Does The Central Bank of Russian Federation believe in ruble force?

On 21 October the Central Bank of Russian Federation cut the day volume of currency interventions by half – from 120 mln. USD to 60 mln. USD. In other words, the controller will allocate fewer funds for influence on a ruble exchange rate in case of its output from the given interventional corridors of a dual currency basket.

This decision seems to be rather logic continuation of the financial authority’s earlier solution as of 7 October. Then the Bank of Russia expanded boundaries of so-called "neutral range" from 1 RUB to 3,10 RUB. While the basket cost is 34,30-37,40 RUB, the Central Bank won’t make currency interventions in one direction or another.

Thus, new exchange rate policy of mega controller led by recently appointed Elvira Nabiullina, is going to appear. The policy is probably directed on gradual implementation of national currency freely floating rate. However, in long-term perspective, actions made by the Central Bank, in case of current economy structure, can lead to a weakening of the ruble.

Today, while the growth of industry production is about zero values, the state and private debt is increasing and country’s financial position is still largely determined by raw materials prices, such steps of Russian Bank seem to be rather optimistic. On the other hand, the Central Bank, seeing the deterioration of country’s economic situation, may reasonably carry out such practice in life. After all in case of currency intervention reducing and expanding of the "neutral range", the controller will save the part of its forex holdings, which maintenance at "due level" is, if not the primary, but very important task for financial authorities.

Solvency ratio of fertilizers and nitrogen compounds manufacturers

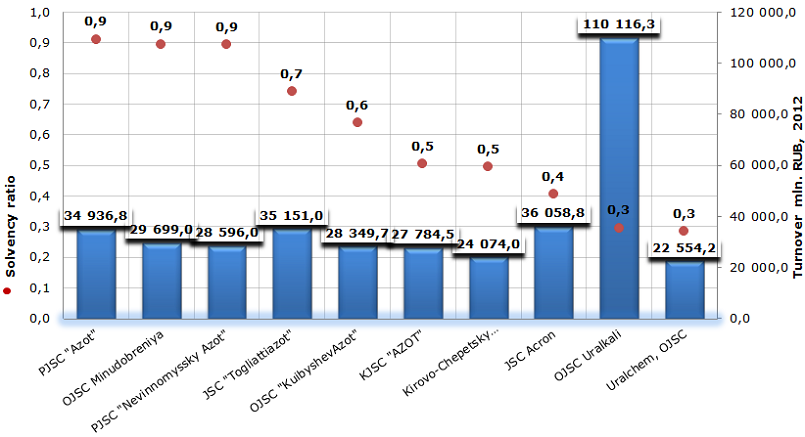

Information agency Credinform prepared а ranking of Russian enterprises engaged in manufacturing of fertilizers and nitrogen compounds. The ranking list includes industry’s largest Russian companies with mentioned activity type and is based on total revenue as stated in the Statistics register, with the reference period of 2012. The selected companies were ranked by decrease of solvency ratio.

Solvency ratio (х) is calculated as the relation of own capital to the balance sum. This reflects the dependence of the company from external borrowings. Recommended value is more than 0,5. If the value less than 0,5, then we can talk about imbalance of company’s finance, high leverage, which increase the economic risks.

On the other hand, in order to keep the market and to develop all the time each enterprise, whether it is a global or small regional company, needs a strategy for technological upgrading, plan for the development of new sales markets. All this demands long-term financial investments, because own funds are not enough. Companies have to attract credit resources.

Thus, the high value of solvency ratio in the conditions of global competition also doesn't save from financial difficulties in the future. They could arise against decline in demand for production, which doesn’t meet the changed requirements or worse than production of other enterprises by properties and quality. The financial management and company’s principals should take into account all internal and external factors of the business environment, to look for golden mean between the development and financial independence.

| № | Name | INN | Region | Turnover 2012, mln. RUB. | Solvency ratio | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Public Joint Stock Company " Azot" | 7116000066 | Tula Region | 34 936,8 | 0,91 | 127(the highest) |

| 2 | OJSC MINUDOBRENIYA | 3627000397 | Voronezh Region | 29 699,0 | 0,90 | 178(the highest) |

| 2 | Public Joint-Stock Company "Nevinnomyssky Azot" | 2631015563 | Stavropol Territory | 28 596,0 | 0,89 | 159(the highest) |

| 4 | JSC "TOGLIATTIAZOT" | 6320004728 | Samara Region | 35 151,0 | 0,74 | 151(the highest) |

| 5 | OJSC "KuibyshevAzot" | 6320005915 | Samara Region | 28 349,7 | 0,64 | 169(the highest) |

| 6 | KJSC "AZOT" | 4205000908 | Kemerovo Region | 27 784,5 | 0,50 | 185(the highest) |

| 7 | Kirovo-Chepetsky Khimichesky Kombinat, OJSC | 4312138386 | Moscow | 24 074,0 | 0,49 | 208(high) |

| 8 | JSC Acron | 5321029508 | Novgorod Region | 36 058,8 | 0,40 | 232(high) |

| 9 | OJSC Uralkali | 5911029807 | PermTerritory | 110 116,3 | 0,29 | 170(the highest) |

| 10 | Uralchem, OJSC | 7703647595 | Moscow | 22 554,2 | 0,28 | 239(high) |

Total 2012 turnover of TOP-10 nitrogen fertilizers manufacturers amounted 377 320,3 mln. RUB. The average estimated value of market leaders solvency ratio - 0,6, which means the maintaining of balance between own and borrowed funds.

Solvency ratio of the largest Russian manufacturers of fertilizers and nitrogen compounds

The following enterprises of TOP-10 have the solvency ratio value more than 0,5: Public Joint Stock Company " Azot" - 0,91, OJSC MINUDOBRENIYA – 0,90, Public Joint Stock Company "Nevinnomyssky Azot" – 0,89, JSC "TOGLIATTIAZOT" - 0,74, OJSC "KuibyshevAzot" – 0,64.

The largest enterprise of the industry by turnover - OJSC Uralkali, with the solvency ratio 0,29, is on 7 place from 10. Rather low ratio value can testify about high proportion of credit to company’s finance.

The worse ratio value in TOP-10 of nitrogen fertilizers manufacturers has Uralchem, OJSC - 0,28, the company takes the last place in the table. Nevertheless, according to independent assessment of creditworthiness by Information agency Credinform, the company has the high solvency index GLOBAS-i®. That means the opportunity to repay the liabilities on time and fully, the non-execution risk of which is insignificant.

It should be noted, that all enterprises in TOP-10 list have the high and the highest solvency index GLOBAS-i®. This fact testifies about good situation in the industry, the companies are competitive not only within the country, but successfully export its production abroad.

From the investment point of view, the collaboration with the companies from the list is quite attractive.