration Courts of the Legitimacy of the Receipt by a Taxpayer of a Tax Benefit”, entrepreneurs and the FTS kept to the due diligence trend for over 10 years.

The Article 54.1 of the Tax Code of Russia entitled “Limits on the Exercise of Rights Relating to the Calculation of the Tax Base (or) the Amount of a Tax, a Levy or Insurance Contributions”, that came into force in August 2017, sets the standards for obtaining tax rebate. The first one - optimization of tax liabilities is not a part of transaction; the second one – the counterparty fulfills the obligations.

In general, the Article 54.1 is a try to formalize a concept of unreasonable tax benefit legislatively.

The Article provides prohibition on tax refund after deliberate misrepresentation by a company of facts about business activity and objects of taxation.

Case studies of “misrepresentation”:

- «split-up» of business to misuse special taxation regimes;

- unreality of settlement of a transaction by the parties;

- concealment of actual income by a taxpayer, designedly unreliable information about the objects of taxation

Signs of unreasonable tax benefits:

- transaction does not have a reasonable explanation from the point of view of economic necessity. For example, joining a company with an accumulated loss without assets in the absence of an economic justification;

- fact of cashing out of funds by a company or interdependent person, fact of using such funds for needs of a company, founders, officials, the use of the same IP addresses, detection of seals and documentation of the counterparty in the territory of the audited company;

- atypical workflow, business practice mismatch of transaction participants, officials.

Obligation under the transaction must be fulfilled by the counterparty declared in the contract, not by any "third person".

For the first time this point of law directly focuses on the need to verify the execution of transaction by the counterparty specified in the contract. The counterparty's reliability is easy to find in case of tax control: fly-by-night companies usually do not have the necessary staff to fulfill their obligations.

There is a presumption of unreasonable tax benefit as long as the person liable for the contract has not fulfilled obligations thereunder. In other words, if the transaction is real, there are no tax claims against participants. However when the actual executor was a third party, the taxpayer loses the right to receive tax benefits on the transaction.

In essence, this norm fixes an objective imputation of tax offense to the taxpayer, depending on the counterparty’s actions.

Among other innovations - the article contains a proviso that one ought not to deprive the taxpayer of his rights if only because documents on transactions were signed by unidentified persons, or counterparties appeared to be fly-by-night companies, or companies used special tax regimes, benefits or reduced tax rates.

Henceforth, the following economic facts cannot give occasion to tax claims in obtaining unreasonable tax benefits:

- signing of primary accounting documents by unidentified or unauthorized person;

- violation of the tax legislation by the counterparty;

- possibility for the taxpayer to obtain the same result of economic activity when making other transactions (dealings) not prohibited by the law.

The new norm of the Tax Code does not waive responsibility for carrying out due diligence activities from the business; however, additional tools appear for the tax authority to prove the facts of obtaining unreasonable tax benefits by using fly-by-night companies or creating affiliated schemes of interdependent persons. Companies are obliged to verify their counterparties even more thoroughly, and the tax body will look for the facts of possible violations.

The adopted Article 54.1 does not abolish previous anti-fly-by-night companies practice, but expands the ability of tax authorities to identify dubious transactions, and gives business additional motivation to check the counterparty.

The largest companies of Russia: not by oil alone

As a rule, prosperity of the country's economy is judged by the largest enterprises. However, sometimes the results of famous domestic brands’ activity do not demonstrate all complexity of inland economic processes. The economy of Germany, for instance, is firmly associated with BMW and Mercedes, Volkswagen and others, but its GDP is mainly formed by small and medium business. At the same time, it is possible to judge the general level of the country's technological development and its main specialization in the international market by leading enterprises.

The main engines of the Russian economy, both by revenue and net profit, are enterprises of fuel and energy complex (FEC). Exporting oil and gas to Europe and Asia, domestic oil holdings are crucial for world cooperation that still gears economic growth of Russia to resources supply and global prices dynamics.

That is why it is pleasant that not only mineral companies are included in the list of the largest enterprises promoting the growth of the country’s economy.

