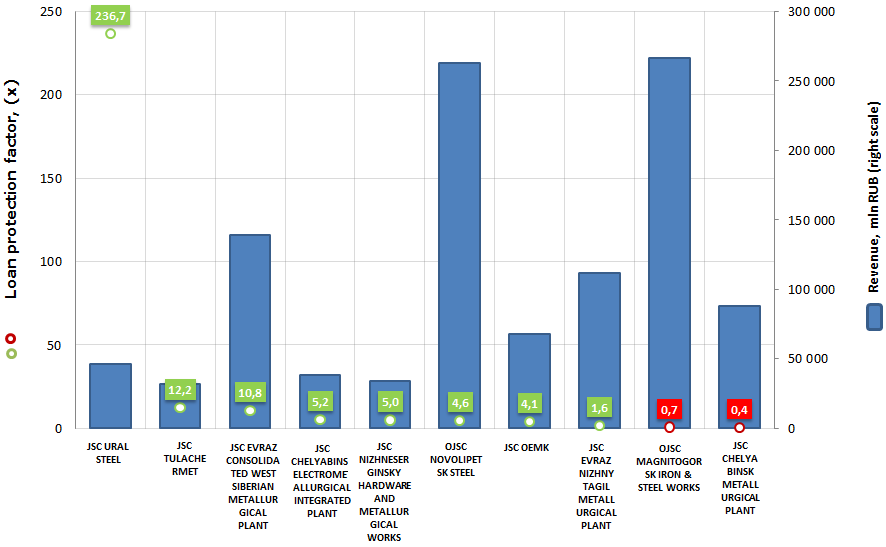

Loan protection factor of the largest enterprises, engaged in cast iron and steel production

Information Agency Credinform has prepared the ranking of the largest Russian metallurgical enterprises, engaged in melting of cast iron and steel.

Top-10 enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in loan protection factor (see table 1).

Loan protection factor (x) is the ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1.

In other words, the higher is the ratio, the better the company services its debts; if the ratio is lower than 1, the company will face the financial difficulties and liquidity crisis in case of one-time requirements of creditors to fulfil obligations.

For the most full and fair opinion about the company’s financial condition, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth, % | Loan protection factor, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | JSC URAL STEEL INN 5607019523 |

Orenburg region | 46 330 | 9,2 | 236,7 | 227 high |

| 2 | JSC TULACHERMET INN 7105008031 |

Tula region | 31 835 | 18,7 | 12,2 | 206 high |

| 3 | JSC EVRAZ CONSOLIDATED WEST SIBERIAN METALLURGICAL PLANT INN 4218000951 |

Kemerovo region | 139 247 | 9,4 | 10,8 | 181 the highest |

| 4 | JSC CHELYABINSK ELECTROMETALLURGICAL INTEGRATED PLANT INN 7447010227 |

Chelyabinsk region | 38 233 | 30,7 | 5,2 | 181 the highest |

| 5 | JSC NIZHNESERGINSKY HARDWARE AND METALLURGICAL WORKS INN 6646009256 |

Sverdlovsk region | 34 288 | 0,7 | 5,0 | 264 high |

| 6 | OJSC NOVOLIPETSK STEEL, NLMK INN 4823006703 |

Lipetsk region | 262 742 | 16,5 | 4,6 | 200 high |

| 7 | JSC OEMK INN 3128005752 |

Belgorod region | 67 500 | 16,6 | 4,1 | 206 high |

| 8 | JSC EVRAZ NIZHNY TAGIL METALLURGICAL PLANT INN 6623000680 |

Sverdlovsk region | 111 398 | 2,1 | 1,6 | 253 high |

| 9 | OJSC MAGNITOGORSK IRON & STEEL WORKS INN 7414003633 |

Chelyabinsk region | 266 478 | 18,6 | 0,7 | 264 high |

| 10 | JSC CHELYABINSK METALLURGICAL PLANT INN 7450001007 |

Chelyabinsk region | 87 730 | 7,2 | 0,4 | 297 high |

The loan protection factor of the largest enterprises, engaged in cast iron and steel production (Top-10), varies from 236,7 (JSC URAL STEEL) to 0,4 (JSC CHELYABINSK METALLURGICAL PLANT).

