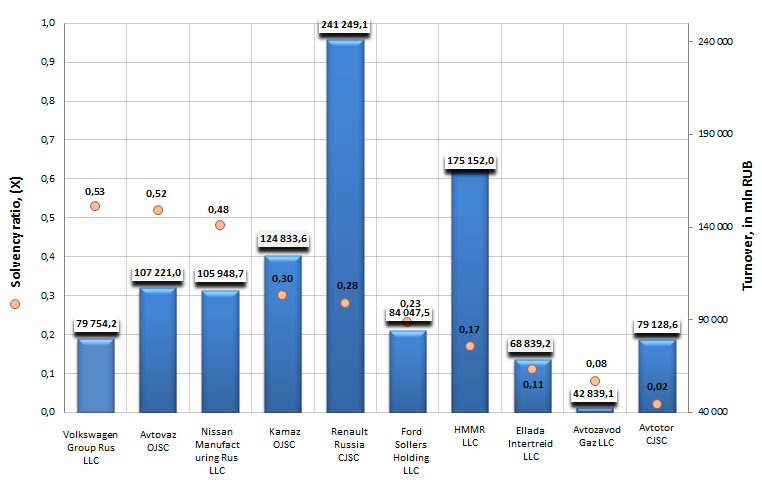

Solvency ratio of automobile factories

Information agency Credinform offers to get acquainted with the ranking of Russian automobile factories. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the enterprises were ranked by decrease in solvency ratio.

Solvency ratio is calculated as the relation of own capital to the balance sum and shows company’s dependence on external borrowings. Recommended value of this ratio is above 0,5. The ratio is interested first of all for investors involved in long-term investing, because it characterizes company’s ability to pay off its long-term liabilities.

However, it is worth mentioning that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry. For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial data.

| № | Name, INN | Region | Turnover for 2013, in mln RUB | Solvency ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Hyundai Motor Manufacturing Rus LLC INN 7801463902 |

Saint-Petersburg | 79 754 | 0,53 | 179 (the highest) |

| 2 | Kamaz OJSC INN 1650032058 |

Republic of Tatarstan | 107 221 | 0,52 | 174 (the highest) |

| 3 | Renault Russia CJSC INN 7709259743 |

Moscow | 105 949 | 0,48 | 179 (the highest) |

| 4 | Nissan Manufacturing Rus LLC INN 7842337791 |

Saint-Petersburg | 124 834 | 0,3 | 253 (high) |

| 5 | Volkswagen Group Rus LLC INN 5042059767 |

Kaluga region | 241 249 | 0,28 | 217 (high) |

| 6 | Ford Sollers Holding LLC INN 1646021952 |

Republic of Tatarstan | 84 047 | 0,23 | 311 (satisfactory) |

| 7 | Avtovaz OJSC INN 6320002223 |

Samara region | 175 152 | 0,17 | 285 (high) |

| 8 | Avtomobilny Zavod Gaz LLC INN 5250018433 |

Nizhnii Novrorod region | 68 839 | 0,11 | 244 (high) |

| 9 | Avtotor CJSC INN 3905011678 |

Kaliningrad region | 42 839 | 0,08 | 222 (high) |

| 10 | Ellada Intertreid LLC INN 3906072056 |

Kaliningrad region | 79 129 | 0,02 | 249 (high) |

The previuos year turned out to be a mixed year for the Russian car market. On the one hand, in December 2014 it was sold a record number of cars in the history of domestic car market – 270,7 ths automobiles and LCVs, that is by 2,4% more than for the similar period of 2013. Excessive demand in December of the previuos year was caused by devaluation of the rouble and fall in oil prices. However, in spite of automobile boom in December, the Russian car market declined by 10,3% at year-end 2014. The experts forecast even more substantial contraction of the market in the current year due to the decline in demand and increase in the cost of automobiles. The companies, depending on the import of vehicles and constituent parts, are at risk.

The first three leaders of the ranking are as follows: Hyundai Motor Manufacturing Rus LLC (solvency ratio value is 0,53), Kamaz OJSC (0,52) and Renault Russia CJSC (0,48). The values of solvency ratio of these enterprises meet generally accepted requirements or are a little behind. In support of good results all companies got the highest solvency index GLOBAS-i®, that points to the ability of the enterprises to pay off their debts in time and fully.

