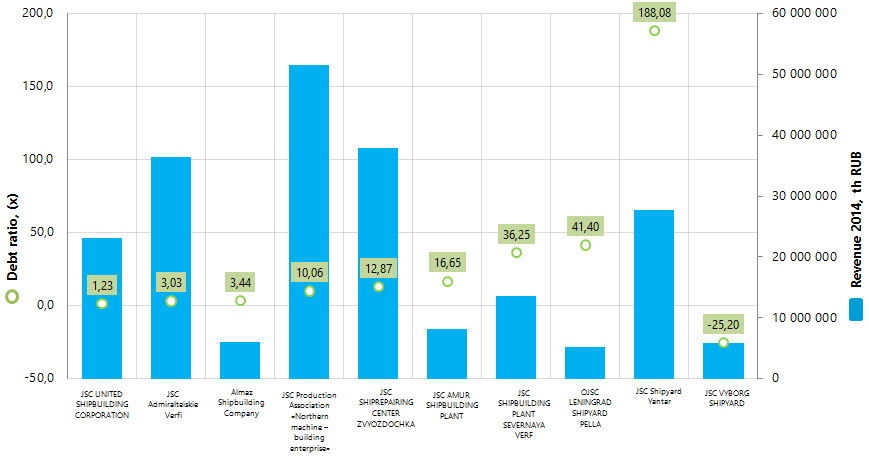

Debt ratio of the largest Russian shipbuilding companies

Information Agency Credinform has prepared the ranking of the largest Russian shipbuilding companies by debt ratio. The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). Then, first ten companies (Top-10) were ranged by increase in debt ratio (Table 1).

Debt ratio is one of the financial stability ratios. The ratios of this group are the most interesting in terms of exploring the possibility of granting the long-term loans or investing as it characterizes the possibility of the company to meet its long-term obligations. Thus, the debt ratio is calculated as a ratio of total borrowed funds to equity capital and shows how many units of borrowed funds the company had attracted to each unit of own sources of financing.

The recommended value of the ratio is less than 1. The debt to assets ratio should not be negative, that’s why the ratio value from 0 to 1 is one of the indicators of company’s high ability to meet its obligations.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in Information and analytical system Globas-i® by the experts of Information Agency Credinform. The practical value of debt ratio for shipbuilding industry is from 0 to 4,88.

| Name, INN, region | 2014 net profit (loss), th RUB | 2014 revenue, th RUB | 2014/ 2013 revenue, % | Debt ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| JSC UNITED SHIPBUILDING CORPORATION INN 7838395215, Saint-Petersburg | 510 420 | 23 161 847 | 583 | 1,23 | 283 High |

| JSC Admiralteiskie Verfi INN 7839395419, Saint-Petersburg | 2 575 347 | 36 386 181 | 126 | 3,03 | 203 High |

| Almaz Shipbuilding Company INN 7813046950, Saint-Petersburg | 269 204 | 5 955 834 | 172 | 3,44 | 196 The highest |

| JSC Production Association «Northern machine – building enterprise» INN 2902059091, Arkhangelsk region | 3 303 852 | 51 491 685 | 118 | 10,06 | 189 The highest |

| JSC SHIPREPAIRING CENTER ZVYOZDOCHKA INN 2902060361, Arkhangelsk region | 15 054 | 37 877 959 | 139 | 12,87 | 263 High |

| JSC AMUR SHIPBUILDING PLANT INN 2703000015, Khabarovsk region | 67 525 | 8 184 291 | 215 | 16,65 | 272 High |

| JSC SHIPBUILDING PLANT SEVERNAYA VERF INN 7805034277, Saint-Petersburg | -1 101 716 | 13 494 252 | 88 | 36,25 | 308 Satisfactory |

| OJSC LENINGRAD SHIPYARD PELLA INN 4706000296, Leningrad region | -1 933 811 | 5 119 557 | 109 | 41,40 | 270 High |

| JSC Shipyard Yantar INN 3900000111, Kaliningrad region | 712 004 | 27 673 735 | 227 | 188,08 | 228 High |

| JSC VYBORG SHIPYARD INN 4704012874, Leningrad region | 49 | 5 897 758 | 136 | -25,20 | 285 High |