OJSC MAGNITOGORSK IRON & STEEL WORKS also has the ratio lower than recommended value. Debt load is high – the sum of interest payable is higher than net profit before tax; in further lending, under the conditions of falling world prices for metals, it is necessary to estimate the possible consequences of drop in revenue and falling demand for products.

Picture 1. Loan protection factor and revenue of the largest metallurgical enterprises, engaged in cast iron and steel production (Top-10)

According to the latest financial statements (2014), the revenue of the leading enterprises, engaged in cast iron and steel production (Top-10), amounted to 1085,8 bln RUB, that is 13,2% higher than in 2013. Revenue growth is significantly higher than GDP growth and inflation rate for the same period.

The larger is the enterprise, the lower is the loan protection factor: retention of the achieved development potential, the development of new sales markets, rebuilding of the resource base – all these requires significant investment and affects the companies' finances.

The industry leaders should be noted separately: the largest enterprises by revenue are NOVOLIPETSK STEEL and MAGNITOGORSK IRON & STEEL WORKS.

NLMK Group is the leading international manufacturer of high quality steel products (including transformer steel) with vertically-integrated business model. Extraction of raw materials and steel production are concentrated in low-cost regions, manufacture of products is carried out in the vicinity of major customers in Russia, North America and EU countries. NLMK Group invariably demonstrates high financial stability. Despite the significant capital investment in large investment projects for the last 10 years, the company maintains rather low level of debt load. Since the launch of the plant in Kaluga, the company finished the stage of sustainable growth and concentrated on the improvement of the efficiency of all business processes, products quality and strengthening of its market positions.

OJSC MAGNITOGORSK IRON & STEEL WORKS is one of the world largest manufacturers of steel and takes the leading place among ferrous metallurgy enterprises of Russia. The company's assets in Russia include large metallurgical complex with full production cycle, starting from iron ore preparation to deep processing of ferrous metals. The plant produces wide range of metal products, a predominant share among which takes products with high added value.

In 2014 the group produced 13 mln tons of steel and 12,2 mln tons of commercial metal products.

All participants from the Top-10 list have the highest and high solvency index, that shows the ability of enterprises to meet their obligations in time and fully; the risk of unfulfillment is low.

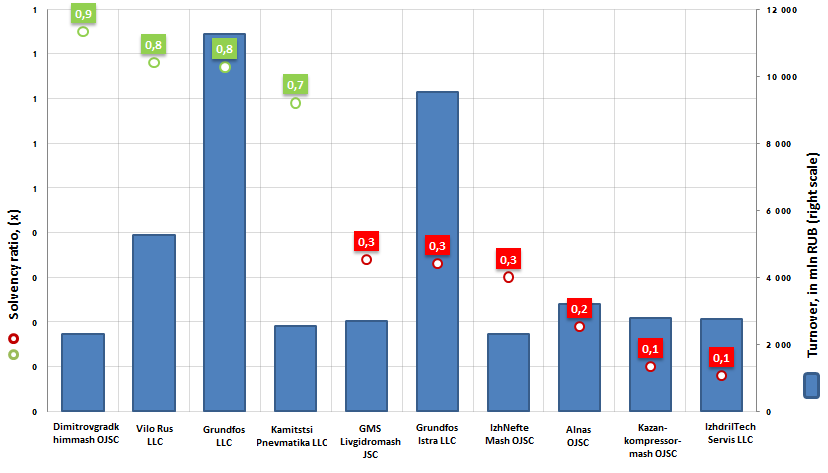

Solvency ratio of the largest manufacturers of pumping equipment

Information agency Credinform prepared a ranking of the largest Russian companies, producing pumping equipment.

The TOP-10 list of enterprises was drawn up for the ranking on the volume of annual revenue, according to the data from the Statistical Register for the latest available period (for the year 2014).

Solvency ratio (х) is the relation of own capital to the balance sum. It shows company’s dependence on foreign loans.

Recommended value is: >0,5.

