Net profit ratio of the largest Russian furniture manufacturers

Information agency Credinform has prepared a ranking of the largest Russian furniture manufacturers. Furniture manufacturers with the largest annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 - 2017). Then they were ranked by revenue (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Sales revenue is money or tangible assets in monetary terms received as a result of business activity after sale of goods and services. Net profit ratio is calculated as a relation of net profit (loss) to sales revenue.

Revenue and the ratio demonstrate the company’s scale and efficiency of its business activity. As a rule, the larger the revenue, the stronger its resistance to negative factors that could be ruinous for small and microenterprises. Revenue also reflects production capacity of a company, especially if taken over time. A real assessment of the company’s market competitiveness can be made by adding net profit ratio to the analysis. A high net profit ratio (higher than the average industry one) indicates a more favorable company’s position in relation to its competitors.

In general, the analysis of furniture production sector shows that this market is rather low concentrated, in other words, there is a large number of participants: 42,2% of total revenue is accounted for by TOP-50 companies, and 86,2% - by TOP-1000. In addition, both in 2016 and 2017 almost half of companies of the sector had a net profit ratio higher than the average industry value. This indicates that this market comprises mostly small and medium-sized companies, and that entry barriers are not high.

A combination of both indicators and their change over time is to be taken into account to get a full and fair view of financial standing of the companies of the sector. See the ranking of TOP-10 companies below (Table 1).

| Name, INN, region | Sales revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MEBEL STYLE LLC INN 3907046732 |

8809 8809 |

10499 10499 |

12,3 12,3 |

-0,3 -0,3 |

0,1 0,1 |

0,0 0,0 |

275 Medium |

| ASKONA-VEK LLC INN 3305037917 |

7494 7494 |

8450 8450 |

1052,8 1052,8 |

320,6 320,6 |

14,0 14,0 |

3,8 3,8 |

227 Strong |

| Furniture factory Marya LLC INN 6455026772 |

6486 6486 |

7189 7189 |

24,8 24,8 |

142,3 142,3 |

0,4 0,4 |

2,0 2,0 |

200 Strong |

| KING OF SOFAS LLC INN 6432009756 |

5303 5303 |

4613 4613 |

213,8 213,8 |

161,1 161,1 |

4,0 4,0 |

3,5 3,5 |

296 Medium |

| DOK-15 LLC INN 5050079140 |

3313 3313 |

3906 3906 |

27,3 27,3 |

41,3 41,3 |

0,8 0,8 |

1,1 1,1 |

222 Strong |

| OZ MICRON JSC INN 6002005478 |

3527 3527 |

3884 3884 |

546,3 546,3 |

623,1 623,1 |

15,5 15,5 |

16,0 16,0 |

175 High |

| JOINT STOCK FURNITURE COMPANY SHATURA INN 5049007736 |

3315 3315 |

3611 3611 |

0,7 0,7 |

114,8 114,8 |

0,0 0,0 |

3,2 3,2 |

210 Strong |

| IKEA INDUSTRY TIKHVIN LLC INN 4715011103 |

3365 3365 |

3431 3431 |

-203,8 -203,8 |

-84,5 -84,5 |

-6,1 -6,1 |

-2,5 -2,5 |

251 Medium |

| MZ5 GROUP LLC INN 4312146860 |

4137 4137 |

3346 3346 |

-76,3 -76,3 |

4,0 4,0 |

-1,8 -1,8 |

0,1 0,1 |

290 Medium |

| LTD ALIVE SOFAS INN 5029042443 |

2937 2937 |

2908 2908 |

52,9 52,9 |

26,4 26,4 |

1,8 1,8 |

0,9 0,9 |

213 Strong |

| Total for TOP-10 companies | 48686 | 51836 | 1651 | 1349 | |||

| Average for TOP-10 companies | 4869 | 5184 | 165 | 135 | 2,88 | 2,81 | |

| Average industry value | 26,1 | 28,8 | 0,7 | 0,7 | 2,77 | 2,37 | |

— improvement compared to prior period,

— improvement compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

In 2017, seven of TOP-10 companies improved their revenue, and also seven companies advanced their efficiency and improved net profit ratio. Along with this, average sales revenue of TOP-10 grew, and average value of net profit declined slightly.

