Bank guarantee will become not binding

The Government will soften requirements to suppliers and contractors on public contracts. These measures were listed into the bailout plan presented by the Government of the RF on the 28th of January 2015.

Suggested easing is meant for the year 2015. As for government contracts, which should be completed till the end of the current year, customer and supplier have the right now to come to an agreement about the change of price, volume of work or amount of goods, as well as of the time of performance. Governmental customers will also get the right to postpone the payment of forfeitures, penalties and fines.

Key changes were undergone by the stance on a bank advance payment guarantee. As a reminder, according to the law on federal purchasing system a winner of the tender (auction) is obliged to stand security of a contract - to provide a bank guarantee or transfer caution money to a client. The amount of collateral varies from 10 up to 30% of contract value. In accordance with introduced changes the amount of collateral will be reduced to 10%.

Bank advance payment guarantees will become not binding. Thus it will be prescribed by the government regulation a number of cases, when a governmental customer has a right, but is not obliged to require security of a contract.

Since 2015 it is suggested to withdraw from bank advance payment guarantees on state contracts priced at more than 1 bln RUB, because advances on these contracts can be transferred only to accounts opened in the Federal Treasury.

Moreover, bank guarantees won’t be required for contracts, on which a customer retains a part of the sum by payment for executed works. In these cases the amount underpaid serves as security.

It was also suggested not to require collaterals, when a state contract means banking support, i.e. all settlements are carried out through special account in a bank, as well as for small contracts. However, concerning small contracts the price threshold is under discussion. Now therefore, it remains extremely small number of cases, when bank guarantees will be in use.

Bank guarantees became a problem for contractors as far back as in the previous year. So that, their price on building contracts increased from 1% up to 5% of contract value for the year, and now it can reach 11-12% at all. The experts suggested to withdraw from bank guarantees on small contracts long before, because many of them become unprofitable due to this, what is additional attack on small business.

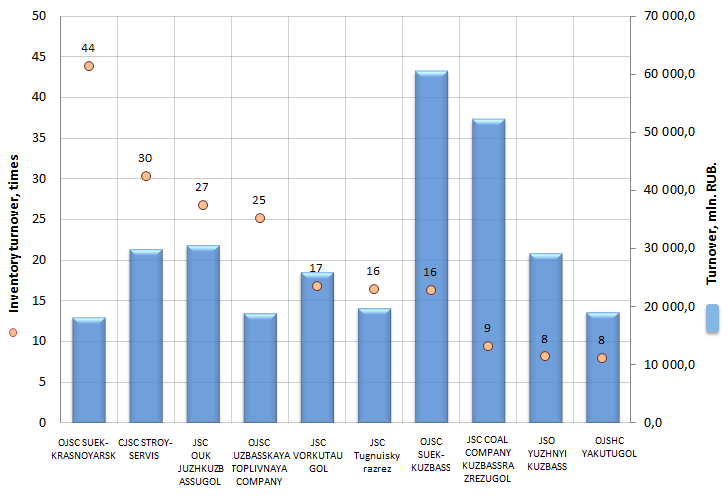

Inventory turnover of the coal mining enterprises

Information Agency Credinform has prepared the ranking of the companies engaged in the coal industry.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the companies were ranged by decrease in inventory turnover.

Inventory turnover (times) – is a ratio of revenue to average value of stocks for a period. The ratio shows the speed of inventories sale.

The ratio is characterized by the company’s effectiveness of using of the resources taking into account the time factor.

The standard value of the ratio is not set, herewith it is recommended to maximize its value.

While making an assessment of the company’s activity, the industry average rate should be taken into account.

For the most full and fair opinion about the company’s financial condition, not only the average revenue values should be taken into account, but also the whole set of financial data.

| № | Name | Region | Revenue, mln. RUB, 2013 | Inventory turnover, times | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OPEN JOINT STOCK COMPANY SUEK-KRASNOYARSK INN 2466152267 |

Krasnoyarsk Territory | 18 115,0 | 44 | 270 high |

| 2 | CJSC STROYSERVIS INN 4234001215 |

Kemerovo region | 29 872,9 | 30 | 284 high |

| 3 | JSC OUK Juzhkuzbassugol INN 4216008176 |

Kemerovo region | 30 574,4 | 27 | 288 high |

| 4 | OPEN JOINT STOCK COMPANY KUZBASSKAYA TOPLIVNAYA COMPANY INN 4205003440 |

Kemerovo region | 18 949,4 | 25 | 258 high |

| 5 | JSC VORKUTAUGOL INN 1103019252 |

Komi Republic | 25 894,2 | 17 | 282 high |

| 6 | JSC Tugnuisky razrez INN 0314002305 |

The Republic of Buryatia | 19 770,0 | 16 | 248 high |

| 7 | OPEN JOINT STOCK COMPANY SUEK-KUZBASS INN 4212024138 |

Kemerovo region | 60 492,0 | 16 | 330 satisfactory |

| 8 | JOINT STOCK COMPANY COAL COMPANY KUZBASSRAZREZUGOL INN 4205049090 |

Kemerovo region | 52 298,7 | 9 | 295 high |

| 9 | JONT STOCK COMPANY YUZHNYI KUZBASS INN 4214000608 |

Kemerovo region | 29 139,8 | 8 | 306 satisfactory |

| 10 | OJSHC YAKUTUGOL INN 1434026980 |

The Republic of Sakha (Yakutia) | 19 081,4 | 8 | 331 satisfactory |

Picture 1. Inventory turnover and revenue of the largest coal mining enterprises (Top-10)

According to the latest financial statements, the revenue of the companies engaged in the coal industry amounted to 304,2 bln. RUB, which is about 49% of the total industry revenue. In 2013 the total revenue of Top-10 enterprises decreased by 6,1% from the level of 2012.

The average inventory turnover is 16 times. Almost all leaders of the market exceed the average value of the index, that allows them to attract additional revenue and indicates the existence of better production cycle.

The highest speed of the inventory turnover (44 times) showed OJSC SUEK-KRASNOYARSK – the largest manufacturer of brown coal in the Krasnoyarsk Region.

OJSC SUEK-KUZBASS – the largest coal enterprise in Russia by revenue makes 16 cycles of inventory turnover per year.

According to an independent assessment of the Information Agency Credinform, seven out of ten participants from the Top-10 list received the high solvency index. Such fact speaks about ability of the largest market participants to meet its obligations on time and fully, the risk of unfulfillment is low.

OJSC SUEK-KUZBASS, JSC YUZHNYI KUZBASS, OJSHC YAKUTUGOL have the satisfactory solvency index, which shows to a potential investor the need of attraction of the additional guarantees for credit and business-cooperation purposes.