Trends among the largest Russian producers of meat and meat products

Information agency Credinform Credinform represents an overview of trends among the largest Russian producers of meat and meat products.

Producers with the largest volume of annual revenue (TOP-10 and TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (2014 — 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets — indicator of real cost of corporate assets, which is annually calculated as the difference between assets of the company and its debt liabilities. If the company’s debts exceed net worth value, net assets indicator is considered negative (insufficiency of property).

| Position in TOP-1000 | Name, INN, region | Net assets value, mln RUB | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | SAMSON CO. LTD INN 7810015329 Saint-Petersburg |

-585,1 |  -841,0 -841,0 |

11 273,6 11 273,6 |

203 Strong |

| 2. | JSC OSTANKINO MEAT PROCESSING PLANT INN 7715034360 Moscow |

5 560,0 |  6 372,5 6 372,5 |

7 300,1 7 300,1 |

216 Strong |

| 3. | LLC MEAT PROCESSING PLANT “PAVLOVSKAYA SLOBODA” INN 5017041244 Moscow region |

1 551,4 |  3 022,5 3 022,5 |

4 461,0 4 461,0 |

184 High |

| 4. | MIRATORG ZAPAD LIMITED LIABILITY COMPANY INN 3906072585 Kaliningrad region |

1 509,5 |  2 030,3 2 030,3 |

4 301,8 4 301,8 |

161 Superior |

| 5. | LIMITED LLABILITY COMPANY PRODUCTION AND COMMERCIAL ASSOCIATION DOMESTIC PRODUCT INN 3923002806 Kaliningrad region |

977,3 |  2 253,9 2 253,9 |

3 845,5 3 845,5 |

206 Strong |

| 996. | JSC AGRO INVEST INN 7710445247 Moscow region Process of being wound up, 30.09.2016 |

2 250,7 |  -863,8 -863,8 |

-890,8 -890,8 |

600 Insufficient |

| 997. | PJSC TVER MEAT PROCESSING PLANT INN 6903027075 Tver region Process of being wound up, 14.10.2013 |

-0,1 |  0,3 0,3 |

-932,0 -932,0 |

600 Insufficient |

| 998. | JSC LUGA PLANT BELKOZIN INN 4710002063 Leningrad region Process of being wound up, 14.03.2018 |

-159,7 |  -1 178,5 -1 178,5 |

-1 326,4 -1 326,4 |

600 Insufficient |

| 999. | LLC YURAL INN 6726017848 Smolensk region Process of being wound up, 27.05.2016 |

-4,5 |  -3,9 -3,9 |

-1 448,0 -1 448,0 |

600 Insufficient |

| 1000. | PJSC VELIKOLUKSKY MEAT PROCESSING PLANT INN 6025009824 Pskov region |

-1 404,7 |  -2 509,4 -2 509,4 |

-1 991,6 -1 991,6 |

240 Strong |

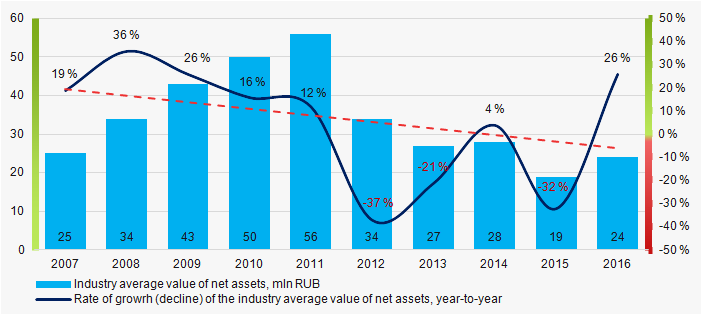

Industry average net assets indicators for the ten-year period have a trend to decrease (Picture 1).

