Economy in Novosibirsk in crisis years

Information agency Credinform has prepared a review of the activity trends of the companies of real economy in Novosibirsk during the financial crisis of 2008 – 2009 years.

The largest enterprises (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the period of 2006 – 2011 years. The analysis was based on the data from the Information and Analytical system Globas.

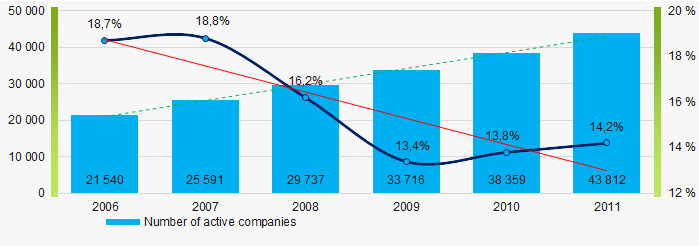

The number of active companies

From 2006 to 2011, the number of active companies increased, but the growth rates decreased especially during the acute phase of the crisis.

Picture 1. Change in the number of active companies in 2006 – 2011

Picture 1. Change in the number of active companies in 2006 – 2011Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of the real sector of economy in Novosibirsk in term of net assets was JOINT STOCK COMPANY SIBERIAN ENERGY COMPANY, INN 5405270340.

In 2011, net assets value of the company amounted to almost 14 billion RUB. In 2019, the figure was almost 23 billion RUB.

The lowest net assets value among TOP-1000 was recorded for LLC TORGOVY KVARTAL-NOVOSIBIRSK, INN 5405230467. In 2011, insufficiency of property of the company was indicated in negative value of -2,8 billion RUB, and -3,2 billion RUB in 2018.

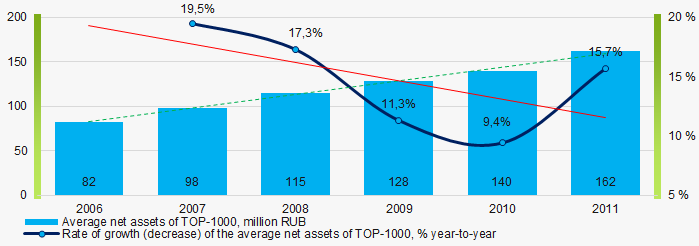

In 2006-2011, the average net assets values of TOP-1000 had a trend to increase, and the growth rates were in general decreased during the acute phase of the crisis and the beginning of its recovery. (Picture 2).

Picture 2. Change in average net assets value of TOP-1000 in 2006 – 2011

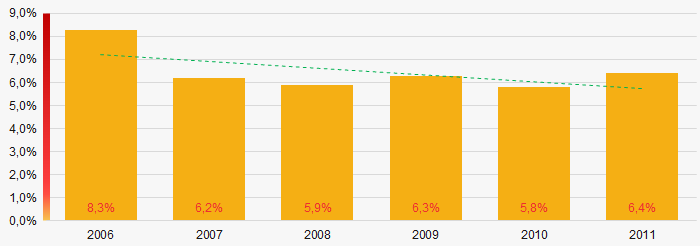

Picture 2. Change in average net assets value of TOP-1000 in 2006 – 2011The shares of TOP-1000 companies with insufficient property have trend to increase in 2006-2011(Picture 3).

Picture 3. Shares of companies with negative net assets value of TOP-1000 in 2006 – 2011

Picture 3. Shares of companies with negative net assets value of TOP-1000 in 2006 – 2011Sales revenue

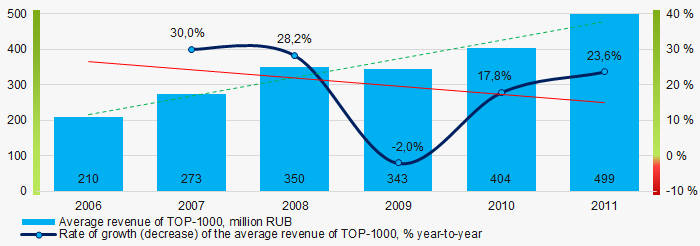

The largest company of the real sector of economy in Novosibirsk by revenue was JSC KATREN, INN 5408130693. The revenue volume exceeded 79 billion RUB in 2011, and almost reached 185 billion RUB in 2019.

