Globas one of the leaders of Russian information and analytical systems

RAEX-Analytics rating contains 32 information and analytical systems for counterparties check.

Estimation criteria include information fullness, functional capabilities, frequency of media references and experts opinion.

Business analysts, chief financial officers, risk managers, security specialists and journalists were invited as experts.

All experts chose Globas according to the criteria of fullness and service capabilities, and praised it for convenience, relevance, analytical tools and the possibility of widespread use: from assessing the security of cooperation with the company to identification of beneficiaries and ultimate owners, as well as performing macroeconomic and marketing research.

A novelty in the rating methodology was a survey of participants about their views on the capabilities and advantages of other systems.

| No. | Information and analytical systems | Rating number | Information fullness, score | Functional and service capabilities, score | Acknowledgment and media references, score | Expert opinion, score |

| 1 | Spark-iNTERFAX | 92,54 | 5,0 | 5,0 | 5,0 | 4,8 |

| 2 | Kontur Focus | 74,18 | 3,0 | 3,8 | 5,0 | 4,6 |

| 3 | Globas (Credinform) | 63,12 | 3,5 | 3,2 | 2,4 | 4,3 |

| 4 | BIR Analitik | 56,83 | 3,2 | 2,3 | 3,9 | 2,8 |

| 5 | SBIS | 55,73 | 2,1 | 2,7 | 4,7 | 3,0 |

| 6 | Delta Security | 54,24 | 3,3 | 3,1 | 1,1 | 3,9 |

| 7 | CaseBook | 54,07 | 2,2 | 3,1 | 2,8 | 3,7 |

| 8 | Seldon.Basis | 54,00 | 3,1 | 1,8 | 3,0 | 3,8 |

| 9 | Kommersant Kartoteka | 53,73 | 2,8 | 2,7 | 2,2 | 3,9 |

| 10 | RUSPROFILE | 52,07 | 2,1 | 1,9 | 4,8 | 2,8 |

| 11 | Integrum.Companies | 51,63 | 2,9 | 2,7 | 1,9 | 3,3 |

| 12 | Honest Business | 42,60 | 1,3 | 1,8 | 4,2 | 2,5 |

| 13 | RUSLANA | 40,63 | 2,3 | 2,8 | 1,3 | 2,1 |

| 14 | TASS Business | 40,62 | 2,2 | 2,3 | 1,2 | 2,8 |

| 15 | SberKorus | 40,39 | 1,9 | 1,3 | 3,9 | 1,9 |

| 16 | Prima-Inform | 39,87 | 2,4 | 2,3 | 1,7 | 1,9 |

| 17 | SKRIN | 38,99 | 2,5 | 1,7 | 1,7 | 2,3 |

| 18 | Lik:Expert | 36,27 | 1,7 | 2,0 | 2,4 | 1,6 |

| 19 | Reputation | 32,09 | 1,6 | 1,4 | 1,8 | 2,3 |

| 20 | Moe Delo | 31,67 | 1,1 | 1,7 | 3,4 | 0,9 |

| 21 | Action.Checking counterparties | 31,01 | 1,1 | 1,1 | 3,3 | 1,4 |

| 22 | FIRA PRO | 30,09 | 2,5 | 1,4 | 1,2 | 0,9 |

| 23 | Birank | 28,45 | 2,5 | 1,8 | 0,6 | 0,6 |

| 24 | Sinaps | 26,56 | 0,8 | 0,4 | 2,4 | 2,7 |

| 25 | CREDITNET | 26,39 | 1,2 | 2,2 | 0,7 | 1,5 |

| 26 | Astral.Skrin | 25,89 | 1,8 | 0,0 | 2,7 | 1,1 |