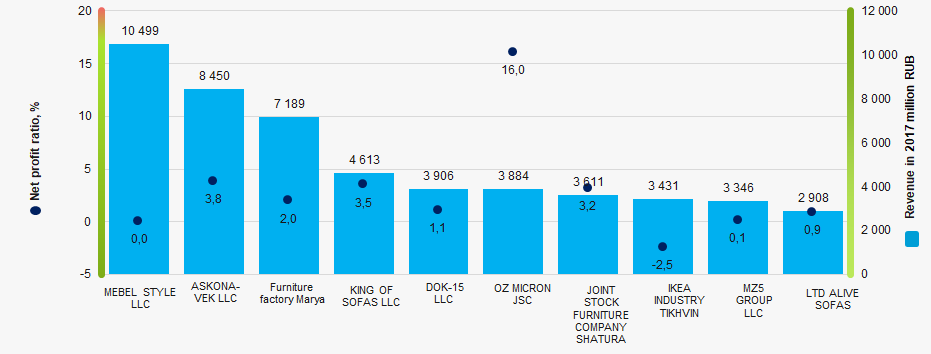

Picture 1. Net profit ratio and revenue of the largest Russian furniture manufacturers (TOP-10)

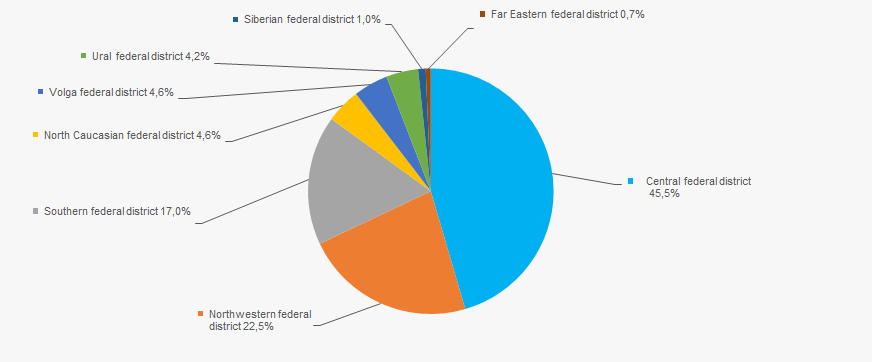

Picture 1. Net profit ratio and revenue of the largest Russian furniture manufacturers (TOP-10)45,47% of total industry revenue in 2017 was produced by companies of the Central federal district (Picture 2). Moscow and the Moscow region have 15,37 and 14,1% of total revenue respectively, and St. Petersburg - 5,94%. In addition, 10,6% of companies’ legal addresses are in Moscow, 8,5% - in St. Petersburg, and 8% - in the Moscow region. This indicates that to some extent furniture production is concentrated in the Central federal district, and federal cities (Moscow and St. Petersburg) play an important role within the industry.

Picture 2. Regions by their share in total revenue of 2017

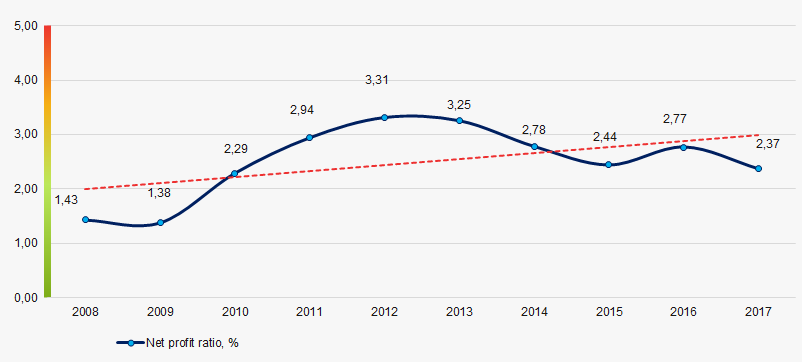

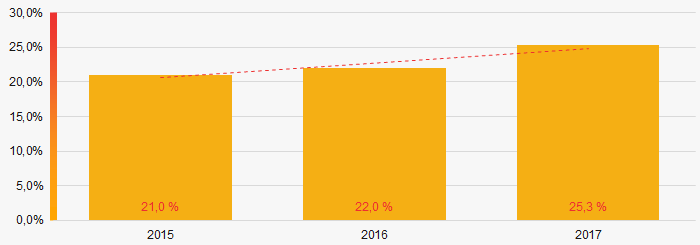

Picture 2. Regions by their share in total revenue of 2017During the decade, average industry value of net profit ratio have been rather stable, excluding crisis years with small decrease (Picture 3). In general, the industry has coped the recession of 2013-2015 and has come to a stable level of the ratio.