The analysis of the results shows that none of Top-10 companies has the recommended value of debt ratio. The first three places of the ranking take the companies with debt ratio value in the range of practical standard. Other companies have ratio values from 10,06 to 118,08. The debt ratio of JSC VYBORG SHIPYARD has negative value. This means that total borrowed funds exceed equity capital of the company.

In 2014 the average value of the indicator within industry amounted to 4,2. All the above testifies about the high level of debt load of Top-10 companies as well as enterprises within industry as a whole. Taking into account the financial and non-financial indicators, 9 out of 10 participants from the Top-10 list have the highest and high solvency index Globas-i®, that characterizes them as financially stable. JSC SHIPBUILDING PLANT SEVERNAYA VERF has satisfactory solvency index Globas-i® because of loses in 2013-2014 and reduction in revenue.

The largest enterprise within the industry by 2014 revenue JSC Production Association «Northern machine – building enterprise» takes the fourth place of the ranking with the debt ratio value 10,06. JSC UNITED SHIPBUILDING CORPORATION has the best ratio value 1,23. In 2014 the enterprise covered the loss, exceeding 300 mln RUB, got a profit of over 500 mln RUB and increased the revenue by more than 5 times in comparison with previous period.

Total revenue of Top-10 enterprises in 2014 amounted to 209,3 bln RUB, that is 46% more than in 2013.

High concentration of shipbuilding companies in Saint-Petersburg and Leningrad region should be noted. 6 enterprises from the Top-10 list are registered in these regions. Besides, 5 enterprises of the ranking are the part of JSC UNITED SHIPBUILDING CORPORATION structure: JSC Admiralteiskie Verfi, JSC Shipyard Yantar, JSC SHIPBUILDING PLANT SEVERNAYA VERF, JSC VYBORG SHIPYARD and JSC SHIPREPAIRING CENTER ZVYOZDOCHKA.

|

2010 |

2011 |

2012 |

2013 |

2014 | |

|---|---|---|---|---|---|

| Cargo and freight-passenger vessels | 9 | 20 | 9 | 11 | 10 |

| Marine tugs (except push tug boats) | 8 | 8 | 10 | 10 | 13 |

| Marine non-self-propelled liquid cargo vessels | 1 | 1 | 1 | 1 | |

| Marine passenger vessels | 1 | 1 | |||

| Marine self-propelled catching vessels | 7 | 9 | 1 | ||

| Marine self-propelled dry cargo vessels | 1 | ||||

| River and lake-type passenger vessels | 44 | 67 | 57 | 38 | 24 |

| River and lake-type self-propelled vessels | 3 | ||||

| River non-self-propelled dry cargo vessels | 8 | 12 | 7 | 11 | 7 |

| Fishing vessels; fish farm and other vessels for processing or preserving of fishery products | 9 | 9 | 1 | 2 | |

| Self-propelled catching vessels (technical and auxiliary type) | 2 | 2 | |||

| Total: | 89 | 126 | 86 | 75 | 59 |

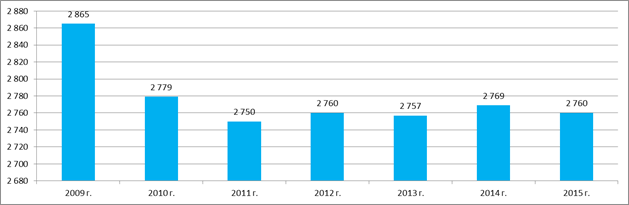

The number of vessels (units) according to the Federal Agency for Sea and Inland Water Transport, supervised by the Russian Maritime Register of Shipping with gross tonnage of more than 100 gross tons, which should be included in the State Register of vessels or shipping book of one of the country’s marine or fishing ports in accordance with the Merchant Shipping Code of the Russian Federation and have vessel's certificate (certificate of navigation or ship's letter), identifying the right of navigation under the State flag of the Russian Federation and ownership or use of the vessel:

New Debt Collection Regulations Introduced in Russia

The legitimacy of debt collection agencies activity has been discussed in the State Duma of the RF for a long time. This situation was finally brought to a conclusion on March 23rd, 2016 with a new law regulating the activities of the debt collection industry.

