Changes in legislation

Starting from January 1st, 2022, the following amendments were introduced to the Part One of the Tax Code of Russia by the Federal Law as of 29.11.2021 №380-FL: strengthening of the administrative liability of financial market participants for the data filed by them, specification of entities, having direct or indirect control over clients or beneficiary, update of the item “financial assets”.

In particular, the new edition of the article 129.7 of the Tax Code of Russia is represented as follows:

| Violation by financial market participants | Fine sanctions |

| Failure to file the data on tax residents of foreign countries or territories; | RUB 300 thousand; |

| Failure to include the data in relation to a single nonresident-client | RUB 50 thousand for each violation; |

| Presentation of incomplete or unreliable data on a nonresident-client | RUB 25 thousand for each act; |

| Willful failure to include or misrepresent the data | RUB 100 thousand for each act. |

Moreover, the liability for presentation of incomplete or unreliable data by the client is introduced by the new article 129.7-1 of the Tax Code of Russia

| Violation by clients of financial market participants | Fine sanctions |

| Presentation of incomplete or unreliable data in relation to themselves, beneficiaries of entities, having direct or indirect control over them; | RUB 25 thousand for each violation in relation to each contract concluded between the client and the financial market participant; |

| Willful presentation of incomplete or unreliable data in relation to themselves, beneficiaries of entities, having direct or indirect control over them. | for an individual - RUB 20 thousand, for a legal entity - RUB 50 thousand for each violation in relation to each contract, concluded between the client and the financial market participant. |

Besides, the amendments specify the list of entities, having direct or indirect control over a client or beneficiary. The new statement states that they are individuals that control clients or beneficiary directly, indirectly or through the third parties (hold more than 25% interest in the capital) or are able to control their activities.

The item “financial assets” is updated. Now it also includes other assets, being the subject matter of the contract, providing financial services between the client and the financial market participant. At the same time, the following assets are not identified as financial ones for the purposes of the Chapter 16 of the Tax Code of Russia: immovable, precious metals (except for the precious metals kept on accounts, deposits or deposited for exoneration) and objects of value kept in safe deposit box.

Users of the Information and Analytical system Globas can get all the available information on all the financial market participants, both banking and nonbanking institutions.

TOP 1000 of freight transport companies

In 2021, due to the shortage of sea vessels and containers, difficulties arose in the movement of goods from China to Europe. Part of the freight traffic switched to road transport, which led to an increase in the cost of transportation from Primorye to the European part of Russia. The results of 2021 will later show how much this situation could affect the situation in the industry in general, while the positive development trends were observed in the period 2011 – 2020.

Among these positive trends are: an increase in the size of net assets and revenue, a significant share of small businesses in the total revenue, a high level of competition, an increase in the return on investment.

The most significant negative trend is the growth of net losses over the past five years.

To analyze the activities of the sector in Globas, the Information Agency Credinform has selected the largest road freight transport companies with the highest annual revenue (TOP 1000), according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2015 – 2020).

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is LLC GAZPROMNEFT - SNABZHENIE, INN 5501072608, Omsk region. In 2020, net assets value of the company almost reached 5,8 billion RUB.

The lowest net assets value among TOP 1000 belonged to LLC VSF LOGISTIC, INN 5009061039, Moscow region. The legal entity is declared insolvent (bankrupt) and bankruptcy proceedings are initiated on 06.03.2020. In 2020, insufficiency of property of the enterprise was indicated in negative value of -378 million RUB.

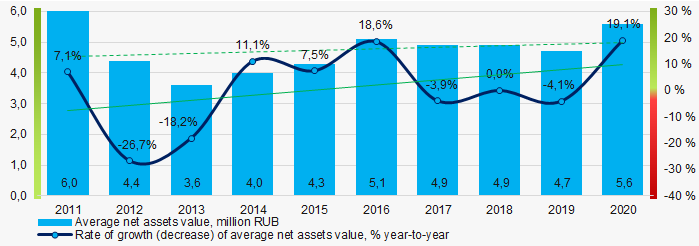

Covering the ten-year period, the average net assets values and their growth rate have a trend to increase (Picture 1).

