Billions for small business

In 2017 1,3 mln contracts at total volume of 975 bln RUB were executed with small businesses.

The volume of contracts with small businesses (SMEs) is amounted a little over 15% of total cost of contracts executed for the reporting period (6 320 bln RUB) that corresponds to legislative regulation obliging governmental customer to place procurements with SMEs.

The number of contracts with small businesses increased by 12% and their cost — by 27% compared to 2016. Average price of contract executed with small and medium enterprises (SMEs) in 2017 amounted to 741 th RUB and increased by 28% compared to 2016.

The increase in rates of budget allocation to small businesses through contract system remains this year: 241 thousand contracts at total amount of 147 bln RUB are executed in the 1st quarter of 2018; that is more than in the similar period of the past year by 30% of the amount and 40% of the number.

Almost half of budget funds allocated for procurements with small business is accumulated in 10 regions.

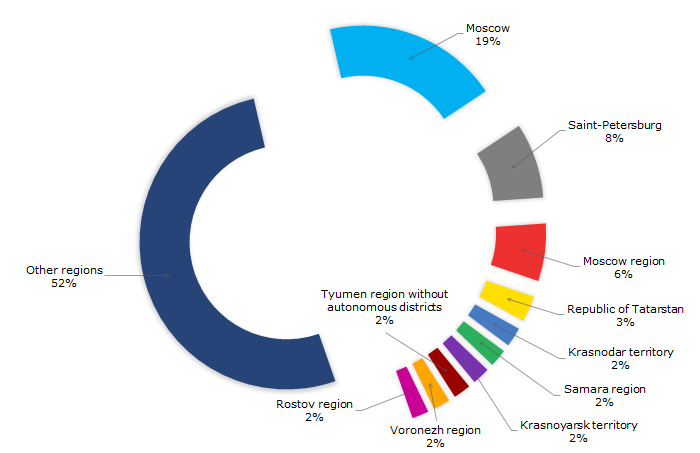

The majority of procurements placed with small businesses is located in Moscow. The capital leads among all regions in terms of small business financing through contract system — 222 bln RUB or 19% of total value of procurements in 2017. Saint-Petersburg follows next with a noticeable lag and 95 bln RUB (8%). Moscow region with 73 bln RUB (6%) closes the top three. Totally 556 billion or 48% of the total procurement value was accounted for Top-10 regions (see Picture 1).

Picture 1. Total value of procurements placed with SMEs, by regions of RF, 2017, in %

Picture 1. Total value of procurements placed with SMEs, by regions of RF, 2017, in %A third of all procurements placed with SMEs is connected with construction activity.

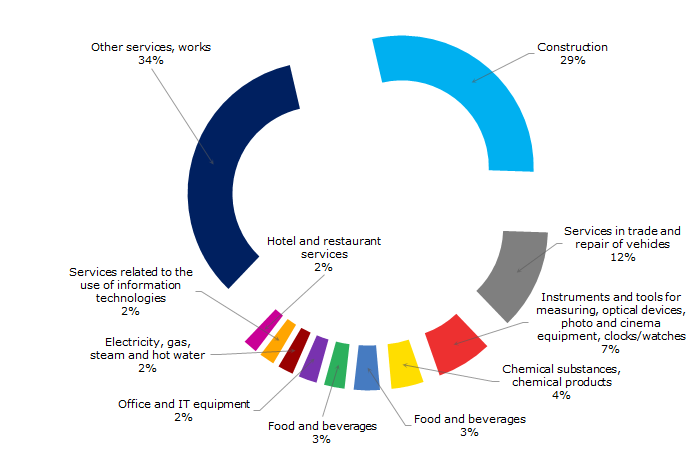

Construction is most-coveted service for governmental or municipal customers — 30% of procurements are related to this activity. The share of repair of vehicles is 12%, and 10% of total procurements value falls for other activities (see Picture 2).

Picture 2. Most common types of activity by total value of procurements placed with SMEs, 2017, in %

Picture 2. Most common types of activity by total value of procurements placed with SMEs, 2017, in %The maximum price of the current contract, executed with a small enterprise, exceeded 10 bln rubles.

Among the small businesses, there are organizations which executed contracts on more than 1 bln RUB.

