Trends in flour trading

Information agency Credinform has prepared a review of trends of the largest Russian companies engaged in trade with flour and macaroni products.

The largest trading companies (TOP-100) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2013-2018). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is LLC DOSHIRAK RUS, INN 7729663418, Moscow. In 2018, net assets value of the company exceeded 5 billion RUB.

The lowest net assets volume among TOP-100 belonged to LLC ITAL CITY FOOD, INN 7729756430, Moscow. In 2018, insufficiency of property of the company was indicated in negative value of -79 million RUB.

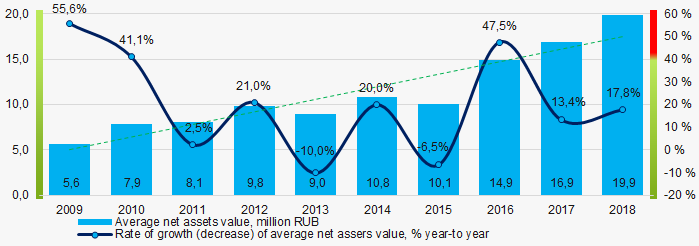

Covering the ten-year period, the average net assets values have a trend to increase (Picture 1).

Picture 1. Change in average net assets value in 2009 – 2018

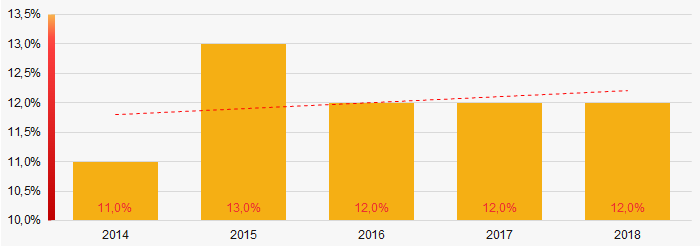

Picture 1. Change in average net assets value in 2009 – 2018The shares of TOP-1000 companies with insufficient property have trend to increase over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-1000

Picture 2. Shares of companies with negative net assets value in TOP-1000Sales revenue

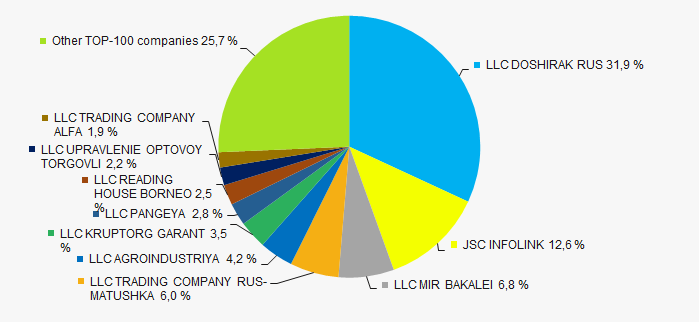

In 2018, the revenue volume of 10 largest companies of the industry was 74% of total TOP-1000 revenue (Picture 3). This is indicative of high level of monopolization in the industry.

Picture 3. The share of TOP-10 companies in total 2018 revenue of TOP-1000

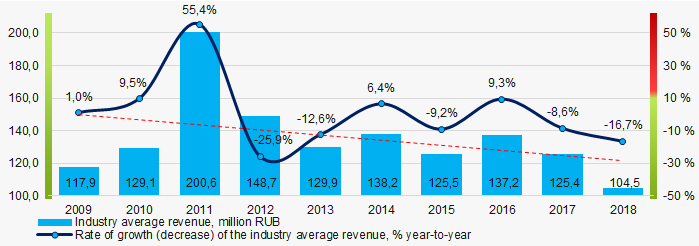

Picture 3. The share of TOP-10 companies in total 2018 revenue of TOP-1000 In general, there is a trend to decrease in revenue (Picture 4).

Picture 4. Change in industry average net profit in 2009-2018

Picture 4. Change in industry average net profit in 2009-2018Profit and loss

The largest company in term of net profit is LLC DOSHIRAK RUS, INN 7729663418, Moscow. The company’s profit for 2018 exceeded 10 billion RUB.

