Credit security of the largest Russian car manufacturers

Information agency Credinform has prepared the ranking of the largest Russian car manufacturers.

In order to prepare the ranking, the list of Top-10 enterprises by the annual revenue volume in the last available in the Statistical register financial period (2014) was created; besides, the revenue dynamic relating to the previous period and interest coverage ratio were calculated (see Table 1).

Interest coverage ratio(x) is a ratio of the profit before taxes and credit interests to total interest payable. It characterizes the creditors’ security rate from non-payment of interests for the provided credit and shows how many times within the accounting period the company earned the assets for payment of interest charges. Recommended value is: >1.

Thus if the ratio is lower than 1, it demonstrates company’s inability to meet all the loan liabilities immediately. This may in its turn lead to business financial imbalance in the present complicated macroeconomic environment, especially in the period of significant (to 40%) car sales decrease on the Russian market.

If the value of the indicator under consideration is not available, there won’t be borrowed assets in company’s accounts and therefore interest payable to creditors. It can be in itself considered from the positive point of view. However for the successful business operations, market holding, implementation of innovations, there is a necessity for access to the capital market. Due to this the aim of the financial management involves reasonable balancing between development and its financial well-being.

In order to get the fullest and fairest view of the company’s financial situation, it is necessary to pay attention not only to the average indicator values in the industry, but also to all the submitted financial indicators and ratios of the company.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth, % | Interest coverage ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | ООО Volkswagen Group Rus INN 5042059767 |

Kaluga region | 230 582,6 | -4,4 | 0,4 | 284 high |

| 2 | ОАО AvtoVAZ INN 6320002223 |

Samara region | 189 370,0 | 8,1 | -7,3 | 297 high |

| 3 | ООО Nissan Manufacturing Rus INN 7842337791 |

Saint-Petersburg | 152 032,9 | 21,8 | - | 269 high |

| 4 | ZAO Renault Rossiya INN 7709259743 |

Moscow | 110 591,8 | 4,4 | 21,2 | 230 high |

| 5 | PAO KamAZ INN 1650032058 |

Republic of Tatarstan | 104 388,6 | -2,6 | 0,4 | 255 high |

| 6 | ООО Ellada Intertreid INN 3906072056 |

Kaliningrad region | 91 640,0 | 15,8 | -18,6 | 218 high |

| 7 | ООО Hyundai Motor Manufacturing Rus INN 7801463902 |

Saint-Petersburg | 85 392,3 | 7,1 | 7,8 | 219 high |

| 8 | ООО Avtomobilny zavod GAZ INN 5250018433 |

Nizhny Novgorod region | 59 277,7 | -13,9 | 0,6 | 302 satisfactory |

| 9 | ООО Ford Sollers Holding INN 1646021952 |

Republic of Tatarstan | 54 887,7 | -34,7 | -2,1 | 327 satisfactory |

| 10 | ZAO Avtotor INN 3905011678 |

Kaliningrad region | 40 967,4 | -4,4 | - | 272 high |

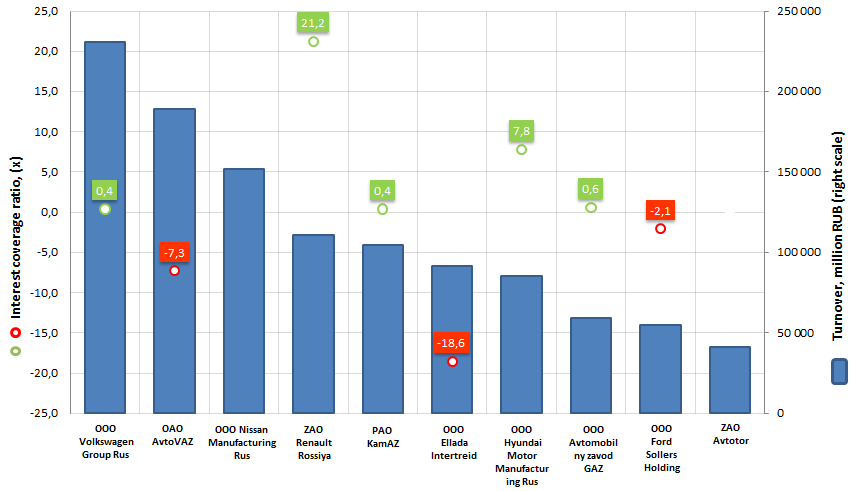

Interest coverage ratio value of the largest car manufacturers (Top-10) varies from -18,6 (OOO Ellada Intertreid) to 21,2 (ZAO Renault Rossiya). The negative indicator shows that there is a net profit before taxes (the company may get the net profit due to changes of deferred tax assets).

Figure 1. Revenue and interest coverage ratio of the Russian largest car manufacturers (Top-10)

Following the results of 2014, the annual revenue of the Top-10 companies amounted to 1119,1 bln RUB. It is higher than the total indicators of the same car manufacturers in the previous period by 0,9%. Taking into consideration the inflation, the financial result of the industry’s giants seems to be modest.

The range of companies have decreased the revenue: OOO Ford Sollers Holing (-34,4%); OOO Avtomobilny zavod GAZ (-13,9%); OOO Volkswagen Group Rus (-4,4%); ZAO Avtotor (-4,4%); PAO KamAZ (-2,6%).

