Trends in woodworking industry

Information Agency Credinform presents a review of activity trends of the largest Russian woodworking companies.

Woodworking companies with the largest annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2015 — 2017). The analysis was based on the data from the Information and Analytical system Globas.

Net asset value indicates fair value of corporate assets and is calculated annually as assets on balance less company’s liabilities. Net asset value is negative (insufficiency of property) if liabilities are larger than the property value.

| № | Name, INN, region, activity | Net asset value, billion RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | KRONOSPAN LLC INN 5011021227 Moscow region Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

14,0 |  17,0 17,0 |

18,6 18,6 |

205 Strong |

| 2 | EGGER DREVPRODUKT GAGARIN LLC INN 6723019741 Smolensk region Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

6,5 |  13,1 13,1 |

17,6 17,6 |

299 Medium |

| 3 | EGGER DREVPRODUKT SHUYA LLC INN 7704267807 Ivanovo region Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

2,2 |  6,0 6,0 |

9,9 9,9 |

220 Strong |

| 4 | SWISS KRONO LLC INN 4407006010 Kostroma region Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

5,4 |  7,7 7,7 |

8,9 8,9 |

192 High |

| 5 | SYKTYVKAR PLYWOOD MILL LIMITED INN 1121009024 Komi Republic Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

2,0 |  3,8 3,8 |

5,9 5,9 |

185 High |

| 996 | MODERN LUMBER TECHNOLOGY LTD INN 7840322535 Saint Petersburg Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials |

-4,0 |  -1,6 -1,6 |

-4,8 -4,8 |

288 Medium |

| 997 | JSC INDUSTRIAL-WOODWORKING COMPLEX APSHERONSK INN 2325014338 Krasnodar territory Manufacture of lumber, except profiled, more than 6 mm thickness; manufacture of untreated railroad and tram sleepers from wood |

-5,3 |  -4,3 -4,3 |

-4,9 -4,9 |

289 Medium |

| 998 | JSC KRASLESINVEST INN 2460205089 Krasnoyarsk territory Sawmilling and planing of wood |

-7,3 |  -8,0 -8,0 |

-9,9 -9,9 |

279 Medium |

| 999 | TRANS-SIBERIAN FOREST COMPANY LTD INN 3808119644 Irkutsk region Sawmilling and planing of wood Process of being wound up, 18.05.2018 |

-10,9 |  -10,6 -10,6 |

-10,2 -10,2 |

600 Insufficient |

| 1000 | RIMBUNAN HIJAU MDF LLC INN 2721143979 Khabarovsk territory Manufacture of products of wood, cork, straw and plaiting materials |

-12,7 |  -11,2 -11,2 |

-12,6 -12,6 |

311 Adequate |

— growth compared to prior period,

— growth compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

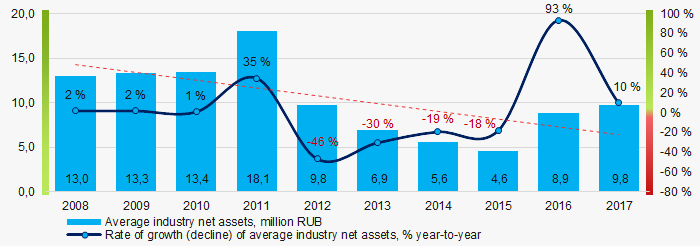

Average net assets of TOP-1000 companies tended to decrease during the last decade (Picture 1).

Picture 1. Change in average net assets of woodworking companies in 2008 — 2017

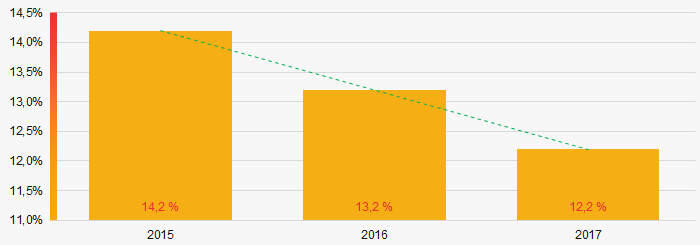

Picture 1. Change in average net assets of woodworking companies in 2008 — 2017 The share of TOP-1000 companies with insufficiency of property tends to decrease within the last 3 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017Sales revenue