Picture 1. Change in average net assets values in 2011 – 2020

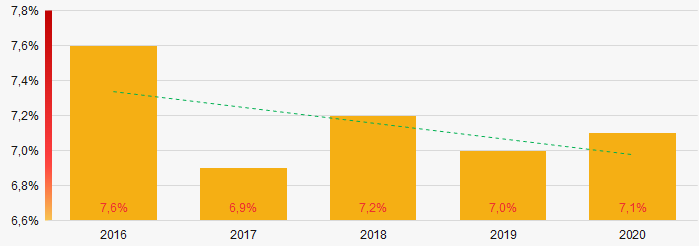

Picture 1. Change in average net assets values in 2011 – 2020Over the past five years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

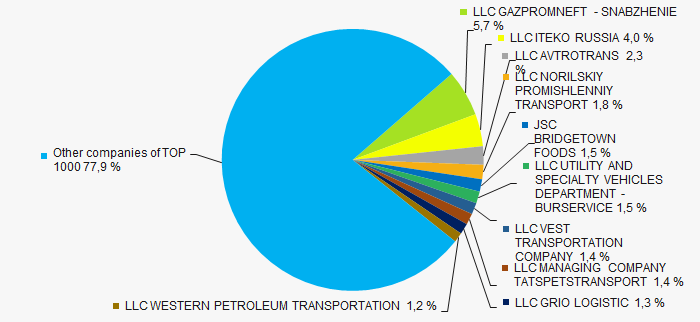

In 2020, the revenue volume of ten largest companies was 22% of total TOP 1000 revenue (Picture 3). This is indicative of a relatively high level of competition in the sector.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

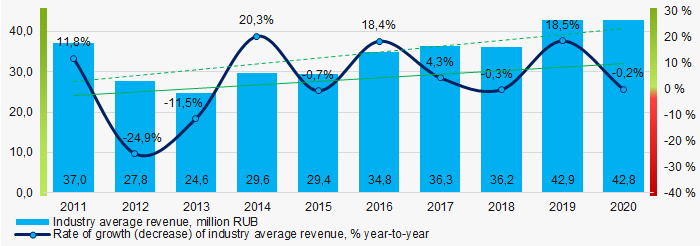

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000Covering the ten-year period, there is a trend to increase in revenue and its growth rate (Picture 4).

Picture 4. Change in average revenue in 2011 – 2020

Picture 4. Change in average revenue in 2011 – 2020Profit and loss

In 2020, the largest organization in term of profit was LLC WESTERN PETROLEUM TRANSPORTATION, INN 7705486752, Moscow. The company’s profit amounted to 1,1 billion RUB.

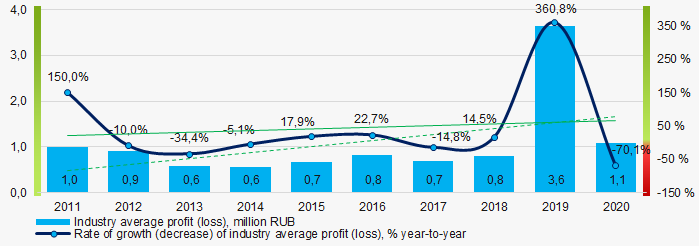

Covering the ten-year period, there is a trend to increase in industry average net profit and growth rate (Picture 5).

Picture 5. Change in industry average profit (loss) values of in 2012 – 2020

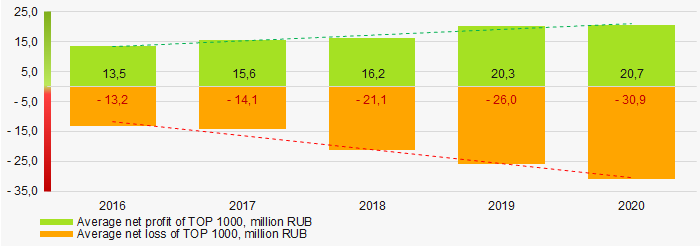

Picture 5. Change in industry average profit (loss) values of in 2012 – 2020For the five-year period, the average net profit values have multidirectional trend to increase (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020Key financial ratios

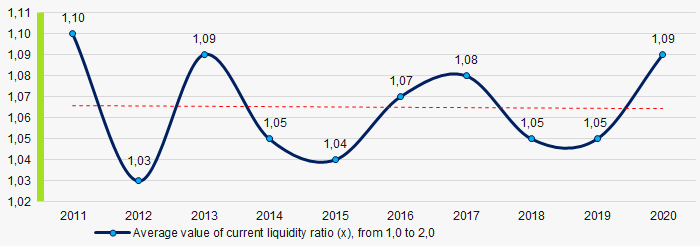

Covering the ten-year period, the average values of the current liquidity ratio were within the recommended one - from 1,0 to 2,0 with a trend to a slight decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2011 – 2020

