Solvency ratio of the largest Russian coal mining companies

Information agency Credinform prepared a ranking of the largest Russian coal mining companies. The coal mining enterprises with the highest volume of revenue (TOP-10 and TOP-100) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2014). Then the companies were ranked by decrease in solvency ratio in 2015 (Table 1).

Solvency ratio (х) is calculated as a relation of equity capital to total assets and characterizes the company's dependence on external loans. Recommended value of the ratio is > 0,5.

The ratio value below the minimum recommended limit means a high dependence on external sources of financing. By the worsening of conjecture in the market it may lead to liquidity crisis and to unstable financial position.

Taking into account the actual situation both for the economy in general and in industries, experts of the Information agency Credinform developed and realized in the Information and analytical system Глобас-i® of actual values of financial ratios that can be normal for the particular industry. For coal mining companies actual value of the solvency ratio is from -0,22 to 0,58.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of ratios, financial and other indicators.

| Name, INN, region | Net profit (loss) of 2015, mln RUB | Revenue of 2015, mln RUB | Revenue of 2015 to 2014, +/- % | Solvency ratio, (х) >0,5 | Solvency index Globas-i® |

| JSC SIBERIAN ANTHRACITE INN 5406192366 Novosibirsk region | 6 194,9 | 22 036,9 | 17 | 0,48 | 225 Hight |

| JSC VORKUTAUGOL INN 1103019252 The Komi Republic | 1 819,9 | 29 624,6 | 51 | 0,46 | 281 Hight |

| JSC KUZBASSKAYA TOPLIVNAYA COMPANY INN 4205003440 Kemerovo region | 1 032,3 | 20 624,7 | 9 | 0,45 | 217 Hight |

| JSC COAL COMPANY KUZBASSRAZREZUGOL INN 4205049090 Kemerovo region | 3 683,4 | 73 496,6 | 27 | 0,38 | 243 Hight |

| LLC SUEK-KHAKASIA INN 1903017342 The Republic of Khakassia | 1 552,0 | 20 375,0 | 22 | 0,14 | 268 Hight |

| JSC RAZREZ TUGNUISKII INN 0314002305 The Republic of Buryatia | 665,0 | 23 231,0 | 6 | 0,06 | 256 Hight |

| JSC CHERNIGOVETS INN 4203001913 Kemerovo region | -3 872,6 | 23 919,8 | 29 | -0,12 | 311 Satisfactory |

| JSC SUEK-KUZBASS INN 4212024138 Kemerovo region | -11 125,0 | 72 194,0 | 5 | -0,17 | 299 Hight |

| OJSHC YAKUTUGOL INN 1434026980 The Sakha (Yakutia) Republic | -18 470,0 | 28 549,3 | 52 | -0,38 | 350 Satisfactory |

| JSC SUEK-KRASNOYARSK INN 2466152267 Krasnoyarsk territory | 1 132,0 | 19 484,0 | 17 | -0,97 | 291 Hight |

| Total for TOP-10 group | -17 388,0 | 333 535,8 | |||

| Total for TOP-100 group | -44 881,6 | 638 941,2 | |||

| Average TOP-10 value | -1 738,8 | 33 353,6 | 19 | 0,03 | |

| Average TOP-100 value | -448,8 | 6 389,4 | 28 | 0,01 | |

| Average value for the industry | -165,3 | 1 465,2 | 15 | 0,03 |

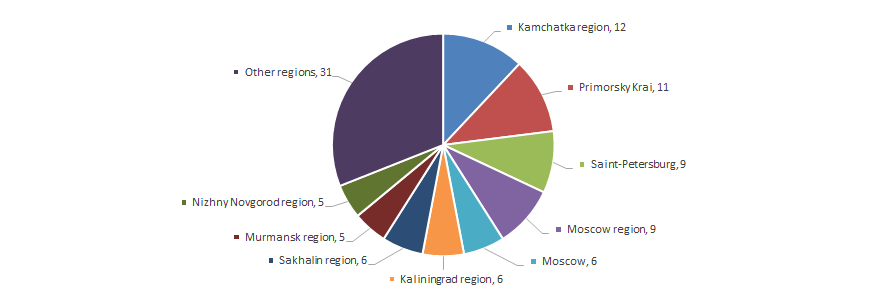

The average values of the solvency ratio in 2015 in the group of TOP-10 and TOP-100 largest coal mining enterprises are below recommended and are in the interval of actual values (marked with red and yellow filling in Table 1 and Picture 1, correspondingly). Besides, OJSHC YAKUTUGOL and JSC SUEK-KRASNOYARSK have got negative solvency index that are not included in the interval of actual values.