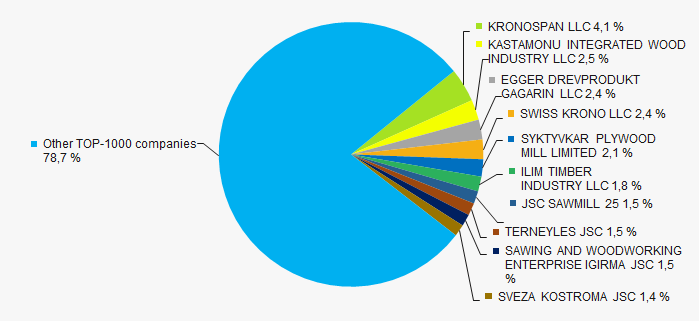

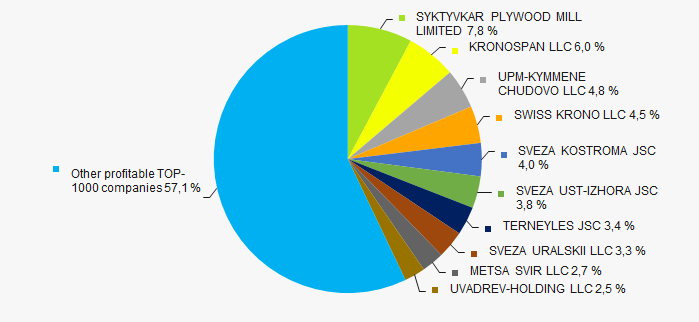

In 2017 sales revenue of 10 leaders amounted to 21% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of a relatively high level of competition within the industry.

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies

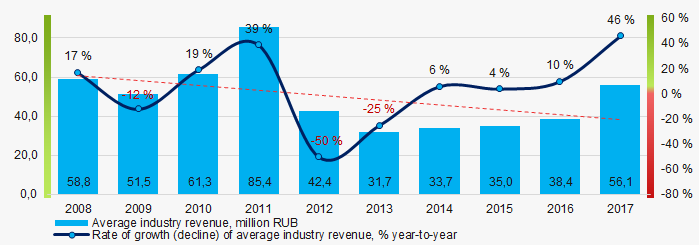

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies In general, average industry revenue tends to decrease during the decade (Picture 4).

Picture 4. In general, average industry revenue tends to decrease during the decade (Picture 4).

Picture 4. In general, average industry revenue tends to decrease during the decade (Picture 4). Profit and loss

n 2017 profit of 10 industry leaders amounted to 43% of total profit of TOP-1000 companies (Picture 5).

Picture 5. TOP-10 companies by their share in 2017 total profit of TOP-1000

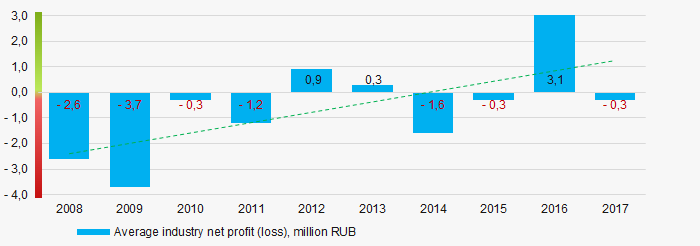

Picture 5. TOP-10 companies by their share in 2017 total profit of TOP-1000Average net profit has mostly negative values, with a trend of the loss to increase (Picture 6).

Picture 6. Change in average net profit (loss) of woodworking companies in 2008 — 2017

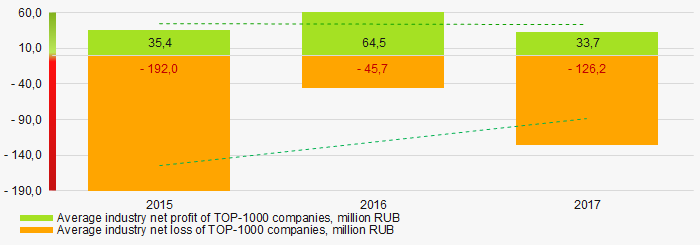

Picture 6. Change in average net profit (loss) of woodworking companies in 2008 — 2017During the last 3 years average net profit of TOP-1000 companies neither increased nor decreased, with a trend of the loss to decrease (Picture 6).