If the parameter has dropped below the minimum permissible limit, than it means that a company is highly dependent on external sources of borrowings, and by the worsening of conjecture in the market it may lead to liquidity crisis, to unstable financial position.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Registration area | Revenue, in mln RUB, for 2014 | Solvency ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Dimitrovgradkhimmash OJSC INN 7302000070 |

Ulyanovsk region | 2 317 | 0,9 | 192 the highest |

| 2 | Vilo Rus LLC INN 7702176142 |

Moscow | 5 267 | 0,8 | 178 the highest |

| 3 | Grundfos LLC INN 5042054367 |

Moscow | 11 249 | 0,8 | 159 the highest |

| 4 | Kamitstsi Pnevmatika LLC INN 7710028420 |

Moscow | 2 541 | 0,7 | 192 the highest |

| 5 | GMS Livgidromash JSC INN 5702000265 |

Orel Region | 2 685 | 0,3 | 271 high |

| 6 | Grundfos Istra LLC INN 5017047704 |

Moscowregion | 9 510 | 0,3 | 272 high |

| 7 | IzhNefteMash OJSC INN 1835012826 |

Udmurt Republic | 2 301 | 0,3 | 229 high |

| 8 | Alnas OJSC INN 1607000081 |

Republic of Tatarstan | 3 198 | 0,2 | 271 high |

| 9 | Kazankompressormash OJSC INN 1660004878 |

Republic of Tatarstan | 2 775 | 0,1 | 290 high |

| 10 | IzhdrilTechServis LLC INN 1831114320 |

Udmurt Republic | 2 762 | 0,1 | 221 high |

The solvency ratio of the leading manufacturers of pumping equipment (top-10) ranges from 0,1 (IzhdrilTechServis LLC) up to 0,9 (Dimitrovgradkhimmash OJSC).

Thus, a number of companies got shortlisted in the Top-10 list has a high degree of dependence on borrowed funds (the solvency ratio is less than 0,5). Their capital doesn’t cover the amount of obligations incurred, and by one-time claiming credit amounts the enterprises will have difficulties with their repayment. Therefore, business needs to maintain a balance between the desire to expand its presence in the market and the ability to cope with a high debt load.

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of pumping equipment (TOP-10)

Annual revenue of the TOP-10 companies, according to the latest published annual financial statement (for 2014), made 44,6 bln RUB, that is by 11,4% higher than the revenue of the same enterprises for the previous reporting period (40 bln RUB).

The largest company in the industry – Grundfos LLC – shows good financial results, including in terms of solvency level: the ratio of capital sum to the volume of borrowed funds is 0,8, that points to a rather low dependence of the firm on foreign loans.

The company Grundfos is the world leader in the production of high-tech pumping equipment and sets the trends in the sphere of water technology.

The pumps Grundfos have been known to domestic consumers since 60-ies of the last century. The representation of the concern in Moscow was opened in 1992. In 1998 was found the subsidiary Grundfos LLC.

Consistent high quality of products, reliability and energy efficiency of manufactured pumps, as well as well-developed network of branches and service centers in the regions of Russia help the company maintain the leadership position in the market of pumping equipment.

In 2005 it was completed the construction of the first stage of the plant «Grundfos Istra». Own production allows to produce high-quality pumps on the territory of Russia, as well as to reduce delivery times and logistical costs of customers. Today the total area of the factory is 30 000 sq. m.

Several types of equipment are set up in the plant: vertical, centrifugal, cantilever-monoblock pumps with variable-frequency motors; water booster systems and fire-fighting units; control cabinets.

The pumps Grundfos are working in water and wastewater treatment plants of Moscow, St. Petersburg, Rostov-on-Don, Voronezh, Khabarovsk, Syktyvkar, Podolsk, Ivanovo, Yaroslavl and a number of other cities. Also, company’s equipment has been installed on objects of housing and communal services and the largest industrial enterprises of Russia, on life-support systems of airports and sports facilities.

This one and other participants of the ranking of the largest TOP-10 manufacturers of pumping equipment got high and the highest solvency index. This fact points to companies’ ability to pay off their debts in time and fully, while risk of default is minimal.