Picture 1. Change in average net assets value of the largest Russian producers of meat and meat products in 2007 — 2016

Picture 1. Change in average net assets value of the largest Russian producers of meat and meat products in 2007 — 2016Sales revenue

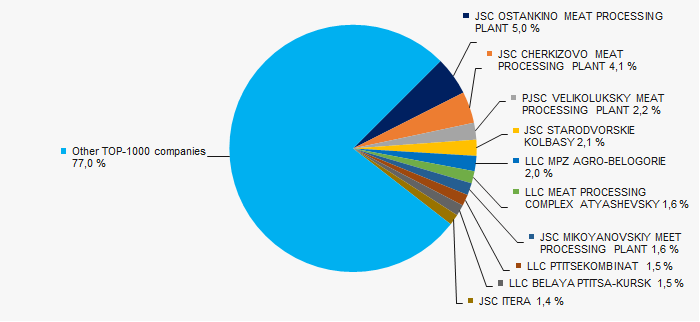

The revenue of the largest 10 companies made 23% of the total revenue of TOP-1000 companies in 2016. This indicates relatively high level of business competition in this sector (Picture 2).

Picture 2. Shares of participation of TOP-10 enterprises in the total revenue of TOP-1000 companies for 2016

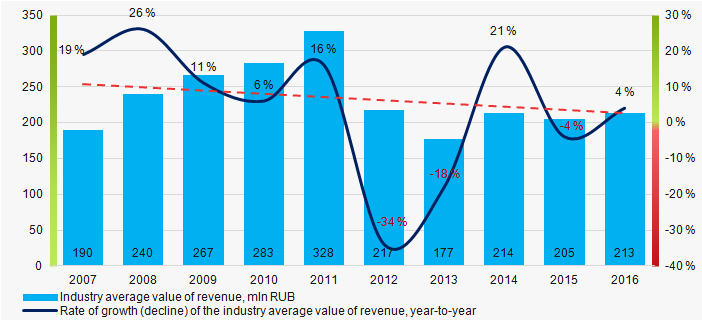

Picture 2. Shares of participation of TOP-10 enterprises in the total revenue of TOP-1000 companies for 2016Trend to decrease in revenue volume is observed (Picture 3).

Picture 3. Change in the industry average revenue indicators of the largest Russian producers of meat and meat products in 2007 — 2016

Picture 3. Change in the industry average revenue indicators of the largest Russian producers of meat and meat products in 2007 — 2016Profit and loss

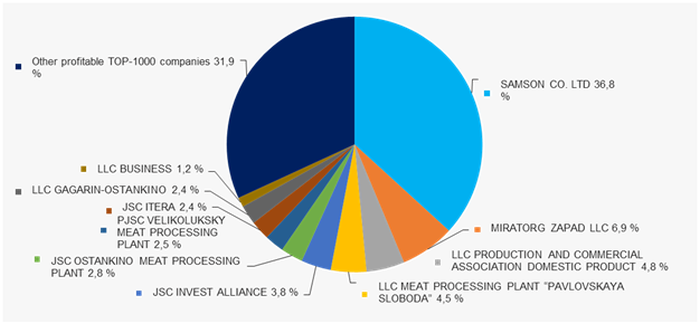

Profit volume of the largest 10 companies made 68% of the total profit of TOP-1000 companies in 2016 (Picture 4).

Picture 4. Shares of participation of TOP-10 enterprises in the total profit volume of TOP-1000 companies for 2016

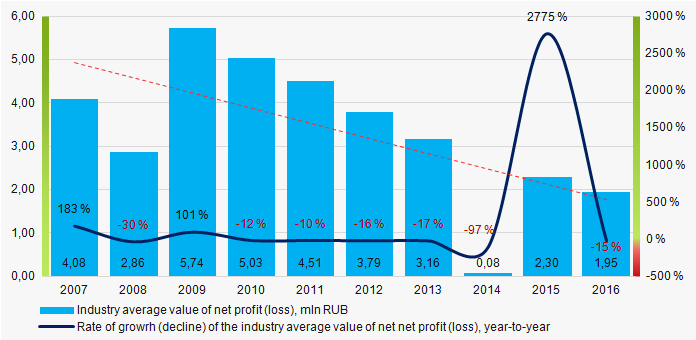

Picture 4. Shares of participation of TOP-10 enterprises in the total profit volume of TOP-1000 companies for 2016Industry average values of net profit indicators of companies for the ten-year period have a trend to decrease (Picture 5).