| 27 | Rescore | 25,21 | 1,5 | 1,2 | 0,9 | 1,8 |

| 28 | FEK.RU | 24,86 | 2,4 | 0,3 | 1,4 | 0,9 |

| 29 | Chekko | 23,62 | 0,9 | 1,0 | 1,8 | 1,6 |

| 30 | Contragentio | 21,85 | 1,8 | 0,3 | 1,0 | 1,5 |

| 31 | Impuls | 21,45 | 1,2 | 1,5 | 0,1 | 1,6 |

| 32 | VBC. Checking counterparties | 20,77 | 1,3 | 0,5 | 2,5 | 0,0 |

Source: RAEX rating agency (“RAEX-Analytics”), March 2021

Globas contains all capabilities for prompt and proper analysis of business partners. It is used by economic security and compliance control services, economists, lawyers, marketing experts and analysts.

In 2021, we continue to improve comparison and analysis tools, add new sources to provide the highest quality service.

Today, relevant and credible information is valuable more than ever.

Activity of non-profit enterprises

At the moment there are more than 270 thousand of non-profit enterprises in Russia. Information agency Credinform presents a review of the activity trends of the largest of them. The largest companies (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2014 – 2019). Their selection and analysis were based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

ANO TV-Novosti, INN 7704552473, Moscow, engaged in radio broadcasting, had the largest net assets amounting to more than 18 billion RUB in 2019.

The lowest net assets value among TOP-1000 was recorded for private company OTS EF ENGLISH FIRST CIS, INN 7707082829, Moscow, engaged in other education of children and adults n.e.c. In 2019, insufficiency of property of the enterprise was indicated in negative value of -2,4 billion RUB.

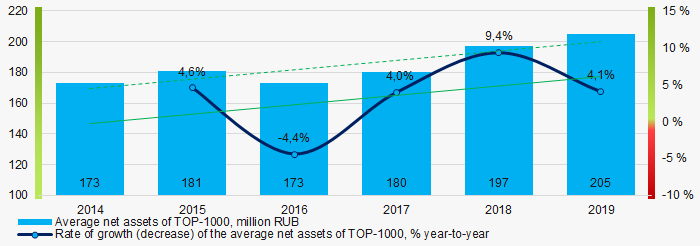

During six-year period, the average net assets values of TOP-1000 have a trend to increase, with the increasing growth rates (Picture 1).

Picture 1. Change in average net assets value in TOP-1000 in 2014 - 2019

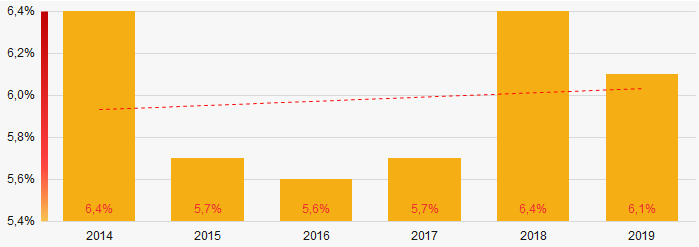

Picture 1. Change in average net assets value in TOP-1000 in 2014 - 2019The shares of TOP-1000 enterprises with negative net assets values had a negative trend to increase during last 6 years (Picture 2).

Picture 2. Shares of TOP-1000 organizations with insufficient property in 2014 - 2019

Picture 2. Shares of TOP-1000 organizations with insufficient property in 2014 - 2019Sales revenue

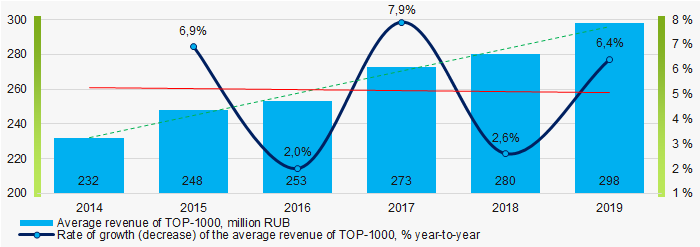

The largest TOP-1000 company in 2019 in term of revenue amounting to more than 342 billion RUB is The Roscongress Foundation, INN 7706412930, Moscow, organisation of conventions and trade shows.

