TOP-10 builders of engineering constructions

Information agency Credinform presents a ranking of the Russian builders of engineering constructions. Industry players (TOP-10) with the largest annual revenue were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2018 - 2019). Then the enterprises were ranked by the return on costs ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Return on costs (%) is calculated as the relation of profit before taxation to the sum of costs for production and sale of products and reflects the amount of income from one spent ruble.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all combination of financial indicators and ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on costs, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| RENAISSANCE HEAVY INDUSTRIES LLC INN 7802772445 Moscow |

37 661,9 37 661,9 |

42 884,2 42 884,2 |

4 732,3 4 732,3 |

2 078,5 2 078,5 |

17,70 17,70 |

11,33 11,33 |

245 Strong |

| AO VAD INN 7802059185 Vologda region |

81 703,5 81 703,5 |

89 676,7 89 676,7 |

4 005,1 4 005,1 |

6 728,6 6 728,6 |

7,02 7,02 |

10,41 10,41 |

180 High |

| OOO OSK 1520 INN 7701753020 Moscow |

29 002,8 29 002,8 |

43 257,3 43 257,3 |

2 194,7 2 194,7 |

2 662,3 2 662,3 |

10,74 10,74 |

8,55 8,55 |

185 High |

| CJSC STROYTRANSNEFTEGAZ INN 7714572888 St. Petersburg |

186 530,4 186 530,4 |

164 178,8 164 178,8 |

6 755,2 6 755,2 |

5 359,5 5 359,5 |

5,47 5,47 |

5,64 5,64 |

236 Strong |

| AO DSK AVTOBAN INN 7725104641 Moscow |

45 609,8 45 609,8 |

47 173,4 47 173,4 |

3 233,6 3 233,6 |

2 257,1 2 257,1 |

10,60 10,60 |

5,23 5,23 |

207 Strong |

| JSC MOSTOTREST INN 7701045732 Moscow |

133 320,5 133 320,5 |

77 298,2 77 298,2 |

2 991,7 2 991,7 |

1 732,1 1 732,1 |

2,81 2,81 |

2,32 2,32 |

235 Strong |

| JSC STROYGAZMONTAZH INN 9729299794 Moscow |

304 102,8 304 102,8 |

193 609,7 193 609,7 |

9 865,6 9 865,6 |

366,0 366,0 |

4,89 4,89 |

1,30 1,30 |

283 Medium |

| JSC CONCERN TITAN-2 INN 7827004484 Moscow |

37 699,2 37 699,2 |

47 626,6 47 626,6 |

8,7 8,7 |

276,9 276,9 |

1,06 1,06 |

0,10 0,10 |

206 Strong |

| LLC GAZPROM INVEST INN 7810483334 St. Petersburg |

67 854,4 67 854,4 |

48 407,9 48 407,9 |

-15,1 -15,1 |

-1 380,8 -1 380,8 |

0,56 0,56 |

-3,02 -3,02 |

309 Adequate |

| JSC LENGAZSPETSSTROY INN 7806027191 St. Petersburg |

53 152,5 53 152,5 |

35 632,7 35 632,7 |

32,6 32,6 |

-6 825,0 -6 825,0 |

0,10 0,10 |

-18,76 -18,76 |

290 Medium |

| Average value for TOP-10 |  97 663,8 97 663,8 |

78 974,6 78 974,6 |

3 380,4 3 380,4 |

1 325,5 1 325,5 |

6,10 6,10 |

2,31 2,31 |

|

| Average industry value |  170,3 170,3 |

166,6 166,6 |

1,8 1,8 |

-0,1 -0,1 |

1,90 1,90 |

0,66 0,66 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

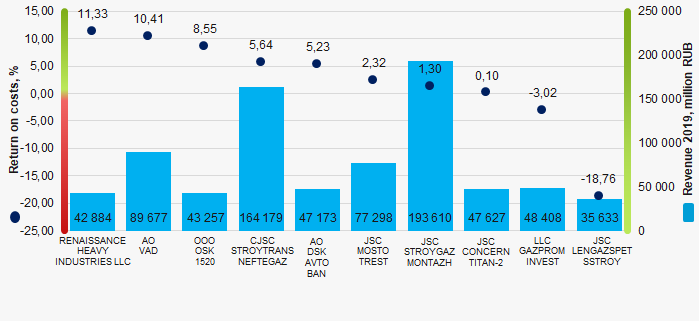

Average value of return on costs ratio of TOP-10 is higher than the average industry value. Just one company has improved its values in 2019 comparing to the previous period.

Picture 1. Return on costs ratio and revenue of the largest builders of engineering constructions in Russia (TOP-10)

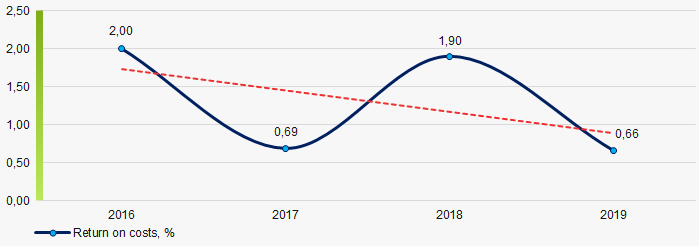

Picture 1. Return on costs ratio and revenue of the largest builders of engineering constructions in Russia (TOP-10)During 4 years, the average industry values of the return on costs ratio had a trend to decrease (Picture 2).