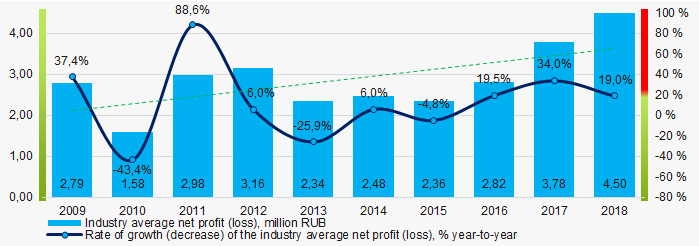

Covering the ten-year period, there is a trend to increase in average net profit (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2009 – 2018

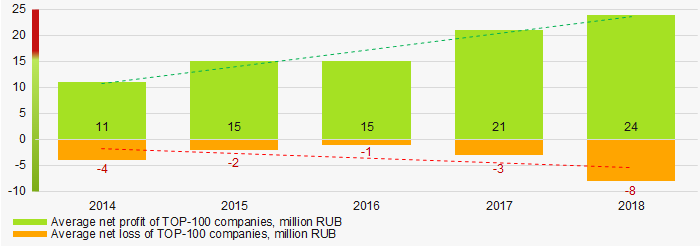

Picture 5. Change in industry average net profit (loss) values in 2009 – 2018For the five-year period, the average net profit values of TOP-100 have the increasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-100 in 2014 – 2018

Picture 6. Change in average net profit and net loss of ТОP-100 in 2014 – 2018Key financial ratios

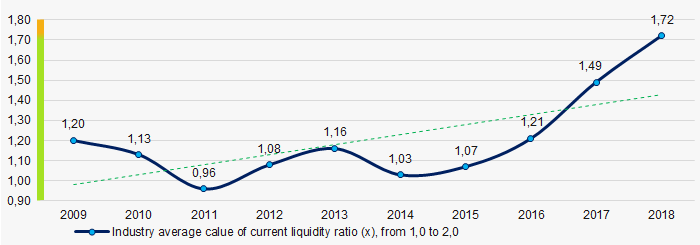

Covering the ten-year period, the average values of the current liquidity ratio within the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2009 – 2018

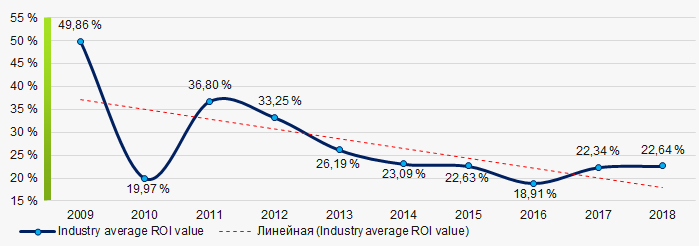

Picture 7. Change in industry average values of current liquidity ratio in 2009 – 2018 Covering the ten-year period, the average values of ROI ratio have a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2009 – 2018

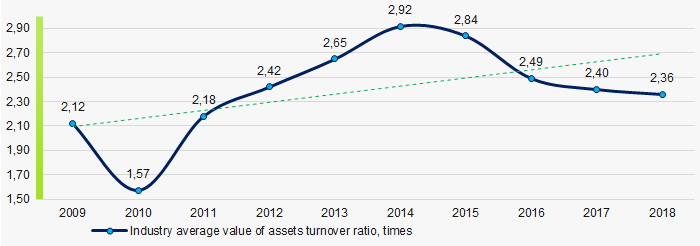

Picture 8. Change in average values of ROI ratio in 2009 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the increasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2009 – 2018

Picture 9. Change in average values of assets turnover ratio in 2009 – 2018Small business

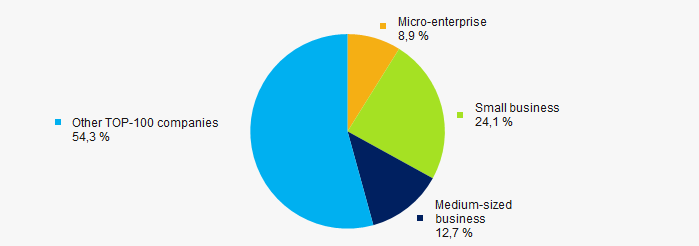

92% companies of TOP-100 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-100 companies is almost 46% that is double on the national average figure (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-100

