Profitability of sales of the chocolate manufacturers

Information Agency Credinform has prepared the ranking of the companies, engaged in manufacture of chocolate and chocolate products.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the companies were ranged by decrease in profitability of sales.

Profitability of sales (%) shows the share of operating profit in the sales volume of the company, in other words – the profit share in each earned ruble. Usually it is calculated as a ratio of net profit (profit after tax) for a certain period to sales volume (in monetary terms) for the same period. The recommended values are different, depending on the industry.

Profitability of sales ratio characterizes the efficiency of the industrial and commercial activity and shows the net profit from each ruble of sales. In other words, the company’s funds, which remained, after covering the cost of production, interest and tax payments. The ratio characterizes the most important aspect of company’s activity – the sales of main production, and also allows to estimate the share of prime cost in the sales.

Profitability of sales is an indicator of the company’s price policy and shows its ability to control the expenses. The ratio is often used for assessment of company’s operational efficiency. However it should be taken into account, that at equal values of revenue, operational expenses and profit before tax, the profitability of sales ratio of two companies can be significantly different, due to the influence of interest payments on net profit.

It should be noted, that the profitability of sales ratio doesn’t consider the planned effect from long-term investment. For example, when the profit-making organization start using new advanced technologies or types of production, that require large investment, the profitability of sales ratio may temporarily decrease. However, if the strategy was chosen correctly, the expenditures will be repaid in the future, and in that case, the decrease in profitability of sales in the reporting period doesn’t mean the low company’s efficiency.

| № | Name | Region | Revenue, mln. rubles, 2013 | Profitability of sales, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC CONFECTIONARY CONCERN BABAYEVSKY INN 7708029391 |

Moscow | 8 053,5 | 17,9 | 164 the highest |

| 2 | MARS LLC INN 5045016560 |

Moscow region | 72 262,0 | 15,5 | 175 the highest |

| 3 | CJSCFerrero Russia INN 5044018861 |

Vladimir region | 25 665,4 | 15,3 | 162 the highest |

| 4 | ROSHEN LTD. INN 4824033114 |

Lipetsk region | 14 698,3 | 14,0 | 209 high |

| 5 | JSC KRASNYJ OCTYABR INN 7706043263 |

Moscow | 9 078,0 | 13,8 | 145 the highest |

| 6 | KONTI-RUS CJSC INN 4629046141 |

Kursk region | 13 099,0 | 13,5 | 206 high |

| 7 | JSC ROT FRONT INN 7705033216 |

Moscow | 8 947,2 | 6,4 | 152 the highest |

| 8 | MON'DELEZ RUS LLC INN 3321020710 |

Vladimir region | 55 301,1 | 5,6 | 240 high |

| 9 | LLC NESTLE ROSSIYA INN 7705739450 |

Moscow | 86 179,0 | 4,8 | 271 high |

| 10 | OJSC ORKLA BRANDS RUSSIA INN 7830000190 |

Belgorod region | 8 025,0 | -9,1 | 317 satisfactory |

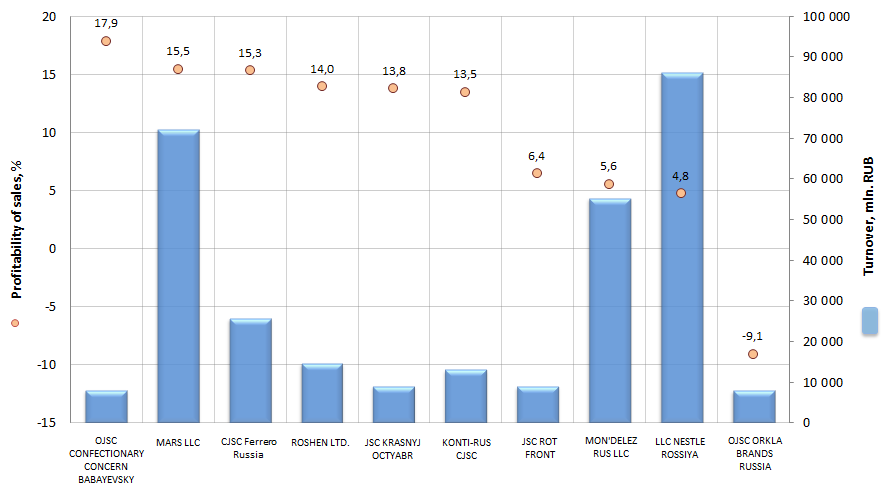

Picture 1. Profitability of sales and revenue of the largest enterprises, engaged in manufacture of chocolate products (Top-10)

Manufacture of chocolate in Russia becomes unprofitable due to the devaluation of ruble and the restrictions on import of raw materials. Because of these facts, chocolate manufacturers are in difficult circumstances, some enterprises might even suspend their production.