The company Ford Sollers Holding LLC, the only one from the TOP-10 list, got a satisfactory solvency index GLOBAS-i®, that testifies to the solvency level, which doesn’t guarantee that debts will be paid off in time and fully. At year-end 2013 the cumulative turnover of the enterprise reduced by 10%.

The rest enterprises of the ranking, in spite of low values of the solvency ratio, got a high solvency index GLOBAS-i®, considering the combination of financial and non-financial indicators.

Solvency ratio of automobile factories in Russia, TOP-10

Contraction of the market forced a number of major players to announce the suspension of production. In spring of the current year General Motors Auto LLC announced the suspension of production for almost two months. Avtovaz OJSC announced the reduction of about 1100 executives of different levels. And it’s far from a complete list of messages about negative trends in automobile industry. Thus, some companies prepaire to the decline in capacities.

Decline in demand and complicated situation on the market forced Russian car manufacturers (including foreign concerns) to apply to the government with request to take a set of measures to encourage Russian car market. However, their offers were accepted only to a limited volume.

The government agreed to prolong the scrappage program, on which 10 bln RUB were allocated with the possibility of limit increase. Moreover, the branch will be supported by public procurements and subsidies for purchase of agricultural, municipal and other socially minded machines.

Along with that, many measures focused on the support of light car industry were rejected. Thus, the govermnment didn’t support the idea of resuming of the program of soft automotive lending, for which the union of car dealers asked 20 bln RUB.

At the same time, the economic situation can spur manufacturers to develop and localize their production on the territory of Russia. Thus, the plant Nissan Manufacturing Rus LLC, near St.-Petersburg, plans to increase the localization from 39% up to 45% in the near future.

However, the process of localization holds also hidden dangers. The transfer of production capacities not always leads to costs reduction in roubles equivalent, because, as a rule, constituent parts used by assembly are imported. In addition, it needs time to implement the plan of localization of production even in urgent term.

See also: Solvency ratio of enterprises involved in advertising business

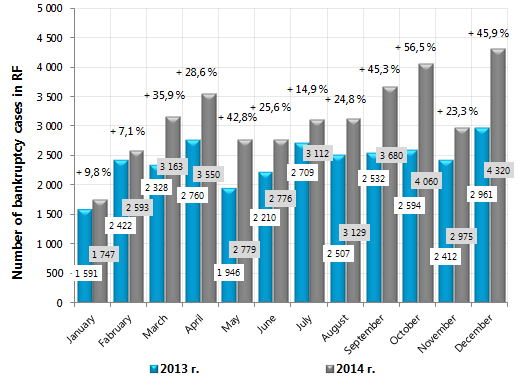

Corporate bankruptcy: meeting the challenges of time

Last year there has been a tendency of increasing in number of new arbitration cases on corporate bankruptcy. In 2014 the proceedings for 37 884 cases were initiated in the courts of the sub-federal units; that is 30,8% (28 972 new cases) higher than in 2013. Learning the annual dynamic by months, the most intensive increase was in October and December 2014. The number of new cases has respectively increased by 56,5% and 45,9% (to October, December 2013).

The second half of 2014 was rather difficult for the Russian economy: Western countries’ sanctions and counter-sanctions, falling of prices on energy resources have resulted in devaluation of the national currency, acceleration of inflation and increase of the key rate of the Central Bank to 17% that has called the lending prospects into question for many Russian companies inland.

All these have adversely affected the national business environment. Significant increase in number of new bankruptcy cases will occur in 2015 with high probability. Programs for import substitution and entrepreneurship development under the conditions of expensive credit resources will unfortunately not be carried out without the state support.

