Solvency of service companies

Information agency Credinform represents a ranking of the largest Russian service companies. The provided personal services (laundry, dry cleaning of fabric and fur items, hairdressing and beauty salons, funeral services, saunas, wellness centers, fitness centers, social services, pet care, etc.) with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2006 - 2011). They were ranked by the solvency ratio (Table 1). The analysis was based on the data of the Information and Analytical System Globas.

Solvency ratio (х) is equity to total assets. The ratio indicates the company's dependence on external loans. The recommended value is >0,5.

The value below the minimum limit indicates a strong dependence on external sources of funds, which, if market conditions worsen, can lead to liquidity crisis and unstable financial position of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, activity | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas in 2020 | |||

| 2009 | 2011 | 2009 | 2011 | 2009 | 2011 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC LINDSTROM INN 7816659619 Saint Petersburg Laundry and dry cleaning of fabric and fur product |

550,1 550,1 |

661,1 661,1 |

89,5 89,5 |

99,6 99,6 |

0,99 0,99 |

0,95 0,95 |

169 Superior |

| JSC LUZHNIKI OLYMPIC COMPLEX INN 7704077210 Moscow Health and fitness |

1 401,6 1 401,6 |

2 185,7 2 185,7 |

352,3 352,3 |

-201,6 -201,6 |

0,80 0,80 |

0,83 0,83 |

232 Strong |

| JSC RITUAL-1 INN 7731137099 Moscow Funeral and related services |

359,2 359,2 |

317,8 317,8 |

15,5 15,5 |

2,9 2,9 |

0,71 0,71 |

0,74 0,74 |

256 Medium |

| GBU RITUAL INN 7743096224 Moscow Funeral and related services |

2 227,7 2 227,7 |

2 143,8 2 143,8 |

41,0 41,0 |

26,2 26,2 |

0,70 0,70 |

0,63 0,63 |

Not assigned |

| JSC FUNERAL HOME GORBRUS INN 7720018290 Moscow region Funeral and related services |

233,1 233,1 |

342,9 342,9 |

12,6 12,6 |

27,8 27,8 |

0,66 0,66 |

0,43 0,43 |

278 Medium |

| LLC SANDUNOVSKIE BANI INN 7702093778 Moscow Health and fitness |

348,2 348,2 |

476,6 476,6 |

56,8 56,8 |

58,7 58,7 |

0,58 0,58 |

0,41 0,41 |

121 Superior |

| JSC STIKS-S INN 7710321266 Moscow Funeral and related services |

449,0 449,0 |

483,5 483,5 |

4,7 4,7 |

3,3 3,3 |

0,34 0,34 |

0,39 0,39 |

275 Medium |

| JSC PASSAZHIR SERVIS INN 7606043703 Yaroslavl region Laundry and dry cleaning of fabric and fur product |

161,7 161,7 |

365,1 365,1 |

16,2 16,2 |

37,2 37,2 |

0,37 0,37 |

0,29 0,29 |

237 Strong |

| LLC MEGGI-2001 INN 5024048699 Moscow region Laundry and dry cleaning of fabric and fur product |

1 370,2 1 370,2 |

529,7 529,7 |

-5,3 -5,3 |

-13,6 -13,6 |

0,07 0,07 |

-0,14 -0,14 |

384 Weak |

| Average value for TOP-10 |  762,2 762,2 |

783,5 783,5 |

59,7 59,7 |

4,8 4,8 |

0,55 0,55 |

0,49 0,49 |

|

| Average value for TOP-1000 |  23,5 23,5 |

24,6 24,6 |

1,2 1,2 |

0,4 0,4 |

0,27 0,27 |

0,25 0,25 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of the solvency ratio is above the average value of TOP-1000. Four companies have the value above the recommended one, and four companies improved their figures in 2011 compared to 2009.

