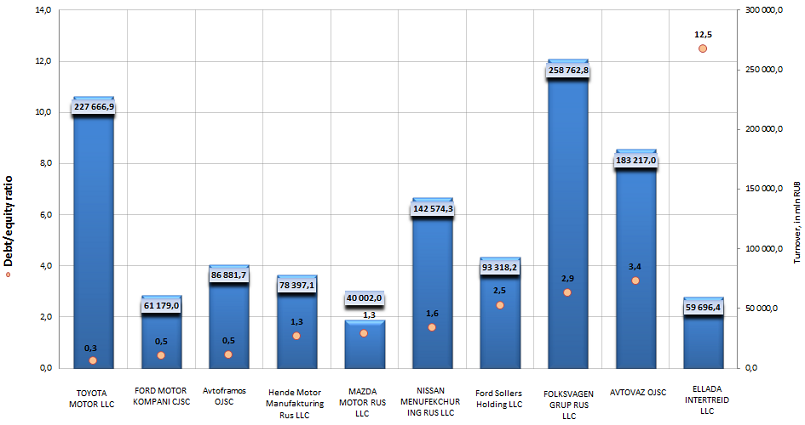

Debt/equity ratio of motor car manufacturers

Information agency Credinform prepared a ranking of motor car manufacturers in Russia.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in debt/equity ratio.

Debt/equity ratio (х) shows the ratio between borrowed and own sources of company financing. Recommended value is < 1. If the ratio is > 1, it means that the volume of borrowed capital is higher, than the volume of own capital, what lays additional financial risks on a company. If the indicator is negative, this fact may testify that the equity capital of a firm is in negative area, there is uncovered loss.

However, it should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for companies of the same industry, consequently, these values are absolutely of recommended character.

For getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average indicator values in a branch, but also to all presented summation of financial indicators and ratios of a company.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Debt/equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | TOYOTA MOTOR LLC INN: 7710390358 |

Moscow region | 227 666,9 | 0,3 | 155(the highest) |

| 2 | FORD MOTOR KOMPANI CJSC INN:4703038767 |

Leningrad region | 61 179,0 | 0,5 | 197(the highest) |

| 3 | Avtoframos OJSC INN: 7709259743 |

Moscow | 86 881,7 | 0,5 | 145(the highest) |

| 4 | Hende Motor Manufakturing Rus LLC INN:7801463902 |

Saint-Petersburg | 78 397,1 | 1,3 | 202(high) |

| 5 | MAZDA MOTOR RUS LLC INN:7743580770 |

Moscow | 40 002,0 | 1,3 | 283(high) |

| 6 | NISSAN MENUFEKCHURING RUS LLC INN:7842337791 |

Saint-Petersburg | 142 574,3 | 1,6 | 219(high) |

| 7 | Ford Sollers Holding LLC INN: 1646021952 |

Republic of Tatarstan | 93 318,2 | 2,5 | 287(high) |

| 8 | FOLKSVAGEN GRUP RUS LLC INN:5042059767 |

Kaluga region | 258 762,8 | 2,9 | 188(the highest) |

| 9 | AVTOVAZ OJSC INN: 6320002223 |

Samara region | 183 217,0 | 3,4 | 203(high) |

| 10 | ELLADAINTERTREID LLC INN: 3906072056 |

Kaliningrad region | 59 696,4 | 12,5 | 204(high) |

Picture 1. Debt/equity ratio, turnover of the largest manufacturers of motor cars (TOP-10)

Cumulative turnover of the largest manufacturers of motor cars (TOP-10) made 1 231 695,3 mln RUB at year-end 2012. The average ratio value is 2,7; most companies have the value of borrowed capital being higher, than the equity.