The small enterprise LLC Spetstrans providing services for processing of solid domestic waste in the North-West administrative district of Moscow executed the contract at 12,4 bln RUB (see Table 1). The microenterprise Tehnostroy LLC undertakes to accomplish construction of a highway bypassed Pskov until December 16, 2019. The contract price is 6,8 bln RUB.

| Rank | Supplier | Customer | Contract №, scope | Contract price, bln RUB | Contract status |

| 1 | SPETSTRANS, LLC Small enterprise |

MOSEKOPROM | 1774370937515000007 Date of contract 29.12.2014 Services for processing of solid household waste in the North-West Administrative District of Moscow |

12,4 | Execution to 25.12.2029 |

| 2 | TEHNOSTROY, LLC Microenterprise |

STATE COMMITTEE OF PSKOV REGION ON TRANSPORT | 2602708751416000028 Date of contract 18.07.2016 Construction of a public road of regional significance Northern bypass of Pskov (2nd launch complex) |

6,8 | Execution to 16.12.2019 |

| 3 | TEHNOSTROY, LLC Microenterprise |

DEPARTMENT OF SAINT-PETERSBURG-MURMANSK MOTORWAY | 1100111701018000068 Date of contract 04.06.2018 Maintenance of federal general-purpose highway Р-21 “Kola” on a site 451 + 365 km, 1070 + 806 km |

2,8 | Execution to 30.07.2023 |

| 4 | KOMPLEKSSTROY, LLC Microenterprise |

STATE BUDGETARY INSTITUTION OF MOSCOW “AUTIO ROADS” | 2772765679018000147 Date of contract 26.03.2018 Supply of materials for asphalt-concrete and concrete plants of the State Unitary Enterprise “Automobile roads” in 2018 |

2,5 | Execution to 31.12.2018 |

| 5 | DORTRANSSTROY, LLC Small enterprise |

DEPARTMENT OF DEVELOPMENT OF NEW TERRITORIES OF MOSCOW | 2770481244217000237 Date of contract 16.11.2017 Construction of Ostafievskoe highway |

2,4 | Execution to 30.11.2019 |

| 6 | ILION, LLC Small enterprise |

MOSCOW ANALYTICAL CENTER IN THE SPHERE OF URBAN ECONOMY | 0373200608514000004 Date of contract 28.03.2014 Implementation of project documentation for creation of a unified navigation system in Moscow |

1,9 | Execution to 31.12.2018 |

| 7 | PROJECT SUPPORT, LLC Small enterprise |

DEPARTMENT OF INFORMATION TECHNOLOGIES OF MOSCOW | 2771087800018000049 Date of contract 13.04.2018 Services for installation and configuration of software providing access for educational institutions of Moscow to the electronic educational environment (second priority) |

1,9 | Execution to 01.05.2024 |

| 8 | SK INTEG, LLC Small enterprise |

DEPARTMENT OF CAPITAL CONSTRUCTION OF THE SVERDLOVSK REGION | 2666100455917000055 Date of contract 28.11.2017 Construction and installation works on the project: “Maternity home with women’s consultation and pregnancy pathology department, Verkhnyaya Pyshma” |

1,7 | Execution to 31.12.2019 |

| 9 | LLC TEHNOSTROY Microenterprise |

DEPARTMENT OF MOSCOW-BOBRUYSK MOTORWAY | 1672500081017000047 Date of contract 18.04.2017 Execution of major overhaul of the existing network of federal general-purpose highway |

1,7 | Execution to 01.12.2018 |

| 10 | KOMSTROY, LLC Small enterprise |

MOSKOLLEKTOR | 2770800088218000017 Date of contract 29.12.2017 Services on operation of low-current systems of collector facilities of State Unitary Enterprise “Moskollektor” |

1,6 | Execution to 31.12.2020 |

The maximum price of the current contract, executed with an individual entrepreneur, does not exceed 100 mln RUB.

Individual entrepreneurs (hereinafter IE) actively participate in the procurement system. Although the maximum volume of contracts in force is significantly inferior to contracts concluded with SMEs. However the contract system has become an essential component in maintaining the financial well-being of small businesses and a source of «long» money. The maximum value of contract with IE is 99 mln RUB (see Table 2).

| Rank | Supplier | Customer | Contract №, scope | Contract price, mln RUB | Contract status |

| 1 | IE Zatsepin Alexander Leonidovich | RF MINISTRY OF DEFENSE | 1770425226117001183 Date of contract 14.11.2017 Services for transportation of servicemen participating in the Victory Parade in 2018 and during mass events for the needs of the Russian Defense Ministry in 2017 and 2018 |

99,0 | Execution to 31.12.2018 |

| 2 | IE Kremlev Denis Vladimirovich | DIRECTORATE OF CAPITAL CONSTRUCTION AND INVESTMENTS OF THE YAMAL-NENETS AUTONOMOUS DISTRICT | 2890101752618000032 Date of contract 26.04.2018 Execution of major repairs of the facility: "Infectious building of the district multi-profile hospital in Salekhard (second priority) |

74,2 | Execution to 18.01.2019 |

| 3 | IE Zatsepin Alexander Leonidovich | RF MINISTRY OF DEFENSE | 1770425226117001197 Date of contract 16.11.2017 Services for transportation of servicemen participating in the Victory Parade in 2018 and during mass events for the needs of the Russian Defense Ministry in 2018 |