The situation in the automobile industry is complicated; the consumer resistance broke down the sales practically of all companies. Only those companies are going to stay alive, which managed to locate the manufacture within the country, to establish cooperation with Russian suppliers thereby protecting themselves from exchange rate fluctuations.

Nevertheless, the losses took place: the largest brands General Motors – Chevrolet and Opel declared their exit from market.

According to the Association of the European Business (AEB), 129,9 thousands of new cars were sold in October 2015 in Russia. It is by 38,5% lower than in October 2014 and by 7,7% lower comparing with the previous month.

The Top-3 leaders by concerns (alliances) are the following ones: Avtovaz-Renault-Nissan, Hyundai-KIA Group, VW Group.

In the whole, 1,32 million of cars were sold within 10 months, that is by 33,6% lower than in the same period of 2014.

224,0 thousand cars were sold under Lada brand. It is followed by KIA - 134,1 thousand cars (-13%), Hyundai 133,5 thousand (-10%), and Renault - 98,1 thousand (-37%).

The leading models are: Lada Granta – 99 653 cars (-22,7%), Hyundai Solaris – 95 047 (0,0%), and KIA Rio – 80 667 (+9,7%).

The Central Bank of Russia will check the credit organizations’ assets in foreign depositories

In 2015 one of the key events on the bank accommodations market was the revocation of Probusinessbank’s license by the order of Bank of Russia № OD-2071 from 12.08.2015. According to press-release of the Central Bank of Russia, noncompliance with the capital adequacy standards served as a formal reason for revocation of license. Noncompliance resulted in decrease in own funds lower than minimum value of authorized capital, which was set on the date of credit organizations state registration. This, in turn, was a result of high-risk activity, connected with placement of funds in low-quality assets, that led to full loss of own funds by the bank.

The results of further proceeding of the Central Bank, published in mass media, showed, that on the date of license revocation, the assets value including reserves amounted to 146,8 bln RUB, liabilities value amounted to 148,1 bln RUB. Meanwhile, the property with the value of 61.5 bln RUB (almost 42% of all assets) was purchased and stored under contracts with non-residents. The property consists of securities of Atlas Investment Solutions (Luxembourg), the warrants1 of Mediobanka International S. A., securities in depositaries: Brokercreditservice (Cyprus) Ltd and Otkritie Capital International Ltd, monetary requirements for transactions with currency and securities to Ambika Investment Ltd and Dinosaur Merchant Bank Ltd (UK) and funds, placed in Falcon Private Bank Ltd.

Further it turned out, that securities of Atlas Investment Solutions and warrants of Mediobanka are not listed and not traded on the market and also have no rating. The rest of Probusinessbank’s funds on the accounts of Dinosaur Merchant Bank Ltd, Baltikums Bank AS, Lavuas Pasta Banka and Falcon Private Bank Ltd totaling about 6,3 bln RUB are not confirmed by extracts, besides, the activity of Falcon Private Bank Ltd turned out to be unprofitable. Ambika Investment Ltd is almost the only contractor for currency transactions on terms, which are quite different from the market. Herewith the deals took place in order to increase profits. Highly liquid assets on total sum of 28,3 bln RUB were placed in Brokercreditservice and Otkritie Capital International and the same depositories provided loans to Merianol and Ambika Investment Ltd on total sum of 25 bln RUB. These companies, in turn, didn’t fulfill the obligations to depositaries; as a result, the property was lost by Probusinessbank. The charge over securities was hidden from the Central Bank.

The funds (totaling about 3 bln RUB) of six borrowers, who had technical and economic relations with the bank, were placed on the operating account of the general contractor in Trast Komercbank (Riga). The debts of other companies to the bank amounted to 5,8 bln RUB.

Thus, the transfer of assets can indicate about the fact, that bank owners use their powers contrary to the legitimate interests of creditors and depositors.

Revealed scheme of the withdrawal of assets abroad served for the Central Bank as a substantial reason for the beginning of mass checks of securities portfolios of banks, which hold them in foreign depositories.

The placement of the securities in foreign depositories is not a violation of the law. However, according to experts, this allows to pledge securities and not to make a reserve for them. The Central Bank can’t receive data from foreign depository without appropriate permission and, therefore, has no information about the charges over securities. Such practice is quite widespread and many banks use it for project financing.

Last week deputy chairman of the Central Bank Vasily Pozdyshev during the meeting with bankers reported, that in 2016 the controller is going to make a request to the banks concerning cash flows, placed in foreign banks, in order to verify the correctness of the financial statements. The same procedure will be carried out in relation to securities in foreign depositories.

According to experts, the Central Bank may pay special attention to small and average private credit institutions, which use foreign banks and depositories to avoid the normative standards or withdraw funds in favor of shareholders. As a result, a new wave of revocation of licenses is possible.

According to the Central Bank data as of 1 October 2015, 767 active credit institutions and 1498 branches are registered in Russia. The subscription on Information and Analytical system Globas-i® will let to get acquainted with their activity, financial indicators and archival information concerning banks with revoked licenses.

1Warrant is a security paper, which give to the owner the right to buy a proportional number of shares at a specified price (as a rule, lower than the current market price) within a specified period of time