Financial accounts of companies for 2014 in Globas-i

The Federal State Statistics Service (Rosstat) has provided financial accounts 2014 for more than 1 960 000 companies.

Accounts have already been preliminary checked and published in the Information and analytical system Globas-i® on 23rd of September.

Predicted target figure on inflation is 4%

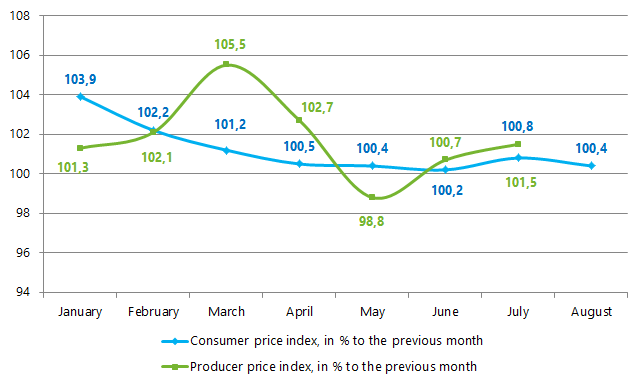

Based on the results of August 2015 the consumer price index (CPI) recorded a 0,4 percentage point (pp) increase compared to July 2015. However, the growth dynamics of the increase in prices is still lower in comparison with the situation in July. Then the increase made 0,8 pp compared to May 2015 (Picture 1). It should also be noted that prior to August 18, 2015 it was recorded the zero inflation four weeks in a row, and from the 11th till 17th of August the average price increase pointed even to a symbolic deflation. And the producer price index increased by 1,5 pp in July 2015 compared to the previous month.

Picture 1. Change in the consumer price index and producer prices for the period January-August 2015

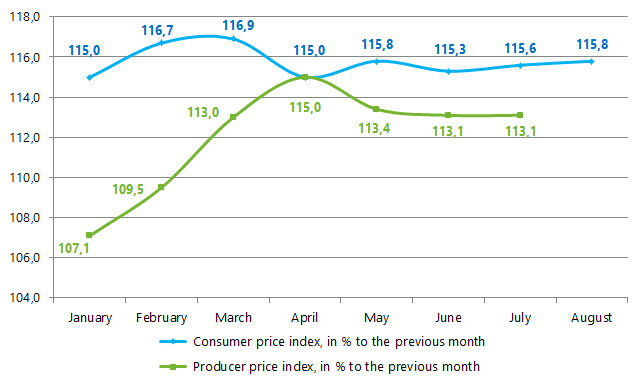

In the whole, the inflation on the CIP is marked at the level of 15,8% as of September 1, 2015 (s. Picture 2), following the results of 6 months – 9,6%. The producer price index reached 13,1% at an annual rate, following the results of 6 months – 12,6%.

Picture 2. Change in consumer and producer price index at an annual rate

An analysis of inflationary trends showed that the inflation rate after August 20, 2015 was caused by the devaluation of the ruble, which occurred as a result of the reduction of world oil prices and other factors. So, on the 24th of August at 08.30 MST, October futures for Brent crude oil cost 44,34 USD per barrel. As of 16.44 MST price fell down - up to 42,92 USD per barrel. During the bidding the lowest drop in futures prices reached 42,54 USD per barrel, approaching in such a way to a minimum of March 12, 2009 - at the rate of 42,19. Against this background, the exchange rate did not reach a bit 71 rubles per dollar.

Prevailing conditions led to the fact, that the Russian government institutions involved in the forecast of macroeconomic indicators developed the worst scenarios of development of Russian economy. The Ministry of Economic Development expects the inflation rate at 11,9% at the end of 2015, the Ministry of Finance – 11,9%, the Central Bank of the RF - 12-13%. In 2016 the Ministry of Economic Development predicts 8,8%, the Ministry of Finance – 7,0%, the Central Bank of the RF – 5,5-6,5%. However, the Regulator intends finally to reduce the inflation up to a level of 4% in 2017.

The Bank of Russia intends to reach the target figure on inflation within its monetary policy through the following instruments:

- the use of inflation targeting regime;

- the use of a number of non-standard instruments to provide liquidity to banks;

- the impact on the price of money in the economy via interest rates;

- the adherence to a floating exchange rate;

- the formation of inflation expectations at a stable low level, etc.

Also the Bank of Russia will continue to ensure a stable functioning and development of the banking sector, financial market and payment system. By conducting of monetary policy the Regulator will develop the mechanisms of interaction with federal executive authorities in the field of tariff regulation, tax policy, management of remaining budgetary funds on accounts of the Bank of Russia. The reaching of the target figures will largely depend on measures of the Government of the RF aimed to ensuring of a balanced budget and consistent implementation of structural reforms in the Russian economy.