Picture 3. Change in average industry value of net profit ratio in 2008 – 2017

Picture 3. Change in average industry value of net profit ratio in 2008 – 2017 Trends in metal ore mining

Information agency Credinform has prepared a review of trends of the largest Russian metal ore mining companies.

The largest metal ore mining companies (TOP-10 and TOP-300) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2015-2017). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

| № | Name, INN, region, activity | Net assets value, bln RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | JSC MIKHAILOVSKY MINING AND PROCESSING PLANT INN 4633001577 Kursk region Open-pit iron ore mining |

112,4 |  75,5 75,5 |

84,8 84,8 |

157 Superior |

| 2 | JSC STOILENSKY MINING AND PROCESSING PLANT INN 3128011788 Belgorod region Open-pit iron ore mining |

69,0 |  80,9 80,9 |

74,4 74,4 |

193 High |

| 3 | JSC EVRAZ KACHKANARCKY ORE MINING AND PROCESSING PLANT INN 6615001962 Sverdlovsk region Open-pit iron ore mining |

67,7 |  67,5 67,5 |

72,3 72,3 |

198 High |

| 4 | JSC KORSHYNOV MINING AND PROCESSING PLANT INN 3834002314 Irkutsk region Open-pit iron ore mining |

27,8 |  30,3 30,3 |

35,0 35,0 |

184 High |

| 5 | JSC UCHALINSKY MINING AND PROCESSING PLANT INN 0270007455 Republic of Bashkortostan Copper ore mining and cleaning |

27,5 |  30,6 30,6 |

30,9 30,9 |

231 Strong |

| 296 | JSC KRASNOKAMENSKY MINE INN 2423012272 Krasnoyarsk territory Open-pit iron ore mining In process of being wound up since 01.08.2016 |

-2,1 |  -2,1 -2,1 |

-2,5 -2,5 |

600 Insufficient |

| 297 | JSC SALAIRSKY CHEMICAL ENTERPRISE INN 4204003399 Kemerovo region Mining of ore and precious metal sand (gold, silver, platinum group metals) |

-2,3 |  -2,5 -2,5 |

-2,7 -2,7 |

369 Adequate |

| 298 | LLC KIMKANO-SUTARSKY MINING AND PROCESSING PLANT INN 7703525082 Jewish autonomous region Iron ore mining and cleaning |

-5,4 |  -3,1 -3,1 |

-3,3 -3,3 |

296 Medium |

| 299 | LLC METALL-GROUP INN 7811122323 Belgorod region Iron ore underground mining In process of being wound up since 22.03.2018 |

-1,8 |  -1,6 -1,6 |

-7,4 -7,4 |

600 Insufficient |

| 300 | LLC LUNSIN INN 5406332398 Republic of Tyva Mining and cleaning of other non-ferrous metal ore, n.e.c. |

-17,1 |  -12,8 -12,8 |

-9,5 -9,5 |

317 Adequate |

— growth of indicator in comparison with prior period,

— growth of indicator in comparison with prior period,  — decrease of indicator in comparison with prior period.

— decrease of indicator in comparison with prior period.

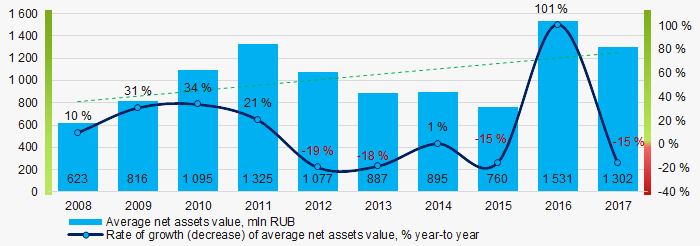

For the last 10 years, the average values of net assets showed the increasing tendency (Picture 1).