73,0 | Execution to 31.12.2018 |

| 4 | IE Andreev Vladislav Alexandrovich | ROAD SAFETY CENTER OF ROSTOV REGION | 2616712165218000013 Date of contract 13.04.2018 Provision of services to ensure the operation of hardware and software complexes of traffic infraction video recording |

59,1 | Execution to 31.12.2018 |

| 5 | IE Nesterov Boris Alekseevich | DEPARTMENT OF AFFAIRS OF THE VORONEZH REGION | 0131200001214000120 Date of contract 06.11.2014 Non-residential lease |

54,7 | Execution to 31.12.2019 |

| 6 | IE Vorobyeva Oksana Vladislavovna | VOSNESENSKIY BOARDING HOUSE FOR ELDERLY AND DISABLED PEOPLE | 2471100226718000015 Date of contract 05.02.2018 Repair of the catering place, laundry and building 1 and 2 floors in the Leningrad Regional State Budget Organization “Voznesensky D” in 2018 |

48,6 | Execution to 31.12.2018 |

| 7 | IE Vorobyeva Oksana Vladislavovna | BUDOGOSCHSKY PSYCHONEUROLOGICAL HOUSE | 2470800541218000040 Date of contract 04.06.2018 Works on the repair of the dormitory building № 1 (1-2 floor and PKO) of the Leningrad Regional State Budget Organization “Budogoschsky psychoneurological house” |

45,2 | Execution to 31.12.2018 |

| 8 | IE Mitin Vladimir Zelimovich | MOSKOMARHITEKTURA | 2771014558918000006 Date of contract 13.02.2018 Rental services of passenger cars with driver |

36,6 | Execution to 31.12.2018 |

| 9 | IE Sashin Alexander Borisovich | NOVY URENGOI CENTRAL CITY HOSPITAL | 2890401271017000762 Date of contract 18.12.2017 Provision of motor transport services |

29,2 | Execution to 31.12.2018 |

| 10 | IE Vlasov Boris Viktorovich | VOLGOGRAD REGIONAL CLINICAL CARDIOLOGY CENTER | 2344390133818000103 Date of contract 10.05.2018 Supply of consumables for the implantation of pacemakers |

18,5 | Execution to 31.12.2018 |

Since the 1st of July, 2018 amendments to the law came into force following the Government Decree as of April 12, 2018 N 439.

Having freed up small purchases worth up to 1 mln RUB from the need for security, the law now obliges participants in large procurements to place contract security in special accounts with accredited banks.

Following the changes in the legislation, it is necessary to expect a shift in the activity of SMEs towards small purchases, an increase in the number of competing participants, and, in view of the facilitated procedure for participation in small purchases, the need for companies to be checked for solvency and reliability.

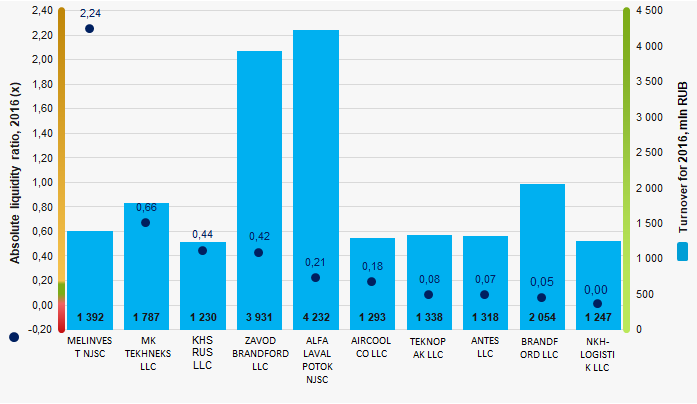

Absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry

Information agency Credinform represents the ranking of the largest Russian manufacturers and suppliers of equipment for the food industry. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2014-2016). Then they were ranked by the absolute liquidity ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Absolute liquidity ratio (х) is calculated as the ratio of the amount of cash, being at the disposal of a company, to short-term liabilities. It determines the share of short-term liabilities, which an enterprise can pay off in the near future. The recommended value is from 0,1 up to 0,15. The higher is the indicator, the better is the solvency of an enterprise.

However, a too high value of the ratio may indicate an irrational capital structure and unused assets in the form of cash and funds on accounts that, over time and as a result of inflation, depreciate and lose their initial liquidity.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry.

