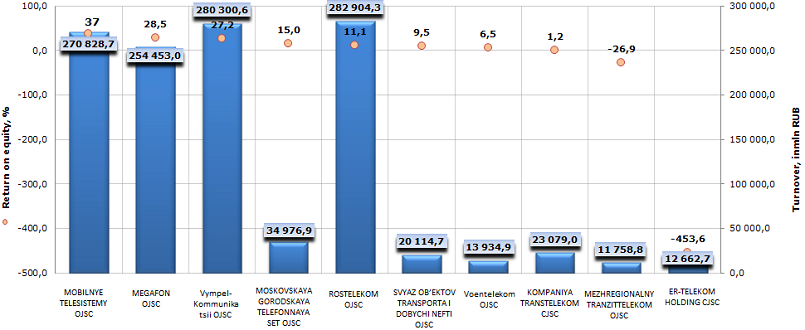

Return on equity of Russian telecommunication companies

Information agency Credinform prepared a ranking of Russian telecommunication companies.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in return on equity.

Return on equity (%) is the relation of company’s net profit to its equity capital. The ratio shows, how many monetary units of net profit were earned by each unit invested by company owners. It allows assessing the effectiveness of use of the capital invested by the owners and general financing strategy of the management of the enterprise; benefit from shareholders’ investments in terms of accounting profit. The higher is the indicator value, the more efficient «have worked out» the investments. If the ratio is negative, it means that the enterprise has net loss.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Return on equity, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | MOBILNYE TELESISTEMY OJSC INN: 7740000076 |

Moscow | 270 828,7 | 37,7 | 215(high) |

| 2 | OJSC MEGAFON INN: 7812014560 |

Moscow | 254 453,0 | 28,5 | 222(high) |

| 3 | Vympel-KommunikatsiiOJSC INN: 7713076301 |

Moscow | 280 300,6 | 27,2 | 237(high) |

| 4 | MOSKOVSKAYA GORODSKAYA TELEFONNAYA SET OJSC INN: 7710016640 |

Moscow | 34 976,9 | 15,0 | 174(the highest) |

| 5 | ROSTELEKOM OJSC INN: 7707049388 |

Saint-Petersburg | 282 904,3 | 11,1 | 183(the highest) |

| 6 | SVYAZ OB’EKTOV TRANSPORTA I DOBYCHI NEFTI OJSC INN: 7723011906 |

Moscow | 20 114,7 | 9,5 | 232(high) |

| 7 | Voentelekom OJSC INN: 7718766718 |

Moscow | 13 934,9 | 6,5 | 251(high) |

| 8 | KOMPANIYA TRANSTELEKOM CJSC INN: 7709219099 |

Moscow | 23 079,0 | 1,2 | 266(high) |

| 9 | MEZHREGIONALNYTRANZITTELEKOMOJSC INN: 7705017253 |

Moscow | 11 758,8 | -26,9 | 293(high) |

| 10 | ER-TELEKOM HOLDING CJSC INN: 5902202276 |

Perm Territory | 12 662,7 | -453,6 | 327(satisfactory) |

Picture. Return on equity of the largest on turnover telecommunication companies in Russia (TOP-10)

Cumulative annual turnover of the first 10 largest on turnover telecommunication companies of Russia made 1 205,0 bln RUB, following the results of the latest available financial statement for the year 2012, went up by 15,1% per annum. Industry leaders accumulate 82,8% of sales revenue of companies from the TOP-100 list in the same branch.

Operators of «the Big Three»: MTS OJSC, Megafon OJSC and VympelKom OJSC (TM Beeline) maintain leadership not only on turnover, but also on the value of return on equity ratio – 37,7%, 28,5%, 27,2% respectively, by this they left their nearest competitor trailing far behind – Rostelekom OJSC (11,1%). That confirms once more the thesis that a private company is more efficient than a state one.

Other participants of TOP-10 aren’t comparable in consolidated revenues with the enterprises mentioned above and are second to them in the value of return on equity ratio (except MGTS OJSC– 15%). By this MEZHREGIONALNY TRANZITTELEKOM OJSC and ER-TELEKOM CJSC showed negative return on equity, what points at net loss from activity following the results of the financial year.

According to the independent estimation of solvency of companies, developed by the Information agency Credinform, all market leaders mentioned above (except ER-TELEKOM CJSC) have a high and the highest solvency index GLOBAS-i®. It means for investors, that the organizations can pay off their debts in time and fully, while risk of default is minimal or low.

Net loss of ER-TELEKOM CJSC and participation in arbitrations as a defendant cause a satisfactory solvency index, what points at that the organization isn’t resistant enough to changes of the economic situation, the level of default risk is from average to above the average.

Will the forecasts of the Ministry of Economic Development and Trade come true?

At the end of the previous month the Ministry of Economic Development and Trade has stated that it expects the exit of the Russian economics from the stagnation in the 2nd – 3rd quarter 2014. The Deputy Minister Andrey Klepach, addressing the Winter Grain Conference, has noted that the GDP growth in Russia could reach about 1% for January-March of the current year. According to preliminary estimates of the Ministry, in January 2014 the economic growth in Russia made 0,7% at an annual rate, fell by 0,5% in comparison with December 2013.

According to the forecasts of the Ministry of Economic Development and Trade, made public in February of the current year, the GDP growth will reach 1,5-2% in the 2nd quarter 2014. And at year-end the economic growth will make 2,5%. However, Klepach has noted that if February trends remain constant in the long term, the annual forecast may be corrected to 2,3%.

Besides, Andrey Klepach has made public the projected values of inflation for the year 2014. According to his opinion, the growth of devaluation of the rouble won’t have a serious impact on the price level and at year-end the inflation value won’t pass the limit of target diapason and by year-end 2014 it will reach most probably 5,3%. According to the Deputy Head of the Ministry of Economic Development and Trade, the main factor, having an influence on the dynamics of inflation, will be the movement of the exchange-value of the rouble. However, devaluation effect will have an impact on domestic prices in about 2-3 months, when the residual stock, purchased at old prices, will be sold out from warehouses.

However, market players speak about the rise in prices as early as March of the current year. So, according to data of the enquiry of representatives of Russian retailers, published on the 15th of March, the rise in prices for imported foods (mainly perishable: vegetables, fruit, fish) and alcohol made on average 15% in comparison with the beginning of the current year. By that the experts associate such changes not only with depreciation of national currency rate, but also with increase in costs, because the value of the services of carriers and customs charges enhance.

Evaluating the objectivity of the forecast of the Ministry of Economic Development and Trade relating to the future of the Russian economy, it should be noted that it was done before the Crimean crisis. Today it is difficult enough to forecast something relating to Russian economy. External factors have a serious impact on the situation and first of all possible economic sanctions on the side of the Occident. However, the experts point out that in the age of globalization and integration the introduction of economic sanctions will have a negative effect on both sides, especially by worldwide trends of economic stagnation. At year-end 2013 the average economic growth in European countries made 0,2-0,5% per annum.

An additional point is that country's leadership has declared the mirrored answer in case of the introduction of sanctions towards Russia from the side of the West yet. By this Moscow has realized several threatening towards countries of European Community, among other things it has stopped the import through Klaipeda port, what has seriously damaged the economics of Lithuania – one of the most vocal supporters of the introduction of sanctions.