Picture 1. Change in average net assets value in 2008 – 2017

Picture 1. Change in average net assets value in 2008 – 2017The shares of TOP-300 companies with insufficient property grow rapidly with the trend to increase over the past three years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-300, 2015 - 2017

Picture 2. Shares of companies with negative net assets value in TOP-300, 2015 - 2017Sales revenue

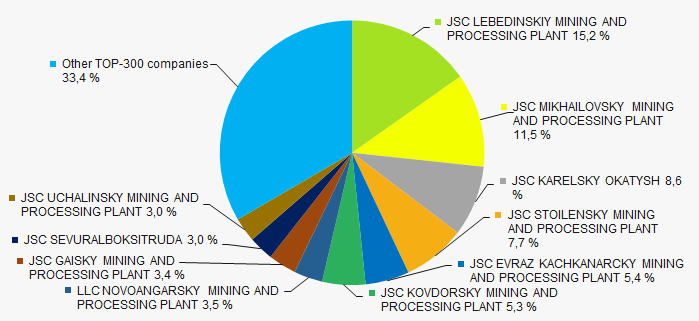

In 2017, total revenue of 10 largest companies in the industry was 67% of TOP-300 total revenue (Picture 3). This testifies high level of monopolization in the industry.

Picture 3. Shares of TOP-10 companies in TOP-300 total profit for 2017

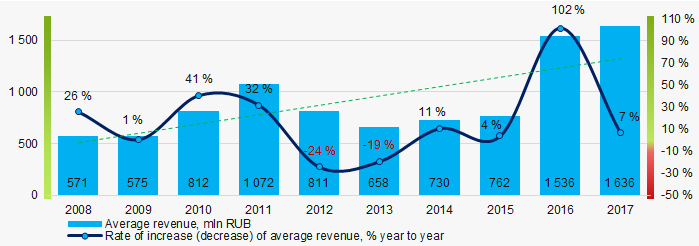

Picture 3. Shares of TOP-10 companies in TOP-300 total profit for 2017In general, there is a trend to increase in industry average revenue over the past 10 years (Picture 4).

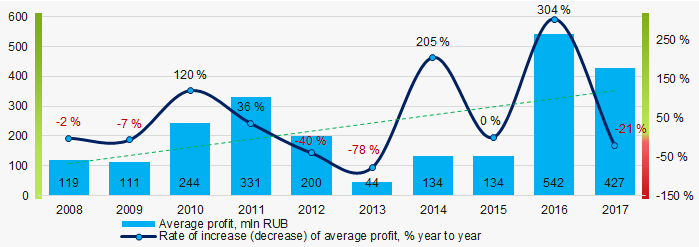

Picture 4. Change in industry average net profit in 2008-2017

Picture 4. Change in industry average net profit in 2008-2017Profit and loss

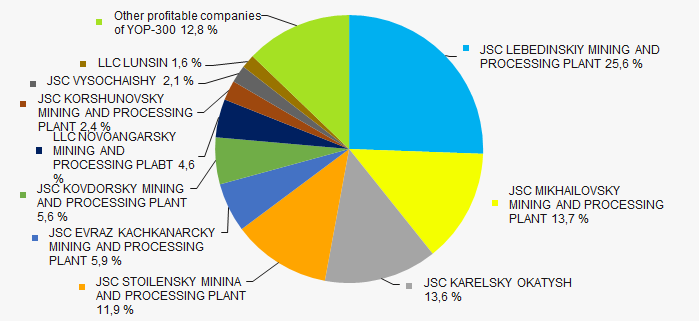

In 2017, profit of 10 largest companies in the region amounted to 87% of TOP-300 total profit (Picture 5).

Picture 5. Shares of TOP-10 companies in TOP-300 total profit for 2017

Picture 5. Shares of TOP-10 companies in TOP-300 total profit for 2017For the last ten years, there is an increase of the industry average net profit values (Picture 6).

Picture 6. Change in industry average net profit (loss) in 2008-2017

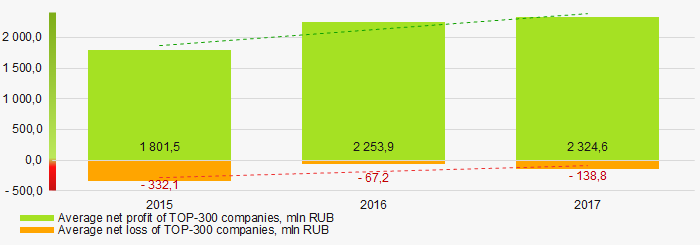

Picture 6. Change in industry average net profit (loss) in 2008-2017For the three-year period, the average net profit values of TOP-300 companies show the increasing tendency with net loss decreasing (Picture 7).