For manufacturers and suppliers of equipment for the food industry the industry average practical values of the absolute liquidity ratio made in 2016 from 0,01 up to 0,34 and 0,37, respectively.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region, type of activity | Revenue, mln RUB | Net profit, mln RUB | Absolute liquidity ratio (x) | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| MELINVEST NJSC INN 5257003490 Nizhny Novgorod region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 401 1 401 |

1 392 1 392 |

169 169 |

137 137 |

1,24 1,24 |

2,24 2,24 |

180 High |

| MASHINOSTROITELNAYA KOMPANIYA TEKHNEKS LLC INN 6678049565 Sverdlovsk region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 156 1 156 |

1 787 1 787 |

68 68 |

156 156 |

0,78 0,78 |

0,66 0,66 |

169 Superior |

| KHS RUS LLC INN 7706502693 Moscow Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 114 1 114 |

1 230 1 230 |

95 95 |

91 91 |

0,28 0,28 |

0,44 0,44 |

211 Strong |

| ZAVOD BRANDFORD LLC INN 4401143067 Kostroma region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

2 375 2 375 |

3 931 3 931 |

348 348 |

372 372 |

0,05 0,05 |

0,42 0,42 |

198 High |

| ALFA LAVAL POTOK NJSC INN 5018035564 Moscow region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

6 064 6 064 |

4 232 4 232 |

174 174 |

55 55 |

0,20 0,20 |

0,21 0,21 |

245 Strong |

| AIRCOOL CO LLC INN 7825124257 St. Petersburg Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 498 1 498 |

1 293 1 293 |

75 75 |

50 50 |

0,22 0,22 |

0,18 0,18 |

230 Strong |

| TEKNOPAK LLC INN 7701372708 Moscow Wholesale of machinery and equipment for production of food, beverages and tobacco products |

50 50 |

1 338 1 338 |

2 2 |

13 13 |

0,48 0,48 |

0,08 0,08 |

258 Medium |

| ANTES LLC INN 5018023992 Moscow region Wholesale of machinery and equipment for production of food, beverages and tobacco products |

1 349 1 349 |

1 318 1 318 |

70 70 |

135 135 |

0,29 0,29 |

0,07 0,07 |

191 High |

| BRANDFORD LLC INN 4401045285 Kostroma region Manufacture of machinery and equipment for production of food, beverages and tobacco products |

1 389 1 389 |

2 054 2 054 |

2 2 |

118 118 |

0,00 0,00 |

0,05 0,05 |

229 Strong |

| NKH-LOGISTIK LLC INN 5257154509 Nizhny Novgorod region Wholesale of machinery and equipment for production of food, beverages and tobacco products |

48 48 |

1 247 1 247 |

2 2 |

31 31 |

0,00 | 0,00 | 260 Medium |

| Total by TOP-10 companies |  16 444 16 444 |

19 821 19 821 |

1 005 1 005 |

1 159 1 159 |

|||

| Average value by TOP-10 companies |  1 644 1 644 |

1 982 1 982 |

100 100 |

116 116 |

0,36 0,36 |

0,44 0,44 |

|

| Industry average value in the manufacture of machinery and equipment for production of food |  67 67 |

68 68 |

3 3 |

3 3 |

0,14 0,14 |

0,13 0,13 |

|

| Industry average value in the wholesale of machinery and equipment for production of food |  48 48 |

51 51 |

1 1 |

3 3 |

0,13 0,13 |

0,12 0,12 |

|

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

The average value of the absolute liquidity ratio of TOP-10 companies in 2016 is higher than the recommended and practical intervals and above the industry average indicators.

Picture 1. Absolute liquidity ratio and revenue of the largest Russian manufacturers and suppliers of equipment for the food industry (TOP-10)

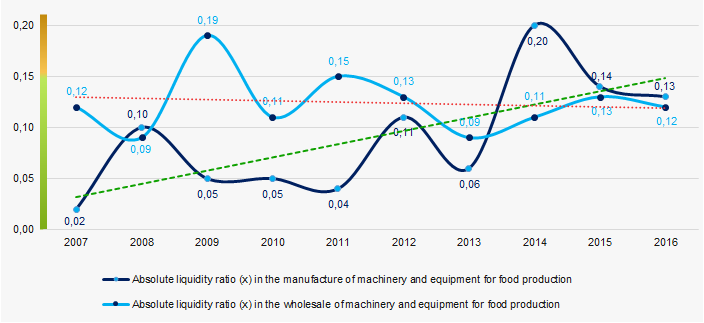

Picture 1. Absolute liquidity ratio and revenue of the largest Russian manufacturers and suppliers of equipment for the food industry (TOP-10)Over the course of 10 years, the industry average indicators of the absolute liquidity ratio in the manufacture of machinery and equipment for food production tend to increase, and in the wholesale of machinery and equipment for food production — to decrease (Picture 2).

Picture 2. Change in the industry average values of the absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry in 2007 — 2016

Picture 2. Change in the industry average values of the absolute liquidity ratio of the largest Russian manufacturers and suppliers of equipment for the food industry in 2007 — 2016