Picture 10. Shares of small and medium-sized enterprises in TOP-100Main regions of activity

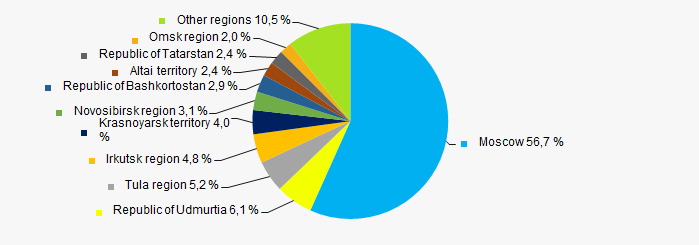

Companies of TOP-100 are registered in 37 regions of Russia, and unequally located across the country. Almost 57% of companies largest by revenue are located in Moscow (Picture 11).

Picture 11. Distribution of TOP-100 revenue by regions of Russia

Picture 11. Distribution of TOP-100 revenue by regions of RussiaFinancial position score

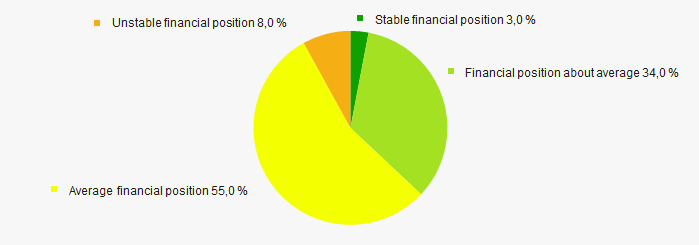

Assessment of the financial position of TOP-100 companies shows that the majority of them have stable financial position (Picture 12).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

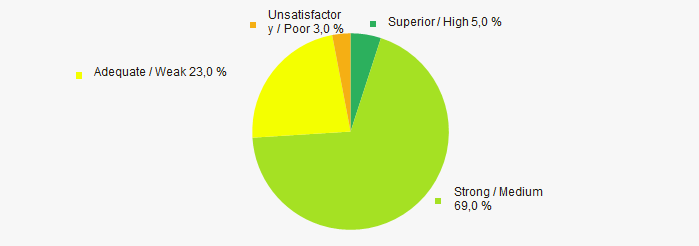

Most of TOP-100 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-100 companies by solvency index Globas

Picture 13. Distribution of TOP-100 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian companies engaged in special construction, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 21% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  1,1 1,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Profitability of sales in flour trade

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in wholesale trade of flour and noodle products. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by profitability of sales (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Profitability of sales (%) is the share of operating profit in the sales volume of the company. The ratio characterizes the efficiency of the industrial and commercial activity and shows the company’s funds, which remained after covering the cost of production, interest and tax payments.

The rage of ratio’s values within companies of the same industry is defined by the differences in competitive strategies and product lines.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Profitability of sales, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC DOSHIRAK RUS INN 7729663418 Moscow |

8 950,00 8 950,00 |

10 076,83 10 076,83 |

1 041,90 1 041,90 |

1 359,91 1 359,91 |

12,21 12,21 |

15,63 15,63 |

173 Superior |

| LLC Mir Bakalei INN 7724189748 Moscow |

1 973,20 1 973,20 |

2 160,71 2 160,71 |

102,44 102,44 |

136,11 136,11 |

6,72 6,72 |

8,42 8,42 |

195 High |

| INFOLINK INCORPORATED INN 7724026535 Moscow |

3 952,30 3 952,30 |

3 976,48 3 976,48 |

362,15 362,15 |

292,51 292,51 |

9,78 9,78 |

6,90 6,90 |

180 High |

| JSC TRADE HOUSE BORNEO INN 5433113660 Novosibirsk region |

846,26 846,26 |

793,83 793,83 |

43,10 43,10 |

32,98 32,98 |

3,85 3,85 |

5,53 5,53 |

203 Strong |

| LLC AGROINDUSTRIYA INN 7106060700 Tula region |

905,78 905,78 |

1 322,23 1 322,23 |

15,09 15,09 |

34,12 34,12 |

3,17 3,17 |

4,02 4,02 |

240 Strong |

| LLC KRUPTORG GARANT INN 2462215861 Krasnoyarsk region, case on declaring the company bankrupt (insolvent) is proceeding, bankruptcy proceedings since 31.10.2019 |