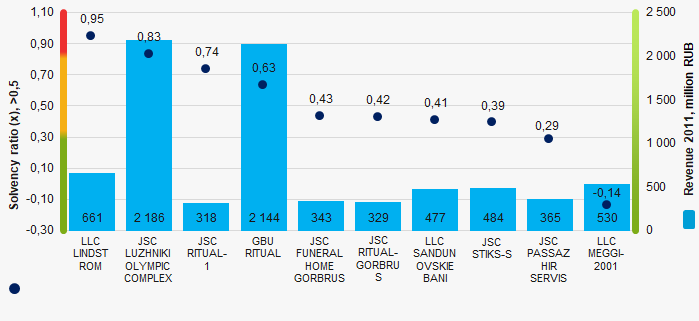

Picture 1. Solvency ratio and revenue of the largest service companies (TOP-10)

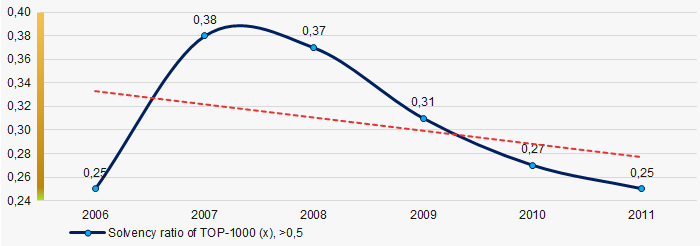

Picture 1. Solvency ratio and revenue of the largest service companies (TOP-10)During six years, the average solvency ratio values of TOP-1000 companies are below the recommended one with a trend to decrease (Picture 2).

Picture 2. Change in the average solvency ratio values of the largest Russian service companies (TOP-1000) in 2006 – 2011

Picture 2. Change in the average solvency ratio values of the largest Russian service companies (TOP-1000) in 2006 – 2011Stress test for the Russian agricultural sector

The crisis makes it clear that the break of the agricultural products supply chain leads to overproduction in one region and to deficit in another.

Closing borders forces farmers in many countries to dispose of excess products, such as milk in the UK or citrus fruits in Spain.

At the same time, countries dependent on food imports find themselves in the most distressing situation, depriving of supply channels.

According to the United Nations World Food Programme’s forecasts, 265 million people will face acute food shortages by the end of 2020 that is twice as many as in 2019.

Will the Russian agricultural sector stand the test of crisis?

Production of agricultural products grows and becomes monopolized by large holdings

According to the results of 2019, production of agricultural products in Russia reached the record of 5,9 trillion RUB and demonstrated the annual growth by 10,5%. Growth by 3% more was recorded in the I quarter of 2020.

Data as of April 2020 indicate the increase in accordance with 2019: - production of flour grew by 14,2%, - cattle meat and pork by 6,2%, - meat semi-finished products by 3,2%, - milk by 4,6%, - butter by 8,1%, - cheese by 1,4%.

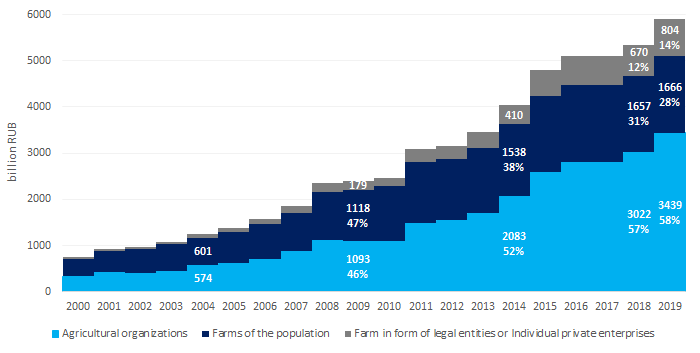

10 year ago most of the agricultural products were produced by the household sector, but today large companies produce almost 60% of livestock and crop products (see Picture 1). This is indicative of monopolization of the market by vertically-integrated holdings. On the one hand, this will lead to further intensification and increase in industrial production, and on the other hand, to decrease in the naturalness of the product through the use of chemical components in production and gene technology.

