Loan security of companies on UTII

Information agency Credinform presents a ranking of Russian companies on unified tax on imputed income. The largest companies (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2017-2019). Then the companies were ranged by loan protection factor (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Loan protection factor (x) is the ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1. No indicator value indicates that the company does not have borrowed funds, therefore, no interest payable to creditors. However, it may not always be the evidence of general well-being as credit resources are necessary for a successful business growth.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all combination of financial indicators and ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Loan protection factor (x), >1 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| FARMLEND INN 0273028277 Republic of Bashkortostan |

12 329 12 329 |

15 624 15 624 |

2 2 |

8 8 |

1,48 1,48 |

5,77 5,77 |

233 Strong |

| JSC PHARMACEUTICAL IMPORT, EXPORT INN 7710106212 Moscow |

31 118 31 118 |

35 558 35 558 |

371 371 |

417 417 |

5,43 5,43 |

4,80 4,80 |

202 Strong |

| OOO TK RESURS-YUG INN 2303024188 Moscow |

45 528 45 528 |

52 257 52 257 |

285 285 |

29 29 |

2,58 2,58 |

1,56 1,56 |

258 Medium |

| JSC AVTODOM INN 7714709349 Moscow |

23 868 23 868 |

30 160 30 160 |

-2 448 -2 448 |

334 334 |

-1,40 -1,40 |

1,45 1,45 |

247 Strong |

| JSC IPC-AMURNNEFTEPRODUCT INN 2801013238 Amur region |

17 709 17 709 |

14 845 14 845 |

21 21 |

13 13 |

1,19 1,19 |

1,15 1,15 |

272 Medium |

| OJSC ILE DE BEAUTE INN 7707061530 Moscow |

19 863 19 863 |

19 879 19 879 |

-462 -462 |

-247 -247 |

-0,77 -0,77 |

0,12 0,12 |

305 Adequate |

| LLC OCTOBLUE INN 5029086747 Moscow region |

21 989 21 989 |

22 943 22 943 |

509 509 |

202 202 |

42,58 42,58 |

220 Strong | |

| JSC NC ROSNEFT – SMOLENKNEFTEPRODUKT INN 6730017336 Smolensk region |

19 360 19 360 |

20 825 20 825 |

-514 -514 |

358 358 |

208 Strong | ||

| LLC MONEKS TRADING INN 7710323601 Moscow |

17 248 17 248 |

17 152 17 152 |

-978 -978 |

-252 -252 |

263 Medium | ||

| JSC LIPETSKNEFTEPRODUKT INN 4822000201 Lipetsk region |

14 433 14 433 |

14 618 14 618 |

21 21 |

604 604 |

296 Medium | ||

| Average value for TOP-10 companies |  22 345 22 345 |

24 386 24 386 |

-319 -319 |

147 147 |

7,30 7,30 |

2,47 2,47 |

|

| Average value for TOP-1000 companies |  1 669 1 669 |

1 721 1 721 |

33 33 |

43 43 |

340,03 340,03 |

56,75 56,75 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of loan protection factor of TOP-10 is lower than the average value of TOP-1000. Three companies out of six have improved their values in 2019 comparing to the previous period.

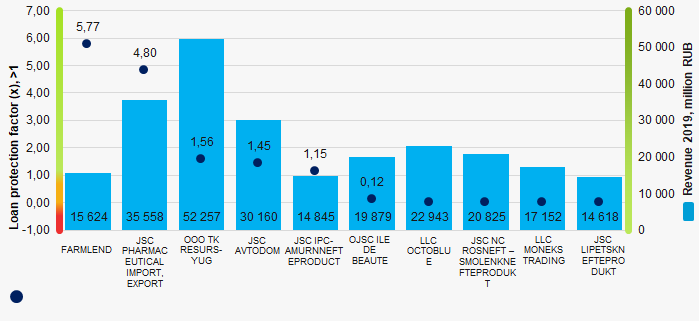

Picture 1. Loan protection factor and revenue of the largest Russian companies on UTII (TOP-10)

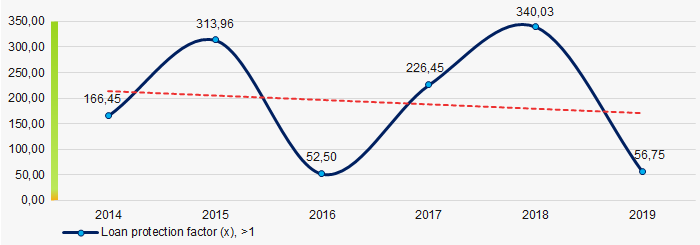

Picture 1. Loan protection factor and revenue of the largest Russian companies on UTII (TOP-10)During 6 years, average values of loan protection factor had a tendency to decrease. (Picture 2).

Picture 2. Change in average values of the loan protection factor of the largest (TOP-1000) Russian companies on UTII in 2014 – 2019

Picture 2. Change in average values of the loan protection factor of the largest (TOP-1000) Russian companies on UTII in 2014 – 2019Changes in legislation

Starting from January 1st, 2021 the Chapter 26.3 of the Tax Code of the Russian Federation «Tax system in the form of the unified tax on imputed income for certain activities» is declared to be no longer in force, in accordance with the Federal law as of 29.06.2012 №97-FL.

Legal entities, having paid the unified tax on imputed income (UTII), have a right to use the simplified tax system (STS) in future as one of the tax regimes, meaning special procedure of tax payment and focused on small and medium business.

In order to use STS, it is necessary to meet the following requirements: there should be less than 100 staff members, income amounting to less than RUB 150 million, shares of other legal entities in company’s capital less than 25%, absence of branches.

The company may switch to STS if its income hasn’t exceeded RUB 112,5 million (article 346 the Tax Code of the RF) based on the result of nine months of the year, in which the notice of switch is applied.

Using of STS exempts of taxes on general taxation system.

Legal entities and sole entrepreneurs, displaying a willingness to switch to STS since January 1st 2021, may deliver a notice of switch no later than December 31st, 2020, according to the form № 26.2-1 (Classifier of Tax Documents 1150001), as approved by the Order of the FTS of the RF as of 02.11.2012 №ММВ-7-3/829@.

After presenting the notice of switch to STS, the tax payers have a right to the change the originally chosen item of taxation or to refuse the using of this tax system, presenting a new notice or a corresponding application to the tax authority no later than December 31st of a calendar year during which the notice was filed. These explanations were given in the Letter of FTS of the RF as of 20.10.2020 №СД-4-3/17181@.

Besides, the Letter of the FTS of the RF as of 20.11.2020 №СД-4-3/19053@ explains:

- removal from the register as a UTII payer will be performed automatically;

- tax return on UTII for the 4th quarter of 2020 should be filed to the place of registration no later than 20.01.2021, tax should be paid – no later than 25.01.2021;

- sole entrepreneurs, displaying a willingness to switch to the patent taxation system since January 1st 2021, may file an application no later than December 17th, 2020;

- if sale of goods (works, services) was carried out during the period of UTII using, sales revenue received by the tax payer during the period of using STS won’t be taken into account while determining the STS tax base;

- when switching from UTII paying to general tax system since 01.01.2021, VAT is calculated while selling of goods (works, services, property rights), shipped (performed, rendered) starting from 01.01.2021.

Subscribers of the Information and Analytical system Globas can get all the available information on all the payers of unified tax on imputed income, using the tool «Filters» and get acquainted with their business operations. Currently Globas contains the data on more than 170 thousand active legal entities-payers of unified tax on imputed income.