Picture 5. Change in the average net profit indicators of the largest producers of meat and meat products in 2007 — 2016

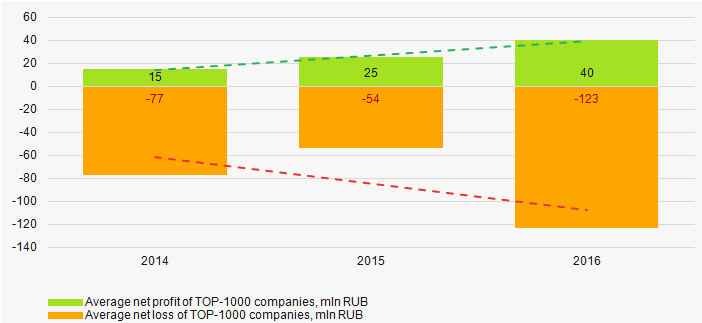

Picture 5. Change in the average net profit indicators of the largest producers of meat and meat products in 2007 — 2016For the three-year period, the average net profit indicators of TOP-1000 enterprises have a trend to increase; at the same time, the average net loss value increases (Picture 6).

Picture 6. Change in the industry average values of profit and loss of meat and meat products producers in 2014 — 2016

Picture 6. Change in the industry average values of profit and loss of meat and meat products producers in 2014 — 2016Key financial ratios

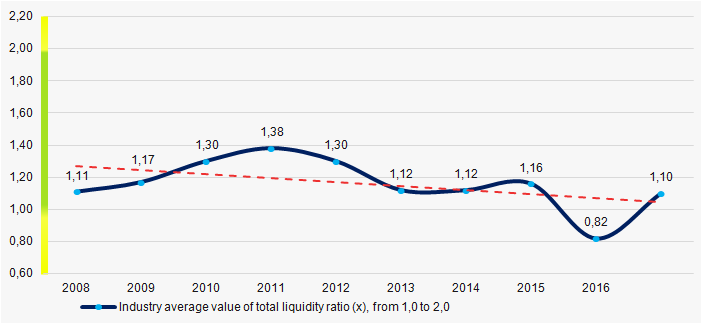

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Over the ten-year period the industry average indicators of the total liquidity ratio were above the range of recommended values — from 1,0 up to 2,0 (Picture 7). In general, the ratio indicator tends to increase.

Taking into account the actual situation both in the economy as a whole and in the sectors, the experts of the Information agency Credinform have developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry.

For producers of meat and meat products the practical value of the total liquidity ratio made from 0,78 up to 2,31.

Picture 7. Change in the average values of the total liquidity ratio of meat and meat products producers in 2007 — 2016

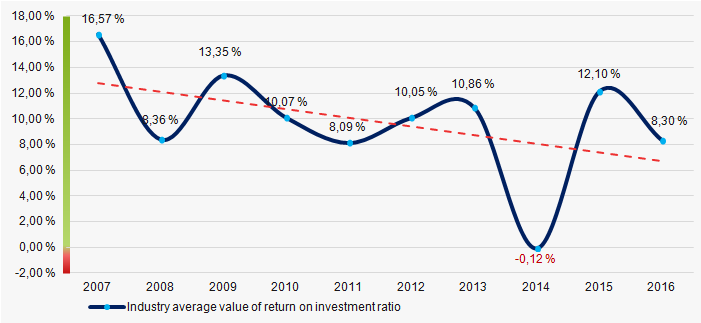

Picture 7. Change in the average values of the total liquidity ratio of meat and meat products producers in 2007 — 2016The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

There has been a trend towards a decrease in indicators of the return on investment ratio for three years (Picture 8).