Picture 2. Change in the average values of the return on costs ratio of the largest builders of engineering constructions in Russia in 2016 - 2019

Picture 2. Change in the average values of the return on costs ratio of the largest builders of engineering constructions in Russia in 2016 - 2019The Russian budget suffered from the limited business activity

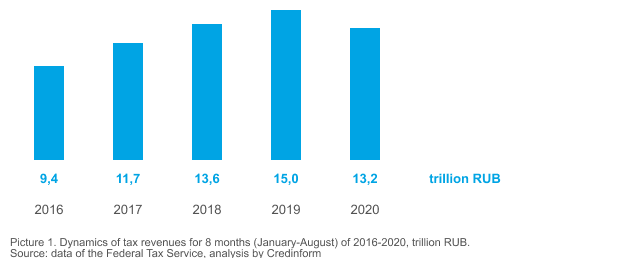

During the several years, tax revenues for the budget had been consistently increasing. However, the volume of taxes collected in 2020 could be less that planned: for the first time since 2009, the dynamics of budget revenues is negative.

The volume of tax revenues for 2020 is lower than in 2018

According to the Information agency Credinform, the state consolidated federal budget received 13,2 trillion RUB in January-August 2020, 12% lower than in corresponding period of 2019 when 15 trillion RUB were received, and 3% lower than in 2018 with 13,6 trillion RUB received (Picture 1).

Picture 1. Dynamics of tax revenues for 8 months (January-August) of 2016-2020, trillion RUB. Source: data of the Federal Tax Service, analysis by Credinform

Picture 1. Dynamics of tax revenues for 8 months (January-August) of 2016-2020, trillion RUB. Source: data of the Federal Tax Service, analysis by CredinformNegative dynamics for the first time in 10 years

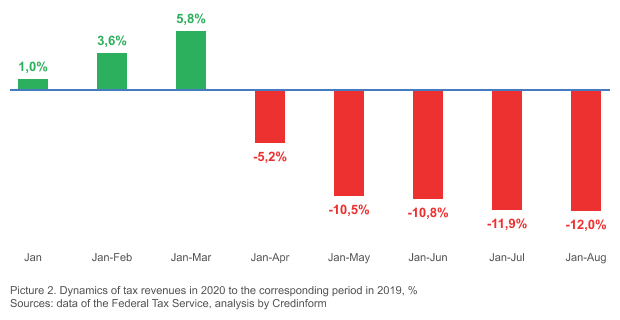

Examining the monthly dynamics of tax revenues, the trend to increase in January-March 2020 (Picture 2) is observed. Since April 2020, the volume of received tax revenues decreased, and the current dynamics is negative for the first time in 10 years.

Picture 2. Dynamics of tax revenues in 2020 to the corresponding period in 2019, % Sources: data of the Federal Tax Service, analysis by Credinform

Picture 2. Dynamics of tax revenues in 2020 to the corresponding period in 2019, % Sources: data of the Federal Tax Service, analysis by CredinformHope for growth

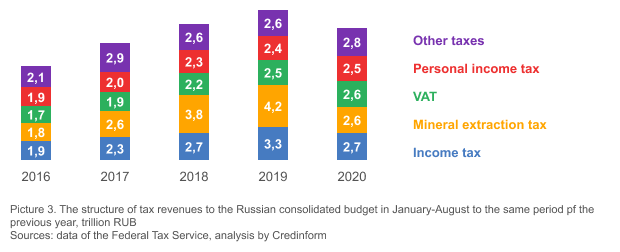

From January to August 2020, there is a 18% decrease (0,6 trillion RUB) in income tax revenues from the companies and 38% decrease (1,6 trillion RUB) in mineral extraction tax revenues compared to the same period of 2019 (Picture 3).

While there is the reduction in income tax and mineral extraction tax revenues, the collection of other taxes is increased. In particular, the volume of value added tax (VAT) payments and personal income tax in January-August 2020 increased by 4% (0,1 trillion RUB) compared to 2019.

A simultaneous increase in VAT and personal income tax payments may indicate a reduction in shadow business in Russia. The growth in VAT revenues was influenced, among other things, by the 20% increased rate. However, the upward trend in revenues has been observed even before its increase in 2019.

Picture 3. The structure of tax revenues to the Russian consolidated budget in January-August to the same period pf the previous year, trillion RUB Sources: data of the Federal Tax Service, analysis by Credinform

Picture 3. The structure of tax revenues to the Russian consolidated budget in January-August to the same period pf the previous year, trillion RUB Sources: data of the Federal Tax Service, analysis by CredinformAlready, it can be concluded that as a result of the business activity restrictions and reduction in tax revenues, the budget of the Russian Federation in 2020 will not receive about 5,5 trillion rubles. A 38% cut in the mineral extraction tax may have a negative impact on the formation of Russia's GDP, since the share of the oil and gas sector is significant.

Simulating situation without the negative impact of external events, the consolidated budget of the Russian Federation for January-August 2020 could show a dynamics of 15% compared to 2019.