Picture 1. Solvency ratio and revenue of the largest Russian coal mining companies (TOP-10)

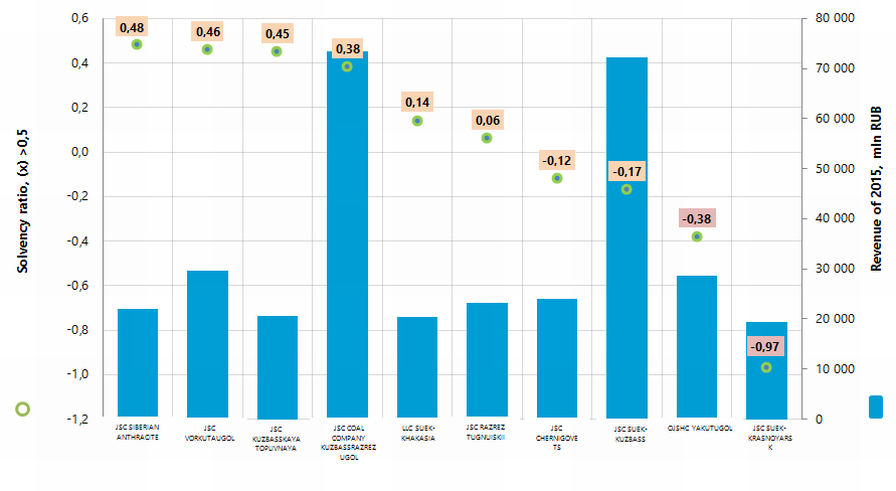

Picture 1. Solvency ratio and revenue of the largest Russian coal mining companies (TOP-10)Revenue volume of the TOP-10 companies in 2015 was 52% of the total revenue of the TOP-100 companies. It shows relatively high level of monopolization in the industry. For example, revenue volume of the three largest companies is 28% of the total revenue of the 100 largest companies (Picture 2).

Picture 2. Shares of the TOP-10 companies in revenue of 2015 of the TOP-100 group, %

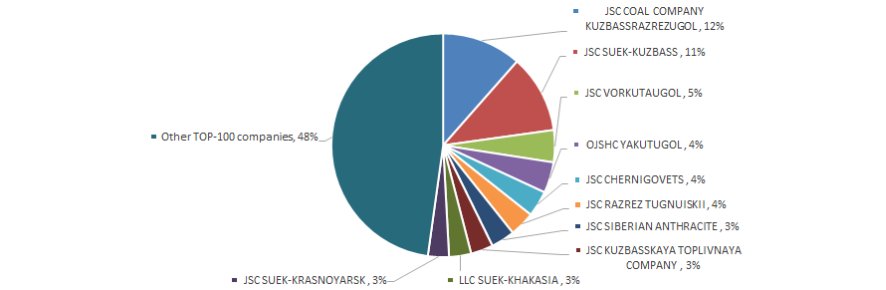

Picture 2. Shares of the TOP-10 companies in revenue of 2015 of the TOP-100 group, %60% companies out of TOP-100 made open-pit coal mining (Picture 3.)

Picture 3. Distribution of the TOP-100 coal mining companies in terms of types of activity, %

Picture 3. Distribution of the TOP-100 coal mining companies in terms of types of activity, %Eight out of TOP-10 companies have got high solvency index Globas-i® , that indicates their ability to repay their debts in time and fully.

JSC CHERNIGOVETS has got satisfactory solvency index Globas-i® , because of the information about the participation as a defendant in arbitration court proceedings in terms of debt collection, cases of late performance of obligations and loss in the balance sheets. Projected growth of the index is stable.