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017Key financial ratios

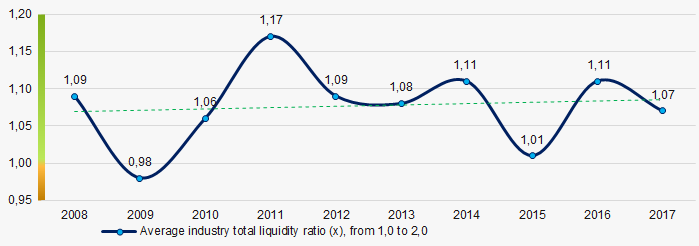

During the last decade average values of total liquidity ratio were within the recommended value — from 1,0 to 2,0, tending to increase (Picture 8).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 8. Change in average values of total liquidity ratio of woodworking companies in 2008 — 2017

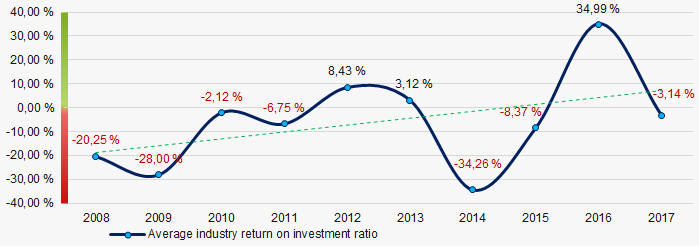

Picture 8. Change in average values of total liquidity ratio of woodworking companies in 2008 — 2017During the last decade, average values of return on investment ratio were in the negative area, but tending to increase (Picture 9).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 9. Change in average values of return on investment ratio of woodworking companies in 2008 — 2017

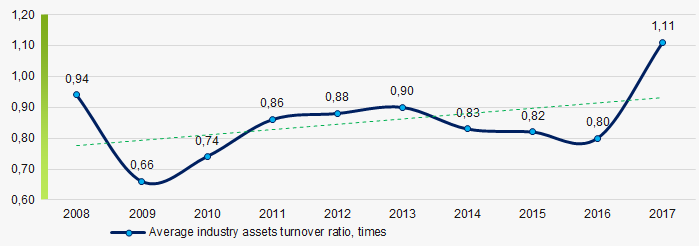

Picture 9. Change in average values of return on investment ratio of woodworking companies in 2008 — 2017Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the decade, this activity ratio tended to increase (Picture 10).

Picture 10. Change in average values of assets turnover ratio of woodworking companies in 2008 — 2017

Picture 10. Change in average values of assets turnover ratio of woodworking companies in 2008 — 2017Activities structure

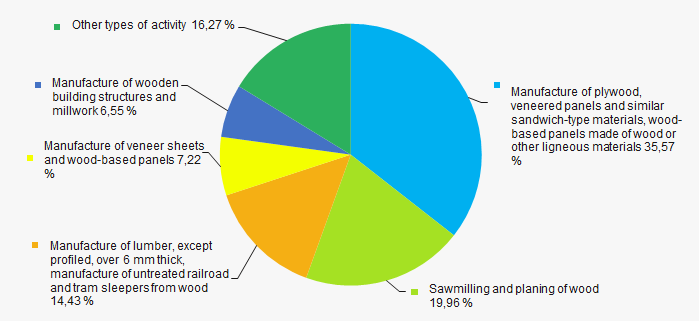

Manufacture of plywood, veneered panels and similar sandwich-type materials, wood-based panels made of wood or other ligneous materials has the majority share in total revenue of TOP-1000 companies (Picture 11).

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies

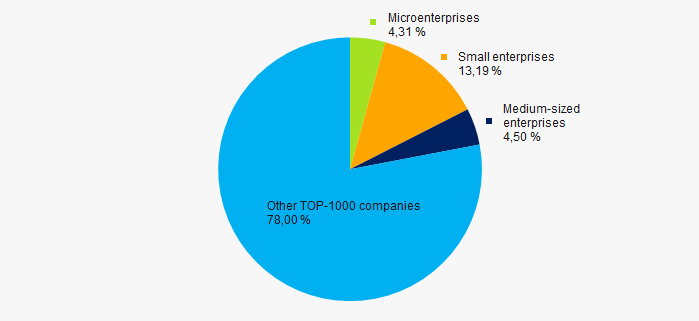

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies78% of TOP-1000 companies are included in the register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation. In general, their share in total revenue of TOP-1000 in 2017 amounted to 22% (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %Key regions of activity