Picture 1. Dynamics of agricultural production by types of farming, billion RUB

Picture 1. Dynamics of agricultural production by types of farming, billion RUBRussia does not depend on imports of main food products

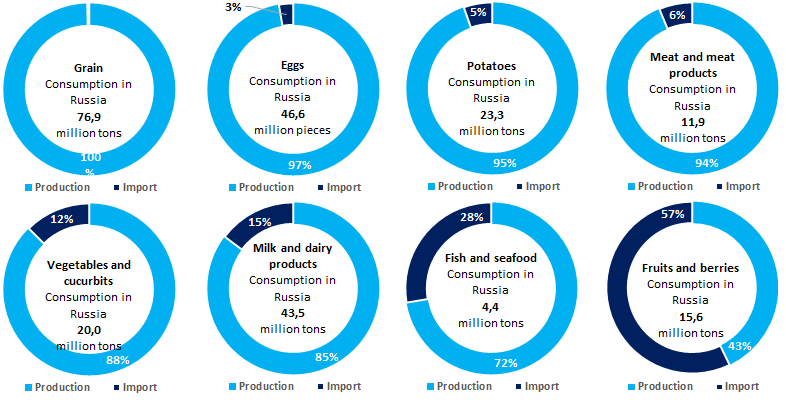

Local farmers almost completely provide for the needs of domestic consumption in the most important commodity groups. More recently, we were critically dependent on imports of meat, vegetables, milk, and grain. A large share of imports today remains only in the segment of fruits and berries, as well as fish and seafood (see Pictures 2-9).

The country provides itself with grain at 100%, holding 1-2 places in the world in exports for several years in a row. The paradoxical situation is in the sugar market: after the dissolution of the Soviet Union, domestic production of sugar beets provided only 20% of consumption, the rest was imported mainly from Ukraine. Overproduction is now observed, and together with low prices, it forces the factories to reduce output, and the relatively high cost of growing beet sugar does not allow increasing exports compared to other regions where warm-weather and unpretentious cane sugar is growing.

Picture 2-9. Domestic consumption, share of own production and import of key agricultural commodity groups. 2018-2019, %

Picture 2-9. Domestic consumption, share of own production and import of key agricultural commodity groups. 2018-2019, %High dependency on import of supplementary agricultural goods

With all the successes of domestic agriculture, there are obvious shortcomings, associated primarily with the means of production. According to the Ministry of Agriculture of the Russian Federation, in 2019 the share of imported vaccines and veterinary drugs was about 65%, feed additives - 60%. Import of sugar beet seeds amounted to 99% of the needs, potatoes - 90%, sunflower - 74%, spring rape - 68%. A positive situation was observed only in seed production of winter and spring wheat, where the share of imported seeds is 10% and 18%, respectively.

In Russia, there is almost no industry for the manufacture of food ingredients: stabilizers, additives, dyes, preservatives. There is still a dependence on the import of technological equipment for the food industry and agricultural machinery.

Conclusion

In order for Russian agriculture to withstand any crisis stress test, further development of agroleasing, expansion of the credit line for farmers, and an increase in subsidies for constantly rising fuel and lubricants are necessary. Palm oil, 4-5 grade wheat (feed grain) for bakery products, aggressive chemicals, unfortunately, have been widely used in domestic production. It requires a transition to extensive forms of farm management, and improving the quality of products.

Now, anti-crisis support measures are targeted mainly at large agricultural holdings with multi-billion revenue. Small regional companies and peasant farm enterprises, even with the maximum turnover for their segment, will never fall into the list of systemically important companies. However, maintaining such enterprises is equally important. If production is monopolized by large holdings, it is enough for one of them to leave the market - and the industry itself will suffer damage, as well as related sectors - equipment manufacturers, transport, retail, and restaurants.

Import of important products for the agriculture, such as vaccines, seeds and agrochemicals, plays a considerable role in reaching high production figures of the sector. In case of the next rouble devaluation or imposition of sanctions affecting the agricultural sector, Russia may face problems from rising prices to the exhaustion of the seed fund, and this will directly affect the country's food security. Avoiding seed dependence, developing and supporting ancillary industries is an important task that requires a prompt solution.

Agriculture is one of the few sectors of the Russian economy in which record growth has occurred in recent years. In 2019, agricultural products export amounted to 25.5 billion USD that is 1,7 times more than arms export. With the elimination of shortcomings and competent government support, the industry is able to become one of the drivers of the economy in times of crisis.