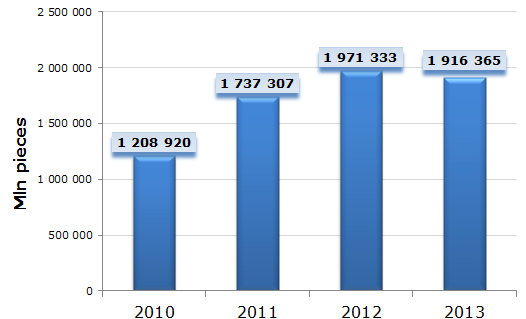

Car market is very sensitive to economic fluctuations in the country. The slowdown in the GDP growth rate in 2013 provoked the decline in production volume by 2,8%. In the current year it is expected further decrease in the market of car manufacture and temporary suspension of conveyers. All this will have an impact on the increase of borrowed capital.

Picture 2. Dynamics of the manufacture of motor cars in the RF

At the present time many the largest auto groups in the world have opened their factories or organized assembly areas on the territory of Russia. Our market is treated as very attractive one, and also because we are visibly behind leading countries in the world on the level of automobilization per capita.

TOYOTA MOTOR LLC, FORD MOTOR KOMPANI CJSC, Avtoframos OJSC (mark Renault) show the ratio < 1 – borrowed capital is less than equity, that maintains additionally their financial stability. It is confirmed by the solvency index GLOBAS-i® of the Information agency Credinform: it is at the highest level by all mentioned organizations, what guarantees, that they can pay off their debts in time. Investment attractiveness of these enterprises is at a high level, now therefore, the decision of possible business cooperation will be informed.

All other companies of the branch have borrowed funds being higher, than own capital. Here it is important to take into account, that it takes a lot of investments to sweep market and organize production. It doesn’t matter, if the capital doesn’t secure loans, what is most important is that the management works out correctly all probable consequences of the «game on credit». A high rating of solvency GLOBAS-i® confirms indirectly, that approved business strategy yields its results, organizations are able to pay off their debts in time, only a breakdown of macroeconomic situation in the country could have an impact on their financial standing.

Are sanctions frightful the Russian economy?

After the annexation of Crimea to Russia, the leaders of many countries, especially Europe and the United States, started talking about the introduction of political and economic sanctions, which should harm the reputation of the state, the Russian economy and signal the disagreement with the policy towards Ukraine. But in fact it was only announced a ban on the entry and arrest of accounts of a number of EU and U.S. officials (who should not have foreign accounts and real estate by law), and businessmen; program of EU (including the introduction of a visa-free regime), NATO and the G8 were suspended; some countries have announced the termination of military cooperation. Sometimes it came to the point of absurdity, when NASA announced the freezing of all contacts with Russia, except for delivering astronauts to the ISS, and military experts from Russia has been said about the impossibility of their visit to NATO headquarters.

The most noticeable were measures against a number of Russian credit institutions, including the Bank of Russia, as well as suspension of card accounts service of their clients by world leading payment systems (Visa and MasterCard); international rating agencies have reconsidered the assessment of key companies’ shares in the country to "negative."

Barack Obama's statement that the U.S. will soon fully meet Europe's demand for energy resources and thereby reduce dependence on supplies from the continent of Russia, was perceived cautiously by the majority of experts.

At present, Russia is the third largest partner of the EU bilateral trade (after the U.S. and China). For Europeans at low rates of growth in their own economies and the more instantaneously from its energy, seems unproductive and unlikely to refuse the results achieved. Such a policy of isolation is not beneficial to all parties.

Sanctions taken had the opposite effect. Russia got down to practical implementation of the national payment system, which initially will be able to cover all the internal settlement and will be protected from external influences; and Chairman of the Federation Council V. I. Matviyenko said about the necessity to developing the establishment of a national rating agency.

Certainly, recent events have made their impact on the Russian economy - there was a drop of the MICEX index, even more pressure is putting on the ruble and inflation, the position of the United States and the European Union in the future deters many potential investors, and trade with neighboring Ukraine for the year will significantly reduce. But there is no point to dramatize the situation: political strife will blow over, and the country will begin to understand that it is necessary to pay more attention to the industrial policy of the state, diversify markets, and develop relations with other countries.