In general, there is a trend to increase in revenue with decreasing growth rates (Picture 3).

Picture 3. Change in average revenue of TOP-1000 in 2014– 2019

Picture 3. Change in average revenue of TOP-1000 in 2014– 2019Profit and loss

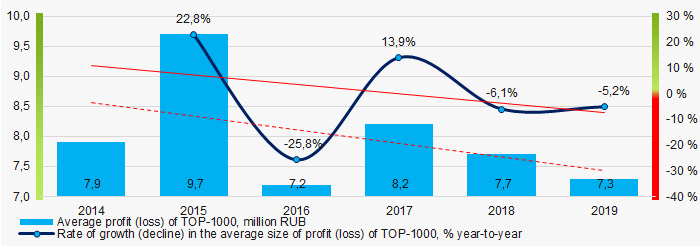

The largest company in 2019 in term of net profit amounting to 661 billion RUB is The Roscongress Foundation as well.

During six-year period, the average profit figures have a trend to decrease with decreasing growth rates (Picture 4).

Picture 4. Change in average profit (loss) of TOP-1000 companies in 2014- 2019

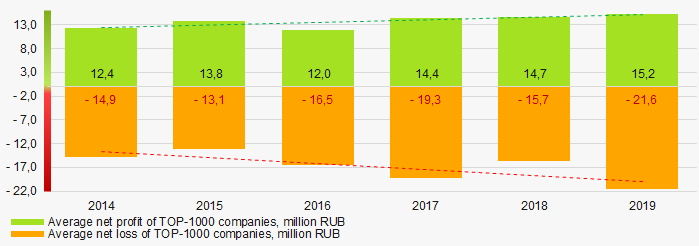

Picture 4. Change in average profit (loss) of TOP-1000 companies in 2014- 2019During six-year period, the average net profit figures of TOP-1000 companies have a trend to increase with the increasing average net loss (Picture 5).

Picture 5. Change in average net profit and net loss of ТОP-1000 companies in 2014 – 2019

Picture 5. Change in average net profit and net loss of ТОP-1000 companies in 2014 – 2019Key financial ratios

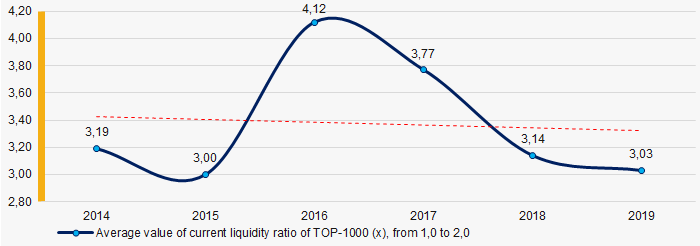

During six-year period, the average values of the current liquidity ratio of TOP-1000 companies were above the recommended one – from 1,0 to 2,0, with a trend to decrease. (Picture 6).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 6. Change in average values of current liquidity ratio of TOP-1000 in 2014 – 2019

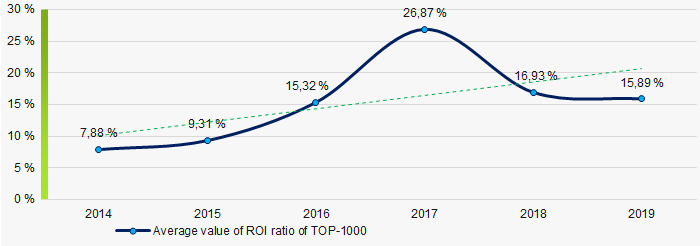

Picture 6. Change in average values of current liquidity ratio of TOP-1000 in 2014 – 2019During six years, the average ROI values had a trend to increase (Picture 7).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 7. Change in average values of ROI ratio of TOP-1000 in 2014– 2019