OJSHC YAKUTUGOL has got satisfactory solvency index Globas-i®, because of the information about claim for recognition of the company bankrupt. Results of proceedings should be expected. Moreover, there are cases of late performance of obligations, unclosed enforcement orders. The company has loss in the balance sheets. Projected growth of the index is negative.

All TOP-10 companies increased revenue indicators in 2015 against the previous period, besides, four companies decreased profit indicators and have got loss (marked with red filling in Table 1).

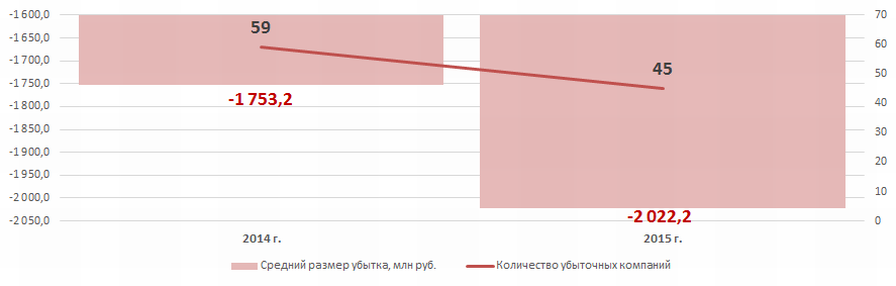

In the TOP-100 group in 2014 59 loss-making companies were observed, in 2015 their amount decreased up to 45. Besides, the loss value 15% increased (Picture 4).

Picture 4. Amount of loss-making companies and average loss (mln RUB) in the TOP-100 companies in 2014 – 2015.

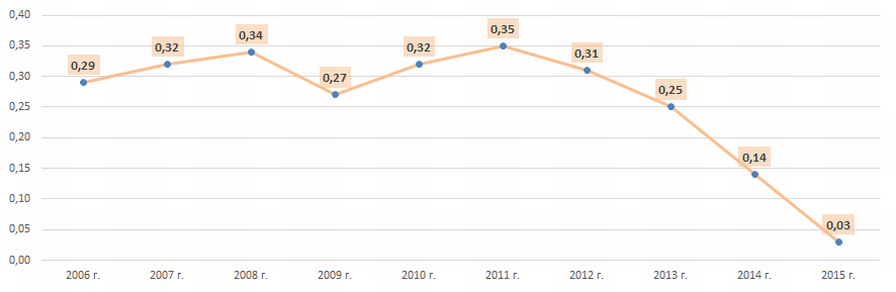

Picture 4. Amount of loss-making companies and average loss (mln RUB) in the TOP-100 companies in 2014 – 2015.In general, industrial solvency ratios stayed only within actual values in 2006 - 2015 (Picture 5), that shows relatively high dependence of the companies on external financial sources.

Picture 5. Average industrial values of solvency ratio of the Russian coal mining companies in 2006 – 2015

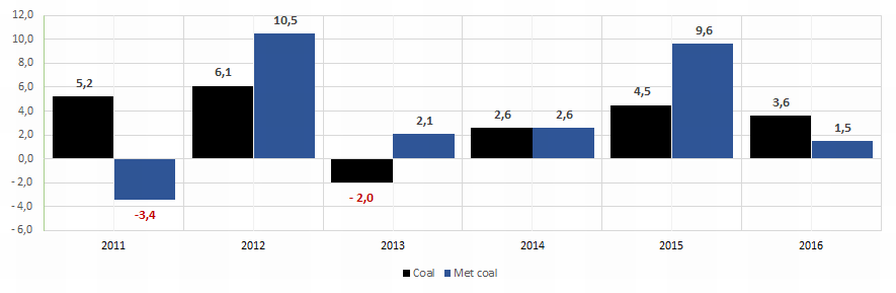

Picture 5. Average industrial values of solvency ratio of the Russian coal mining companies in 2006 – 2015 Indicators of the coal mining industry in natural terms demonstrate positive dynamics in general, that is confirmed by the data from the Federal State Statistics Service (Picture 6 and Table 2).