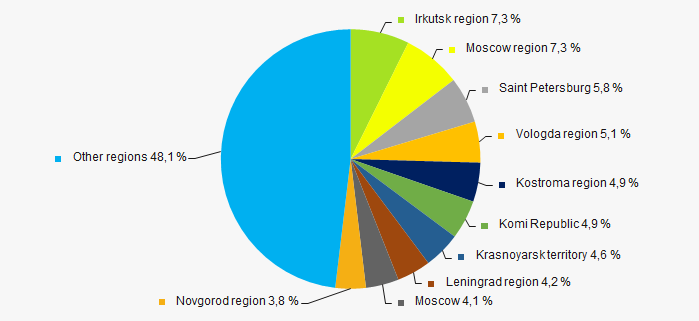

TOP-1000 companies are unevenly located throughout Russian territory, and are registered in 71 region. Companies with the largest revenue are concentrated in the Irkutsk and Moscow regions (Picture 13).

Picture 13. Revenue of TOP-1000 companies by Russian regions

Picture 13. Revenue of TOP-1000 companies by Russian regionsFinancial position score

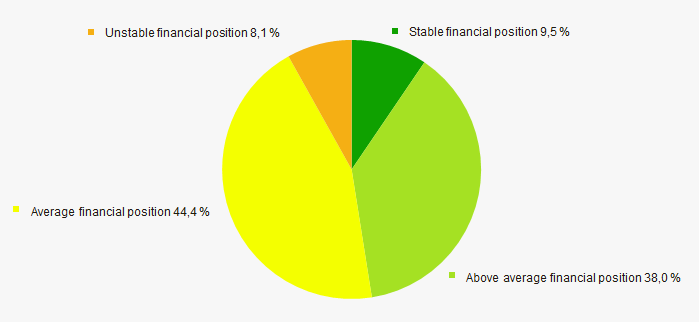

Assessment of financial state of TOP-1000 companies indicates that most of the companies have an average financial standing (Picture 14).

Picture 14. Assessment of financial state of TOP-1000 companies indicates that most of the companies have an average financial standing (Picture 14).

Picture 14. Assessment of financial state of TOP-1000 companies indicates that most of the companies have an average financial standing (Picture 14).Solvency index Globas

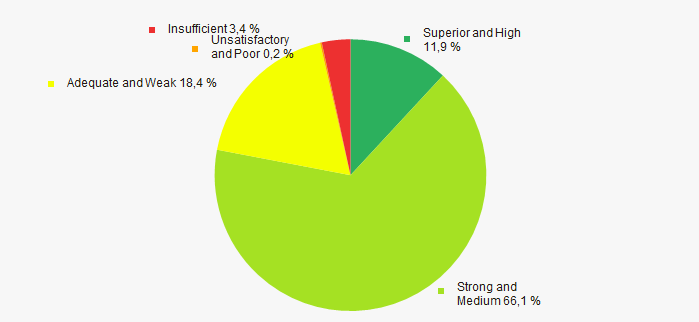

he majority of TOP-1000 companies have got a superior, high, strong or medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 15).

Picture 15. TOP-1000 companies by Solvency index Globas

Picture 15. TOP-1000 companies by Solvency index GlobasIndex of industrial production

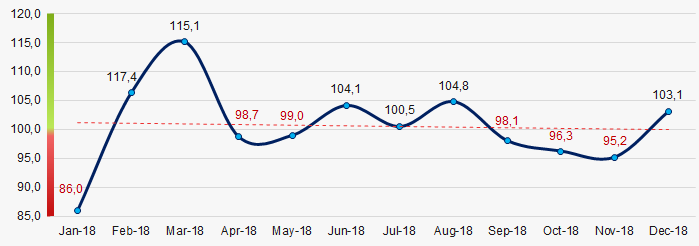

According to the Federal State Statistics Service, during 12 months of 2018 the trend of some decrease of the index of industrial production is observed in the woodworking industry (Picture 16).