Largest companies of Russia by annual revenue

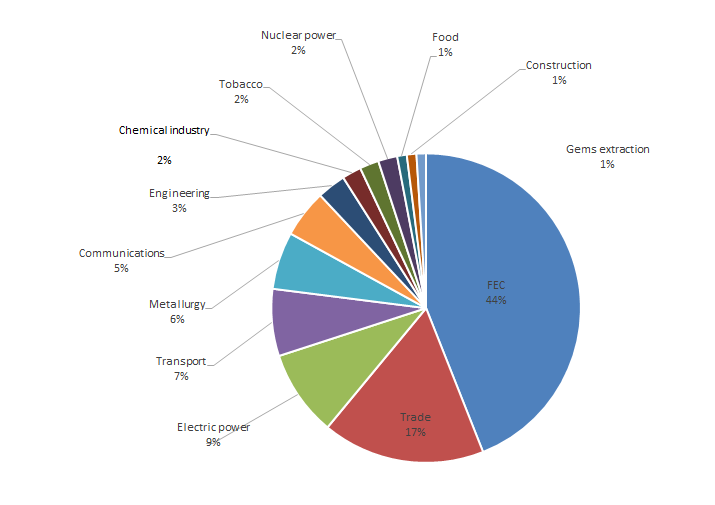

Following the analyses of the largest companies of Russia by turnover, the share of FEC enterprises in total revenue of Top-100 reduced from 54% in 2015 to 44% in 2016 (see picture 1). However, the sector still dominates in the economy of the country. Nowadays the companies of the following business begin to make substantial contribution to the GDP: retailers increased their share from 14,1% in 2015 to 17% in 2016, electric power – from 4,1% to 9% and transport – from 5,6% to 7%. Reduction of total share of oil and gas enterprises in the rating indicates the positive trend of national economy diversification. At the current dynamics, the significant reduction of dependence of Russia on FEC should be expected. According to the Ministry of Finance, revenue from oil and gas sales in 2016 amounted to 36% of budget receipts. In 2014, the share of oil and gas revenue was 51%.

Picture 1. Distribution of revenue of Top-100 companies of Russia by the sectors of economy

Picture 1. Distribution of revenue of Top-100 companies of Russia by the sectors of economy GAZPROM, ROSNEFT and RZD remain the largest businesses in Russia (see table 1). However, the highest revenue increase rate for Top-10 companies was demonstrated by TRADE HOUSE PEREKRESTOK: its turnover during the year increased by 16,8%, up to 848,3 bln RUB, and the company rose from 9 to 8 position in the rating.

Table 1. Top-10 of the Russian companies with the highest revenue

| Rating | Sector | Company | Turnover 2016, bln RUB | |

| 1 | - | FEC | GAZPROM | 3934,5 |

| 2 | - | FEC | OC ROSNEFT | 3930,1 |

| 3 | - | Transport | RZD | 1577,5 |

| 4 | - | FEC | GAZPROM NEFT | 1233,8 |

| 5 | - | Trade | TANDER (Magnit) | 1175,2 |

| 6 | - | FEC | SURGUTNEFTEGAZ | 992,5 |

| 7 | - | FEC | GAZPROM MEZHREGIONGAZ | 884,8 |

| 8 |  +1 +1 |

Trade | TRADE HOUSE PEREKRESTOK | 848,3 |

| 9 |  -1 -1 |

FEC | TRANSNEFT | 803,1 |

| 10 |  +1 +1 |

Trade | TRADE COMPANY MEGAPOLIS | 624,1 |

Table 2 contains companies with the highest revenue increase rate in 2016. Among them are ALROSA, GAZPROMNEFT-TSENTR and AGROTORG. ORENBURGNEFT, VERKHNECHONSKNEFTEGAZ and URALKALI had the highest rate of reduction of turnover for 2016. Significant decrease in revenue is due to downgrade of demand-supply situation in the commodity markets of petrochemical products.

Table 2. Russian companies with the highest rate of increase and decrease in revenue

| Rating | Sector | Sector | Turnover 2016, bln RUB | |

| 14 |  +33 +33 |

Trade | AGROTORG | 481,7 |

| 32 |  +48 +48 |

FEC | GAZPROMNEFT-TSENTR | 288,1 |

| 47 |  +16 +16 |

Gems | Gems | 249,5 |

| 76 |  -27 -27 |

FEC | FEC | 199,3 |

| 121 |  -48 -48 |

Chemical industry | URALKALI | 131,3 |

| 127 |  -67 -67 |

FEC | VERKHNECHONSKNEFTEGAZ | 128,5 |

Companies with the highest net profit

Another indicator for company size assessment and leaders identification is net profit.

