Shadow-fighting

Under its Transparent Business project, the Federal Tax Service has disclosed information about 2.5 million out of 4.2 million active legal entities. This data was formerly considered a tax secrecy.

Almost 40% of Russian companies stayed in the shadow.

Since August 2018, the Federal Tax Service has started to publish data that is not a tax secrecy anymore. This information is available only concerning legal entities, excluding major taxpayers, defense and strategic enterprises. Data concerning the latter are to be disclosed in 2020.

Information disclosed is relevant as of December 31, 2017.

Average number of employees

Companies are to give an account of their last year’s average number of employees to tax authorities (Paragraph 3 Article 80 of the Tax Code of the Russian Federation). This information is to be provided by all enterprises whether or not they perform actual activity or in fact have employees.

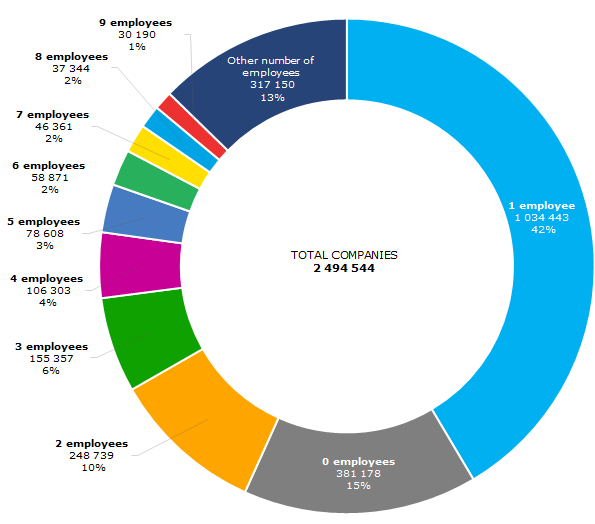

42% (or over one million) of companies that provided reports, have only one employee, and 15% of enterprises do not have staff at all (see Picture 1).

Absence of staff or a number that is obviously insufficient for activity increases the risk of the company to turn out to be a shell company or an abandoned business. However, there are other reasons:

- Aspects of record keeping: only full-time employees are included in the data of the Federal Tax Service, whereas a significant part of Russian companies has contractor or secondary employment agreements with their employees. In addition, the employees on maternity or educational leave are not included in the data.

- Tax minimization: wage bill has the burden of social security contributions, so the employers do not get full-time employees.

- Nature of activities: these days a company can be competitive and even successful without a large number of employees. Tasks are transferred to subcontractors, and the company’s director just coordinates the work.

- Errors: disclosed information is provided by legal persons themselves. The Federal Tax Service recommends that they “provide error-correcting reports with valid data without delay”. An example is EXPRESS LLC. On August 1, 2018 when the data was published, the company had 698,000 employees. For comparison, Russian Railways, the largest Russian employer, employs 737,000 people.

Picture 1. Companies by average number of employees according to the Federal Tax Service, as of 31.12.2017

Picture 1. Companies by average number of employees according to the Federal Tax Service, as of 31.12.2017Total income and expenditure

Data concerning total income and expenditure is provided from financial accounts. 2.5 million companies provided this information to the Federal Taxation Service.

Total income = revenue + income from participation in other companies + interest receivable + other income.

Total expenditure = cost of sales + selling and marketing expenses + administrative expenses + interest payable + other expenses.

In case of lack of balance sheet, this data gives an overview of size of business, and if the financial account is available – it can be used for additional comparison and check of figures from official sources, as they sometimes contain errors.

In particular, financials of ADAM-S LLC: a1b99439d89e raise doubts: this company from Ingushetia reported the Federal Taxation Service to have revenue of 122 trillion rubles, at the same time a revenue of 121 million rubles is stated in the balance sheet.

Paid taxes and fees

Total taxes and fees paid by the company during the calendar year, excluding total taxes and fees paid for import to the customs territory of the Eurasian Economic Union (EEU), are to be included.

2.1 million companies disclosed this information. Minimum taxes paid indicate that the company does not perform business activity. For example, DIAMANT LLC .36 ruble of taxes to all budgets in 2017

See the statistics of types of paid taxes and their regional distribution below.

2.2 trillion rubles or 39% of all taxes paid by companies is VAT. Insurance contributions for compulsory pension insurance are ranked second with 1.3 trillion rubles, and the next one is profit tax – 1 trillion rubles (see Table 1).

Table 1. Total taxes paid by companies in 2017, by tax types

| Rank | Tax | Total paid taxes, billion rubles | Share of the tax in paid taxes, % |

| 1 | VAT | 2238 | 39 |

| 2 | Insurance and other contributions for compulsory pension insurance | 1316 | 23 |

| 3 | Profit tax | 958 | 17 |

| 4 | Insurance contributions for compulsory health insurance | 314 | 6 |

| 5 | Corporate property tax | 195 | 3 |

| - | Other taxes | 685 | 12 |

| Total | 5679 | 100 |

Moscow companies accumulate 35% of all paid taxes. Other regions are far behind the capital city. The ranking is to change after the disclosure of major taxpayers, especially in the regions in which fuel and energy companies are registered.