Picture 8. Change in the average values of the return on investment ratio of meat and meat products producers in 2007 — 2016

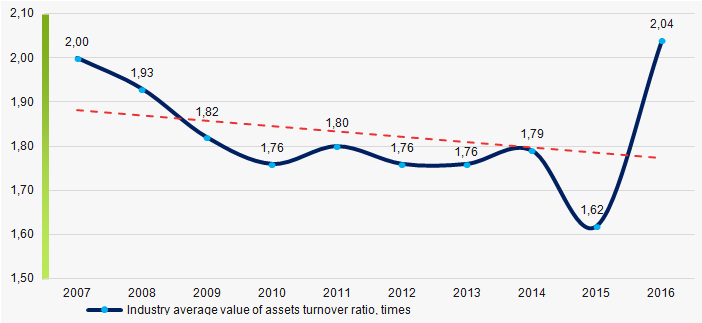

Picture 8. Change in the average values of the return on investment ratio of meat and meat products producers in 2007 — 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a trend to decrease over the ten-year period (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of meat and meat products producers in 2007 — 2016

Picture 9. Change in the average values of the asset turnover ratio of meat and meat products producers in 2007 — 2016Production structure

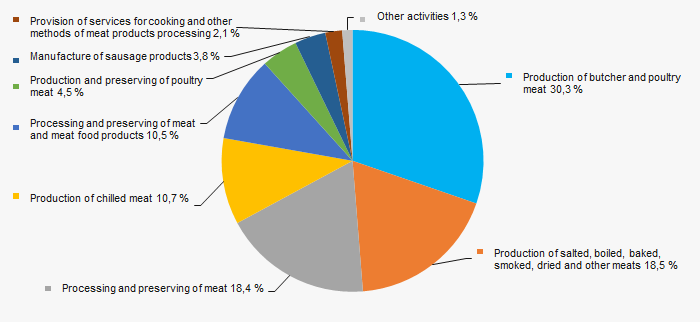

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in production of butcher and poultry meat products (Picture 10).

Picture 10. Distribution of types of activity in the total revenue of TOP-1000 companies, %

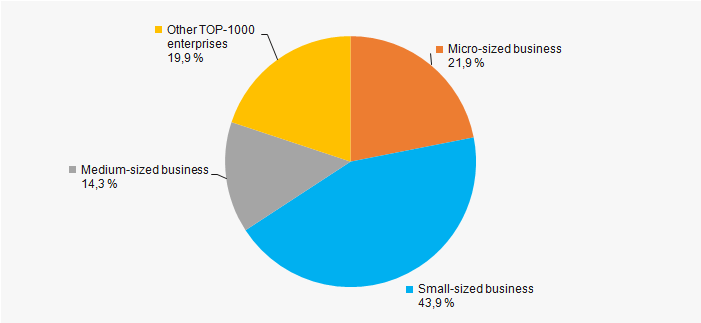

Picture 10. Distribution of types of activity in the total revenue of TOP-1000 companies, %80% of TOP-1000 companies are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the RF (Picture 11).

Picture 11. Shares of small and medium-sized businesses in TOP-1000 companies of the industry, %

Picture 11. Shares of small and medium-sized businesses in TOP-1000 companies of the industry, %Main regions of activity

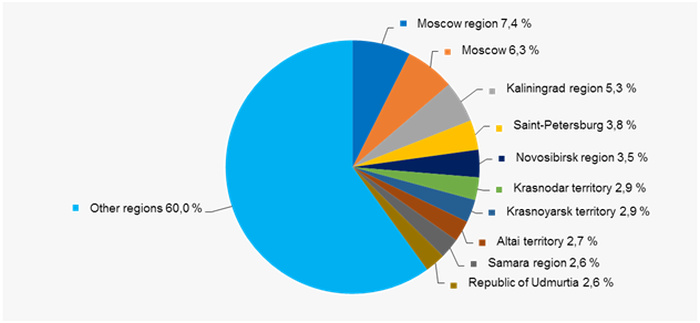

Companies of TOP-1000 are spotty located across the country and registered in 77 regions of Russia (Picture 12).