868,91 868,91 |

1 092,30 1 092,30 |

6,00 6,00 |

-51,62 -51,62 |

3,98 3,98 |

3,12 3,12 |

550 Insufficient |

| LLC UPRAVLENIE OPTOVOI TORGOVLI INN 2320049658 Republic of Tatarstan |

656,89 656,89 |

691,26 691,26 |

2,82 2,82 |

2,88 2,88 |

0,90 0,90 |

1,34 1,34 |

233 Strong |

| LLC TRADE COMPANY ALFA INN 3801113450 Irkutsk region |

649,39 649,39 |

593,44 593,44 |

-8,97 -8,97 |

3,60 3,60 |

-0,39 -0,39 |

0,79 0,79 |

304 Adequate |

| LLC PANGEYA INN 0273028534 Republic of Bashkortostan |

776,80 776,80 |

871,83 871,83 |

11,82 11,82 |

2,39 2,39 |

2,20 2,20 |

0,42 0,42 |

244 Strong |

| LLC TRADE COMPANY Rus-MATUSHKA INN 1835081820 Udmurtia |

1 543,78 1 543,78 |

1 901,12 1 901,12 |

4,66 4,66 |

0,30 0,30 |

0,06 0,06 |

0,09 0,09 |

295 Medium |

| Average value for TOP-10 companies |  2 112,33 2 112,33 |

2 348,00 2 348,00 |

158,10 158,10 |

181,32 181,32 |

4,25 4,25 |

4,63 4,63 |

|

| Average industry value |  125,37 125,37 |

104,46 104,46 |

3,78 3,78 |

4,50 4,50 |

3,38 3,38 |

5,61 5,61 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

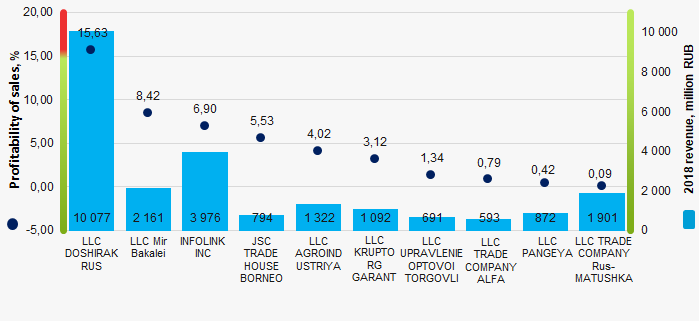

In 2018, the average value of profitability of sales for TOP-10 companies is lower than average industry value: eight companies improved the results.

Picture 1. Profitability of sales and revenue of the largest Russian companies engaged in wholesale trade of trade flour and noodle products (ТОP-10)

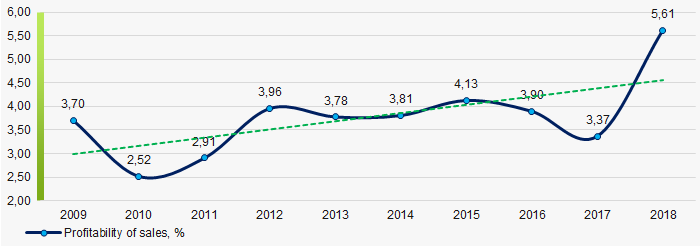

Picture 1. Profitability of sales and revenue of the largest Russian companies engaged in wholesale trade of trade flour and noodle products (ТОP-10)Within 10 years, the average industry indicators of profitability of sales showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of profitability of sales of Russian companies engaged in wholesale trade of flour and noodle products in 2009 – 2018

Picture 2. Change in average industry values of profitability of sales of Russian companies engaged in wholesale trade of flour and noodle products in 2009 – 2018