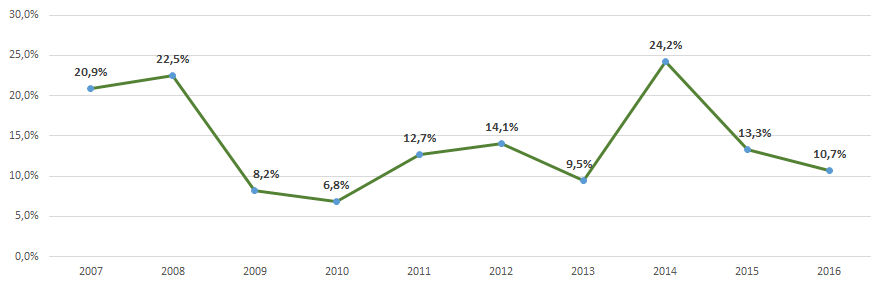

Picture 6. Growth rate of coal mining volume in natural terms, year-on-year, %.

Picture 6. Growth rate of coal mining volume in natural terms, year-on-year, %.In the period from 2010 to 2016 the largest coal mining volume was observed in 2016. (Table 2).

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Coal | 317,0 | 333,8 | 354,3 | 347,2 | 356,1 | 372,0 | 385,4 |

| Met Coal | 67,1 | 64,8 | 71,6 | 73,1 | 75,0 | 82,2 | 83,4 |

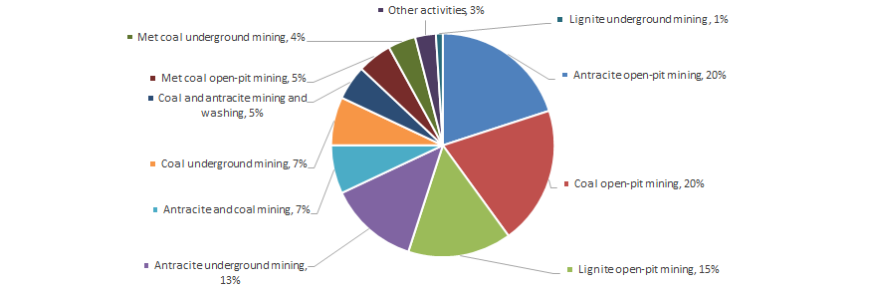

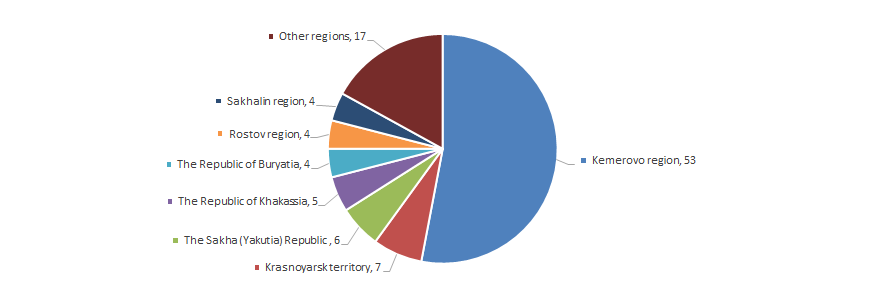

Coal mining companies are distributed on the territory of the country irregularly. Their maximum concentration is observed in regions disposing natural coal reserves, that is especially typical for Kemerovo region. That is confirmed by the data from the Information and analytical system Глобас-i®, according to that the 100 largest companies in terms of revenue volume for 2015 are registered in 20 regions of Russia (Picture 7).

Picture 7. Distribution of the 100 largest coal mining companies through regions of Russia

Picture 7. Distribution of the 100 largest coal mining companies through regions of Russia The leverage ratio of the largest Russian fish processing and preserving companies

Information Agency Credinform has prepared the ranking of Russian fish processing and preserving companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranged by 2015 leverage ratio (Table 1).

Leverage ratio (or the ratio of borrowed and own funds) is one of the financial stability ratios. The ratios of this group determine the possibility of granting the long-term loans or investing as they characterize the possibility of the company to meet its long-term obligations. The leverage ratio (х) is calculated as a ratio of total borrowed funds to equity capital and shows how many units of borrowed funds the company had attracted to each unit of own sources of financing.