In general, there was a trend to increase in revenue with decreasing growth rate (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011Profit and loss

The largest company in term of net profit was BROKERCREDITSERVICE LTD, INN 5406121446. The company’s profit exceeded 5 billion RUB in 2011, and 137 billion RUB in 2017.

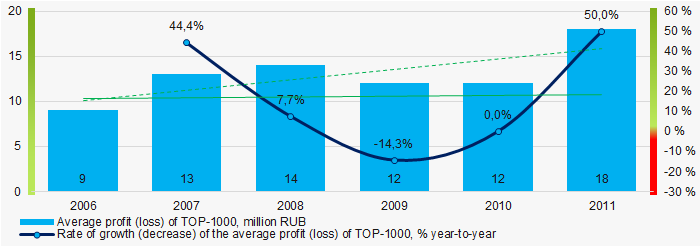

During the period of 2006 – 2011, the average profit figures of TOP-1000 companies had a trend to increase with the insignificantly increasing growth rates. (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 in 2006- 2011

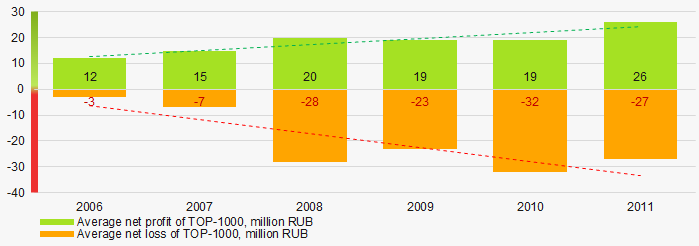

Picture 5. Change in average profit (loss) of TOP-1000 in 2006- 2011In 2006 – 2011, the average net profit figures of TOP-1000 companies had a trend to increase with the increasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2006 – 2011

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2006 – 2011Key financial ratios

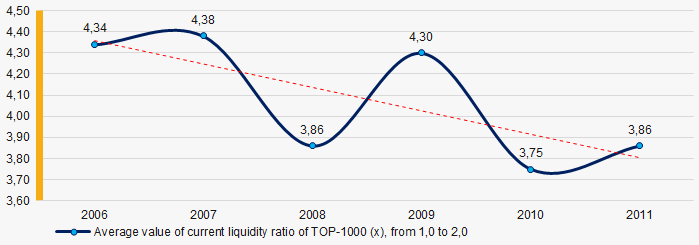

In 2006 – 2011, the average values of the current liquidity ratio of TOP-1000 were above the recommended one – from 1,0 to 2,0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2006 – 2011

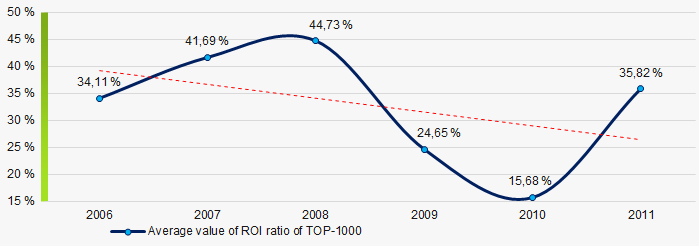

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2006 – 2011At the period of 2006 – 2011, there was a general trend to decrease in the average ROI values of TOP-1000 with a significant decline in 2010 (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2006 – 2011

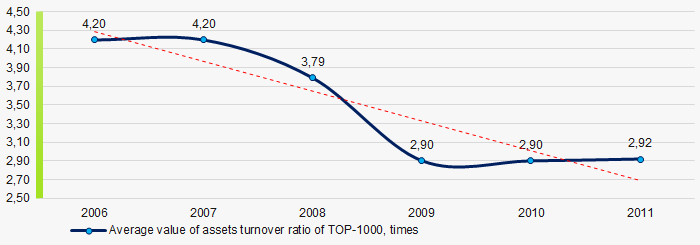

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2006 – 2011Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

In 2006 – 2011, there was a trend to decrease of this ratio (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 in 2006 – 2011

Picture 9. Change in average values of assets turnover ratio of TOP-1000 in 2006 – 2011Small enterprises

