Solvency ratio of the largest Russian meat products manufacturers

Information agency Credinform has prepared a ranking of the largest Russian manufacturers of packaging. The companies with the largest volume of annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2014 — 2016). Then they have been ranked by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is a ratio of shareholders’ equity to total assets and shows the dependence of the company on external loans. Its recommended value: >0,5. A value less than a minimum one is indicative of a dependence on external sources of funds, which may result in a liquidity crisis, unstable financial standing in the event of economic downturn.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries.

The practical value of solvency ratio of meat products manufacturers amounted from 0,01 to 0,85 in 2016.

The whole set of indicators and financial ratios is to be considered in order to get a full and comprehensive insight into a company’s financial standing.

| Name, INN, region | Revenue, million RUB | Net profit, million RUB | Solvency ratio (x) | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Ostankinsky Meat-Processing Plant PJSC INN 7715034360 Moscow |

36 764 |  39 569 39 569 |

812 |  928 928 |

0,85 |  0,93 0,93 |

216 Strong |

| ITERA NJSC INN 4003037662 Kaluga region |

9 619 |  11 171 11 171 |

485 |  803 803 |

0,77 |  0,87 0,87 |

208 Strong |

| Mikoyanovsky Meat Factory NJSC INN 7722169626 Moscow |

12 301 |  12 454 12 454 |

135 |  155 155 |

0,40 |  0,46 0,46 |

173 High |

| Starodvorskie sausages NJSC INN 3328426780 Vladimir region |

15 197 |  16 507 16 507 |

644 |  307 307 |

0,25 | 0,25 | 231 Strong |

| Atyashevsky Meat Processing Plant LLC INN 1303066789 Republic of Mordovia |

11 503 |  12 556 12 556 |

149 |  250 250 |

0,14 |  0,16 0,16 |

214 Strong |

| Poultry Factory LLC INN 2631029799 Stavropol territory |

11 733 |  11 613 11 613 |

69 |  95 95 |

0,09 |  0,10 0,10 |

242 Strong |

| Agro-Belogorie Meat Processing Plant LLC INN 3123183960 Belgorod region |

17 480 |  15 675 15 675 |

-11 |  55 55 |

0,01 |  0,02 0,02 |

248 Strong |

| Belaya Ptica-Kursk LLC INN 4604006115 Kursk region |

10 696 |  11 424 11 424 |

-27 |  29 29 |

0,00 |  0,01 0,01 |

276 Medium |

| Cherkizovsky Meat Processing Plant NJSC INN 7718013714 Moscow |

29 953 |  32 430 32 430 |

-881 |  -1 759 -1 759 |

0,10 |  -0,08 -0,08 |

288 Medium |

| Velikoluksky Meat Plant PJSC INN 6025009824 Pskov region |

15 737 |  17 250 17 250 |

-1 105 |  807 807 |

-0,36 |  -0,29 -0,29 |

240 Strong |

| Total for TOP-10 companies | 172 998 |  182 665 182 665 |

2 285 |  3 686 3 686 |

|||

| Average value for TOP-10 companies | 17 300 |  18 267 18 267 |

229 |  369 369 |

0,23 |  0,24 0,24 |

|

| Average industry value | 205 |  211 211 |

2 | 2 | 0,14 |  0,21 0,21 |

|

Average value of solvency ratio for TOP-10 companies is above the recommended values. Two of TOP-10 companies a solvency ratio above the recommended, and two companies have a negative ratio value.

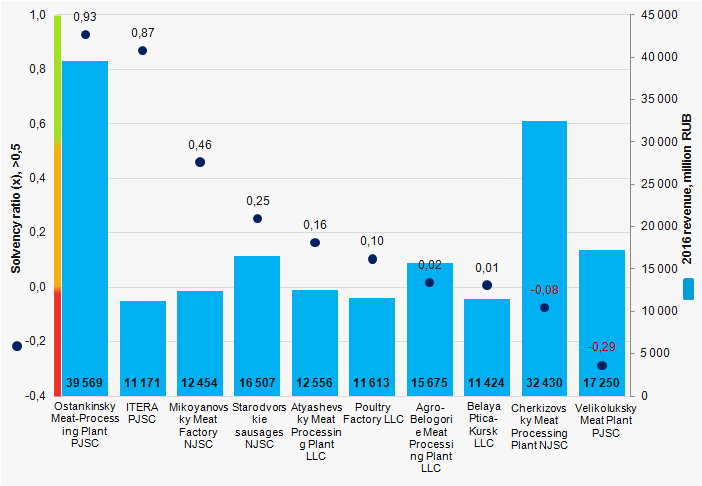

Picture 1. Solvency ratio and revenue of the largest Russian meat products manufacturers (TOP-10)