Picture 12. Distribution of TOP-1000 companies by the regions of Russia

Picture 12. Distribution of TOP-1000 companies by the regions of RussiaFinancial position score

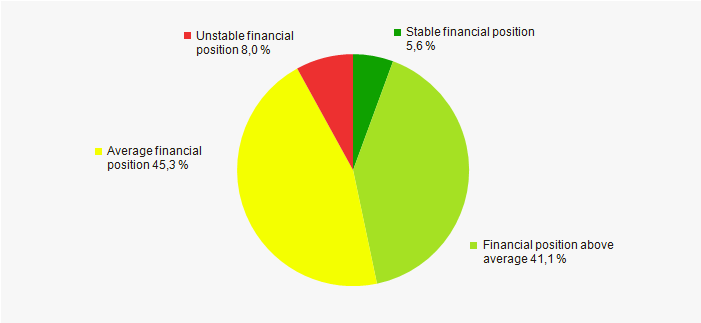

An assessment of the financial position of companies in the industry shows that the majority of them have stable financial position and financial position above average (Picture 13).

Picture 13. Distribution of TOP-1000 companies by financial position score

Picture 13. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

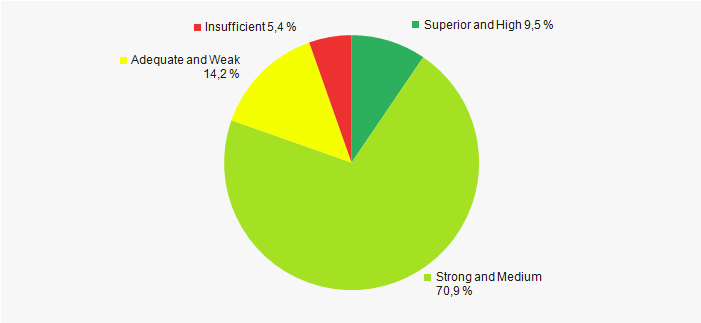

Most of TOP-1000 companies got Superior/High or Strong/Medium Solvency index Globas, that indicates their ability to pay off debts in time and fully (Picture 14).

Picture 14. Distribution of TOP-1000 companies by solvency index Globas

Picture 14. Distribution of TOP-1000 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of the largest Russian producers of meat and meat products, taking into account the main indices, financial indicators and ratios, indicates the prevalence of unfavorable trends in the industry. Declining net assets, revenue, profit and key financial ratios are alarming factors.

Trust economy attracts corporate investment

St. Petersburg International Economic Forum 2018 (SPIEF 2018) showed that Russia is the territory of possibilities: over 17 thousand participants from 143 countries visited the event. During the Forum 593 agreements at the amount of over 2,6 trillion RUB were signed.

The biggest agreements of SPIEF 2018 (May 2018, St. Petersburg) were the following: an agreement worth USD 1.5 billion to construct a natural gas processing plant in the town of Ust-Luga (Leningrad Region); contracts with a total value of USD 2.1 billion for the supply of petrol fuel; an agreement to open a credit line of EUR 807 million by a consortium of five European banks; an agreement to form a syndicated loan of up to RUB 278 billion to fund the construction of the Belkomur railway line. The agreements were signed by companies from Germany, Japan, Mongolia, other countries of Europa and Shanghai Cooperation Organization.

SPIEF 2018 was held under the slogan «Building a Trust Economy». Trust is a key asset in business. It is more complicated to comply with agreements and make forecasts under media wars and sanctions. The Forum confirmed the importance of winning confidence in cooperation with business partners under the conditions of global economy. Trust cerates the breeding ground for corporate investment.

Despite the sanctions pressure and political turbulence over Russia, transnational companies achieved a dominant position in the Russian market. Excluding isolated cases, they continue successful business development by establishing subsidiaries or investing into domestic companies. It is often the case ultimate beneficiary of a foreign shareholder is of Russian origin. This fact is the further proof of Russia’s integration in the global economy and being its integral part.