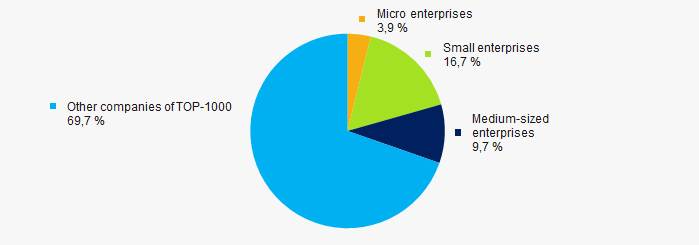

75% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in total revenue of TOP-1000 amounted more than 30% in 2011 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises of TOP-1000 in 2011

Picture 10. Shares of small and medium-sized enterprises of TOP-1000 in 2011Financial position score

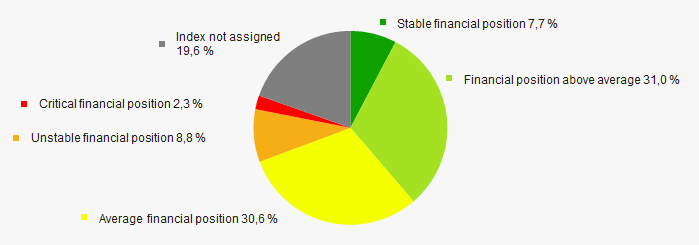

According to the assessment, the financial position of most of TOP-1000 companies is above average in 2020 (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020Solvency index Globas

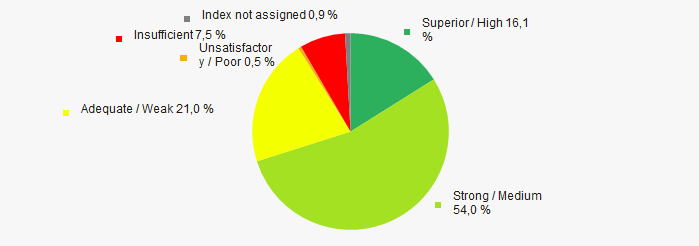

In 2020, most of TOP-1000 companies got Superior / High and Strong index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest companies of the real economy sector in Novosibirsk, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2006 - 2011 (Table 1).

| Trends and evaluation factors | Relative share of factor, % | Possible forecast |

| Dynamics of the number of active companies |  10 10 |

|

| Rate of growth of the number of active companies |  -10 -10 |

During the acute phase of the crisis and the period of recovery, rate of growth of the active companies may be decreased |

| Dynamics of the average net assets value |  10 10 |

|

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

During the acute phase of the crisis, rate of growth in the net assets may be decreased |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

|

| Dynamics of the average revenue |  10 10 |

|

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

During the acute phase of the crisis and the period of recovery, rate of growth in revenue may be decreased |

| Dynamics of the average profit |  10 10 |

|

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

During the acute phase of the crisis, rate of growth in average profit may be decreased |

| Growth / decline in average values of companies’ net profit |  10 10 |

|

| Growth / decline in average values of companies’ net loss |  -10 -10 |

During the acute phase of the crisis and the period of recovery, net loss may be increased |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

|

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

During the acute phase of the crisis and the period of recovery, return on investment ratio may by decreased |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

Business activity may by decreased during the acute phase of the crisis, and will be slowly increased during the period of recovery |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

|

| Financial position (the largest share) |  10 10 |

|

| Solvency index Globas (the largest share) |  10 10 |

|

| Average value of relative share of factors |  2,1 2,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Profit of software developers

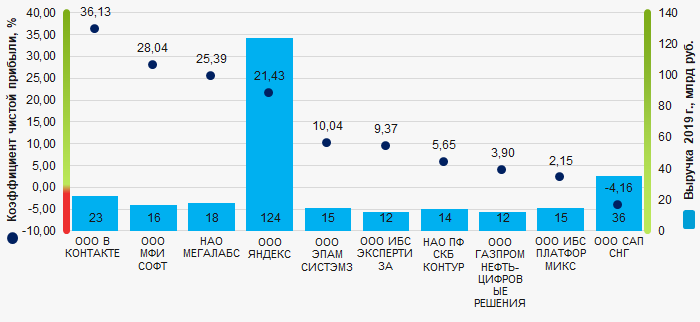

Information agency Credinform represents a ranking of the largest Russian software developers. Software developers and companies rendering consultancy services in this business area (TOP-10) with the largest annual revenue were selected for the ranking, according to the latest accounting periods in the Statistical Register (2017 – 2019). Then they were ranked by the net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is a relation of net profit (loss) to sales revenue. It is an indicator of the level of sales revenue.