Picture 16. Index of industrial production in woodworking industry in 2018, month-to-month, (%)

Picture 16. Index of industrial production in woodworking industry in 2018, month-to-month, (%)Conclusion

A comprehensive assessment of the largest woodworking companies, that considers key indexes, financial figures and ratios, is indicative of predominance of positive trends within the sector (Table 2).

| Trends and assessment factors | Relative share of the factor, % |

| Rate of growth (decline) of average industry net assets |  -10 -10 |

| Increase/ Decrease of share of companies with negative net assets |  10 10 |

| Rate of growth (decline) of average industry revenue |  -10 -10 |

| Level of competition / monopolization |  10 10 |

| Rate of growth (decline) of average industry net profit (loss) |  10 10 |

| Increase/ Decrease of average industry net profit of TOP-1000 companies |  5 5 |

| Increase/ Decrease of average industry net loss of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry total liquidity ratio |  10 10 |

| Increase/ Decrease of average industry return on investment ratio |  5 5 |

| Increase/ Decrease of average industry assets turnover ratio |  10 10 |

| Share of small and medium-sized business within the industry by revenue over 30% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial standing (majority share) |  5 5 |

| Solvency index Glogas (majority share) |  10 10 |

| Index of industrial production |  -10 -10 |

| Average factors' value |  2,3 2,3 |

— positive trend (factor) ,

— positive trend (factor) ,  — negative trend (factor).

— negative trend (factor).

Globalization of the world economy slowing down

Under instability of the world economy and trade wars, pace of globalization has slowed down. It is for this reason that the number and volume of M&A transactions has reduced.

Mergers and Acquisitions (hereinafter “M&A”) market crossed national borders and became an indicator of globalization process. Common outcome of the development of any large company is its intention to internationalize activities. The company must have clear competitive advantages and choose the most effective ways of business development to increase revenue and profitability. Commonly speaking, M&A transactions aim at the following:

- scale and synergy effect - comprehensive financial result of merged companies is significantly higher than if these operate independently;

- diversification of activity allows to break away from niche specialization and cover other areas of the economy;

- acquisition of effective enterprises to obtain profit or unique developments;

- simplification of production chain and internal standards enable the quality of products and services to be improved at lower or comparable price level;

- public interest, which on the one hand seeks to control of strategic properties, and on the other to allow privatization.

M&A costs are due primarily to possible monopolization of the market occurring under no government regulation. In that case, positive effects are reversed by the lack of competition. Hostile takeover and raiding are also common. It should be considered that national production characteristics disappear in a globalized economy, and it is increasingly difficult to acquire the unique product.

Major trends on the international M&A market

The international M&A market is tightly relates to condition and dynamics of the global economy, particularly of the USA and EU countries. China is proactive, purchasing assets not only in Africa and Asia, but also in Western Europe.

Peak of volume and number of cross-border M&A transactions was recorded in 2007, when over 15 thousand mergers and acquisitions at the amount exceeding 2 trillion USD were made. Since then, this result is not surpassed. According to the results of 2018, about 14 thousand M&A transactions at the amount of 1.5 trillion USD were conducted. This indicates the slowing of world economy globalization.

The biggest transaction in 2018 was the acquisition by the American telecommunications holding AT&T of one of the largest media and entertainment conglomerates WarnerMedia (СNN, Time Inc., Warner Bros, etc.). The price of transaction amounted to 130 billion USD. According to the leading electronic databases publisher Bureau van Dijk (Belgium), Credinform strategic partner, AT&T assets at the date of acquisition amounted to 444 billion USD, and 69 billion USD of WarnerMedia.

The largest cross-border transaction was acquisition by Japanese pharmaceutical corporation Takeda Pharmaceutical of Irish biochemical company Shire plc. The volume is estimated at 62 billion USD.

The Russian M&A market

The Russian M&A market stagnating under the instable situation on foreign markets. The low growth rates of the economy and consumer demand continue to have negative impact, as well as sanctions and barriers affecting business of the Russian enterprises abroad and entry of new foreign investors.