Figure 1. Monthly dynamic of new cases on corporate bankruptcy in Russia for 2013-2014, increase rate, %

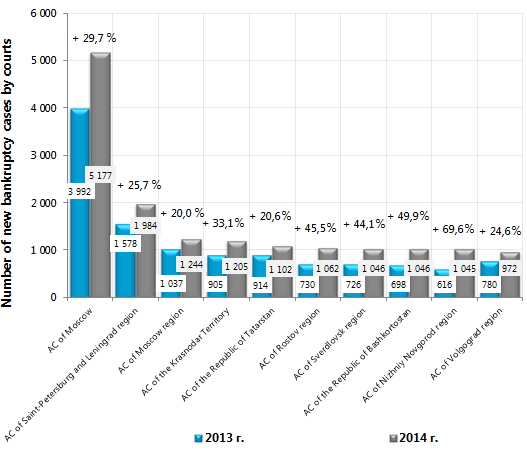

From the angle of regional courts of arbitration, the total amount of new bankruptcy cases is traditionally higher in the largest subjects of the country – Moscow, Saint-Petersburg, Moscow and Leningrad regions. However the highest increase in new cases (for the Top-10 regions) was recorded in Nizhniy Novgorod region with 69,6% (1045 new cases against 616 cases in 2013).

Figure 2. The number of new cases on corporate bankruptcy in the arbitration courts of the sub-federal units in 2013-2014, Top-10, increase rate, %

According to the data of the Information and analytical System GLOBAS-i®, the number of new cases on bankruptcy (insolvency) of major companies were initiated in 2014. The country’s № 1 enterprise in terms of assets in respect of which the monitoring procedure was introduced is NPO Mostovik LLC, Omsk. The enterprise was engaged in engineering and construction of bridges throughout Russia (“Zhivopisniy Bridge” in Moscow, cable-stayed bridge in Russky Island), sports facilities for the Olympic Games in Sochi; the enterprise also had several major contracts for construction of subway in Omsk, the opening of which was indefinitely postponed.

The statement of insolvency has griped one more big company engaged in the Olympic construction - TransKomStroy LLC. The company implemented the following projects: “Gorky Gorod” on the Shore of Mzymta River, sports and tourist complex “Gornaya Karusel”, Olympic mediavillages. Payables have exceeded the value of the company’s assets.

NPO Kosmos LLC closes the anti-ranking top three of the new bankruptcy cases against the largest enterprises. The company is regarded as one of the major road contractors in Moscow. It was the general contractor of the “Bolshaya Leningradka” project – reconstruction of Leningradksy prospect and Leningradskoye highway from Belorussky Train Station to Zelenograd; the company was also engaged in reconstruction of Dmitrovskoye and Leningradskoye highways, Bolshaya Akademicheskaya Street, and construction of the Alabyano-Baltic Tunnel.

| № | Name | Region | Assets, mln. RUB | Payables, mln. RUB | Case number |

|---|---|---|---|---|---|

| 1 | NPO Mostovik LLC INN: 5502005562 |

Omsk region | 75 093,50 | 32 629,30 | А46 - 4042/2014 |

| 2 | TransKomStroy LLC INN: 7724655847 |

The Krasnodar territory | 55 390,30 | 56 636,80 | А32 - 33424/2014 |

| 3 | NPO Kosmos LLC INN: 7720068118 |

Moscow | 29 736,10 | 14 593,80 | А40 - 4760/2014 |

Trying to struggle against macroeconomic challenges, the government of RF has developed a turnaround plan, which has been announced on the 28th January 2015. According to the plan, government support programs in Russia will be applied at a wider range of small and medium-sized businesses, than the existing rules allow. This will happen due to the twofold increase for annual revenue ceiling from sale of goods and works, which is the criterion at classifying the enterprise as micro-sized business. Ceiling increase in term of turnover will allow to transfer about 8 thousand companies to this category, which are now formally considered as medium-sized. Due to this more companies will be able to participate in public procurement for small-sized business.

Moreover, according to the turnaround plan it was obtained the right to reduce tax rates in form of the single imputed income tax (UTII) from 15% to 7,5% for the separate activity types. The subjects of RF will be allowed to reduce taxes from 6% to 1% for enterprises with the simplified tax system. They will also get the right to reduce by half the maximum amount of potential annual income (from 1 mln. RUB to 500 th. RUB) which is possible to be received by a sole entrepreneur.

Attempted measures should support the national business and change the negative tendency of bankruptcy increasing.