Net profit ratio of cereals and leguminous plants suppliers of Russia.

Credinform Information Agency is coming with ranking release of Russian cereals and leguminous plants suppliers. The ranking list includes industry's largest companies and is based on net profit ratio as stated in Statistics register, with the reference period of 2011.

Net profit ratio (%) is a relation of overall net profit (loss) to net sales, and it is used to analyze company’s annual financial results. It shows how profitable were sales and how effective was financial management of a company, as well marketing and logistics policies. The higher is net profit ratio, the more profitable business is. Worth mentioning, however – agriculture companies do usually have a lower net profit ratio than the companies in other sectors; net profit ratio here is heavily dependent on climatic factors such as drought, torrential rains etc. that are hard to predict.

| № | Company | Taxpayer identification number | Region | Turnover in 2011, mln RUB | Net profit ratio (%) | GLOBAS-i® Solvency index |

|---|---|---|---|---|---|---|

| 1 | Zolotaya Niva Limited Liability Company | 2635049370 | Stavropol Territory | 1 886,6 | 23,67 | 208(high) |

| 2 | AVANGARD-AGRO-Voronezh Limited Liability Company | 3666128249 | Voronezh region | 1 389,2 | 23,31 | 276(high) |

| 3 | Agrotechnologii Limited Liability Company | 6803120472 | Tambov region | 1 484,3 | 16,33 | 289(high) |

| 4 | Krasnoyaruzhskaya Zernovaya Closed Joint Stock Company | 3113001402 | Belgorod region | 2 115,7 | 13,27 | 267(high) |

| 5 | Agroobyedinenie Kuban Joint Stock Company | 2356045713 | Krasnodar Krai | 2 479,9 | 10,24 | 258(high) |

| 6 | Dobrynya Limited Liability Company | 4804005574 | Lipetsk region | 1 491,3 | 9,83 | 243(high) |

| 7 | Joint Stock Foreign Trade Company Exima | 7703011680 | Moscow | 2 914,9 | 6,16 | 213(high) |

| 8 | Closed Joint Stock Company "Vostok Zernoprodukt" | 1659041882 | The Republic of Tatarstan | 1 455,8 | 5,21 | 246(high) |

| 9 | Agropromyshlennaya korporatsiya AST Company M, Limited Liability Company | 7721147115 | Moscow | 3 454,2 | 0,28 | 238(high) |

| 10 | Pochaevo Agro Limited Liability Company | 3108007208 | Belgorod region | 1 903,6 | 0,02 | 319(sufficient) |

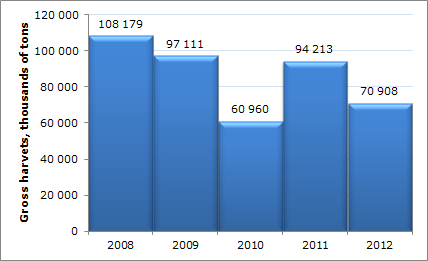

Diagram. Gross harvest of cereals and leguminous plants in Russia, thousands of tons

If we look at the gross harvest of cereals and leguminous plants over the last 5 years, we find 2008 was a year of an absolute yield bumper with more than 108 mln tons of crops – for the first time in Russia’ modern history. At the same time, the industry now is more dependent on climate factors rather than economic factors as it used to be in the 1990s (47,8 mln tons of crop in 1998). Heat and drought of summer 2010 was the main reasons why companies produced 1,8 times less grain (61 mln tons) than in 2008. The same situation, although not that rough, took place in 2012.

The quantity of gathered grains is important to companies’ profitability and income, as well as overall food security of Russia.

Credinform Information Agency experts say 2013 cereals harvest is likely to reach 91-92 mln tons – these expectations are based on of gross harvest dynamics over the last 15 years; favourable climate conditions in grains-growing regions are important to take into account, too.

Industry biggest companies are listed in the table above. The top-10 total turnover following 2011 financial results reached 20 575,5 mln rubles. The average value of net profit ratio is 10,8%.

All companies have their net profit ratio above zero-line. Agropromyshlennaya korporatsiya AST Limited Liability Company M (0,03%) and Pochaevo Agro Limited Liability Company (0,02%) got their net profit ration coming close zero-line, with profit hardly exceeding the losses.

Zolotaya Niva Limited Liability Company (Stavropol Territory) and AVANGARD-AGRO-Voronezh Limited Liability Company hold the biggest net profit ration value – 23,7% and 23,3%respectively, with profit made up of more than 20% of net sales. Besides, both companies got one of the highest scores in independent solvency and financial stability Globas-i® index of Credinform – that means they are able to pay off their liabilities, duly and in time, while the risk of default and bankruptcy is rather low.

Two companies – Agrotechnologii Limited Liability Company (16,3%) and Krasnoyaruzhskaya Zernovaya Closed Joint Stock Company (13,3%) – got a higher-than-average ratio. The solvency index Globas-i® of these companies is high enough and varies generally from 200 to 299 scores. The rest of the listed companies have their index gone lower than 10,8%.

Top-10 worst performer, Pochaevo Agro Limited Liability Company, made the sufficient solvency index which means there is a little guarantee it will pay its liabilities duly and in time; it also means the company lacks financial stability to adapt to economic situation in change.

