Federal loan guarantees for small business owners were given the green light

It is no surprise that small and medium-sized business in industrially developed countries plays a key role in the contribution to the development of the GDP (gross domestic product). The establishment of this form of business activity historically began in Russia relatively recently and, generally speaking, the management of our country didn’t pay close attention to this question. The situation has begun changing recently for the better, they recognize in the governmental authorities that small economy and private initiative must play increasingly greater role.

Even today the government has granted two-years tax holidays for organizations of high-technology sector; it was expanded the range of entrepreneurs who can buy back leased premises into the ownership; at a regional level it was established the guarantee fund for credit arrangements, that mainly helped many companies survive during the financial crisis in 2008.

On the other hand it must be admitted, that the final consensus for small business promotion is not reached between different governmental blocks. It was admitted by the Minister of Finance Alexey Ulyukaev in the Gaidar Forum hold in the middle of January: according to his words, the legislative amendments passed the year before, which caused the increase of social transfers for the business, led to the closure of more than 500 000 small enterprises. As the result it was got a doubtful economic effect by problems apparent for all.

Increase of tax burden or business promotion – this is the key task, which has to be completed in the coming years.

According to words of the Chairman of the Government of the RF Dmitry Medvedev visited the Gaidar Forum, the Cabinet has been already instructed to expand the successful regional experience and create the Federal guarantee fund for credit arrangements for small and medium-sized enterprises, which resources will act not only as a guarantee towards third party creditors, but also be used on a repayable basis for companies themselves.

In view of the fact that the oil and gas sector doesn’t ensure high economic growth rates yet, such initiative looks fully justified. The idea of the Fund by itself must finally lead to that money will work for the economy, in contrast with the «hoard for a rainy day» - the Reserve Fund.

In the Forum, on top of everything else, it was heard an idea to grant tax holidays not only for entrepreneurs of high-technology sector, but also for other small companies. The business has to reach break-even point, before making returns to the treasury – this practice is widely used in the world. Such brave suggestion, in view of the recent increase of social transfers, most probably won’t be understood by the ministers, but for carrying out of so called economic diversification, which has been talking about for many years, it will be necessary to renew this subject some day or other.

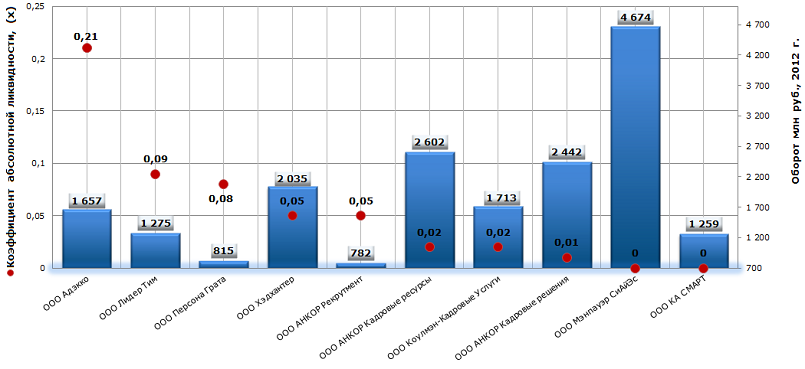

Absolute liquidity ratio of companies providing services for personnel selection and job placement in Russia

Information agency Credinform prepared a ranking of absolute liquidity ratio of Russian companies providing services for personnel selection and job placement. The companies with highest turnover in this branch were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in value of absolute liquidity ratio.

Absolute liquidity ratio is calculated as the ratio of monetary funds amount and short-term financial investments, available by an enterprise, to short-term liabilities. In other words, the mentioned ratio shows, what part of short-term liabilities may be covered only by absolutely liquid assets.

The standard limit > 0.2 is used for the ratio in foreign practice of financial analysis, that actually means, that not less than 20% of short-term liabilities of a company are repayable every day. At the same time, taking into account the aspects which are typical for Russian practice, it is usual to use the standard values from 0,1 to 0,15 for the analysis of Russian companies. As too high ratio value means unreasonably high volume of free cash, which might be used for business development.

| № | Name, INN | Region | Turnover for 2012, mln RUB | Absolute liquidity ratio(х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Adekko LLCINN 7707309438 | Moscow | 1 657 | 0,21 | 290 (high) |

| 2 | Lider Tim LLCINN 7728701100 | Moscow | 1 275 | 0,09 | 262 (high) |

| 3 | Persona GrataLLCINN 7717681839 |

Moscow |

815 | 0,08 | 281 (high) |

| 4 | HedhanterLLCINN 7718620740 |

Moscow |

2 035 | 0,05 | 244 (high) |

| 5 | Ankor RekrutmentLLCINN 7702712241 | Moscow | 782 | 0,05 | 288 (high) |

| 6 | Ankor Kadrovye resursy LLCINN 7702727960 | Moscow | 2 602 | 0,02 | 280 (high) |

| 7 | Koulmen-Kadrovye resursy LLCINN 7701833356 | Moscow | 1 713 | 0,02 | 343 (satisfactory) |

| 8 | Ankor Kadrovye resheniya LLCINN 7725683815 | Moscow | 2 442 | 0,01 | 294 (high) |

| 9 | Menpauer CIS LLCINN 7714572528 | Moscow | 4 674 | 0 | 289 (high) |

| 10 | Konsaltingovoe agentstvo SMART LLCINN 7724768978 | Moscow | 1 259 | 0 | 297 (high) |

Absolute liquidity ratio of companies providing services for personnel selection and job placement, TOP-10

The absolute liquidity ratio of the company Adekko LLC, being at the top of the rating, is 0,21, that is higher than Russian, but in accordance with international standards. The company got a high solvency index GLOBAS-i®, that characterizes it as financially stable.

The enterprises Lider Tim LLC and Persona Grata LLC, with absolute liquidity ratios 0,09 and 0,08 respectively, are on the 2nd and on the 3rd places. By that the ratio values of these companies are near to Russian standards. Both enterprises got also a high solvency index GLOBAS-i®.

The rest seven TOP-10 companies presented extremely low values of the analyzed ratio, that can indicate about the deficit of absolute liquidity ratios in the industry in total. However, only the company Koulmen-Kadrovye resursy LLC got a satisfactory solvency index GLOBAS-i®, because it has losses in the accounting period.

In summary, it should be mentioned that in order to retain financial stability the companies need to strike a balance between sufficient amount of liquid assets and adequate volume of short-term loans, i.e. to manage efficiently their debt burden.