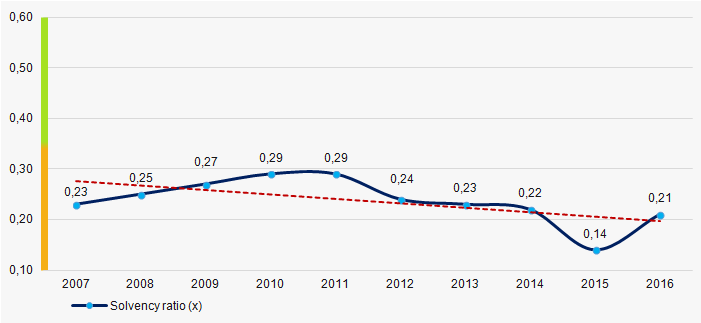

Picture 1. Solvency ratio and revenue of the largest Russian meat products manufacturers (TOP-10)Average industry values of solvency ratio tend to decrease within the last decrease (Picture 2). This is indicative of a high dependence of meat processing industry on external loans.

Picture 2. Change in average industry values of solvency ratio of the largest Russian manufacturers of meat products in 2007 — 2016

Picture 2. Change in average industry values of solvency ratio of the largest Russian manufacturers of meat products in 2007 — 2016Banks will know their customers better

Through the Federal law from 07.08.2001 № 115-FL «On counteracting the legalization (laundering) of proceeds received by criminal way and terrorism financing», credit institutions will receive data on accounts of companies and individual entrepreneurs in third party banks in the forthcoming summer. This data will be provided by the Federal Tax Service (FTS) through the system of interdepartmental online interactions on a round-the-clock basis.

Such kind of data is necessary for credit institutions at companies check in accordance with Art. 7 «Rights and obligations of organizations engaged in cash transactions» of the mentioned Federal law, as well as at shell companies identification and assessment of would-be borrowers at lending.

For example, information about accounts in other banks may indicate the fact of company’s virtual operating. This is one of the signs of trustworthiness. According to the experts, transparentizing of clients’ activity to banks can accelerate the opening of accounts, consideration of applications for credit and upgrading the outstanding credits monitoring.

In the future, increased competition on the corporate funds market will probably take place.

For reference

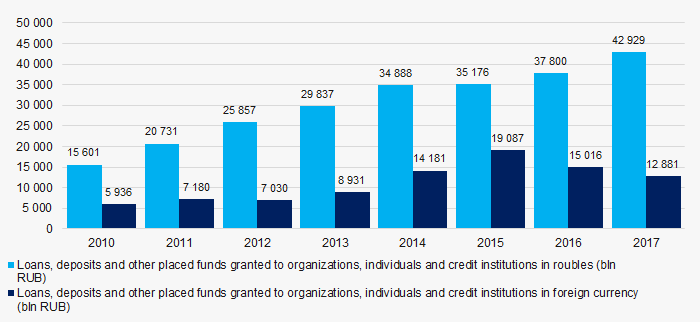

According to the Central Bank of RF, the volume of loans, deposits and other placed funds granted to organizations, individuals and banks in roubles is ever-increasing (Picture 1).

Picture 1. Loans, deposits and other placed funds granted to organizations, individuals and credit institutions for 2010 — 2017

Picture 1. Loans, deposits and other placed funds granted to organizations, individuals and credit institutions for 2010 — 2017Users of the Information and Analytical system Globas have a possibility to get acquainted with activity of all bank and non-bank credit institutions and their branches with active licenses. Information about all credit institutions with revoked licenses and their branches is also available.