Bulk of investment to corporate sector flows from the West

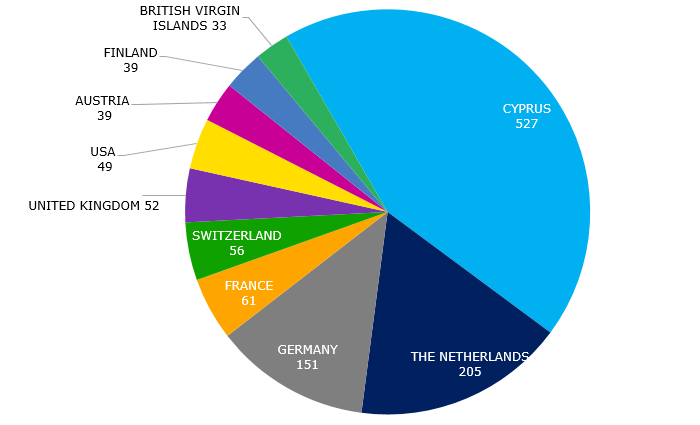

Among large Russian companies with revenue exceeding 2 bln RUB, there are about 1,5 thousand organizations of the real sector with foreign legal entity holding a control share in the capital (see Picture 1). Total turnover of these companies is up to 21,5 trillion RUB. As a comparison, the GDP of Russia in 2017 was amounted to 92 trillion RUB.

A third of companies from the list is owned by investors from Cyprus. Usually this means Russian citizens as ultimate beneficiaries. It is revealing that France and Germany are in top ten of investors in the Russian capital. In business community, these countries speak more often about meaningless of sanctions and necessity of their ending.

It is interesting that despite good political relations between Russia and Asia, China and India being included in the region, invest to the Russian corporate sector extra carefully. Only 16 from 1,5 thousand companies with foreign capital are owned by Chinese business, that is almost 10 less in comparison with Germany; and merely 1 company is invested by India. In this context, it is premature to speak about pivot to Asia; connections with Europe remain to be crucial and preferred.

Picture 1. Number of the Russian companies with turnover exceeds 2 bln RUB being controlled by foreign shareholders, country of investment origin

Picture 1. Number of the Russian companies with turnover exceeds 2 bln RUB being controlled by foreign shareholders, country of investment originBeing on the Russian market, leading transnational corporations continue to draw significant income

The Table 1 contains Top-10 of the largest companies established by foreign corporations in Russia. LA SOCIETE A RESPONSABILITE LIMITEE AUCHAN, leading by revenue, is a subsidiary of French retailer. The share in operating revenue of AUCHAN HOLDING from the Russian presence is almost 10%. TOYOTA MOTOR LLC, the second by revenue, contributes 1,8% to the concern. The share of JTI MARKETING AND SALES LLC in the corporation’s operating revenue is 24,5%.

Range of corporate investment’s interests is very wide: retail, food and tobacco industry, engineering.

| Rank | Company Revenue for 2016 Industry |

Majority shareholder Interest |

Country of majority shareholder | Parent company Country of incorporation Operating revenue for 2016 |