Picture 7. Change in average profit and loss of ТОP-300 in 2015 – 2017

Picture 7. Change in average profit and loss of ТОP-300 in 2015 – 2017Key financial ratios

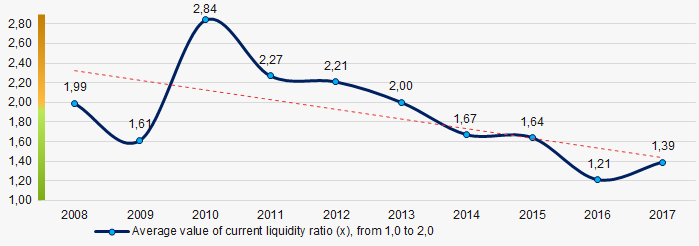

For the last ten years, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 8).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 8. Change in industry average values of current liquidity ratio in 2008 – 2017

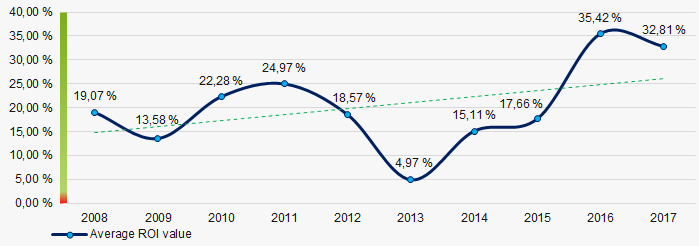

Picture 8. Change in industry average values of current liquidity ratio in 2008 – 2017For the last ten years, relatively high level of ROI ratio with a trend to increase was observed (Picture 9).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 9. Change in average values of ROI ratio in 2008 – 2017

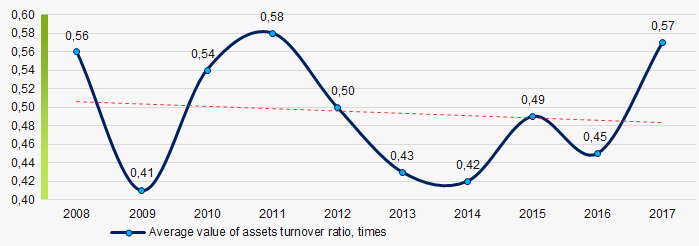

Picture 9. Change in average values of ROI ratio in 2008 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, business activity ratio demonstrated the downward trend (Picture 10).

Picture 10. Change in average values of assets turnover ratio in 2008 – 2017

Picture 10. Change in average values of assets turnover ratio in 2008 – 2017Production structure

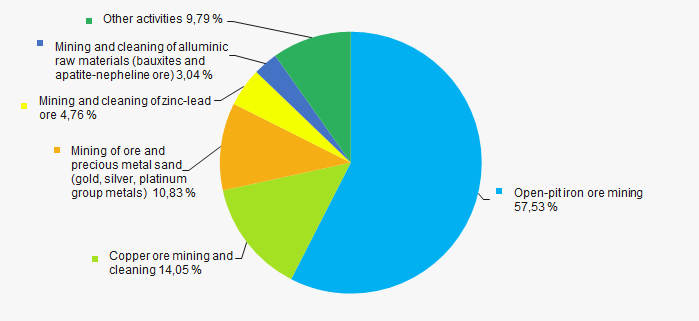

The highest share in total revenue of TOP-300 falls for companies engaged in open-pit iron ore mining (Picture 11).

Picture 11. Distribution of activity types in total revenue of TOP-300, %

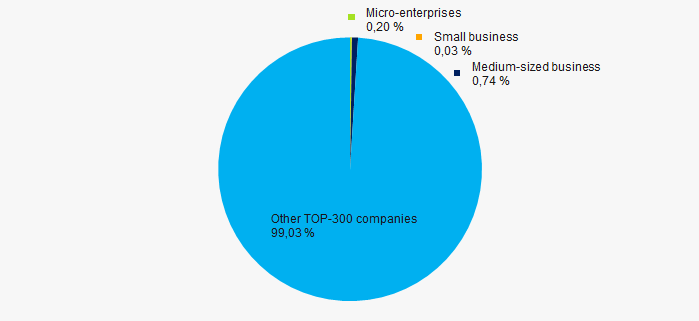

Picture 11. Distribution of activity types in total revenue of TOP-300, %60% companies of TOP-300 are registered in the Register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue for 2017 amounted to only 0,97% (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in TOP-300, %

Picture 12. Shares of small and medium-sized enterprises in TOP-300, %Main regions of activity