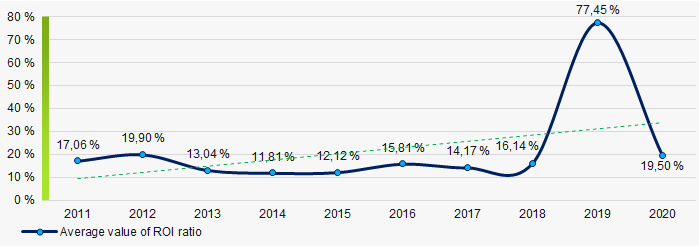

Picture 7. Change in industry average values of current liquidity ratio in 2011 – 2020Covering the ten-year period, the average values of ROI ratio had a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2011 - 2020

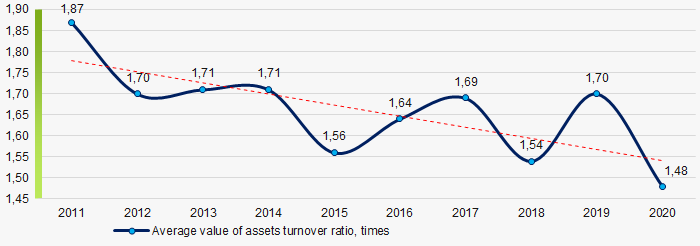

Picture 8. Change in industry average values of ROI ratio in 2011 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2011 – 2020

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2011 – 2020Small business

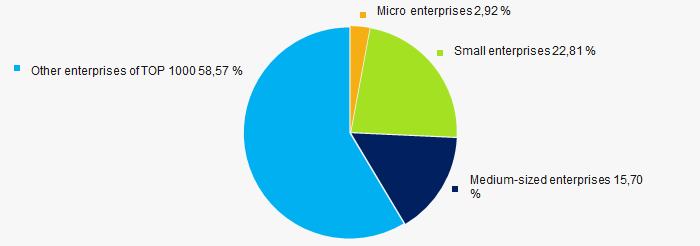

86% of companies of TOP 1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2020, their share in total revenue of TOP 1000 was 41%, twice higher than the average country values in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Main regions of activity

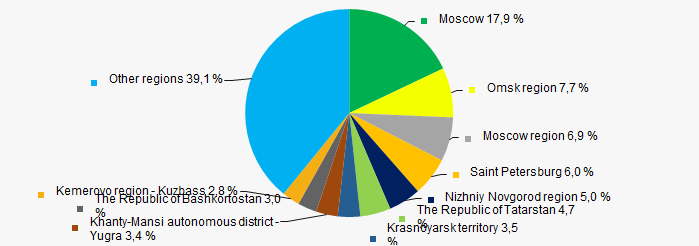

Companies of TOP 1000 are registered in 78 regions (89% of the RF subjects), and unequally located across the country. Almost 61% of TOP 1000 companies largest by total 2020 revenue are located in ten regions Russia (Picture 11).

Picture 11. Distribution of TOP 1000 revenue by regions of Russia

Picture 11. Distribution of TOP 1000 revenue by regions of RussiaFinancial position score

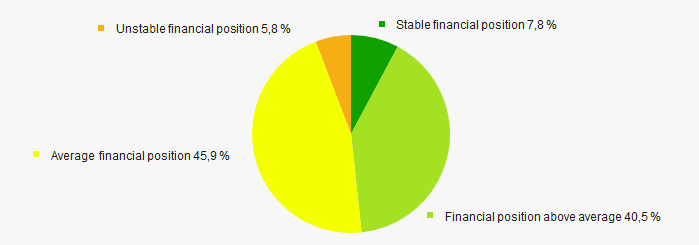

Assessment of the financial position of TOP 1000 companies shows that the majority of them have average financial position (Picture 12).

Picture 12. Distribution of TOP 1000 companies by financial position score

Picture 12. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

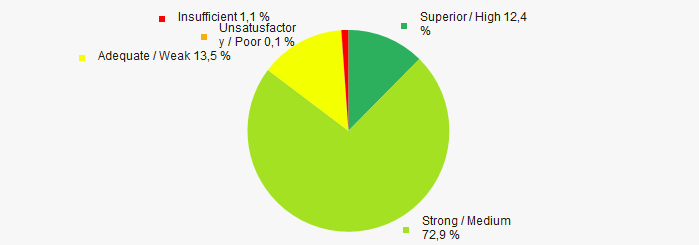

Most of TOP 1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP 1000 companies by solvency index Globas

Picture 13. Distribution of TOP 1000 companies by solvency index GlobasConclusion

Complex assessment of activity of largest road freight transport companies, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in their activities in 2011 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  10 10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  10 10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth (decrease) in the average profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  5,3 5,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)