There is no standard value for this ratio. It is recommended to compare companies of the same industry, or change in the ratio of the specific company. Negative value of the ratio is indicative of the net loss, and the high one means the efficiency of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| V KONTAKTE LTD INN 7842349892 Saint Petersburg |

19 309,1 19 309,1 |

22 629,2 22 629,2 |

7 059,3 7 059,3 |

8 177,0 8 177,0 |

36,56 36,56 |

36,13 36,13 |

189 High |

| MFI SOFT LIMITED INN 5260146265 Nizhnii Novgorod region |

9 524,2 9 524,2 |

16 387,2 16 387,2 |

2 024,7 2 024,7 |

4 595,7 4 595,7 |

21,26 21,26 |

28,04 28,04 |

171 Superior |

| JSC MEGALABS INN 7713556058 Moscow |

15 955,5 15 955,5 |

17 887,6 17 887,6 |

1 911,1 1 911,1 |

4 542,0 4 542,0 |

11,98 11,98 |

25,39 25,39 |

178 High |

| YANDEX LLC INN 7736207543 Moscow |

104 828,1 104 828,1 |

123 748,2 123 748,2 |

28 241,3 28 241,3 |

26 516,1 26 516,1 |

26,94 26,94 |

21,43 21,43 |

170 Superior |

| EPAM SYSTEMS LTD INN 7719232155 Moscow |

11 690,1 11 690,1 |

14 629,4 14 629,4 |

2 037,2 2 037,2 |

1 468,2 1 468,2 |

17,43 17,43 |

10,04 10,04 |

193 High |

| IBS EXPERTISE INN 7713606622 Moscow |

10 336,1 10 336,1 |

12 145,8 12 145,8 |

948,1 948,1 |

1 138,6 1 138,6 |

9,17 9,17 |

9,37 9,37 |

227 Strong |

| SKB KONTUR INN 6663003127 Sverdlovsk region |

12 776,0 12 776,0 |

14 099,4 14 099,4 |

794,8 794,8 |

796,8 796,8 |

6,22 6,22 |

5,65 5,65 |

173 Superior |

| INFORMATION AND TECHNOLOGY SERVICE COMPANY INN 7728654530 Saint Petersburg |

8 527,0 8 527,0 |

11 940,0 11 940,0 |

144,8 144,8 |

465,2 465,2 |

1,70 1,70 |

3,90 3,90 |

269 Medium |

| IBS PLATFORMIX INN 7707507077 Moscow |

13 805,7 13 805,7 |

14 872,4 14 872,4 |

268,8 268,8 |

320,2 320,2 |

1,95 1,95 |

2,15 2,15 |

189 High |

| LIMITED LIABILITY COMPANY SAP CIS INN 7705058323 Moscow |

35 188,7 35 188,7 |

35 575,6 35 575,6 |

540,8 540,8 |

-1 480,6 -1 480,6 |

1,54 1,54 |

-4,16 -4,16 |

265 Medium |

| Average value for TOP-10 |  24 194,1 24 194,1 |

28 391,5 28 391,5 |

4 397,1 4 397,1 |

4 653,9 4 653,9 |

13,47 13,47 |

13,79 13,79 |

|

| Industry average value |  44,8 44,8 |

56,9 56,9 |

5,7 5,7 |

5,0 5,0 |

12,69 12,69 |

8,36 8,36 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of debt-to-assets ratio of TOP-10 companies is above the average industry one. Five companies improved the standard value in 2019.

Picture 1. Net profit ratio and revenue the largest software developers in Russia (TOP-10)

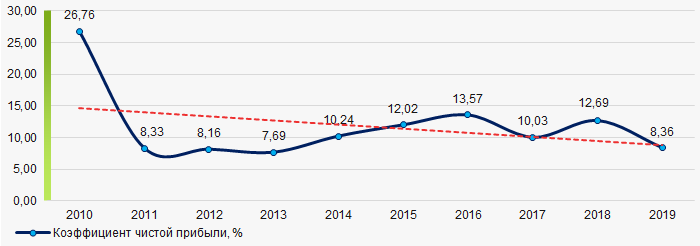

Picture 1. Net profit ratio and revenue the largest software developers in Russia (TOP-10)During the decade, average industry values of net profit ratio had a tendency to decrease. (Picture 2).

Picture 2. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019

Picture 2. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019