The recommended value of the ratio is less than 1. The ratio of borrowed and own funds should not be negative, therefore the ratio value from 0 to 1 is one of the indicators of company’s high ability to meet its obligations.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas-i® by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. The practical value of leverage ratio for fish processing and preserving companies is from 0 to 5,97.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | 2015 net profit, mln RUB | 2015 revenue, mln RUB | 2015/2014 revenue,% | Leverage ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| Yuzhno-Kyrilsky Fish Factory LTD INN 6518005270 Sakhalin region |

720,5 | 1 637,3 | 76 | 0,35 | 172 The highest |

| PAO Ozernovsky Fish Canning Plant N 55 INN 4108003484 Kamchatka region |

1 213,9 | 3 336,7 | 75 | 0,60 | 179 The highest |

| Roskon LLC INN 3904067043 Kaliningrad region |

267,0 | 2 327,7 | 28 | 1,37 | 264 High |

| FSUE Arkhangelsk Federal Penitentiary Service INN 3621005430 Saint-Petersburg |

103,7 | 2 082,1 | -19 | 1,51 | 266 High |

| PAO Ryboobrabativayuschy Kombinat № 1 INN 7805024462 Saint-Petersburg |

69,5 | 4 984,2 | -13 | 4,27 | 202 High |

| NAO Nizhegorodryba Plus INN 5260072045 Nizhny Novgorod region |

7,2 | 2 791,6 | 12 | 4,34 | 209 High |

| NAO RUSSIAN SEA INN 5031033020 Moscow region |

-842,0 | 7 459,6 | -4 | -2,87 | 281 High |

| NAO Baltic Coast INN 7826059025 Leningrad region |

-232,2 | 10 065,3 | 12 | 9,81 | 255 High |

| NAO Yuzhmorrybflot INN 2508098600 Primorsky Krai |

106,2 | 4 772,6 | 45 | 12,74 | 245 High |

| LLC RUSSIAN FISH WORLD INN 5074018058 Moscow |

6,1 | 1 809,3 | 17 | 14,85 | 218 High |

| Total for TOP-10 group of companies | 1 419,7 | 41 266,3 | |||

| Total for TOP-100 group of companies | 4 130,8 | 87 241,8 | |||

| Average value within TOP-10 group of companies | 142,0 | 4 126,6 | 11 | 4,70 | |

| Average value within TOP-100 group of companies | 41,3 | 872,4 | 22 | 18,54 | |

| Industry average value | 3,6 | 88,3 | 2 | 5,94 |

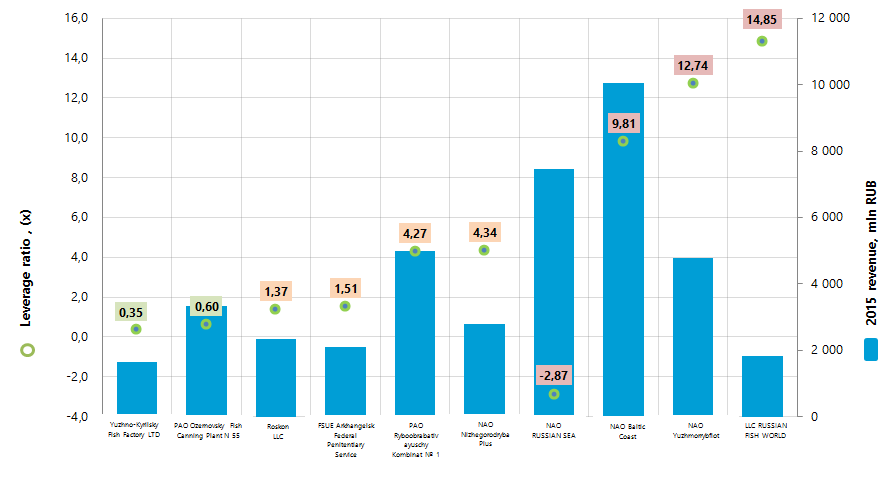

In 2015 the average value of leverage ratio in TOP-10 group of companies is within the recommended and practical values (red and yellow colors, accordingly, in Table 1 and Picture 1). Meanwhile NAO RUSSIAN SEA has negative value of the ratio. The average values of the ratio within TOP-100 group of companies and industry are higher than recommended and practical values (red color in Table 1).