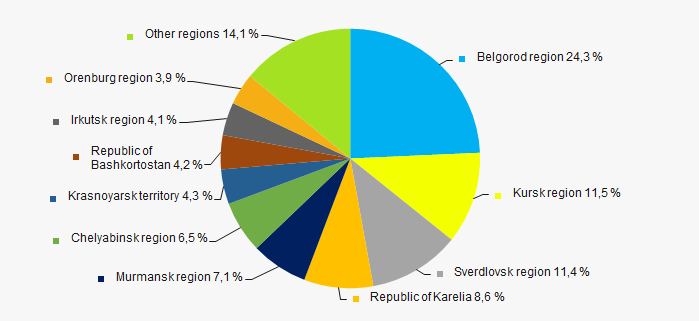

Companies of TOP-300 are located across the country extremely unequally, taking into account the location of sources. The companies are registered in 42 districts. The highest share of revenue volume is concentrated in Belgorod region (Picture 13).

Picture 13. Distribution of TOP-300 revenue by districts of Russia

Picture 13. Distribution of TOP-300 revenue by districts of RussiaFinancial position score

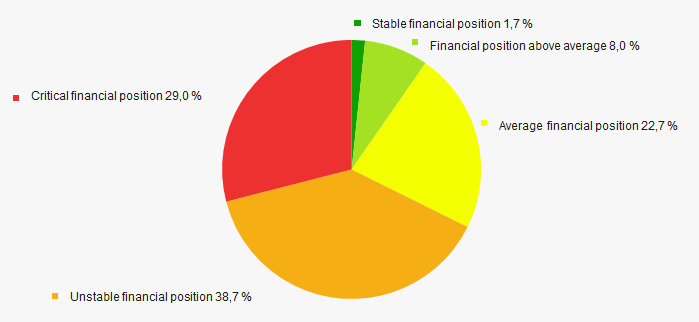

Assessment of the financial position of TOP-300 companies shows that the majority of them have unstable financial position (Picture 14).

Picture 14. Distribution of TOP-300 companies by financial position score

Picture 14. Distribution of TOP-300 companies by financial position scoreSolvency index Globas

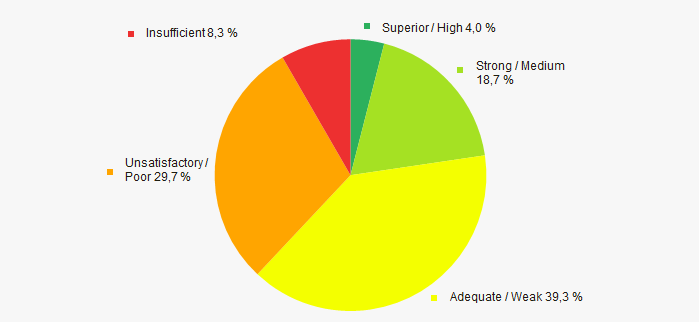

Most of TOP-300 companies got Adequate / Weak Solvency index Globas. This fact generally shows the ability to meet their obligations in time and fully (Picture 15).

Picture 15. Distribution of TOP-300 companies by solvency index Globas

Picture 15. Distribution of TOP-300 companies by solvency index GlobasIndex of industrial production

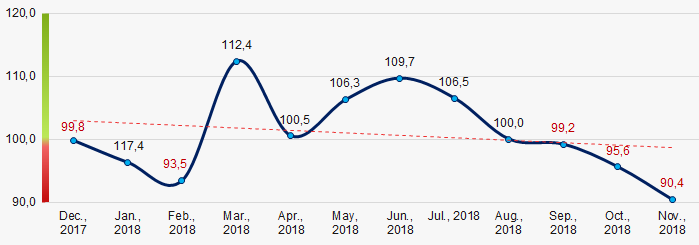

According to the Federal State Statistics Service (Rosstat), during 12 months of 2017 - 2018, the trend to decrease of industrial production indexes is observed. For 11 months of 2018, the index decreased by 1,7% at average, and increased by 0,9% for the period of December 2017 – November 2018 (Picture 16).

Picture 16. Index of industrial production of vehicles and equipment in 2017 – 2018, month-to-month (%)

Picture 16. Index of industrial production of vehicles and equipment in 2017 – 2018, month-to-month (%)Conclusion

Complex assessment of activity of the largest metal ore mining companies, taking into account the main indexes, financial ratios and indicators, demonstrates some prevalence of favorable trends (Table 2).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Concentration level of capital |  -10 -10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 30% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  -5 -5 |

| Solvency index Globas (the largest share) |  5 5 |

| Industrial production index |  -10 -10 |

| Average value of relative share of factors |  0,7 0,7 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).