Table 2. Total taxes paid by companies in 2017, by regions

| Rank | Region | Total paid taxes, billion rubles | Share of the region in paid taxes, % |

| 1 | Moscow | 2002 | 35 |

| 2 | Saint Petersburg | 437 | 8 |

| 3 | Moscow region | 397 | 7 |

| 4 | Krasnodar territory | 198 | 3 |

| 5 | Republic of Tatarstan | 138 | 2 |

| - | Other regions | 2507 | 45 |

| Total | 5679 | 100 |

Special tax regimes

Special tax regime is set based on activity type, number of employees and company’s revenue. Legislation allows simultaneous application of several special tax regimes, and combination of some of them with general taxation system.

The Federal Tax Service published information concerning 1.9 million companies that apply special tax regime. Almost 90% of companies use Simplified Tax System (STS). 5% of companies combine STS with Unified Tax on Imputed Income (UTII) (see Table 3).

Table 3. Main types of special tax treatment used by companies in 2017.

| Unified Agricultural Tax | STS | UTII | Number of companies | Share of total number of companies that provided information about using special tax regime, % |

| + | 1734746 | 90 | ||

| + | + | 103802 | 5 | |

| + | 83923 | 4 | ||

| + | 14776 | 1 | ||

| Production sharing agreement and other combinations of tax treatment | 1329 | <0 | ||

Consolidated group of taxpayers

Consolidated group of taxpayers (CGT) is a voluntary alliance of companies created for payment of profit tax for total financial result of all group.

The group can be created if one company is a direct or indirect shareholder of others (share in each of them is not less than 90%).

Member of CGT is a company that is a party of an active agreement of creation of a consolidated group of taxpayers.

Responsible member of CGT is the member that, according to the agreement of creation of a consolidated group, has the duty to charge and pay profit tax of all companies of the group.

The Federal Tax Service disclosed data concerning 88 companies that are members of consolidated groups.

Summary

- Having disclosed this data about companies, the tax service has received a point in the dispute concerning its right to charge additional tax. In case of a tax dispute with a taxpayer the Federal Tax Service may appeal to availability of information concerning counterparties.

- Business community has received a new source of information about companies’ activities.

- Released data is an auxiliary tool, as an overall assessment of a company includes many other, no less important information, as well as a comprehensive analysis that is possible only by means of a professional Information and Analytical system.

On December 1, 2018 the Federal Tax Service plans to publish information about arrears, companies’ tax debts and data concerning tax violations. This information will help Globas users to assess a company’s tax burden and to avoid the risk of cooperation with an abusive taxpayer.

Return on assets of bus companies

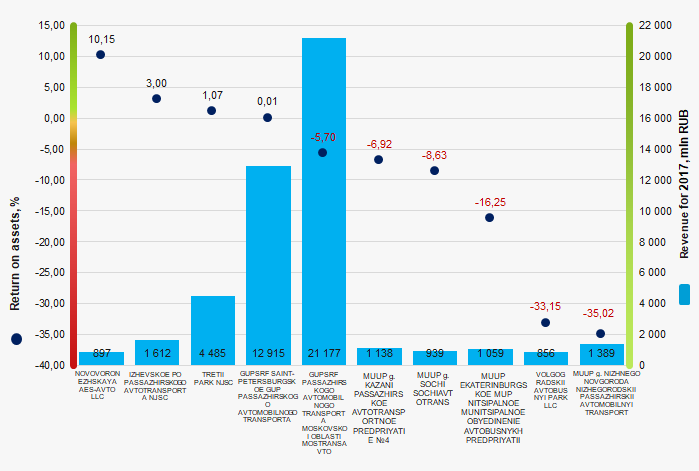

Information agency Credinform represents the ranking of the largest Russian bus companies. Vehicle companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by return on assets ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on assets (%) is the relation of the sum of net profit and interest payable to the total assets value of a company. It shows how many monetary units of net profit gets every unit of total assets

The ratio characterizes the effectiveness of using by the company of own resources and its financial management. That is why the higher is the ratio value, the more effective is business, that is the higher return per every monetary unit invested in assets.