Share of the Russian company in total operating revenue |

| 1 | LA SOCIETE A RESPONSABILITE LIMITEE AUCHAN $5,5 bln Retail |

99% SOGEPAR S.A. |

France | AUCHAN HOLDING France $55,7 bln |

9,9% |

| 2 | TOYOTA MOTOR, LLC $4,6 bln Engineering |

100% TOYOTA MOTOR EUROPE |

Belgium | TOYOTA MOTOR CORPORATION Japan $252,2 bln |

1,8% |

| 3 | JTI MARKETING AND SALES, LLC $4,5 bln ТTobacco industry |

100% JT International Germany GmbH |

Germany | JAPAN TOBACCO INC Japan $18,4 bln |

24,5% |

| 4 | PHILIP MORRIS SALES AND MARKETING, LLC $4,4 bln ТTobacco industry |

99% Philip Morris GmbH |

Germany | PHILIP MORRIS INTERNATIONAL INC. USA $26,7 bln |

16,5% |

| 5 | METRO CASH & CARRY, LLC $4,4 bln Retail |

54,45% Metro Cash & Carry INTERNATIONAL HOLDING B. V. |

The Netherlands | METRO AG Germany $42,3 bln |

10,4% |

| 6 | VOLKSWAGEN GROUP RUS, LLC $3,2 bln Engineering |

55,14% VOLKSWAGEN FINANCE LUXEMBOURG S.A. |

Luxembourg | VOLKSWAGEN AG Germany $237,6 bln |

1,3% |

| 7 | LA SOCIETE A RESPONSABILITE LIMITEE LEROY MERLIN VOSTOK $3,1 bln Retail |

99,99% Bricolage Investissement France |

France | GROUPE ADEO France $17,5 bln |

17,7% |

| 8 | International Tobacco Marketing Services, JSC $3,0 bln ТTobacco industry |

89,3% BRITISH AMERICAN TOBACCO COMPANY LIMITED |

The Netherlands | BRITISH AMERICAN TOBACCO P.L.C. United Kingdom $27,6 bln |

10,9% |

| 9 | MERCEDES-BENZ RUSSIA SAO $2,8 bln Engineering |

100% Daimler AG |

Germany | DAIMLER AG Germany $164 bln |

1,7% |

| 10 | NESTLE ROSSIYA, LLC $2,3 bln Food industry |

84,08% NESTLE S.A. |

Switzerland | NESTLE S.A. Switzerland $88,8 bln |

2,6% |

Some of the largest Russian companies are owned by foreign legal entities

The Table 2 contains the largest Russian companies owned by a foreign shareholder, for example: MAGNITOGORSK IRON & STEEL WORKS, NOVOLIPETSK STEEL, VIMPEL-COMMUNICATIONS, RUSSIAN ALUMINIUM, AVTOVAZ. The experience of attracting nonresidential stockholders confirms that Russia is a country with open economy, including in term of transferring business to another jurisdiction.

| Rank | Company Revenue for 2016 Industry |

Majority shareholder Interest |

Country of majority shareholder |

| 1 | TRADE COMPANY MEGAPOLIS, JSC 624,1 bln RUB Food distribution |

Megapolis Distribution B.V. 99,99% |

The Netherlands |

| 2 | MAGNITOGORSK IRON & STEEL WORKS, PJSC 339,1 bln RUB Metallurgy |

Mintha Holding Limited 84,26% |

Cyprus |

| 3 | NOVOLIPETSK STEEL, PJSC 335,2 bln RUB Metallurgy |

FLETCHER GROUP HOLDINGS LIMITED 84,03% |

Cyprus |

| 4 | VIMPEL-COMMUNICATIONS (Beeline), PJSC 272,4 bln RUB Communications, IT |

VEON Holdings B.V. 99,99% |

The Netherlands |

| 5 | RUSSIAN ALUMINIUM (Rusal), JSC 233,9 bln RUB Metallurgy |

UNITED COMPANY RUSAL ALUMINIUM LIMITED 100% |

Cyprus |

| 6 | AVTOVAZ, PJSC 190,0 bln RUB Engineering |

ALLIANCE ROSTEC AUTO B.V. 64,6% |

The Netherlands |

| 7 | O`KEY, LLC 180,6 bln RUB Retail |

O'KEY GROUP S.A. 99,3% |

Luxembourg |

| 8 | SNS-HOLDING, LLC 149,3 bln RUB Tobacco distribution |

GK SNS LIMITED 100% |

Cyprus |

| 9 | RUSENERGISBYT, LLC 148,5 bln RUB Electricity supply |

RESENERGO INVESTMENTS LTD 50,5% |

Cyprus |

| 10 | ANTIPINSKY REFINERY, JSC 146,7 bln RUB Manufacture of petroleum products |

Vikay Industrial Limited 79,99% |

Cyprus |