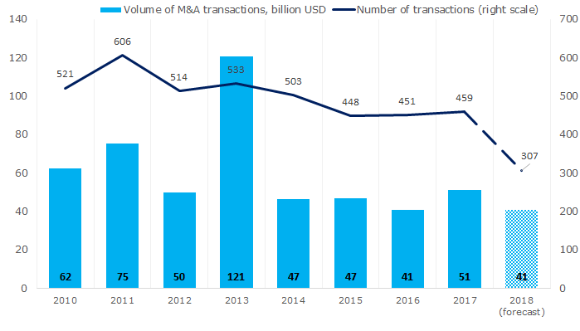

The largest volume of M&A market in Russia was recorded in 2013, when 533 transactions at the amount of 121 billion USD (or 3.8 trillion RUB) were made (see Picture 1).

Latest available figures show that 230 transactions at the amount of 31 billion USD (1.9 trillion RUB) were made in Q1-Q3 of 2018. According to tentative forecast for 2018 (taking into account the results of Q4), total amount of transactions will be 42 billion USD (2.6 trillion RUB) that is 20% less than in 2017.

Picture 1. Volume and number of M&A transactions on the Russian market, including domestic

Picture 1. Volume and number of M&A transactions on the Russian market, including domesticTable 1 contains the largest M&A transactions in Russia for Q1-Q3 of 2018. It is noteworthy that takeover JSC Promsvyazbank by the State Corporation Deposit insurance agency was a necessary measure aimed at avoiding the collapse of one of the leading commercial banks in Russia. The situation is similar with JSC Binbank , restored by the Central Bank of Russia. On January 1, 2019, Binbank was joined to FC Otkritie .

Major trends on the Russian M&A market are as follows:

- the state policy on localization of production within the country and relatively low prices for assets and operating expenses make domestic companies attractive for cross-border M&A transactions in the future;

- further consolidation of domestic assets by large corporations and the state;

- domestic business will continue to search for opportunities for international development, especially in the resource-rich regions of North Africa, Middle East and Latin America;

- low economic growth and consumer demand will continue to have a negative impact on the dynamics of M&A transactions.

| № | Sector | Objest | Sellers | Acquirers | Package | Amount, million USD | Format |

| 1 | Financial institutions | JSC Promsvyazbank | Alexey Ananyev and Dmitriy Ananyev, other minor shareholders | Deposit insurance agency | 24,99% | 4 250 | Domestic |

| 2 | Construction and real estate | Stroigazkonsalting group of companies | United Capital Partners (USP) | Gazprombank group | 50% | 2 882 | Cross-border |

| 3 | Communications | Wind Tre (Italy) | Veon (parent company of JSC Vimpelcom) | CK Hutchison (Hong Kong) | 50% | 2 867 | Cross-border |

| 4 | Trade | JSC Magnit | Sergey Galitskiy | JSC VTB Bank | 29,1% | 2 410 | Domestic |

| 5 | Transport | LLC MODUM-TRANS (former LLC UVZ-Logistik) | JSC NPK Uralvagonzavod | Invest-Logistika | 100% | 2 120 | Domestic |

| 6 | Food industry and retail trade | Agrokor | Government of Croatia | JSC Sberbank JSC VTB | 39,2% 7,5% |

1 633 | Cross-border |

| 7 | Food industry | JSC Donskoy tabak | Agrokom group, Ivan Savvidi | Japan Tobacco (Japan) | 100% | 1 600 | Cross-border |

| 8 | Financial institutions | JSC Binbank | Mikhail Shishkhanov (67,97%), Mikhail Gutseriev (28,49%), other minor shareholders | Central Bank of the Russian Federation | 99,99% | 994 | Domestic |

| 9 | Mining operations | LLC GDK Baimskaya | Millhouse Capital (owned by Roman Abramovich) | Kaz Minerals (Kazakhstan) | 100% | 900 | Cross-border |

| 10 | Construction and development | JSC SEZ Production and industrial type Alabuga and JSC SEZ Innopolis | JSC Special economic zones | Ministry of Land and Property of the Republic of Tatarstan | 100% | 569 | Domestic |

| Top-10 | 20 225 | ||||||

M&A market is dynamic, and reacts quickly to global economic processes. Under the conditions of instability of the world economy and various restricted measures outside the WTO framework, mistrust between participants of economic processes is growing. That results in decrease in the number of mergers and acquisitions. Whether the idea of globalization becomes an illusion or is transformed into something new, the near future will show.