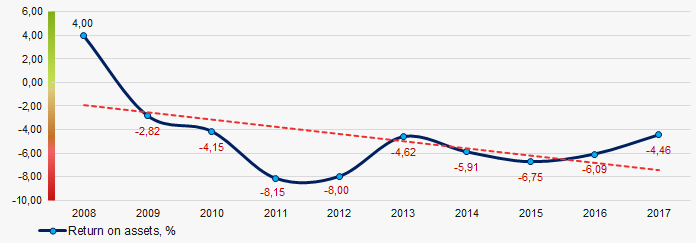

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For bus companies the practical value of the return on assets ratio is from -4,46.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, mln RUB | Net profit (loss), mln RUB | Retun on assets, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NOVOVORONEZHSKAYA AES-AVTO LLC INN 3651008478 Voronezh region |

485,6 485,6 |

897,3 897,3 |

19,8 19,8 |

68,1 68,1 |

3,42 3,42 |

10,15 10,15 |

208 Strong |

| IZHEVSKOE PROIZVODSTVENNOE OBYEDINENIE PASSAZHIRSKOGO AVTOTRANSPORTA NJSC INN 1833046700 Udmurtian Republic |

1648,2 1648,2 |

1612,3 1612,3 |

-19,1 -19,1 |

31,1 31,1 |

-2,35 -2,35 |

3,00 3,00 |

243 Strong |

| TRETII PARK NJSC INN 7814010096 St. Petersburg |

4020,0 4020,0 |

4485,1 4485,1 |

57,7 57,7 |

16,9 16,9 |

3,36 3,36 |

1,07 1,07 |

210 Strong |

| GUPSRF SAINT-PETERSBURGSKOE GUP PASSAZHIRSKOGO AVTOMOBILNOGO TRANSPORTA INN 7830001758 St. Petersburg |

11683,6 11683,6 |

12914,7 12914,7 |

239,9 239,9 |

1,1 1,1 |

2,00 2,00 |

0,01 0,01 |

202 Strong |

| GUPSRF PASSAZHIRSKOGO AVTOMOBILNOGO TRANSPORTA MOSKOVSKOI OBLASTI MOSTRANSAVTO INN 5000000017 Moscow region |

20708,0 20708,0 |

21177,4 21177,4 |

-2227,2 -2227,2 |

-1398,9 -1398,9 |

-8,42 -8,42 |

-5,70 -5,70 |

258 Medium |

| MUUP GORODA KAZANI PASSAZHIRSKOE AVTOTRANSPORTNOE PREDPRIYATIE №4 INN 1658007039 Republic of Tatarstan |

1106,6 1106,6 |

1138,2 1138,2 |

0,2 0,2 |

-11,3 -11,3 |

0,12 0,12 |

-6,92 -6,92 |

272 Medium |

| MUUP GORODA SOCHI SOCHIAVTOTRANS INN 2320051015 Krasnodar territory |

784,8 784,8 |

939,1 939,1 |

-304,9 -304,9 |

-149,8 -149,8 |

-16,76 -16,76 |

-8,63 -8,63 |

311 Adequate |

| MUUP EKATERINBURGSKOE MUP NITSIPALNOE MUNITSIPALNOE OBYEDINENIE AVTOBUSNYKH PREDPRIYATII INN 6659001670 Sverlovsk region In process of reorganization in the form of accession, 04.09.2018 |

944,1 944,1 |

1059,0 1059,0 |

-199,7 -199,7 |

-68,6 -68,6 |

-37,46 -37,46 |

-16,25 -16,25 |

600 Insufficient |

| VOLGOGRADSKII AVTOBUSNYI PARK LLC INN 4719024079 Volgograd region |

0,3 0,3 |

856,5 856,5 |

-12,3 -12,3 |

-67,9 -67,9 |

-12,93 -12,93 |

-33,15 -33,15 |

292 Medium |

| MUUP GORODA NIZHNEGO NOVGORODA NIZHEGORODSKII PASSAZHIRSKII AVTOMOBILNYI TRANSPORT INN 5260000192 Nizhny Novgorod region |

1417,5 1417,5 |

1388,9 1388,9 |

-200,7 -200,7 |

-139,1 -139,1 |

-52,58 -52,58 |

-35,02 -35,02 |

291 Medium |

| Total by TOP-10 companies |  42798,7 42798,7 |

46468,3 46468,3 |

-2646,3 -2646,3 |

-1718,4 -1718,4 |

|||

| Average value by TOP-10 companies |  4279,9 4279,9 |

4646,8 4646,8 |

-264,6 -264,6 |

-171,8 -171,8 |

-12,16 -12,16 |

-9,15 -9,15 |

|

| Industry average value |  63,9 63,9 |

64,4 64,4 |

-3,3 -3,3 |

-2,3 -2,3 |

-6,09 -6,09 |

-4,46 -4,46 |

|

— improvement of the indicator to the previous period,

— improvement of the indicator to the previous period,  — decline in the indicator to the previous period.

— decline in the indicator to the previous period.

The average value of the return on assets ratio of TOP-10 enterprises is worse than the industry average. Six companies from the TOP-10 list showed an improvement of the indicator in 2017 compared to the previous period.

Picture 1. Return on assets ratio and revenue of the largest Russian bus companies (TOP-10)

Picture 1. Return on assets ratio and revenue of the largest Russian bus companies (TOP-10)The industry average indicators of the return on assets ratio have a downward trend over the course of 10 years (Picture 2).

Picture 2. Change in the industry average values of the return an assets ratio of Russian bus companies in 2008 – 2017

Picture 2. Change in the industry average values of the return an assets ratio of Russian bus companies in 2008 – 2017