To sum up, one can say that many factors influence financial results of agricultural companies: costs for transportations by rail, tariffs for energy resources, changing world prices for agriculture production, condition of technological equipment in use, quality of winter crops etc. Besides, the climate factor is important here – it is able to shape analytical reviews and evaluations of overall cereals and leguminous plants gross considerably, no matter of how developed are these industries.

The tendencies of publishing industry in Russia

Following the results of the first six months of 2013 and according to the Russian Central Institute of Bibliography the total circulation of released books comprised 240 million of copies, which is 7,3% less than the results of six months of the previous year. At the same time the positive tendency is to be noticed in the amount of the titles of the books released: within two quarters of current year 59 000 titles were released, which is 2,3% more in comparison with the similar period of the previous year.

Nowadays the publishing industry all over the world is in the recession. However, despite the negative tendencies, one can notice the positive dynamics in the amount of titles released in Russia within the first six months of 2013, although it is accompanied by the decline in number of copies. An average book circulation in Russia has decreased by 4,3% comparing with the previous six months and comprised 4 173 copies instead of 4 361. Moscow and Saint Petersburg publishing houses are traditional leaders of the industry. Cumulative percentage of circulation of the two main cities of Russia comprises 83,4% of the total release number countrywide, whereas 78,5% is accounted for by Moscow. It’s necessary to mention Rostov region as a leader among regions, which continues to make the top three, notwithstanding permanent decline in the number of released production. Then follow Volgogradskaya, Voronezhskaya and Nizhegorodskaya regions. Among regions haven’t made top ten, it’s worth noting Tambovskaya region, the Mary-El Republic, the Republic of Khakassia, the Republic of Karelia, which managed to improve their showings in comparison with the previous periods.

On the whole the above-described situation is standard for many countries nowadays. According to opinion of many experts the reasons of decline in demand on printed literature are demographic crisis, reader’s demand disparity, and also popularity of electronic media and internet resources. All these factors lead to decline in issuing editions. At the same time amid crisis the majority of publishing houses placed their stakes on releasing products with the least cost. Despite the negative tendencies, the amount of bound editions has remarkably increased (0,8% more comparing with the first six months of 2012). Moreover, amid crisis a proportion of re-editions continues to increase (from 35,9% оf the total amount in 2012 to 37% of the total amount in 2013), as their release is less expensive and more reliable. For the moment serial edition holds a steady position, 2/3 of all the editions is accounted for by its proportion.

Talking about the most popular genres, the leading positions are occupied by books which are likely to satisfy public and governmental needs in education. In expired year “non-light literature” (study materials, science literature, reference materials) comprised more than half of released books. Within the first six months of 2013 16 million copies of political, social-economical literature and more than 13 million of science and 19 million of study materials were released.

Among the publishing houses the leaders in amount of released book titles are still “Eksmo” and “AST”, however as for editions their showings have remarkably decreased, although “Eksmo” continues to occupy leading position. The second best in amount of released book titles is “Prosveshcheniye”. Besides, regional higher education institutions editions are also included in the list.

According to Information system GLOBAS-i® of Credinform agency based upon analysis of the financial accounts, the top-three of the largest in turnover Russian publishing houses appears as follows: The Publishing House “Komsomolskaya Pravda”, The Publishing House “Eksmo” and “ARIA-AiF”. At the same time “Eksmo” (books’ issue leader) was allocated to the highest solvency index which characterizes the company as financially stable. The Publishing House “Komsomolskaya Pravda” and “ARIA-AiF” were allocated high solvency index, that is also characterizes these companies as investment attractive.

Newspapers and magazines is the important segment of the publishing activities. Unlike book printing, there are positive tendencies in this field. In 2012 the total circulation of released in the country newspapers increased on 13% in comparison with 2011 and the circulation of released magazines in 2011 increased on 5,7% in comparison with 2010. It’s necessary to mention that in this segment of the market the leading positions are occupied by Moscow publishers. In the general amount of released in 2012 newspapers the proportion of the circulation of the capital issues comprised 41% (in 2011 – 39,6%), and magazines in 2011 – 84%. At the same time the most popular is light literature, however public affairs journalism has essentially reduced the circulation. Thus, the biggest proportion of released newspapers in 2012 is accounted for by popular (28%) and advertising (23%) literature. Then follow public affairs issues (20%), moved from the first position occupied in 2010, having reduced the circulation by 2012 on 54,6%. In 2011 the first position among the magazines are also occupied by illustrated mass issues (18 % of the total circulation) and leisure activities issues (15 % of the total circulation).

According to the statistical research made by one of the ten leading world companies investigating book market – NOP World – Russia ceased to be the most reading nation, having occupied just the seventh position. The first position is occupied by India. It is to be mentioned that a decline in interest in books is the trend not only in Russia, but also in the USA and the UK, that did not reach the top 10. It is hoped, that the culture of reading in our country will regenerate and we will again turn to books as to the essential sources of information and time-honoured wisdom, and the reading a good literature will come back into fashion.

For information on the financial state of Russian and foreign companies, as well as analytical reports on market sectors of Russian industry, you can refer to the daily updated information and analytical system GLOBAS-i® or our Custom Service Department specialists by phones:

+7 (812) 406 8414 (Saint-Petersburg); +7 (495) 640 4116 (Moscow).