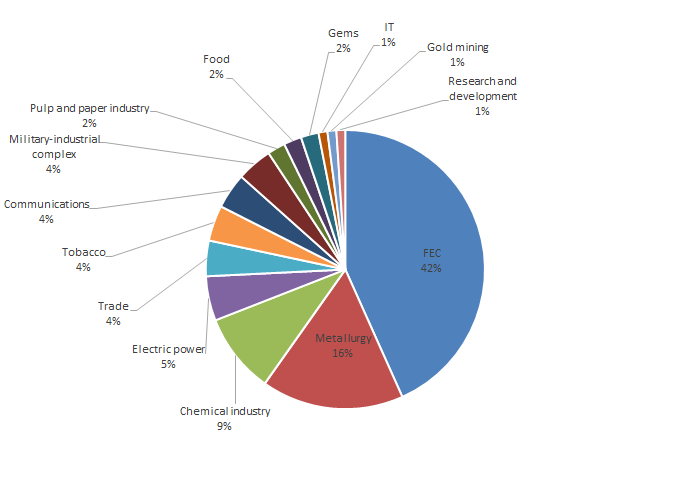

Today the bulk of net profit is still with FEC companies. At the same time, growth in number of companies of other sectors is observed. For example, metallurgy enterprises have almost double increased net profit share in Top-100 compared to 2015 (see picture 2).

Picture 2. Distribution of net profit of Top-100 companies of Russia by the sectors of economy

Picture 2. Distribution of net profit of Top-100 companies of Russia by the sectors of economy Rating of the most profitable business of Russia has changed significantly in comparison with 2015 (see table 3). GAZPROM with net profit of 411,4 bln RUB heads the list.

The second profitable company is LUKOIL with 182,5 bln RUB.

Then follows POLYUS KRASNOYARSK, gold mining company with comprehensive financial result of 150,8 bln RUB. At the year-end, the company had three-fold increase in net profit and implemented new investment-attractive “Natalka deposit” project.

Through revaluation of exchange rate difference and devaluation of rouble to foreign currency, diamond-mining company ALROSA demonstrated the growth of figure in seven times and became fourth in the rating.

By means of military and industrial products sales, ROSTEC corporation with net profit of 124,7 bln RUB is the 6th. It should be noted that Russia is the second to the USA in term of armament export in the global market. According to the data for 2016, the country’s share is 23% of total world arms exports.

GAZPROM NEFT rose on 58 positions and demonstrated the highest net profit growth rate in almost 8 times for 2016. This result is mainly connected with the opening of the “Prirazlomnaya” oil production platform in the Barents Sea.

GAZPROM NEFT rose on 58 positions and demonstrated the highest net profit growth rate in almost 8 times for 2016. This result is mainly connected with the opening of the “Prirazlomnaya” oil production platform in the Barents Sea.

Table 3. Top-10 of the Russian companies with the highest net profit

| Rating | Sector | Company | Company | |

| 1 |  +1 +1 |

FEC | GAZPROM | 411,4 |

| 2 |  +1 +1 |

FEC | LUKOIL | 182,5 |

| 3 |  +28 +28 |

Gold mining | POLYUS KRASNOYARSK | 150,8 |

| 4 |  +50 +50 |

Gems | ALROSA | 148,6 |

| 5 |  +4 +4 |

FEC | NOVATEK | 147,9 |

| 6 |  +12 +12 |

Research and development | ROSTEC | 124,7 |

| 7 |  -3 -3 |

Metallurgy | MMC NORILSK NICKEL | 122,7 |

| 8 |  +58 +58 |

FEC | GAZPROM NEFT | 122,4 |

| 9 |  +54 +54 |

Electric power | FGC UES | 106,0 |

| 10 |  -2 -2 |

FEC | TATNEFT | 104,8 |

SURGUTNEFTEGAZ, used to be the first in the rating in 2015, deserves special mention. The company is no longer among the most profitable enterprises due to losses of 104,8 bln RUB in 2016. This was caused by loss in exchange rate difference: the company hold foreign currency for the account and sustained significant financial losses in 2016 on the background of the rouble strengthening.

Planned decrease of FEC share in the Russian economy is taking place: companies of IT (Yandex), telecommunications industry (MTS), pharmacy (R-Pharm) and other sectors appear in the lead.

At the current trend, dependence on oil and gas income and falling oil prices will not so critically influence all sectors; economy will continue to diversify and processing industry, construction and trade will become new drivers of growth.