The market experts note, that manufacture of chocolate in Russia by not less than 60% depends on import ingredients. Because of the devaluation of ruble, the cocoa products cost for enterprises, engaged in manufacture of chocolate, increased by more than 50% within a year. The experts also note, that the food embargo, imposed in August 2014, has also influenced on the prime cost of chocolate production, as it affected on supplies of nuts and dried fruits from the European Union countries, the USA, Canada, Australia and Norway.

Besides, the price of other raw materials, which are used for chocolate production, has increased at the same time. These, in particular, are sugar and dairy products, the share of which in the prime cost structure is 14% and 25% respectively.

The average customer price of 100 grams of chocolate in Russia increased by 38% within a year – from 49,1 RUB. (March 2014) to 62,1 RUB. (March 2015)

In February 2015 «KRASNYJ OCTYABR» and «BABAYEVSKY» already announced about the possible increase in prices for its products due to the rise in prices for imported raw materials. In November 2014 «BABAYEVSKY» admitted the possibility of stoppage in production of some sweets because of food embargo.

The annual revenue of the largest manufacturers, engaged in production of chocolate products (Top-10), according to the data for the latest available financial statements (for the year 2013) is amounted to 301,3 bln. RUB., the growth - 9,3%.

The highest ratio value in terms of revenue among the largest chocolate manufacturers in Russia have the following enterprises: OJSC CONFECTIONARY CONCERN BABAYEVSKY (17,9%), MARS LLC (15,5%) and CJSC Ferrero Russia (15,3%).

CONFECTIONARY CONCERN BABAYEVSKY – is the oldest enterprise in Russia and the part of Holding company United confectioners; it manufactures such well known types of sweets and chocolate as: Belochka Babaevskaya, Mishka, Visit, chocolate Vdohnovenie.

Mars LLC started its business in the Russian market in 1991 and in 1995 opened its first plant – the plant for production of chocolate in Stupino, Moscow region. However, in addition to production of chocolate, chewing gum and other confectionery in 4 Russian regions, Mars LLC also manufactures pet food. Within two decades Mars Incorporated has invested in the Russian market more than 1 bln. USD.

CJSC Ferrero Russia is the Russian subdivision of Ferrero Group of companies. Ferrero entered the Russian market in 1995 and introduced 5 leading brands: Raffaello, Kinder Chocolate, Kinder Surprise, Nutella and Tic Tac. The company’s production is represented in more than 100 Russian cities. The combined share of Ferrero (in monetary terms) in Russia amounted to 15,7% in those market segments, where Ferrero production is represented (including packaged chocolate, biscuits, chilled snacks, chocolate paste and refreshing dragee).

9 out of 10 participants from the Top-10 list have the highest and high solvency index, that shows the ability of enterprises to meet their obligations in time and fully; the risk of unfulfillment is low.

The Ministry of Economic Development of the Russian Federation forecasted the partial rescinding of sanctions in 2016

The Ministry of Economic Development of the Russian Federation has prepared the optimistic script of economic development in 2015-2018. According to the forecast, the economic growth by 2,7-3,3% per year can be already expected in the next year; that is significantly higher than in the basic script, according to which the growth of GDP won’t be higher than 2,5% in the coming years.

The optimistic script was created on the basis of the following prerequisites: the oil prices in 2016-2018 will rise to 70-90 USD per barrel and the economic sanctions against Russia will be partially rescinded already in 2016. At the same time, the Head of the Ministry Aleksey Ulukaev noted, that the effect from additional measures of the government economic policy was also taken into account.

Besides, the favorable course of events assumes the growth of investment into equity, industrial production, actual earnings and labor efficiency from the next year. At the same time, the inflation will decrease from 11,6% in 2015 to 4,8% in 2018.

However it should be noted, that even the offered optimistic plan assumes, that Russia will fall behind the world economy by growth rates in the coming years. Thus in 2016-2018, depending on the scripts, offered by The Ministry of Economic Development of the Russian Federation, Russia will grow by 7,6-9,3%, at the worldwide average growth of 12,2%.

At the same time, the Ministry of Finance of the Russian Federation, another relevant department, considers that even the basic script, offered by the Ministry of Economic Development of the Russian Federation, is too optimistic. According to the Ministry’s forecast, the GDP dynamics over the next few years won't exceed 1,5%, while the projected oil price will be 60-70 USD per barrel by 2018.

Deputy director of the Development Center of National Research University Higher School of Economics Valery Mironov notes, that both scripts are far from reality and don't correspond to the accumulated experience of the developing economies, which passed through the currency crises within the last 10 years. Mironov says, that, as a rule, the next year after the crisis, the economy grows on average by 0,5%. Valery Mironov also emphasizes, that the investments have been starting to reduce two years prior to December devaluation, and he doesn't see the prerequisites for their growth in the coming years.

However some experts think that the improvement of forecasts is reasonable, as the results of the first quarter were better than expected.