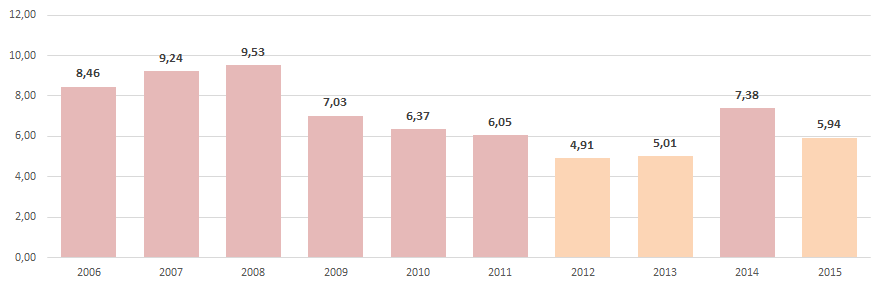

The industry values of leverage ratio were within recommended and practical values in 2012, 2013 and 2015 (yellow color in Picture 2).

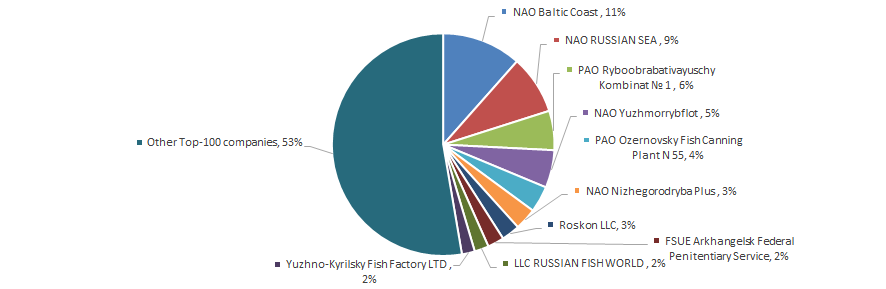

In 2015 total revenue of 10 largest companies amounted to 47% from TOP-100 total revenue. This fact testifies rather high level of monopolization within industry. Thus, total revenue of 3 largest companies amounted to 26% from TOP-100 total revenue (Picture 3).

All companies from TOP-10 list have the highest or high solvency index Globas-i®, this fact shows the ability of the companies to meet their obligations in time and fully.

In 2015 five companies from TOP-10 have decrease in revenue in comparison with previous period or have loss (red color in Table 1).

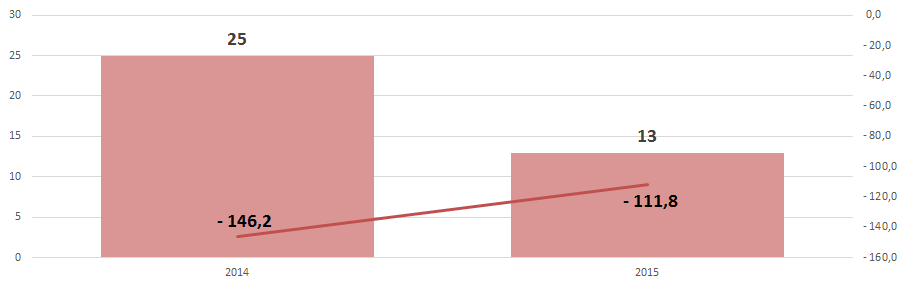

In 2014 the TOP-100 list included 25 loss-making companies and in 2015 their number decreased almost twice to 13. Thus, 2015 average loss is also decreased by 24% (Picture 4).

In general, the industry ratios of fish processing and preserving companies in monetary terms show positive dynamics; this testifies the data from the Federal State Statistics Service (Picture 5 и Table 2).

Within 2006-2016 the maximum revenue from processing and preserving of fish was in 2016, the minimum - in 2006 (Table 2).

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|

| 31 382,1 | 37 941,9 | 46 494,6 | 50 303,8 | 53 747,4 | 60 554,8 | 69 081,4 | 75 651,1 | 93 943,5 | 106 478,6 | 117 835,5 |

Fish processing and preserving companies are unequally distributed across the country and due to specific nature of activities concentrated in regions located close to sources of raw materials. This fact is confirmed by data from the Information and Analytical system Globas-i®, according to which 100 largest companies in terms of 2015 revenue are registered in 33 Russian regions (Picture 5).