On February 18, 2016 at the initiative of the Chairmen of both Chambers of the Federal Assembly, a number of bills concerning the protection of citizens from unfair practices by debt collection companies were introduced to the State Duma. On 23th of March, 2016 the Bill № 999547-6 «On protection of rights and legitimate interests of individuals in the implementation of activities on debts collection» was discussed at the meeting of the Property Committee and was subsequently recommended for consideration at the plenary meeting, which was held on April 12, 2016. After discussion the Bill was passed by deputies at the first reading.

According to the Bill, the Government of Russia must appoint a regulator vested with rights of maintaining the register of collectors and enforce compliance. The interaction order of a collector with the debtor, concerning banks, microfinance organizations, other creditors and individuals providing debts collection is now regulated.

- For violations of this regulation penalty at the rate of US$30 thousand is fixed.

- The limitations on interaction with debtor are imposed on collectors: on amount of calls – not more than twice a week; on personal meetings – not more frequently than once a week. Interaction with the disqualified, citizens hospitalized in health care institutions, the disabled, individuals under the legal age is forbidden. Interaction outside the borders of Russia and the use of facilities concealing its telephone and e-mail address, and also interaction with debtor at nighttime are also forbidden.

- A debtor has the right to appoint a representative, or any other individual or legal entity authorized to act on behalf of the debtor throughout the debt collection process. A debtor can refuse any interaction with a debt collection agency. In this case, when the discretionary payment period has passed, only legal action will be possible.

- Disclosure of personal data about debtor to collector, gained by means of the debt claim from a credit organization, is only allowed with the written consent of the debtor.

- Individuals having a criminal record for crimes in the sphere of economic and public security, and also managers with a bad business reputation cannot be involved in debts collection.

- Legal entities can be engaged in this activity only with the authorized capital in the amount not less than US$ 154 thousand providing that it is their primary activity.

Backgound: In March of 2010 a State Duma Committee on Property organized a round-table discussion of legislative aspects of introducing the personal bankruptcy concept in Russia. In the course of discussion legislators criticized the absence of regulations of collection agencies. The absence of regulations governing the activities of credit organizations with debtors-individuals meant that the companies operated in a legal void. On the 6th of April, 2012 hearings were held by the Property Committee on the subject: «Legislative aspects regarding regulation of rehabilitation procedures applicable to citizens-debtors». Participants in the hearing were the State Duma Deputies, the Council of the Federation members, representatives of the Ministry of Economic Development and Trade of the RF, the Federal Bailiff’s Service, Russian Bankers’ Association and the RF Presidential National Association of Professional Collection Agencies.

Furthermore round-table discussions on the debt collection bill were held by the Committee for Economic Policy, Innovative Development and Entrepreneurship on October 8, 2015. At the center of discussions were unsavory collection practices. In the course of plenary meetings of the State Duma on December 18, 2015 and on January 20, 2016 several deputies suggested restrictions or legislative limitations for collection activity in Russia.

According to the experts of the Information agency Credinform, the new regulations will lead to fundamental changes of the collection services market in Russia. According to the Information and analytical system Globas-i®, there are more than 890 active organizations registered specifying in their company name the definition «collection agency». Only three of them registered for their primary activities the OKVED 74.87.1 («Collection of payments, solvency assessment in relation to the financial condition or business practices of an individual or a legal entity») according to the Russian National Classification of Economic Activities. The authorized capital of these three organizations ranges from US$150 to 300.