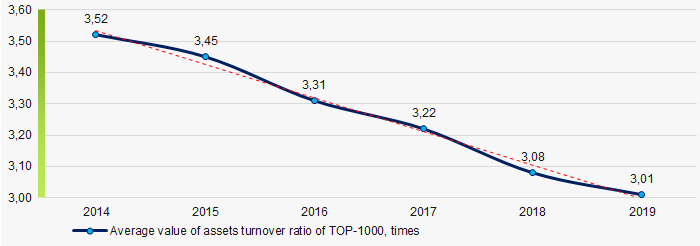

Picture 7. Change in average values of ROI ratio of TOP-1000 in 2014– 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

During the six-year period, there was a trend to decrease of this ratio (Picture 8).

Picture 8. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2019

Picture 8. Change in average values of assets turnover ratio of TOP-1000 companies in 2014 – 2019Small enterprises

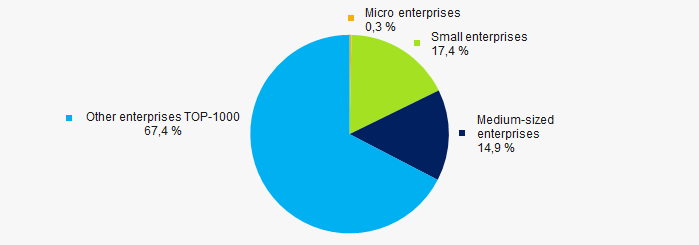

54% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in total revenue of TOP-1000 in 2019 amounts to almost 33%, which is significantly higher than the average country values in 2018 - 2019 (Picture 9).

Picture 9. Shares of small and medium-sized enterprises in TOP-1000

Picture 9. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

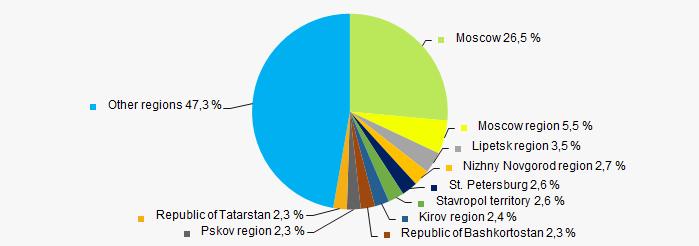

Companies of TOP-1000 are registered in 75 regions of Russia, and unequally located across the country. 32% of largest by revenue companies consolidate in Moscow and Moscow region (Picture 10).

Picture 10. Distribution of TOP-1000 revenue by the regions of Russia

Picture 10. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

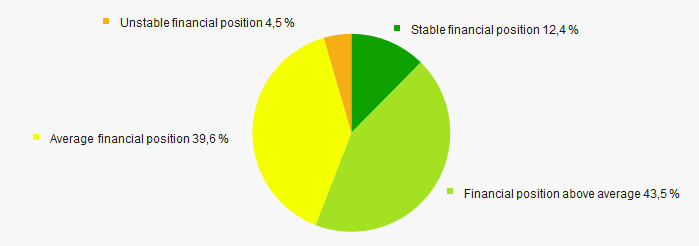

According to the assessment, the financial position of most of TOP-1000 companies is above average (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score

Picture 11. Distribution of TOP-1000 companies by financial position score Solvency index Globas

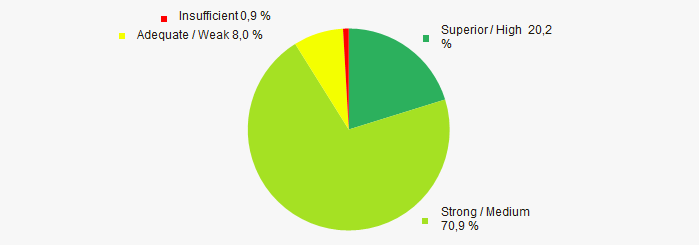

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the TOP-1000 non-profit enterprises, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in their activity in 2014 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factor, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  0,3 0,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)